What is going on in these “crazy” markets?

The markets volatility yesterday was bordering on the crazy, they must have known we had planned a Market Matters Christmas lunch, hence no afternoon report yesterday afternoon - apologies. The previous night, markets had been quiet with the US closed in respect of former President George HW Bush’s funeral but suddenly just as local stocks were opening the US S&P500 futures plunged almost 2% in a couple of minutes for no apparent reason. The markets nerves are clearly on edge and while the precise catalyst for the futures sell-off was unclear Hong Kong shares did slide ~2.5 percent after the arrest of the chief financial officer of tech giant Huawei Technologies Co. -- a move that threatens to reignite U.S.-China tensions, this was in all likelihood the reason the Chinese yuan fell the most since October.

Overall I felt it was an impressive performance by local stocks only retreating -0.2% yesterday although the strength was in the defensive Real Estate, Telco, Golds, Transport and Utilities Sectors – fairly in line with yesterday’s report around where to hide in a bear market. The move away from “risk” was very noticeable with the standout weakness in the Software & Services / resources stocks as the roller-coaster ride in both the index and sectors continues unabated.

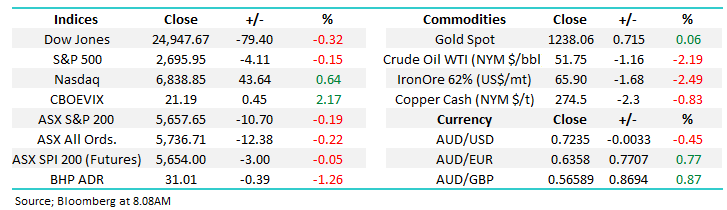

The ASX200 remains range bound between 5594 and 5778 but considering the current negative sentiment and huge nervous jitters another test below 5600 would not surprise. However we should remember that the seasonal Christmas rally doesn’t usually swing into gear until the second week of December so were not panicking around our short-term view - just yet.

MM remains bullish the ASX200 short-term targeting a “Christmas rally” towards the 5900-6000 area – suddenly feels a long way away.

Overnight the Dow closed only down 79-points after rallying over 700-points from it intra-day low, a great result and the tech based NASDAQ actually closed up +0.6%, we can see more reversion today on the sector performance level i.e. risk back in favour. The SPI futures are calling the ASX200 to open unchanged with BHP falling back under $31 in the US likely to be a headwind this morning at least.

Today’s report is going to look at what’s driving some of today’s volatility and importantly how we will play these huge swings.

MM is now in “Sell Mode” but ideally at higher levels.

ASX200 Chart

The Chinese Yuan

Over recent years equity markets have not liked any aggressive appreciation in the $US-Yuan i.e. a depreciation in the Yuan. Back in August 2015 when the Yuan fell over 6% against the $US it appeared to ignite the painful 15% decline in US stocks.

As we can see below, 2018 has seen a far sharper 10% fall in the Yuan, with the moves very aggressive at times and stocks have fallen accordingly. At this stage we are neutral the Yuan which is not a great help but it’s a market we will studying far closer in the years ahead. However we would point out that yesterdays fall in the yuan does not register in comparison to previous swings in 2018.

Weakness in the Yuan is becoming an excellent leading indicator for stocks and is firmly on our watchlist at MM.

$US v Chinese Yuan Chart

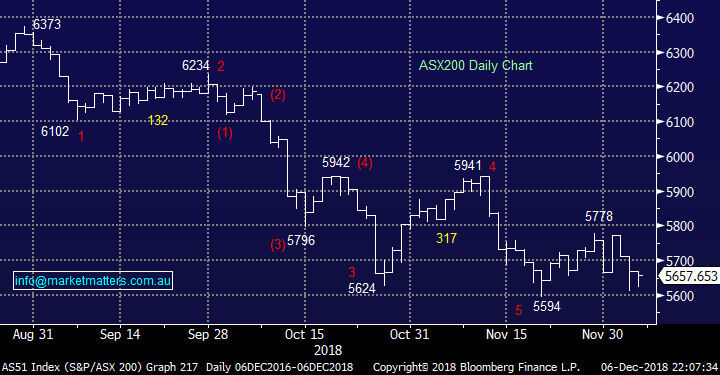

Market volatility

The recent market volatility while obviously significant it’s not outrageous – it simply feels that investors had been lulled into a false sense of security in 2016 and 2017 when global stocks ground higher and complacency became entrenched – massive central banks support will do that. It should be remembered that stocks usually correct 5% three times a year and 10% once so 2018 has not been a particularly bad outlier.

MM believes that the Volatility Index (VIX) will trade between 20 and 30 in the coming years as opposed to the 10 and 20 that has been so common in the last 3-years. Perfect conditions for active investors like ourselves.

Hence subscribers should be prepared for our Growth Portfolio in particular to see its cash holding, or equivalent depending on the use of ETF’s, regularly change by ~20%. Also, the sectors weightings are likely to see some active rebalancing on regular occasions.

MM believes volatility will become the new normal.

Investors will need to remain on top of their portfolios to avoid joining the herd and panic selling at the wrong time, and importantly holding certain stocks / sectors just because they worked last year or feel comfortable will likely lead to weak performance.

The US VIX (Fear Index) Chart

A US / local recession?

Much is being written about when / if the US and perhaps the resilient Australia will enter a recession. People are now actually talking about it with a degree of inevitability and this is certainly adding to the markets current skittish weakness. I’m not an economist but its not a big call to now say a recession is getting closer and this current longest bull market in history is closer to its end than the beginning – I’ve heard both this week.

Unfortunately Australia is unlikely to avoid a global downturn this time, especially while property prices remain on the nose. Due to our medium-term bearish call for local stocks perhaps this time the pundits are correct and a recession is approaching but I imagine the US & Chinese governments will fire a few more preventative bullets along the way which will help stocks as they occur.

At MM we will simply stick with our call from the “2018 Outlook Piece” and subsequent long-term outlook – In January we said “At MM we think that markets are currently under-pricing risk and we’re overdue for a correction, the first of which will be a ‘shot across the bow’ before the market powers higher yet again, pre-empting a more painful pullback later in the year”. – smack on the money so far.

At this stage I can give a quick sneak preview into our 2019 Outlook Piece - we are still looking for a rally towards 5950 into January BUT unfortunately we see a test of 5000 in 2019/20. Very exciting times for the prepared.

Medium-term MM continues to believe the next 10% for the ASX200 is down not up.

ASX200 Chart

Interest Rates

The US 10-year bond yield is the most watched global interest rate and we think they are very interesting just here. MM has been calling a pullback towards 2.75% for a number of weeks, things had become too optimistic economically and rising yields simply needed a rest.

This has now been achieved but we have not jumped on the “the next move for Australian interest rates is down” band wagon like Shane Oliver, or that the US will only raise rates 2/3 times before they start cutting again. To me, it’s simply too premature for this call to have validity. Our anticipated pull back in bond yields has unfolded and that required by definition a degree of economic pessimism to creep into markets but a clear reconciliation from the US and China on trade plus further Chinese stimulus and opinions could again change very quickly – it’s the nature of markets today. Investors should not forget that Trump and Xi do not want a recession.

MM is now neutral bond yields.

US 10-year bond yield Chart

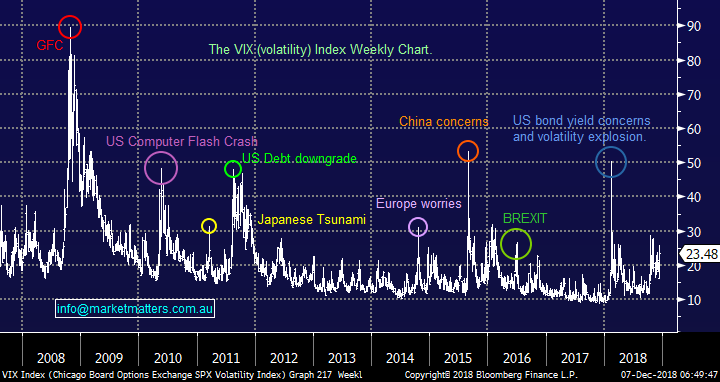

Gold

The declining $A has helped the gold price rally nicely for the local miners i.e. this week gold in $A is up over 3% already. Hence I have to say I am touch disappointed with the performance of our golds stocks so far this week considering 3 major factors which have been providing solid sector tailwinds.

1 – Gold has rallied over 3% in $A terms.

2 – Risks of aggressively rising interest rates in the US has diminished significantly.

3 – Market and economic uncertainty has been escalating rapidly.

Perhaps it’s a sign that local investors are simply not too concerned here. Over the last 5-days Newcrest (ASX: NCM) which we own is actually marginally lower and the smaller stocks in the sector have only appreciated ~3% - I would have expected more.

MM is considering switching NCM to a more “battered” position in the resources sector.

NB Overnight even while US stocks rallied strongly from their lows BHP closed down 40c / 1.3% in the US implying the sector will again struggle today.

Gold in $A Chart

Conclusion

MM remains short-term bullish stocks but bearish medium-term.

We cannot stress enough how much we believe the investing landscape is evolving dramatically from the last decade. Our view is stock, sector and even market rotation will be required in the years ahead for optimum portfolio performance its NOT time to buy and hold.

Overseas Indices

US stocks enjoyed a great recovery last night as buyers continue to emerge into weakness…….just like the sellers into strength.

We remain bullish US stocks into Christmas / 2019, initially targeting the 2850 area i.e. now ~5.5% higher.

US S&P500 Chart

European indices remain neutral with the German DAX hitting our target area which has been in play since January. To turn us bullish we still need to see strength above 11,800.

The FTSE was smacked over 3% last night basically coping it from all angles. Technically this week is interesting and we can actually now see a 7-8% bounce into Christmas.

UK FTSE Chart

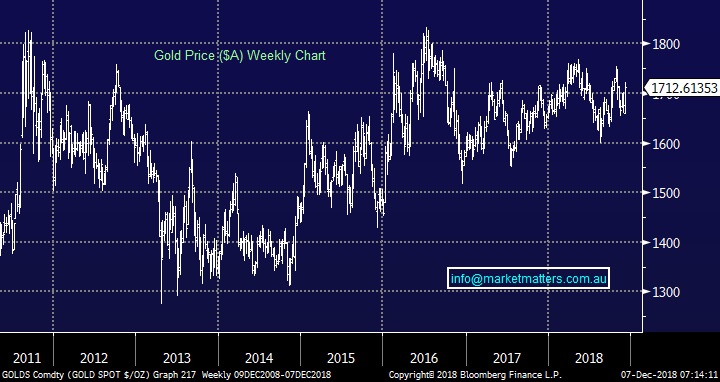

Overnight Market Matters Wrap

· It was another rollercoaster night on global markets, as concerns over US-China trade wars and slowing global growth once again weighed on sentiment in early trading. The trade fears were raised following the arrest in Canada of the CFO of Chinese telco giant Huawei for extradition to the US, a move which is expected to upset Chinese officials.

· Key European markets closed down over 3% while the Dow was over 3% weaker (c800pts) at the low point of the day, but a late rally saw it recover most of those losses as bargain hunters stepped up, after the WSJ reported that the Fed was expecting to slow the future pace of rate hikes. The NASDAQ, which was also down over 2% at its worst, recovered to close slightly up for the day (+0.4%), while the Dow and S&P closed only slightly weaker. Bonds also headed lower with the 10yr us bonds below 2.9% on growth concerns, at one stage hitting 2.83% (closing at 2.87%).

· Oil also under pressure with the Brent benchmark down over 2%, at around US$60/bbl, following reports that OPEC was planning to cut 1mb/d of supply, which is less than expected. Base metals likewise were sold off, with copper down 1.5%, while gold was steady atUS$1242/oz.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 07/12/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.