What now MM has gone “very long”? (AAPL US, BBOZ, CBA, PDL, RIO, EHL, GDX US, BIN, JPM US, TBF US)

The ASX200’s strong early gains slowly and steadily dissipated throughout yesterday’s session with the index finally closing up only 27-points, significantly underperforming the Dows 400-point surge on Tuesday which saw the tech-based NASDAQ soar to fresh all-time highs. The market breadth was solid with almost 70% of the market closing up on the day but when the influential banks are heavy it’s hard for our market to enjoy meaningful gains e.g. Commonwealth Bank (CBA) -1.2% and Westpac (WBC) -0.3%.

Sentiment swings around the coronavirus outbreak in China and the potential knock-on effect on their economy continues to dominate equities, however while the number of confirmed cases has surpassed 24,000 and the death toll approaches 500 investors are becoming increasingly optimistic as it appears that things are not escalating exponentially out of control i.e. containments working. The US tech based NASDAQ scaling fresh all-time highs yesterday illustrates the path of least resistance remains up and traders / fund managers are still in “buy the dip” mode which has been a winning formula for many years however history tells us “many an investment thematic works until the day it doesn’t.”

Importantly to reaffirm MM’s view moving forward : we believe that 2020 will continue to be a choppy year as waves of optimism and pessimism are likely to wash through stocks, no great surprise considering the markets record breaking post GFC advance and elevated valuations that make it relatively easy for investors to sell stocks on the sniff of a pullback. Our current best guess is the ASX200 will make fresh all-time highs in Q1 up towards 7200 before enduring another ~5% correction, perhaps this time on bond yield concerns – we plan to tweak our portfolios accordingly e.g. currently we have a very low cash position after buying the coronavirus panic sell-off on Monday hence it’s what / where to sell which we are now focused on.

MM will become very bullish the ASX200 if it closes back above 7000 with a target ~3% higher.

Overnight US stocks optimism around a cure for coronavirus sent US stocks soaring with the Dow up nearly 500-points, that’s 1000-points over 48-hours to be less than 1% below its all-time high, the SPI futures are indicating the ASX200 will rally +0.8% early on taking the ASX200 to ~7030.

Today we’ve focused on the how we plan to play a market rally towards 7200 if / when it unfolds, paying particular attention to our Growth Portfolio.

ASX200 Chart

US equities are rallying strongly as I type with all-time highs just around the corner for the broad indices while the tech based NASDAQ is dragging the chain for a change gaining around a quarter of the S&P500 with Tesla (TSLA) down ~17% and a few other stocks like Microsoft (MSFT US) encountering some profit taking.

MM remains bullish US equities short-term with an ideal target for the S&P500 ~3400.

US S&P500 Index Chart

Apple Inc (AAPL US) has followed our market roadmap perfectly of late in a similar manner to Alibaba (BABA US) touched on yesterday. From a technical perspective Apple should make fresh all-time highs again.

MM believes Apple’s is likely to test 350 over the months ahead before consolidating the strong gains over the last 8-months.

Apple Inc (AAPL US) Chart

China’s stock market continued its strong rebound from Mondays sell off and amazingly it’s now only down -4.4% for the week, as we touched on earlier this week it’s a very brave investor whose prepared to take on the PBOC (People Bank of China) – over the weekend they told the market they intended to support financial markets, that’s enough for me not be short!

China’s Shenzhen CSI 300 Index Chart

Evaluating selling candidates in the MM Growth Portfolio

I know some subscribers will be finding us a touch too active at present but there are times to sit back and be passive and other times when a more aggressive approach is best to add some much enjoyed alpha (performance) to a portfolio – I don’t believe many people would argue that the volatility to date in 2020 has certainly presented some solid opportunities on both the buy and sell side of the fence and it’s our job at MM to endeavour to take advantage of as many of these as possible in a sensible calculated manner.

Remember MM is targeting the ASX200 to test ~7200 in the weeks / months ahead before we feel it will be prudent to take some $$ back off the table, especially as we are currently very long in our Growth Portfolio with a cash holding of only 1% : https://www.marketmatters.com.au/new-portfolio-csv/

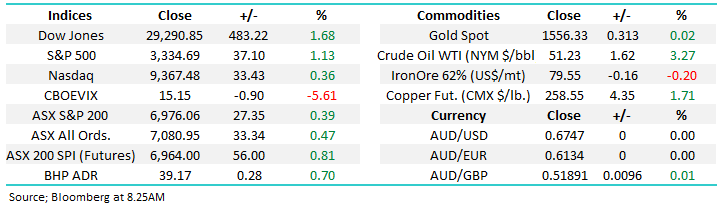

1 BetaShares Australian Equities Bearish ETF (BBOZ) $8.68

Arguable the easiest way to reduce our market exposure is to buy a bearish ETF, we like the BBOZ as our preferred vehicle having enjoyed some success in the past. This is a leveraged product with exposure to the ASX200 of around 2.4x hence if we allocate 5% into the BBOZ it’s like holding a 12% short position to the local market.

MM is looking to buy the BBOZ around the 8 level.

BetaShares Australian Equities Bearish ETF (BBOZ) Chart

2 Banks

MM is holding 23% of the MM Growth Portfolio in “Big Four” banks CBA, NAB and Westpac (WBC), we are considering taking profit on our CBA holding above the $86 area.

CBA is the bank MM is most likely to sell.

Commonwealth Bank (CBA) Chart

3 Investment Managers

MM is holding 9% of our Growth Portfolio in UK facing Pendal Group (PDL) and Janus Henderson (JHG) while we like both of these positions on both a valuation basis and global situation, we may consider selling PDL if it squeezes up towards $9.50.

Pendal Group Ltd (PDL) Chart

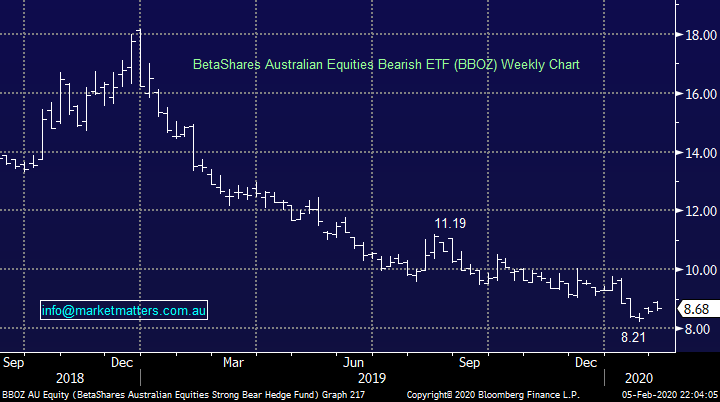

4 Resources

MM is holding a recently increased 24% exposure to the resources sector via Beach Energy Ltd (BPT), Western Areas (WSA), OZ Minerals (OZL), BHP Group (BHP) and RIO Tinto (RIO). While this is how we wish portfolios to be skewed through 2020 if one of these 5 holdings do squeeze higher in a meaningful manner over the coming weeks we will consider taking some $$ off the table.

RIO Tinto (RIO) Chart

5 Smaller businesses

MM now holds 13% of our Growth Portfolio in Pact Group (PGH), Costa Group (CGC) and Emeco Holdings (EHL) after taking a small profit recently on a 1/3 of our PGH holding. At this point in time we are happy with these 3 stocks but obviously never say never, PGH around $3.25 will be tempting.

EHL has pulled back recently after raising $65m at $2.07 a share to purchase Kalgoorlie based contractor Pit N Portal, close to today’s price, we currently like the direction the company is evolving and plan to increase our holding in the current rights issue which closes on February the 10th.

NB Eligible shareholders can increase their holding by 1 share for every 10.29 shares held at $2.07. Please note, this is a non-renounceable rights issue. We plan to take up our rights effectively increasing our holding by ~10%

Emeco Holdings (EHL) Chart

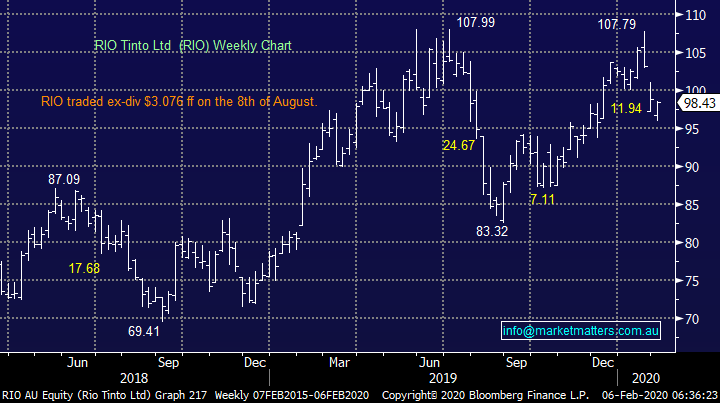

6 Gold stocks

MM is currently holding 3% of the Growth Portfolio in Newcrest (NCM) and Evolution Mining (EVN) respectively, definitely too much over last few months. We continue to look for the best place to exit /reduce these holdings but if equities are again close to a short-term top it may now be prudent to exercise a little patience at least with one holding.

MM is looking for optimum exits from EVN and NCM.

VanEck Gold Miners ETF (GDX US) Chart

7 Capital Goods Holdings

MM is currently holding almost 7% of the MM Growth Portfolio in Service Stream (SSM) and NRW Holdings (NWH), this is a sector we remain bullish and hence reticent sellers.

MM still likes SSM and NWH.

ASX200 Capital Goods Index Chart

8 The “others”

Lastly MM is holding 17% across Boral (BLD), Sims Metal (SGM), Computershare (CPU) and Bingo Industries (BIN), overall, we are happy with these four holdings although Bingo (BIN) back above $3 will be tempting.

Bingo Industries (BIN) Chart

Conclusion (s)

MM is looking to reduce its market exposure if / when the ASX2000 pushes towards the 7200 area, above is an indication of our current thoughts around both how and why.

MM International Equites Portfolio

Our cash position is currently at 21% hence we are not “all in” on the long side but 3 things are currently on our radar:

1 – Increase our ProShares Short S&P500 position basis ~3400 in the underlying index.

2 – Take profit on Alibaba (BABA US) into fresh all-time highs, with a view to re-entering ~10% lower.

3 – Take profit in JP Morgan (JPM US) & / or cut Wells Fargo (WFC US) – the later may be a loss, but both into strength.

JP Morgan (JPM US) Chart

Conclusion (s)

MM is looking to tweak its International Portfolio into further strength for stocks i.e. reduce exposure overall into new highs.

The MM Global Macro ETF Portfolio

The MM Global Macro Portfolio is now 41.5% in cash as we continue to watch the current volatile financial markets very closely. : https://www.marketmatters.com.au/new-global-portfolio/

Things continue to evolve in-line with our views hence until further notice we will follow our laid-out plan of the previous weeks, at these stage 2 things are on the trading / investing pad:

1 – MM is looking to increase our ProShares Short S&P500 position basis ~3400 in the underlying index.

2 – MM is looking to fade a new low in bond yields, our preferred ETF is the ProShares short 20+ Treasury ETF (TBF US) again for MM to get are targeted entry we are likely to need equities to take another leg lower : https://etfdb.com/etf/TBF/#etf-ticker-profile

MM is looking to buy the TBF, preferably below 18.

ProShares Short 20+year US Treasury ETF Chart

Conclusion (s)

MM has our ideal scenario figured out now it’s time to sit back and wait and see if we are correct, if so, we will be trimming equities into fresh all-time highs – perhaps sooner rather than later!

Overnight Market Matters Wrap

· The SPI is up 56 points as equities continued to rally in Europe and the US overnight. The NASDAQ rose 0.4%, the S&P 500 climbed 1.1% and the best performer was the Dow, +1.7%.

· Chinese researchers have claimed to have made a breakthrough in developing a vaccine for the coronavirus, however this has been refuted by the WHO. The WHO did say they were sending a team to China to help fight the outbreak.

· US company earnings and growth outlooks, along with stronger than expected jobs data is taking the focus away from the virus outbreak, despite the largest number of new infections being reported overnight.

· Metals on the LME continue to bounce hard with copper and nickel up 2%. Iron ore bucked the trend, falling 3%. Oil jumped 3% despite US inventories rising as OPEC+ held talks with hopes that output cuts may be on the cards.

· The March SPI Futures is indicating the ASX 200 to open 59 points higher, testing the 7035 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.