When & what to start buying? (HYG US, NAB, WPL, BLD, APX, APE)

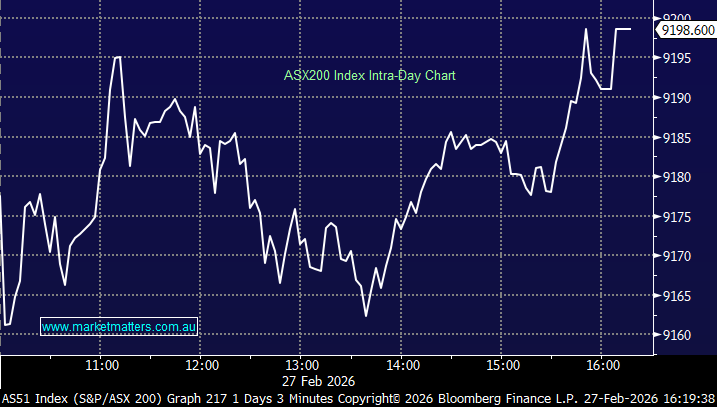

The ASX200 was crunched yesterday because during our time zone global equities caved in to the risks of a 2nd wave of COVID-19, the 2.2% local sell-off was pretty much across the board with over 90% of the index closing in the red, the clear underlying theme being “risk off”. On the sector level the Energy & Consumer Discretionary were the worst on ground both falling by -3.4% as investors continued to lose faith in a rapid “V-shaped” global economic recovery. At MM we have been looking for a ~8% pullback towards the 5700 area to start putting our increased cash levels back to work hence as the title suggests it’s now time to decide “when & what” we should start buying.

It often amazes me how financial markets so often ignore the relatively obvious, stretching elastic bands way too far in the process, before snapping back in periods of pure panic or euphoria:

1 – The ASX200 had rallied over 40% from its March low with many stocks / sectors dismissing the virus pandemic as a blip in the road, as we said at the start of the month “MM is very wary of stocks short-term” although we have maintained our medium-term bullish stance.

2 – Secondary outbreaks were almost inevitable according to health experts and yet yesterday as around 100 new cases surfaced in Beijing, a city with a population 21.5million people, we saw global stocks plunge lower. I question when the virus still has no vaccine, what did people expect? The US still worries us, they have “gone back to work” yet they have plenty of states where the statistics remain a concern.

The Fed started the loss of faith in stocks last week and the coronavirus might just have provided the capitulation just one week later, things are undoubtedly unfolding very rapidly at the moment. We believe now is the time to start accumulating stocks with some bad news finally being at least contemplated by equities i.e. the market simply needs to pause before we can ascertain if the things will rapidly return to normal, or we’re in for a long and painful deep recession.

MM remains bullish equities medium-term with our initial ideal entry target having been reached.

ASX200 Index Chart

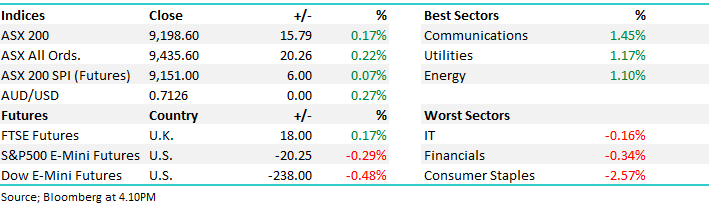

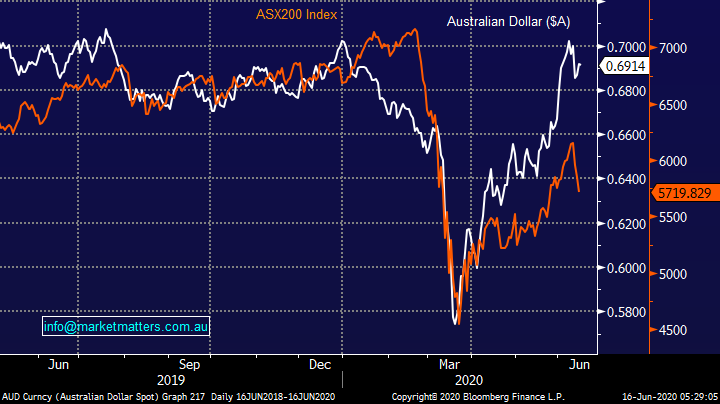

Overnight we’ve seen the risk / growth play snap back into favour with the $A rallying 1.5c from its lows against the greenback. We view this as very encouraging sign for equities, and it remains our belief that the $A and ASX200 will converge on the performance front implying stocks are now in the buy zone again

MM remains bullish the $A targeting the 80c region.

Australian Dollar ($A) & ASX200 Chart

Global Markets.

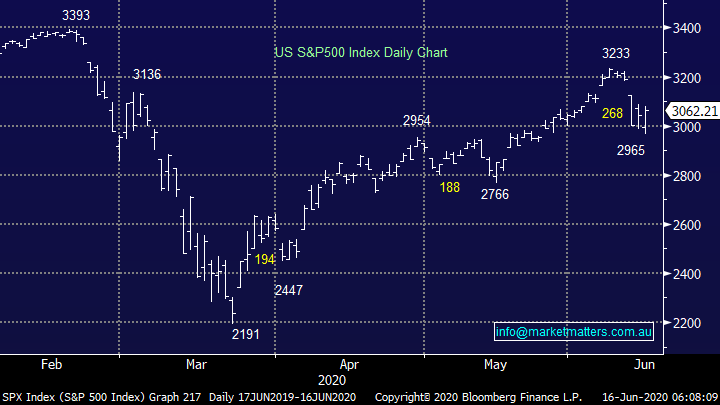

US stocks followed the Feds bullish lead overnight recovering strongly with the S&P500 futures rallying 5% from their lows, posted just as our market was closing, hence we expect a strong opening this morning by local stocks – remember the quote “don’t fight the Fed” – in the early hours the Fed came out and said they were going to start buying corporate bonds immediately, they clearly had seen enough volatility!

From a technical perspective we see 2 obvious scenarios unfolding in the weeks ahead, using the S&P500 as a benchmark either the correction is already complete and we’re headed higher towards 3300 before another potential pullback, or we consolidate between 3000 and 3100 before another leg lower towards 2800 however either way the key is MM is primarily looking for areas to accumulate stocks.

MM remains bullish US stocks medium-term.

US S&P500 Index Chart

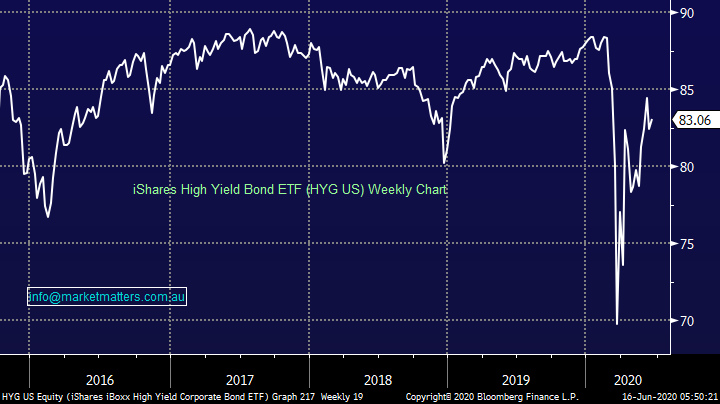

The Fed has started “a portfolio of corporate bonds immediately” by definition this is creating a huge floor under corporate debt markets and while it may be leading to an almost false market in our opinion it’s not a trend to fight – as we said above this is a major tailwind for equities.

MM remains bullish corporate bonds short-term.

iShares High Yield Bond ETF (HYG US) Chart

Updated buys into current weakness.

In Sundays Weekend Report we wrote about 3 stocks / sectors we were contemplating buying into a dip towards the 5700 area, the expected weakness has unfolded so it’s time for action to follow our words! Hence this morning’s report is a simple update om those 3 stocks MM is looking to buy, plus an additional 2 - it’s time to be clear and concise.

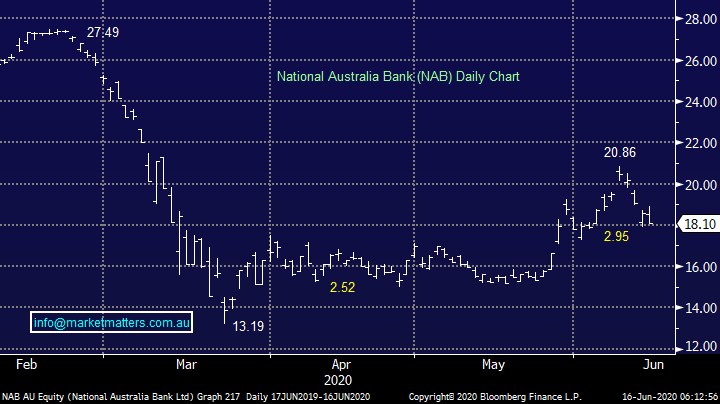

A “Big 4” Bank.

We continue to like the sector into weakness, and want to take our neutral stance to an overweight one, for those that missed it previously there are a couple of key reasons for this view:

1 – Banks took large COVID-19 provisions under the influence from a panicked government, while it’s impossible to know exactly how things will unfold short-term come 2021/22 we believe it will be business as usual (ish) including their much cherished dividends.

2 – Assuming the above is correct the major banks should enjoy ~35% upside from current levels, we hold CBA and Westpac while National Australia Bank (NAB) is very much in our buying sights for both Growth & Income Portfolios.

MM likes NAB into current weakness.

National Australia Bank (NAB) Chart

The Energy Sector.

Crude oil is strongly correlated to economic growth and as such it’s been hammered recently as the market digested last week’s extremely cautious statement by the Fed plus for good measure COVID-19 has again added to fears e.g. Santos (STO) declined over 18% from its intra-week high. We have had our eyes on Woodside (WPL) around $20 for weeks and nothing’s changed, the current foray towards our buy zone has clearly pricked our ears and we’re dipping our toe back into the water here.

MM likes WPL around $20.

Woodside Petroleum (WPL) Chart

Building Stocks.

The Australian Building Sector remains up well over 20% since mid-May, supported by expectations of government stimulus targeting construction. We covered Boral on the weekend which has seen the sharpest rebound from the lows (+28%) however the sector collectively remains bullish. A new CEO announced yesterday was taken favourably as was the reassurance around their balance sheet, which was a concern of ours.

MM likes BLD targeting a break of $4 in 2020.

Boral (BLD) Chart

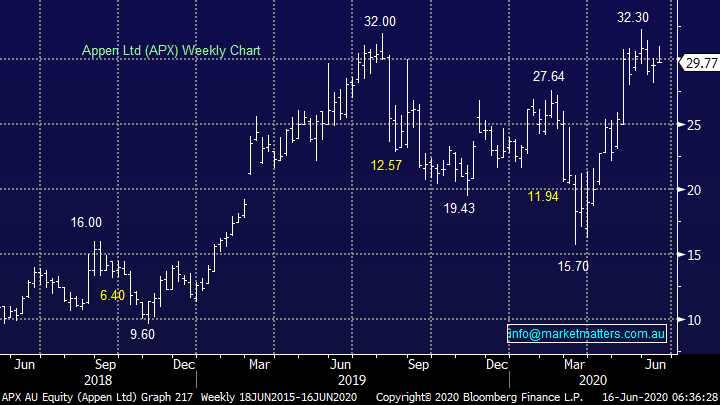

Appen (APX) $29.77

At MM we are not averse to taking the occasional “short-term active play” if we believe the company is of the right quality and of course the risk / reward is appealing. APX fits this profile today even though it’s close to its all-time high, remember the best performing stocks usually continue much further than most people anticipate.

MM likes APX initially targeting 15-20% upside.

Appen (APX) Chart

AP Eagers (APE) $6.45

As we saw yesterday when the markets runs for cover in mass of “risk off” its Energy & discretionary spending that’s in the cross hairs but when confidence returns rotation kicks in – a common theme in 2020. At MM we are believers that the recovery will gather momentum into 2021 hence buying automotive business APE into pullbacks fits the profile. A stock we’re considering more for the income portfolio.

MM likes APE after its 17% correction.

AP Eagers (APE) Chart

Conclusion

MM is in “buy mode” viewing the recent pullback as an opportunity to upweight our equity exposure

We like the 5 stocks specifically discussed above, although NAB, WPL & APX appeal most given our current portfolio composition.

*watch for alerts.

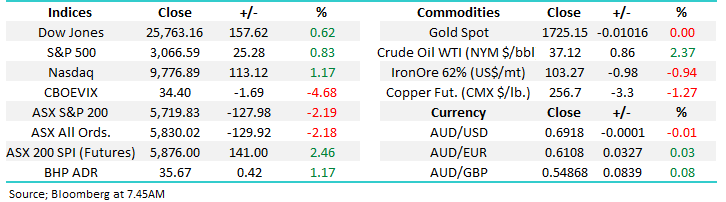

Overnight Market Matters Wrap

- A volatile session was experienced across the globe overnight, with the US selling off earlier on Covid-19 fears, only to bounce back aggressively, thanks to the start of a fresh round of US bond buying

- The Dow rose as much as 4.22% from its intraday lows, while the broader S&P 500 gained as much as 3.85%.

- US 2-year treasuries declined, while the 10-years gained. Germany however witnessed their 10-year yield hitting a two-week low, down 1bps.

- On the energy front, crude oil erased its recent losses, climbing 2.2% to US$37.05/bbl, while safe haven, gold was a touch weaker.

- The June SPI Futures is indicating the ASX 200 to jump quick off the gates, 157 points higher towards the 5875 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.