Where are the opportunities likely to appear when the market bounces / bottoms? (BHP, FMG, WSA, BPT, OZL)

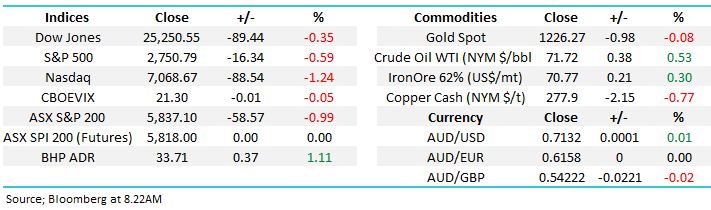

The ASX200 was again sold off aggressively yesterday falling 100-points by midday before showing a glimmer of optimism to regain almost 50% of the drop to finally close down -1%. The market was dominated by red with the banks / financials the largest burden to the index thanks to continued weakness in housing clearance rates over the weekend, while the Energy and Telcos sectors were the only two which managed to close in the black.

Revisiting our short term view that we outlined in the Weekend Report on Sunday;

“Without getting too short-term in nature, we see the ASX 200 unfolding as below:

1 – We believe the ASX200 looks set to rotate between 5775 and 5900 next week.

2 – Over the next few weeks, into November, we anticipate another attempt at fresh lows probably down towards 5700.

So, we retain a bearish bias short term however importantly, we believe the worst from an acceleration context is probably behind us at this stage.”

MM is looking to rejig our stock exposure around the 5900 area while potentially scouring for a few quick bargains 2-3% lower than yesterdays close.

Overnight US stocks again came under pressure with the S&P500 closing down -0.6% with the selling concentrated in the tech based NASDAQ which fell -1.2% i.e. it’s a dangerous time to be exposed to high growth / valuation stocks where plenty of blue Sky has been priced in. What caught our eye was Europe, Nikkei futures and Hang Seng futures all closing positive, it feels to us that the buy US stocks – sell the emerging markets / Europe “play” is unwinding, the SPI futures are pointing to the ASX200 opening only marginally lower.

Today’s report is going look at what stocks / sectors we want to buy into current weakness – obviously this may entail some switching in the Growth Portfolio as currently we only hold 3% cash and 5% in the BBUS ETF i.e. short US equities.

ASX200 Chart

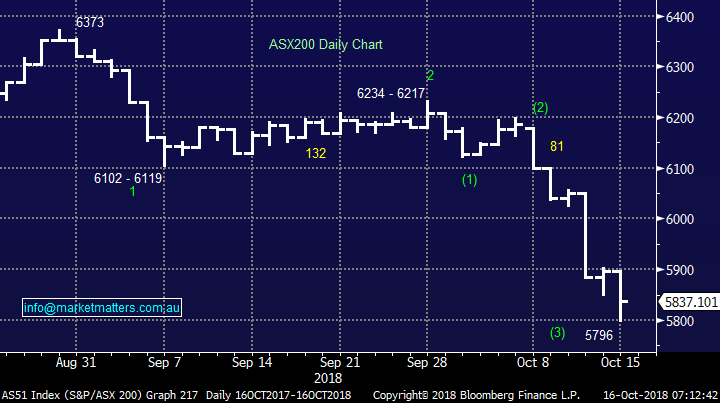

BREXIT facing stocks have been hammered over recent times with over the last month CYBG (CYB) down -13.8% and Janus Henderson (JHG) down -12.7%. While we feel both of these are overdone on the downside politicians can be scary.

We currently hold JHG which is already on a short leash but if we had no exposure to the European negotiations we would be considering adding CYB to the Growth Portfolio around $5.00

CYBG Ltd (CYB) Chart

The ASX200 has been in a bull market since March 2009 as global central banks aggressively stimulated global economies to avoid the recession becoming a depression – especially in the US where the GFC was focused.

Economically we are now clearly in the “late cycle”, just as we believe stocks are. Unemployment rates are falling globally and demand is running above output in many industries, fuelling the need for more workers, materials and investment. Wages are rising, commodity prices (especially energy) are rising and the introduction of tariffs on imported goods all add to inflationary pressure.

Hence central banks are removing QE by increasing interest rates and winding back bond purchases. Recently, the United States again hiked cash rates and this follows rate hikes in the UK, Sweden, Canada, Indonesia, India and Mexico amongst others – all since June.

The removal of QE has the very important impact of reducing liquidity in the financial system and making credit more expensive / difficult to attain putting downward pressure on assets.

Historically “late cycle” investing can be profitable but dangerous for the uninformed i.e. increasing interest rate, rising inflation and slowing growth are all generally bad news for bonds and equities.

However not all sectors have a bad time “late cycle” i.e. 2-years before a recession hits and 1-year afterwards.

Over the 11 US recessions since 1940 buying resources into the late cycle period have outperformed industrial stocks by over 25%.

Obviously China - US trade tensions is the wildcard this time around but it has led to significant corrections in much of the sector over recent weeks / months.

Hence MM is looking to increase our resources weighting moving forward –we currently hold 11% of the Growth Portfolio in the sector via RIO, Mineral Resources and Newcrest Mining (NCM), we expect this to increase noticeably moving forward. Gold was up another ~$8 overnight.

ASX200 Chart

Following are 5 resources stocks MM doesn’t hold but likes moving into 2019 plus our ideal entry levels – most of these are a tweak / reiteration of previous notes, plus we like Gold exposure here and will look to average Newcrest (NCM) / Buy Evolution (EVN).

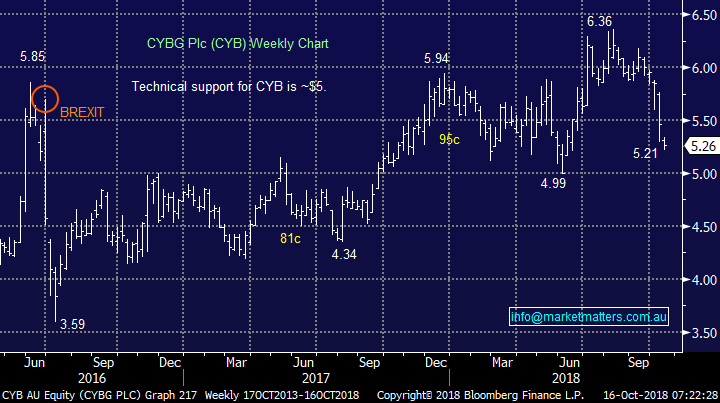

Before we crack on with new ideas is the resource space, worth noting that the next month is a big one on the news front with a heap of quarterly’s and a few site visits. Below calendar thanks to Peter O’Connor.

RIO is out this morning with Q3 production numbers and they look okay. Copper is very strong while Iron Ore is weaker, however that was to be expected given planned maintenance. Importantly, they reconfirmed Iron Ore guidance at the top end their previously guided range of 330 to 340 million tonnes.

1 BHP Billiton (BHP) $33.34

We remain very keen to buyback into BHP with our ideal level below $31 feeling miles away – at least the stock has remained below where we exited many months ago (just).

BHP has sold its US shale operation for $14.6bn, well under the $20bn purchase price in 2011 but still putting the mining giant in a strong position for capital returns to shareholders – a clear support for the share price.

There’s a lot to like about BHP at the moment except it feels very owned by the market due to anticipated capital returns – we plan to be patient on entry for now.

BHP is out with production numbers tomorrow.

BHP Billiton (BHP) Chart

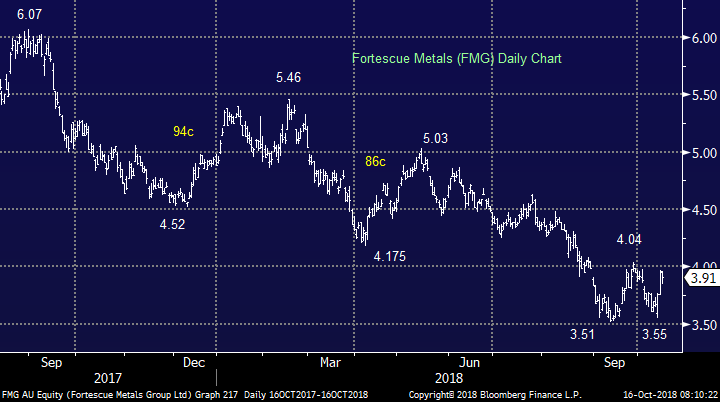

2 Fortescue Metals (FMG) $3.91

FMG pleased the market this month by announcing a $500m buyback, we believe this is a stock that has become totally undervalued and unappreciated.

Technically we are keen buyers around $3.25 but the buyback news may make this level too optimistic. Even after the recent 10% bounce its yielding 5.9% fully franked. We up weighted FMG in the Income Portfolio last week.

MM is keen on FMG

Fortescue Metals (FMG) Chart

3 Western Areas (WSA) $2.47

Nickel producer WSA has already corrected over 40% from its April high, a very painful move following a euphoria style blow off as the nickel price surged on US – Russia sanction concerns.

MM remains a keen buyer of WSA around $2.20.

Western Areas (WSA) Chart

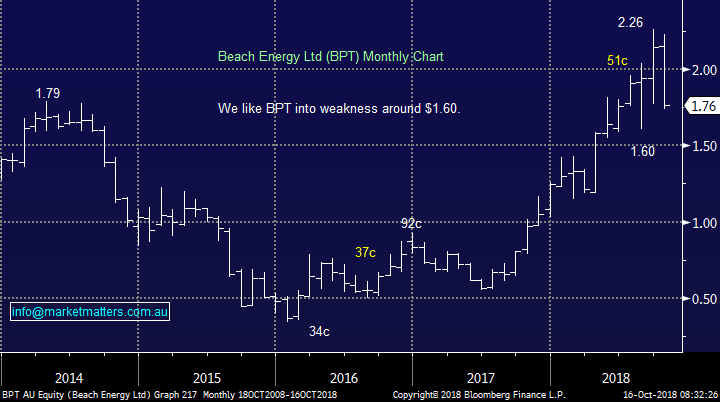

4 Beach Petroleum (BPT) $1.76

BPT has been on a rollercoaster ride over the last few months with a 40% rally now being followed by ¬30% correction.

MM likes BPT around the $1.65 area, not too far away.

Beach Petroleum (BPT) Chart

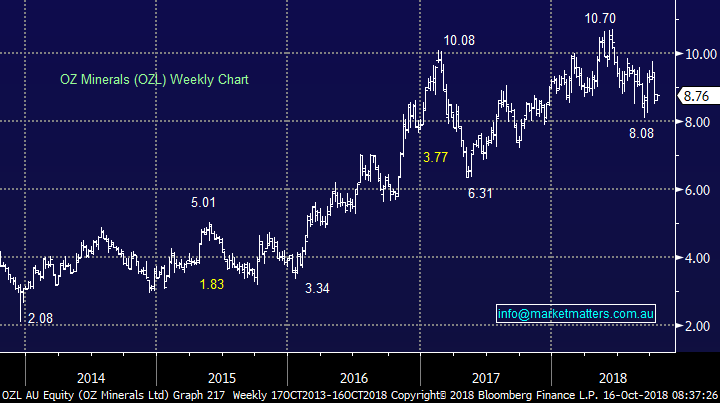

5 OZ Minerals (OZL) $8.76

OZL which is generally regarded as a copper play has also had a volatile year and technically, like South32 shown below, looks vulnerable to further declines.

Our ideal buy area for OZL is now around $7, significantly lower but this is a volatile stock.

OZ Minerals (OZL) Chart

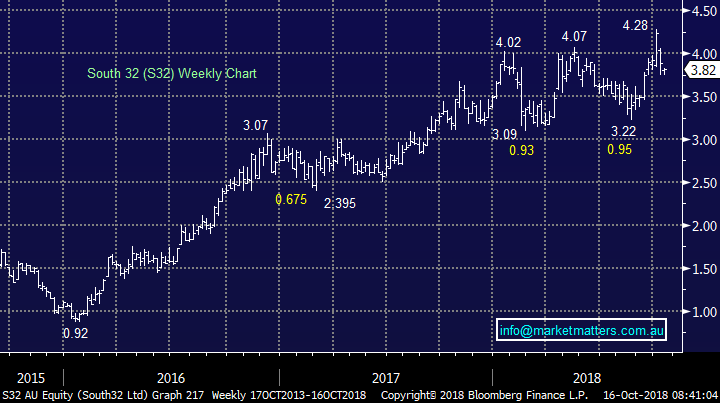

South32 (S32) Chart

Conclusion

MM is looking to increase both its relative weighting and total exposure to the resources with BHP, FMG, WSA, BPT and OZL on the radar as discussed above + increasing Gold.

NB Our ideal entry levels are lower in all cases, with the slight exception of FMG, but don’t underestimate the volatility of both the market and sector at present.

Importantly, we plan to use this market weakness to ‘set’ our portfolios to be more aligned with rising inflation, late cycle investing. Resources fit that bill, as do quality growth at reasonable prices (i.e ALL, COH, CSL)

Overseas Indices

No change with our bearish view on US stocks, we now expect fresh recent lows by the S&P500 towards 2700, over 2%, before a decent bounce.

US S&P500 Chart

European indices were firm last night which ties in with our technical picture as the DAX sits close to our long term 111,350 target area. We are neutral short-term but still concerned by the bigger picture.

German DAX Chart

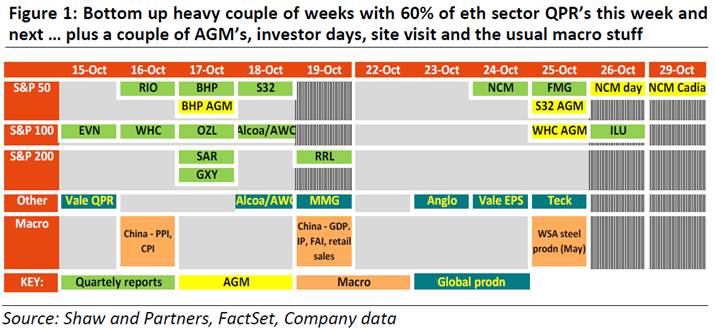

Overnight Market Matters Wrap

· The US equity markets resumed its recent downtrend, with the Nasdaq 100 underperforming against its peers as growth and momentum stocks were sold as investors switched into more defensive stocks that trade at more attractive multiples.

· Trade tensions remain with US and China, while geopolitical tensions are still on a high, with the US and Saudi.

· BHP in the US is set to claw back a little of its recent losses and outperform the broader market, after ending its US session up an equivalent of 1.11% from Australia’s previous close.

· The December SPI Futures is indicating the ASX 200 to open marginally lower, around the 5835 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.