Where’s the bottom for growth stocks? (BPT, APT, APX, XRO, ALU, COH, CSL)

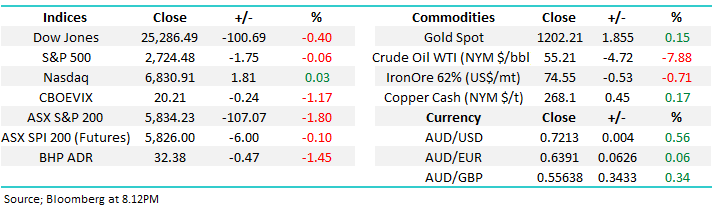

The ASX200 got whacked yesterday and while it was always going to be a hard day at the office for equities following the Dow’s 600-point plunge I didn’t hear many people calling us down over 100-points, including myself! The tech stocks led the decline but unlike yesterday there was no meaningful support from other sectors with only 10% of the market managing to close in the green.

As mentioned in the afternoon report we envisaged 2 potential likely scenarios unfolding over the next few weeks:

“A – The market experiences a corrective pullback towards 5800 prior to an assault well above the psychological 6000 area.

B – The October weakness returns with a vengeance and stocks retest, and probably break, the 5600 area.”

At this stage we still prefer A but following such a savage decline we must consider the “what ifs”. I will cover how we see “scenario B” unfolding if weakness does persist shortly in today’s report.

MM remains mildly bullish the ASX200 into 2019 but we are open-minded.

Overnight US / Europe were relatively quiet with gains in Europe but small losses in the US. The local market looks likely to open down around 15-points with BHP falling 1.5% not helping matters. Today’s report is going to look at 6 well-known local growth stocks for further clues to when the current savage selling will subside – we have touched on some of these previously but a lot of water has gone under the bridge over the last few weeks.

Remember we would only consider buying this sector for a sharp short-term bounce, not a long-term view.

ASX200 Chart

We believe the short-term picture for “scenario B” is actually fairly exciting for the active investor but not necessarily for the buy and hold players:

1 – By definition if A prevails we will see a test of 5600 but MM does not expect a major break of this area in 2018.

2 – If we reach 5600 in the coming days / weeks MM will be bullish for a Christmas rally back towards 5950-6000, not exciting compared to Mondays close but ok if you have some cash to deploy into weakness – remember it will feel pretty average at the time!

3 – Seasonally the Christmas rally starts between late November and mid-December with November usually weak although not as bad as yesterday’s 100-point plunge – note 2018 has not followed the usual seasonal path closely.

4 – Hence our preference for “scenario A” may in hindsight have led to us missing the opportunity to significantly increase cash levels around 5900 but we believe a second bite at the cherry will present itself in the next 6-weeks if “B” does prevail.

ASX200 Chart

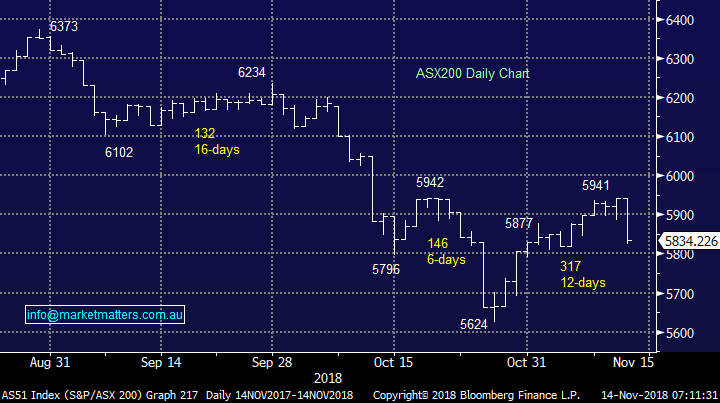

The talking point of overseas markets last night was the almost 8% plunge in crude oil reaching levels not seen since November 2017 and taking the current correction to a whopping 28%.

In the US the energy sector not surprisingly dominated losses, falling around 2.5%. The local energy sector is already down 8% over the last month with more obviously expected today.

BHP Billiton (ASX: BHP) is set to open down around 50c / 1.5% at $32.37 – we continue to like BHP under $30 and Beach Petroleum (ASX: BPT) below $1.50.

MM currently has no exposure to the energy sector bit will consider it if the current panic unwind continues ~8-10% lower.

Crude Oil Chart

Beach Petroleum (ASX: BPT) Chart

6 local “High Growth” stocks being hammered by investors

Since October the market has been very anti high valuation / growth stocks which have outperformed for almost a decade and the drum MM has been banging all this time is “don’t expect a decade’s trend to be unwound in just a few weeks” – it’s likely to have much further to go from a relative performance perspective.

However just like a ping pong ball rolling down a staircase it will have major bounces along the way, especially when we consider stocks like Afterpay Touch (ASX: APT) have already halved in price.

Today we’ve selected 6 growth stocks looking for signs of how they may trade into Christmas, especially looking for good risk / reward opportunities. Also the growth names currently appear to be the key to the overall markets sentiment / direction – MM has regularly quoted that the NASDAQ and Russell 2000 are the leading indices in the US.

The chart below illustrates how the NASDAQ significantly outperformed the Dow from March 2018 but since October we’ve seen a huge reversion and importantly things are now almost back into line.

NASDAQ v Dow Jones Chart

There are no surprising names in the 6 stocks I have selected below but the last few weeks movements have provided excellent set-ups in a couple – time to be “stalking” the trade.

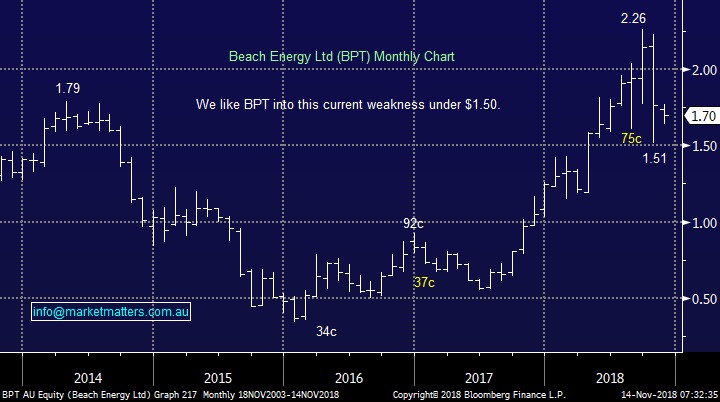

1 Afterpay Touch (ASX:APT) $11.75

APT has corrected over 50% since late August as crazy valuations came down to earth with an inevitable thud however looking at APT’s valuation will still scare the majority (or it should!)

With the announcement of a potential Senate inquiry into “debt vultures”, payday lenders, lease-to-buy schemes and 'buy now, pay later' providers not covered by the banking royal commission the uncertainty / volatility around the stock is likely to be ongoing into 2019. A few recent broker downgrades hasn’t helped recently.

MM could consider APT as an aggressive buy below $10.50, or 10% lower.

Afterpay Touch (APT) Chart

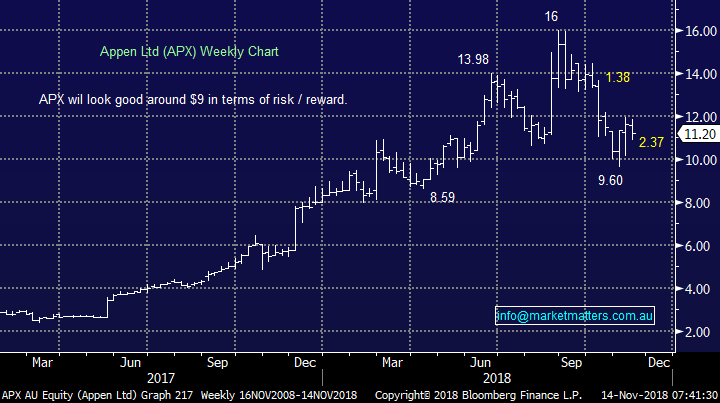

2 Appen Ltd (ASX: APX) $11.20

Machine learning business Appen Ltd (APX) fell over 4% yesterday but it didn’t make the bottom 10 worst performers in the ASX200.

We like this particular business but like many in the group it was simply too hot -it’s a global leader in machine learning and artificial intelligence, a very cutting edge sector over the last few years. While the stock’s now trading on an ok valuation considering its long-term growth potential looking at valuations I think in this sector is fairly futile. These are momentum / risk stocks and money flow around these names will drive their share prices in the nearer term. Another sharp leg lower and the elastic band of negativity will have stretched too far in our opinion.

MM likes APX into fresh recent lows under $9.60, ideally around $9 – definitely worth watching.

Appen Ltd (APX) Chart

3 Xero (ASX: XRO) $40.05

Cloud accounting and business provider XRO has corrected almost -30% since the end of August but this is a quality business with sustainable growth. I love their product and the longer a user is on board, the more ‘sticky’ their revenue becomes.

The question is obviously what price to pay for this growth, a tumbling NASDAQ is certainly not helping sentiment around the stock – XRO has corrected 30% and the NASDAQ 14.7% over recent weeks.

We like XRO as a business and could consider “nibbling away” around $35.

Xero (XRO) Chart

4 Altium (ASX: ALU) $22.35

ALT develops design automation (EDA) software for Microsoft Windows and has enjoyed consistent growth in revenue over the last 6-years, impressive as its competitors have struggled.

Their goal is to dominate the PCB market (Printed circuit board) and the business is ticking all the correct boxes at present, the only issue was the shares were too expensive as investors chased GARP – “growth at any price”.

The recent 34% correction the stock has certainly helped address these valuation issues.

MM likes ALT below $20 for at least a 20% rally.

Altium (ALU) Chart

5 Cochlear (ASX: COH) $168.02

We put our hand up and bought Cochlear following the Dows 800-point plunge in October, clearly too early in hindsight.

The hearing aid business is undoubtedly top quality but it’s been caught up in the aggressive flight from growth in a greater degree than we anticipated.

MM is looking to exit COH back above $180.

Cochlear (COH) Chart

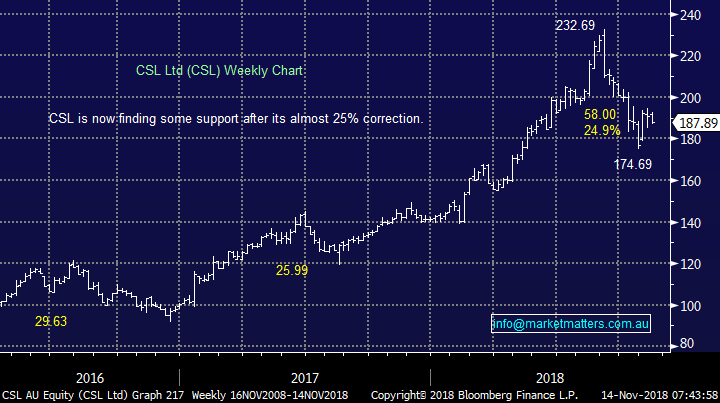

6 CSL Ltd (ASX: CSL) $187.89

We also purchased CSL following Dow’s 800-point plunge in October, this has proven ok with stock still around our entry levels.

MM is now looking to take profit on this position closer to $200.

CSL Ltd (CSL) Chart

Conclusion

For the first time in many months MM will be bullish growth stocks if we see another leg lower in the coming weeks.

Our favourite 3 at the time of writing are:

1 – Altium (ALU) under $20.

2 – Appen Ltd (APX) below $9.50.

3 – Xero (XRO) around $35.

We anticipate buying at least one of these if the opportunity presents itself.

Overseas Indices

No change we are looking for US stocks to hold current levels before rallying into Christmas – our target for the this pullback by the S&P500 was 2700, less than 0.5% below last night’s low.

US S&P500 Chart

No change, European indices are now also neutral with the German DAX hitting our target area which had been in play since January.

German DAX Chart

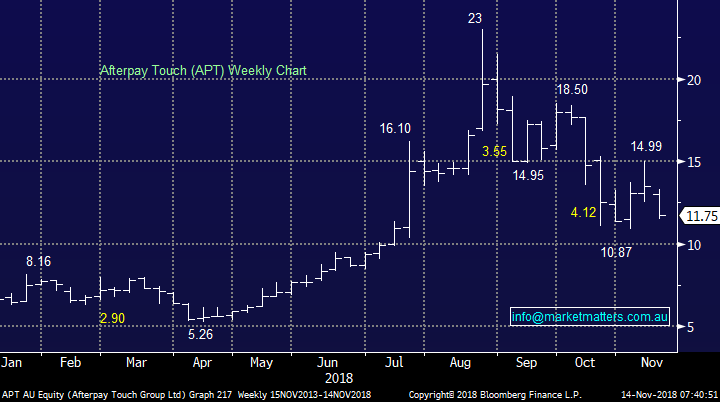

Overnight Market Matters Wrap

· A mixed session was experienced overnight in the US, with both the Dow and broader S&P 500 ending their day marginally lower, whilst the Nasdaq 100 closed marginally higher.

· The clear underperformer continued to be seen in the energy sector (-2.39%), as crude oil slid aggressively down 7.88% overnight to its 9-month low!

· Domestically, DuluxGroup (ASX: DLX) is expected to report its full year earnings, while BHP is expected to underperform the broader market, after ending its US session down an equivalent of -1.45%, following the weakness in crude oil.

· The December SPI Futures is indicating the ASX 200 to open 18 points lower towards the 5815 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.