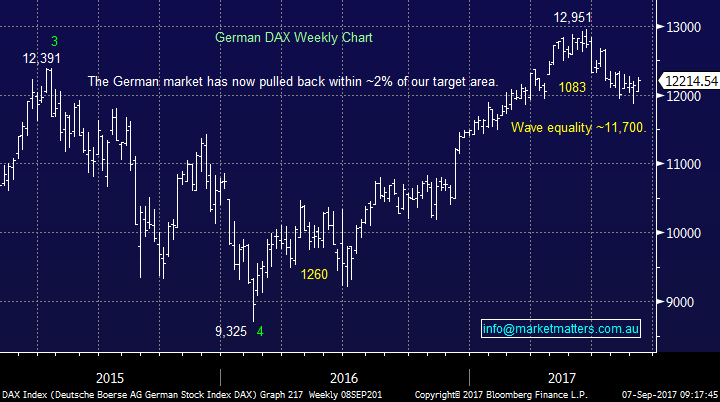

Where we plan to be invested into Christmas

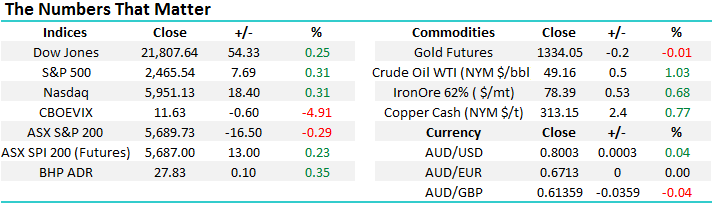

The ASX200 was extremely resilient yesterday only falling 16-points / 0.3% managing to ignore the 234-point / 1.1% plunge by the Dow, while following the script we outlined in the previous MM morning report i.e. falling hard in the early morning only to recover throughout the day. We continue to believe any spike lower towards / under the 5600 over coming weeks will represent good buying for the remainder of 2017.

Following some weak economic data out of the US on Tuesday night the theme for our market was very much centred around US interest rates not rising again this calendar year, a major shift to what the market has been anticipating for most of 2017, this change created some distinct winners and losers from a sector perspective:

Winners: Energy, resources and the “yield play” stocks.

Losers: Banks, Diversified Financials and the Insurance sector.

Interestingly the winners were generally in the market sectors we are looking to sell / lighten while the losers included a number of stocks which we are bullish into Christmas. Another week or two of this relative sector performance and MM will be extremely excited with the “switch” opportunities that are likely to present themselves.

Our view remains that interest rates will again rise in the US this December and markets will witness a spring back in the stocks / sectors that have endured a relatively tough period recently, while the perceived safer havens that fund managers have been accumulating will underperform.

ASX200 Weekly Chart

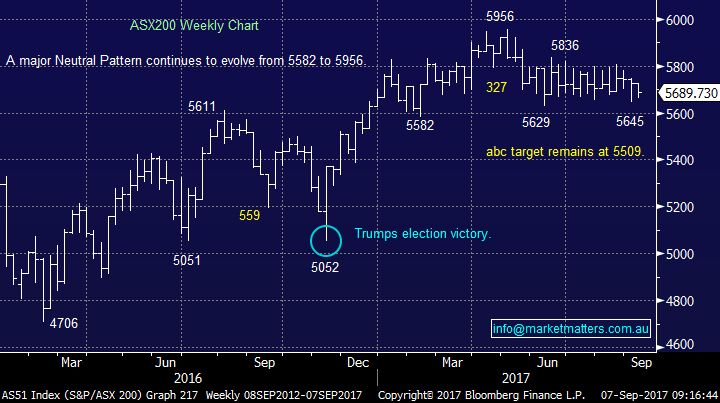

US Stocks

US equities held firm overnight following a decision by Congress to raise the debt ceiling until December – this issue will be back on the agenda before we know it. The Dow managed to regain about a quarter of the previous night’s losses.

There is no change to our short-term outlook for US stocks where are targeting a ~5% correction i.e. a further 750-points for the Dow.

US Dow Jones Daily Chart

Bond yields (interest rates)

As was demonstrated perfectly on the ASX200 yesterday US bond yields remain the key to relative sector performance moving forward, hence importantly we believe correction from the peak of economic optimism around 6-months ago is very close to having run its course. If / when US 10-year yields rally away from the current 2% level we should see some renewed love for the banks and financials.

US 10-year bond yield Weekly Chart

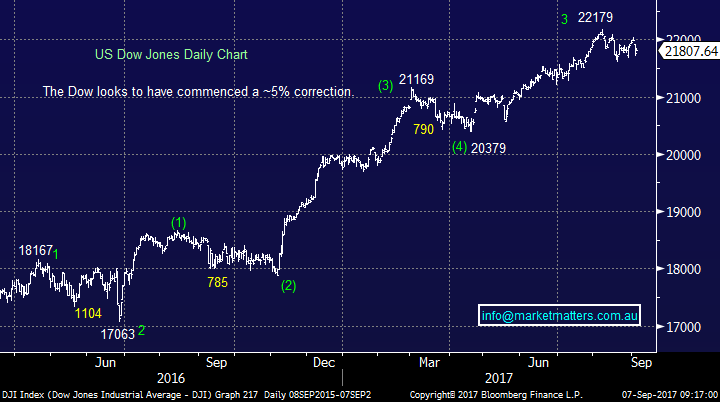

European exposure

We still believe that the correction by European stocks which commenced in late June has almost run its course although ideally, we will see a further ~4% downside – to date the German DAX has corrected 8.4%, compared to ASX200 which has pulled back 5.5% since May. We believe European stocks will probably outperform the US for the rest of 2017.

NB Australian stocks have been far more correlated to European markets than the US in 2017.

German DAX Weekly Chart

Hence yesterday MM was happy to increase its holding to CYB which looks poised for a rally back well over $5.

CYBG PLC Bank (CYB) Daily Chart

A second stock on our “European radar” is currently Janus Henderson (JHG) which we sold out of above $43.30 in late June. The stock is currently 3.6% below our exit level and we will again become potentially interested buyers of JHG under $40, another ~4% lower.

Janus Henderson (JHG) Weekly Chart

Banking and Financial exposure

The ASX200 is dominated by our banking and finance sectorsand these heavyweight areas are certainly weighing on thelocal markets performance at present. However, we believe this sector will come back into vogue moving forward in 2017, especially with ANZ, NAB and WBC paying healthy dividends in November. Also, we remain bullish the US Banking sector with an initial target 10% higher but a 20% rally would not surprise.

Remember our seasonal analysis identified ~20th of this month as an ideal to buy local banks with an average return of well over 4%, since the GFC, before the end of October.

We may add to our healthy banking / financial holdings in the MM Growth Portfolio later in the month but obviously how / where will depend on individual stocks performance over the coming week (s).

US S&P500 Banking Index Weekly Chart

Resources exposure

No change to our view which is probably unpopular with many market players at present but we intend to reduce our resources exposure moving forward, ideally into a little further strength. BHP goes ex-dividend today ~54c fully franked, we would now be keen sellers of BHP over $28 on an ex-dividend basis.

BHP Billiton (BHP) Weekly Chart

Conclusion (s)

We believe US bond yields are set to rally from current levels which should be bullish for banks / financials and particularly bearish for the “yield play”.

There is a strong likelihood we will be switching according to this view within our portfolio this month.

Overnight Market Matters Wrap

· The US major equity indices closed in positive territory with US financial stocks bouncing back after heavy falls the previous day, while energy stocks were strong as refineries continued to restart after Hurricane Harvey.

· The Volatility (VIX) index retreated of course, with geopolitical tensions slowly receding in investors’ eyes.

· The September SPI Futures is indicating the ASX 200 to open 4 points higher attempting to test the 5700 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 07/09/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here