What’s next after the US mid-terms? (APX, CYB)

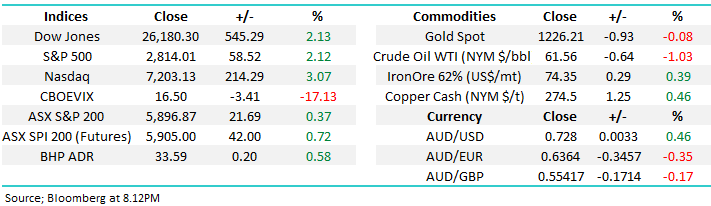

The ASX200 enjoyed another solid day even as the news filtered through that President Trump had lost the House of Reps in the US mid-term elections – no surprise to the polls and bookies alike who had this as a 85% probable outcome, however the Republicans retained the senate which was more a 50/50 bet. The US S&P500 futures rallied throughout our day as “buy on rumour, sell on fact” played out in reverse.

While the banks remained strong what caught our eye was the return to favour of the high valuation / growth stocks – investors were “buying risk”. One of the things we will look at today is what of if risk comes back into vogue, how far are we likely to bounce?

Its worth reiterating a point I made in yesterday’s report:

“I do feel a lot of investors / fund managers are highly cashed up and the path of most pain may be a sharp rally into Christmas.”.

On reflection perhaps, it won’t be a sharp rally but a steady prolonged grind higher, it will still hurt the fund managers / investors who felt clever in mid-October when markets fell but I suspect very few pulled the “buy trigger” in the few days when bargains presented themselves.

We have been short-term positive the ASX200 initially targeting a break back above 5900 which basically was achieved yesterday taking the recovery from the October low to 272-points / 4.8%.

MM remains mildly bullish the ASX200 short-term while the index holds above 5840 support.

Overnight US / Europe markets were strong as a relief rally gained momentum throughout the session, Dow up 545-points while the SPI futures were pointing to a open for the ASX200 up around 30-points / 0.5% - remember we saw a decent portion of the US gains overnight in their futures market during out time zone yesterday.

Today’s report is going to look at what we can expect from equities now the uncertainty of the US mid-terms is behind us.

ASX200 Chart

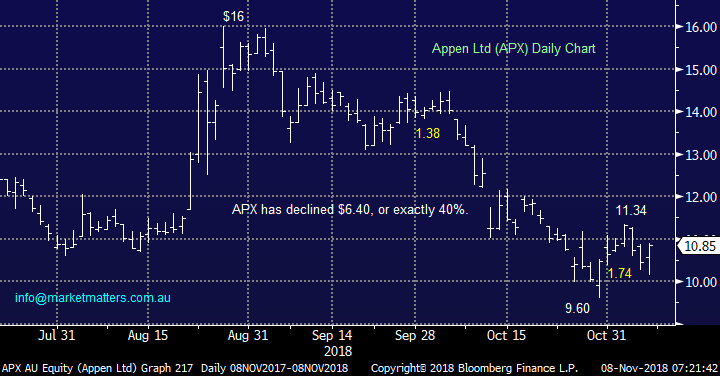

Appen Ltd (APX) $10.85

We talked about machine learning business Appen Ltd (APX) in yesterday’s report with the conclusion that we liked the stock but into fresh lows around $9.

However, this view has been revised overnight following the increased appetite we saw for risk throughout Wednesday’s session.

We now expect APX to at least bounce towards $12, around 10% higher.

Appen Ltd (APX) Chart

The Australian growth sector is highly correlated to the US tech based NASDAQ which soared over 3% last night. The technical picture for the NASDAQ is excellent from a risk / reward perspective i.e. buy the NASDAQ targeting fresh all-time highs with stops below 7020, which equates to 2% risk while targeting almost 10% upside.

MM is bullish the NASDAQ with stops / exit if it fails to hold above the 7020 level.

The strong implication here is the Australian high growth / valuation sector should rally, or at least bounce, strongly.

US NASDAQ Chart

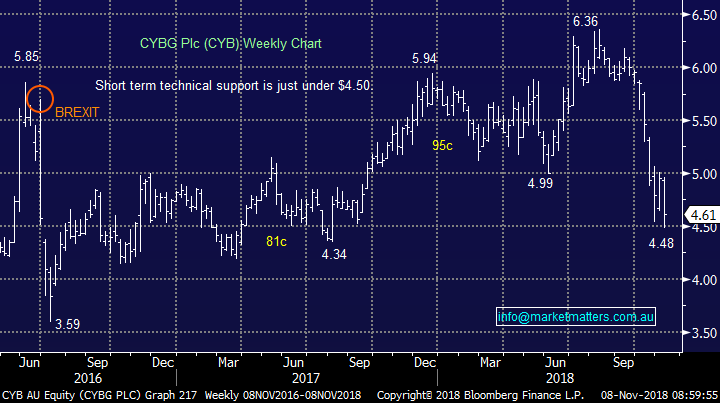

Another battered up stock that caught our eye into the close yesterday was CYBG (CYB) which ended the day down 2.7% but almost 3% above its intraday low

CYBG Plc (CYB) $4.61

Over recent weeks one of the worst performing stocks has been the UK spin-off from NAB, CYB which owns Clydesdale and Yorkshire banks, and is in the midst of a deal with Virgin Money – it’s fallen almost 30% from its 2018 high only a few months ago. The stock has been hit hard since warning the market that mortgage competition was increasing in the UK, arguably better news than what’s happening to the domestic property market.

However, the Australian operated banks have been sold off aggressively over the last 3-years while CYB has soared over the last 2-years i.e. the market was too long / optimistic CYB but the 30% fall has addressed the bulls in a quick and painful manner.

MM is now bullish CYB looking for a 10% rally minimum.

Another example of a stock that had a tough October looking ok for at least the next few weeks.

CYBG Plc (CYB) Chart

Post US mid-term elections

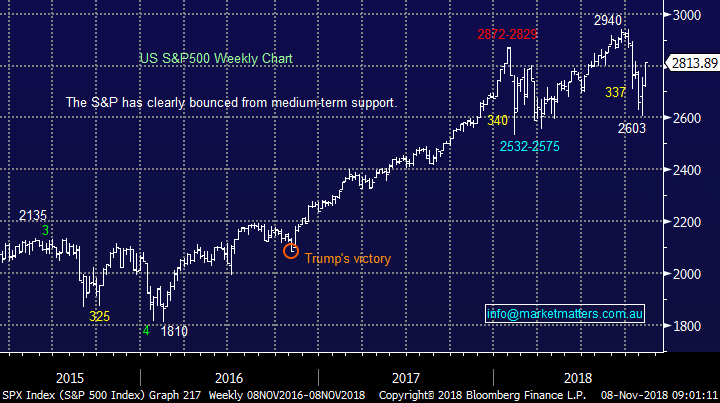

President Trump has lost the House of Reps, leading many to question if this will be the end to the longest bull market in history. The overnight rally by US stocks certainly implies not.

The first thing to do is to reflect on recent market moves:

1 – The S&P500 had rallied over 40% since Donald Trump surprised the world and became President back in November 2016.

2 – However last month we saw stocks close down 7% after tumbling over 10% at one stage.

US S&P500 Chart

Since World War 2 there have been 18 mid-term elections so let’s review what usually happens into these votes:

1 – The second year of a Presidents term is usually the worst for stocks, which is when the mid-terms occur i.e. in the case of President Trump that’s now (2018).

2 – Delving a touch deeper leading into the mid-term elections stocks are usually weak falling on average 1% by the end of October compared to an average rise of ~7% in years without the worry of these elections.

As we know markets hate uncertainty but once the elections have passed markets usually have a cracking time.

The statistics for next year are simply remarkable and most certainly not something to fight even if all correlations do eventually get broken:

1 – Following the mid-term votes US stocks have been higher 100% of the time one year later and this obviously includes a full mix of Democrat and Republican perceived victories in both the House and Senate.

2 – The average rise over the year following the mid-terms is an astounding +17% and that’s not from any panic lows in the year but simply post vote.

This year may feel wild or weak to many but as an index its simply up a few %, the volatile swings in January / February and of course October just hindered sentiment. Importantly if 2018/9 follows the script, we should expect the market to surge in November after the uncertainty of the elections are behind us – the Dow’s rally last night certainly supports this view.

MM has held the below path for the S&P500 as our preferred scenario for 2018/9 and at this stage it feels good – don’t get me wrong we were nervous at times last month but our Growth Portfolio is 93% committed to equities compared to starting October significantly underweight and carrying 2 negative facing ETF’s.

We should also remember the latest clues from the Bank of America’s Fund Manager survey released late last month:

1 – 85% of fund managers believe we are “late cycle” for growth, the highest since November 2008, a few months before the start of the longest bull market in history i.e. they’re bearish.

2 – Fund managers cut their exposure to US stocks by 17% last month citing valuations as the main reason why, these investors may be forced to buy back in at higher prices.

Basically investors are bearish global growth which is a perfect catalyst for a bounce in risk assets but maybe not enough for a prolonged rally.

MM also believes the equity bull market is late cycle and there will be excellent opportunities for the active investor.

S&P 500 Chart

Conclusion

We are now bullish US stocks into 2019 assuming the S&P500 can hold 2740 and the NASDAQ 7020.

MM is basically fully committed to equities which is great although a little more exposure to the growth end of town would be nice at least short-term.

We are looking to slowly increase our cash levels into strength while evaluating a few short-term opportunities along the way e.g. growth stories like APX today.

Overnight Market Matters Wrap

· Uncertainty in the US surely has dissipated following the mid-term election results with the Republicans remaining in control of the Senate. This led to a rally on all 3 majors, with both the Dow and S&P 500 ending their session just over 2.1% higher and the tech. heavy Nasdaq 100 outperforming by closing 3.07% higher.

· The Aussie Battler, AUD managed to hit the US73c level this morning, only to trade back towards US72.80c this morning.

· Crude Oil lost further ground, down 1.03% overnight as inventories surpassed analysts’ expectations.

· BHP is expected to outperform the broader market this morning, after ending its US session up an equivalent of 0.58% from Australia’s previous close, while the US related stocks such as Macquarie Group (MQG) is also expected to outperform.

· The December SPI Futures is indicating the ASX 200 to open 21 points higher towards the 5920 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 08/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.