Who else could be at risk from China’s commercial actions? (CTD, OZL, APT, TWE, A2M, NUF, ELD, BKL)

LOCAL REPORTING CALENDAR: CLICK HERE **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

Today we have a long list of results – best to click the link above. I have covered WES, PPT, SIQ, STO, A2M, DHG in the recording below.

The ASX200 may have traded within just 2-points of a fresh 5-month high yesterday but as you would expect during reporting season the real the action was under the hood with the 10 best stocks advancing on average more than 10% while the equivalent losers basket dropped by just over 8%. Surprisingly on a day when the index gained 44-ponts / 0.8% the number of winners only just nudged the losers but reporting season continues to give the market an underlying bid-tone, investors are cashed up and if the reports “ok” the buyers are stepping up in a major way.

The sighs of relief in a market which is braced for negative shocks can be heard across the trading floor every time a company delivers a result / future outlook which contains no major negative surprises. Unfortunately the landmines are still strewn throughout our market, which is no great surprise after COVID-19, but in most cases the buyers are emerging after just 1-2 days of falls as opposed to the classic 3-day sell-off where professionals often prepare to buy on day 3 i.e. gap day, acceleration day and exhaustion day. The quicker and shallower pullbacks confirm our view that this liquidity driven rally remains intact with plenty of cash looking for a home.

However, the latest Bank of America Fund Managers Survey shows professional investors are now becoming more positive after the S&P500 has made fresh all-time highs but the positioning is not scarily so. Not surprisingly US tech remains the most crowded trade followed by gold but there are some green shoots evolving for inflation assets, all in all no great surprises for MM leaving us bullish but expecting more cycles of corrections followed by fresh highs through the remainder of 2020 – as the press trumpets Apple (AAPL US) becoming the first $US2 trillion dollar business this morning we actually feel the US tech space is close to another 6-8% pullback – the momentum is waning.

MM remains bullish the ASX200 medium-term.

ASX200 Index Chart

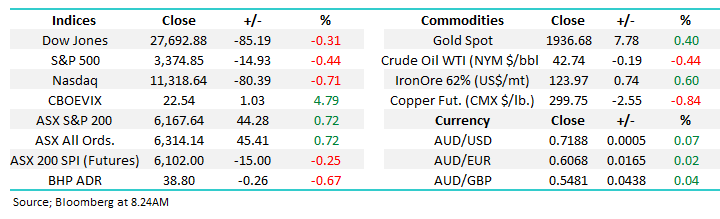

On Tuesday we discussed the “recovery trade” gaining momentum specifically looking at Corporate Travel (CTD) flagging it as a high risk buy before its report but liking it all the same. Yesterday they did deliver a better result than downbeat expectations, revenue was $349.9m v $331m expected, underlying NPAT was $32m v $31m expected and they talked to a strong level of client retention (97%). Looking forward things were also positive as they continue to win new business in all the regions where they operate and while a long road to recovery awaits, we like CTD’s low fixed cost business model and exposure to essential business related travel, although clearly we’re now in a new world where a combination of Zoom + face to face will be the future.

MM is bullish CTD targeting over 20% upside.

Corporate Travel (CTD) Chart

OZ Minerals (OZL) delivered a great result yesterday which the share price had clearly been anticipating - underlying NPAT of $80 million (up 82%) on higher volumes and a strong gold price, EBITDA of $251 million (up 55%) at a robust operating margin of 44%, strong operating cash flows of $151 million (up 49%), Fully franked interim dividend of 8 cps declared. In terms of production guidance, we saw upgrades across all operations following strong H1 performance. While the company’s share price feels a touch stretched short-term and will undoubtedly rotate around with the copper price, we are not considering taking profits, we like the business, sector and reflation trade!

MM remains long and bullish OZL.

OZ Minerals (OZL) Chart

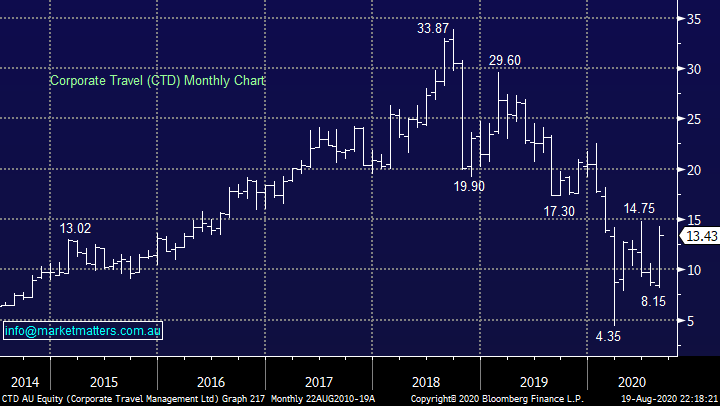

After-market yesterday Afterpay (APT) delivered some very warming news to the market in terms of a trading update ahead full year results this time next week (27th). Earnings for the full year will be almost double that forecast in July i.e. $44m compared to the flagged $20-25m plus the core measure of profitability transaction margin was coming in 0.25% higher than expected. The reason being is that loss rates are lower, approximately 0.38% v the 0.55% expected and that drives an increase in margins and therefore profitability – the stock should “pop” higher this morning, Bells have just increased their target price on the stock to $92.50. This is also a positive read through for the wider BNPL space, with Z1P Co (Z1P) reporting on the 27th August.

MM can see APT testing well above $80 on current momentum.

Afterpay Ltd (APT) Chart

Overseas Indices & markets

Last night US stocks surrendered early gains after the Fed minutes where they tempered optimism on growth in H2 of 2020 and they panned yield-curve control – great news for our bigger picture global macro view on reflation. Short-term we think the euphoria in tech sector is getting a little overheated and the likelihood of a pullback is increasing by the day.

MM remains bullish US stocks medium-term.

US NASDAQ 100 Index Chart

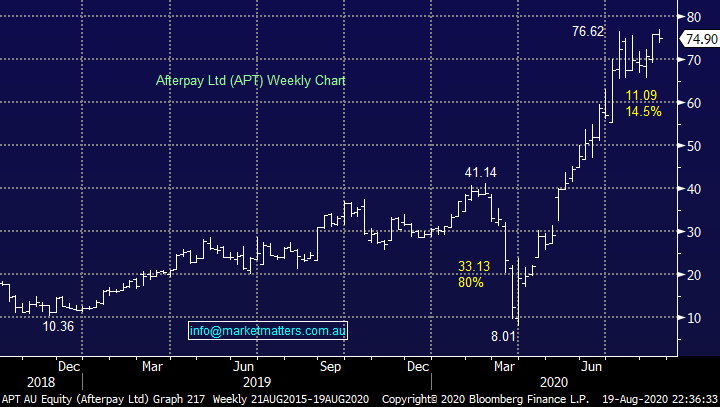

Overnight the song remained the same as Led Zeppelin would say, following the Fed minutes bond yields rose, the $US followed suit sending down many commodities like precious metals and oil although copper was a noticeable standout closing up above the psychological 300 $US/lb area. Further consolidation from the likes of silver is our expected path, MM plans to increase our position around $US22/oz and take profits above $US30/oz – we’ve seen plenty of choppy rotation by the ASX perhaps its time for gold and silver.

MM remains bullish precious metals.

Silver ($US/oz) Chart.

The risks of China’s political / commercial snub of Australia.

This week we saw Treasury Wine (TWE) get smashed following the news that China had commenced an anti-dumping investigation into Australian wine. The company has found itself in the middle of a game of political football, the Australian government has rattled China’s cage by launching an independent inquiry into COVID-19 and this is one of the ways they have hit back, we said at the time that MM felt there was no upside to Australia, especially during a pandemic to provoke China and I’m sure everybody exposed to TWE would now agree. Xi Jinping & Co. have demonstrated on many occasions they don’t mind causing major collateral damage to make their point which is clearly bad news for anyone caught in the crosshairs, like TWE

Chinese consumption may be growing at a phenomenal rate, but investors need to consider their steps carefully as evidently not all roads are paved with gold, there may be some more political potholes looming on the horizon. Today we have looked at 4 (the Chinese death number!) other companies who could find themselves reading some scary political news in the press in the months ahead if Australia – China trade tensions escalate. Remember we’ve already previously seen suspension of some of our beef imports and threats of tariffs on Australian barley, surely dealing with the virus would be far more useful than paying for inquiries that will arguably achieve zero.

MM feels TWE has slipped into the “too hard” basket.

Treasury Wine (TWE) Chart

1 a2 Milk Co Ltd (A2M) $18.25.

a2M has been a huge success story of the last few years, yesterday they nearly matched expectations reporting a 32.8% increase in revenue and a net profit after tax of NZ$385.8m – about a 2% miss to forecasts but much of the growth came from China label infant formula where sales almost doubled as Chinese consumers stockpiled essential items during the pandemic. While they still only hold 2% of that particular market, the company’s rhetoric took a turn yesterday, shifting from a clear growth focus to one flagging a tougher, more competitive outlook. The key for me was their discussion on rising dividends in the years ahead which implies that A2’s expansion may start to slow, which is easy to comprehend given the rise of cheaper Chinese branded product underpinned by growth in the domestic herd of A2 cows.

While we believe the company has great international growth potential moving forward, the shorter term trends are more negative as the company comes off a period of phenomenal growth into an environment of rising competition and the potential for a souring of China/Australia relations.

MM would only consider a2M ~$17, or 6-8% lower.

A2 Milk Co Ltd (A2M) Chart

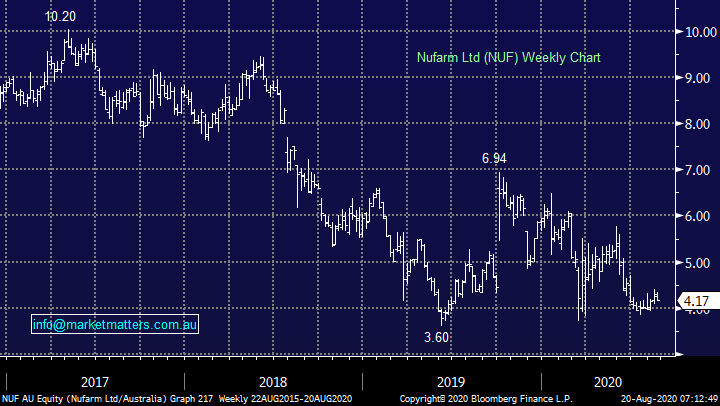

2 Nufarm (NUF) $4.17

Crop protection / seeds specialist NUF relies heavily on China for product supply. With a supply chain significantly exposed to deteriorating trade relationships with China the company could endure the same fate as TWE if China imposes tariffs or supply constraints. The company has other issues weighing on its share price without having to contend with the risk from China, we have no interest in NUF and a break of 2019’s low feels highly likely.

MM is neutral NUF, at best.

Nufarm Ltd (NUF) Chart

3 Elders (ELD) $10.36.

Agri company ELD has enjoyed a great run over the last 12-months but it also could be in the China firing line if international business ties spiral downwards. ELD imports all of their chemicals for crop protection and fertiliser from China hence supply chain disruptions and / or tariffs could devastate the business. Also for good measure the company has exposure to the Chinese consumer through its exports of beef & lamb, overall the risk / reward is not exciting to MM ~$10 but a 6-8% pullback on China fears would spike our interest.

MM is neutral ELD.

Elders (ELD) Chart

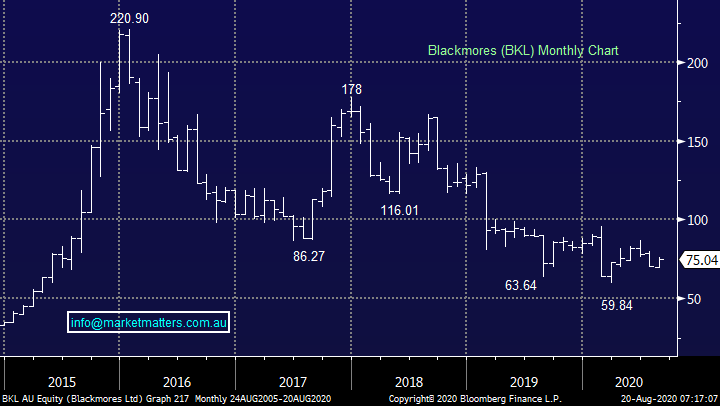

4 Blackmores (BKL) $75.04.

Vitamins business BKL generates ~40% of its revenue from Asia with the company targeting 10% growth from China from 2021, gains which could be stopped in their tracks by one stroke of the pen in China. The world’s 2nd largest economy ranks in the same position with regard to vitamins consumption making the already tricky regulatory environment a positive minefield for BKL.

MM is neutral BKL.

Blackmores (BKL) Chart

Conclusion

MM has no interest in these 4 stocks at current levels but a 6-8% correction by A2M and ELD on China trade concerns we believe would provide some very interesting risk / reward opportunities.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.