What horses should we back for a “V-shaped” recovery? (CGC, NSR, SYD, GMG, IEL, AAC, ALL)

The ASX200 put in a stellar performance yesterday closing up 13-points, ignoring an almost 400-point plunge on Wall Street, the buying was fairly broad-based with over 65% of the ASX200 closing up on the day led by the IT sector which rallied over 2%. The late weakness in US equities on Tuesday night was fuelled by concerns that the Moderna vaccine trials were questionable, something we flagged as almost inevitable but MM believes the Fed is the gorilla in the room at present and while they spout market friendly rhetoric like “the Fed is not out of ammo” risk assets should remain very well supported into any meaningful pullbacks. If your memory goes back to the recovery from the 87 crash it was Alan Greenspan who was quick to prime the pumps, printing money and reminding banks that they were in the business of lending that money – the recovery was quick.

Common sense tells us that we will probably hear numerous claims followed by reality checks around COVID-19 vaccines, we are an optimistic species which unfortunately can allow hope to get ahead of facts at times, if Bill Gates says 6-9 months at best before we have a readily available treatment for the virus its good enough for me – remember the 20-year old Gates Foundation has over $70bn in assets with much of this firepower directed at the coronavirus hence he’s probably got a fair handle on things. However major swings between optimism & pessimism are inevitable after stocks have plunged ~40% because of this unprecedented modern-day event, we continue to regard these swings as potential opportunity at MM, while retaining an upside bias overall.

Equities are popping higher as I type with US stocks making fresh 10-week highs with many citing optimisms around a successful reopening of developed economies as the main driver. However, we still believe equities are currently enjoying a primarily liquidity driven rally which is starting to threaten a FOMO (Fear of Missing Out) blow-off. Our best guess is the ASX200 will test 5700, before some short-term profit taking may emerge. MM moved up the “risk curve” aggressively in April with our Growth Portfolio now only holding 7.5% in cash, we will be looking to de-risk to a certain degree if such a move unfolds in the coming weeks.

Today’s report is consequently focused on places we believe investors should consider in the event of a “V-shaped” recovery by both the Australian and global economies.

MM remains bullish equities medium-term but we’re now adopting a more neutral stance short-term.

ASX200 Index Chart

I was delighted to see one of MM’s holdings Costa Group (CGC) rally almost 10% yesterday on solid volume, the stock has seen its shorts slowly but surely decline over the last 30-months from ~12% to almost 4%, in other words the bears are now far less confident calling this fruit and vegetable operator lower – the world must eat even through COVID-19 and I’ve certainly noticed the blueberry prices soar in the last few months.

MM still believes CGC can test $4 in 2020.

Costa Group (CGC) Chart

There’s always 1 or 2 stocks that frustrate us at any one given time and today its NSR, we wrote about buying the stock below $1.60 after its recent capital raise, the stocks subsequently ground 12% higher, back above its pre-raise level. It’s now come to light that Abacus Property Group (ABP) have taken a stake in NSR and although this feels unlikely to lead to a domestic takeover US Public Storage who bid $2.20 before the pandemic is still lurking, what it does reflect is a company who know the industry inside out believes NSR represents great value at current prices.

MM remains bullish NSR.

National Storage (NSR) Chart

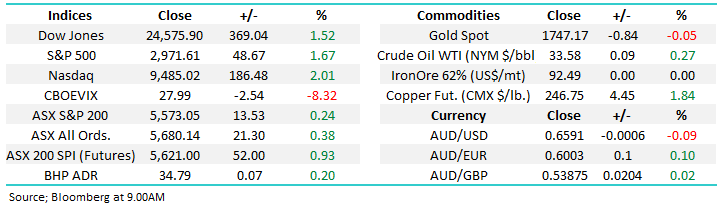

Overseas equities

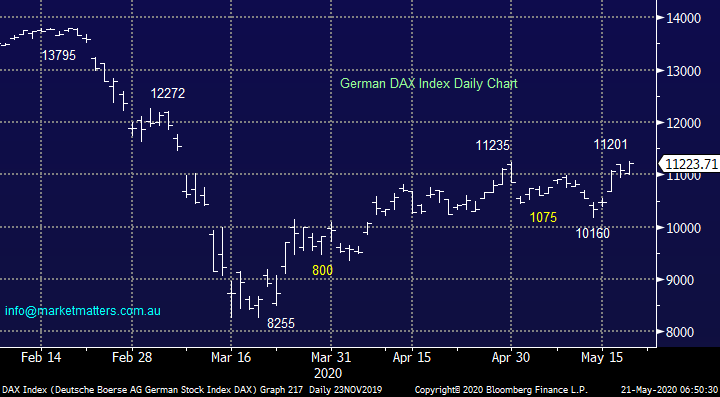

Overnight US stocks rallied strongly overnight with the S&P500 & NASDAQ making fresh 10-week highs, the later is amazingly only 2.6% below its February all-time high. Stocks are embracing optimism around economies reopening combined with the huge liquidity and zero interest rate tailwinds – certainly a potent concoction! Our pullback targets were achieved last week in both the US and Europe turning us short-term bullish which was clearly on the money, we remain mildly bullish global equities short-term but were only looking for 3% further upside from the Russell 2000 small-cap index while the larger cap S&P500 has already achieved our minimum target area.

MM remains bullish global stocks medium-term but short-term they are starting to feel “rich”.

US Russell 2000 (Small Cap) Index Chart

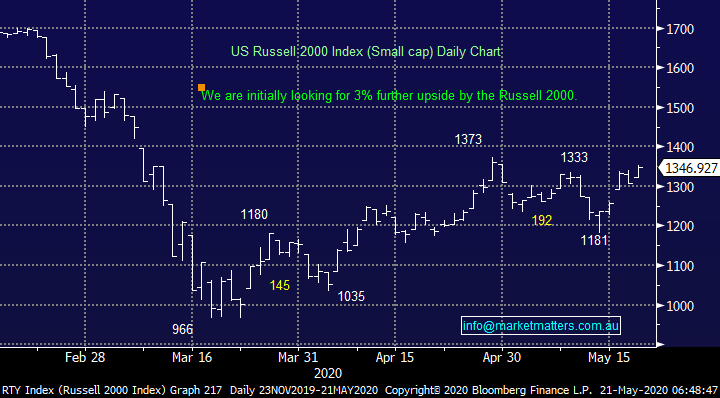

European Indices like our own have been lagging the likes of the tech-based NASDAQ and S&P500 but they remain slightly bullish with a little further upside feeling on the cards. To put things into perspective European indices have bounced ~36% compared to the NASDAQ’s 40% but the tech-based index didn’t fall as far in the first place hence making all-time highs only one good day away!

MM is considering where to take some $$ “off the table” into the current market surge.

German DAX Index Chart

How to position for a V-shaped recovery

Over recent months our opinion has been that a global economic recovery would manifest itself as mixture of both “U & V-shaped” scenarios depending on the respective industries with IT clearly at the forefront as we can see below, not a perfect “V” but pretty close! These largely debt free companies have in many cases actually seen revenue improve during COVID-19 while dips in turnover for the likes of Apple (AAPL US) is very manageable considering its few hundred billion sitting lazily on its balance sheet – no capital raise required here!

Relatively high value / growth stocks such as IT and Healthcare have benefitted significantly from bond yields collapsing towards zero, and even negative in many parts of Europe, in a vaguely similar manner to gold. The real damage in equities land has been inflicted on companies carrying debt who potentially could not withstand the current huge economic downturn i.e. the cost of servicing debt remains but if / when revenue dries up cashflow issues rapidly arise, including companies who were firing on all cylinders in Q4 of 2019 – nobody had predicted or made provisions for a pandemic.

Hence much of our market has been simply hammered as investors price in the risk of a capital raise, or even worse. However if we are going to see a “V-shaped” recovery in most parts of the economy some of these battered names will simply be too cheap – we saw it with Costa Group (CGC) yesterday who rallied almost 10%, when fund managers look to re-establish positions in these stocks there’s often a dearth of sellers at such depressed prices, as we’ve said previously this market is underweight equities after March’s washout hence bounces can often be sharp and aggressive.

US NASDAQ Index Chart

Today we are looking to review stocks and sectors that might well provide major upside to a rapid return to normality on a global scale, ideally with relatively limited downside if it all goes “pear-shaped”, sounds easy! In other words, prudent portfolio construction with much thought about tail risk in both directions is required, it’s not all about what’s been sold off the most hence can bounce the hardest although there is a degree of that involved.

Our research team at Shaw recently identified 5 “themes” we think could provide potential upside as we emerge to a post-virus world. Travel, Retail and Basic Services, Wellbeing, Gaming/Real Estate and finally Agribusiness. Each has either been significantly disrupted by the shutdown (Gaming, Travel, Shopping Centres, Retailers) and/or is a potential beneficiary in a post-virus world (Agri, Wellbeing). Firstly, let’s look at MM’s snapshot thoughts toward these 5 groups:

1 – Travel : The worst performing sector which has undoubtedly been smacked but many areas may well not return to 2019 levels for years to come, definitely a space to want bargains – we recently purchased Sydney Airports (SYD) for our Income Portfolio.

2 – Retail & Basic Services : Many stocks have recovered a large portion of their losses from this group but we are wary of the indebted Australian Consumer in many cases – in April we purchased Super Retail (SUL) and Transurban (TCL) for our Income Portfolio, while we have traded JB Hi-Fi (JBH) in the Growth Portfolio.

3 – Wellbeing: A large group which covers the likes of Pharma, Healthcare, and wellbeing/nutraceutical stocks, with an emphasis on those companies exposed to a return to elective surgery – we recently purchased Ramsay Healthcare (RHC) for our Growth Portfolio.

4 – Gaming / Real Estate: These two sectors are bundled together under the thematic of restricted movement impacting shopping centres, hotels, and clubs. We are wary of the growth in ethical investing diminishing returns on gaming stocks while property needs to be individually evaluated as we are cautious towards shopping centres in the years ahead – MM holds Aristocrat (ALL) in our Growth Portfolio & Abacus (ABP) in our Income Portfolio which has a growing focus on self-storage.

5 – Agribusinesses : On the surface our favourite as the world must eat and with China and Asia growing many of our products are very much on the menu but not surprisingly this area has performed the best - we own Costa Group (CGC) in our Growth Portfolio.

Sydney Airports (SYD) Chart

Today I have briefly looked for our favourite 3 stocks from a long list within these 5 categories as we look to balance risk / reward moving forward.

1 Goodman Group (GMG) $14.75

GMG is a stock we have had on our radar for a few weeks but as we often say at MM we cannot buy the whole market unfortunately we only have a certain amount of funds to allocate across our portfolios and the last time I checked alas the MM balance sheet did not match that of Apple. Two weeks ago the company came out and reconfirmed both earnings and dividend guidance for the full year, highlighted that gearing is at the lower end of their target range (0-25%) and they have cash ($1.4bn) + funding facilities ($1.1bn) currently available.

Simply a great property stock that pays 50% of their earnings out in dividends and reinvests the rest, they’re a critical part of the online sales supply chain and they’re incredibly well managed. It’s a good story and while we don’t own, we should at the right price. As mentioned, a few times MM is looking to de-risk into current market strength, GMG is one stock we would be keen to buy into a market pullback assuming we have increased cash reserves.

MM is a keen buyer of GMG into weakness.

Goodman Group (GMG) Chart

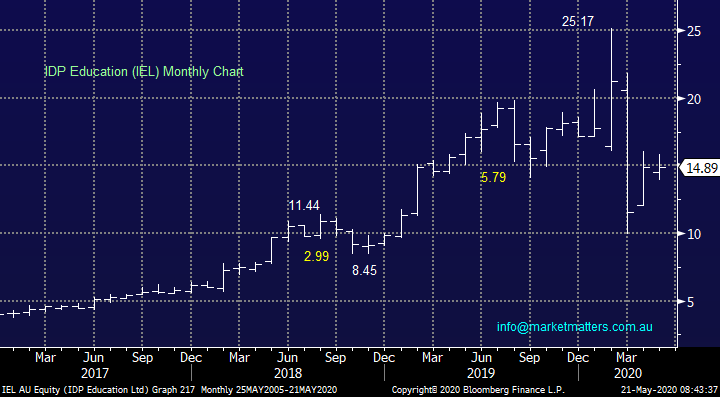

2 IDP Education (IEL) $14.89

I really like Australia’s profile as a premium education venue for the years ahead, we only have to look at the current local results with COVID-19 to know we will be regarded as a clean country and overseas students crave clean & safe when they go to a foreign land. IEL is a company which offers student services like university and course guidance on a worldwide basis – with its shares trading over 40% below Februarys’ all-time high I can smell a bargain. Also, the Morrison government will be extremely keen to kickstart this $20bn export industry for Australia, this potential tailwind never hurts.

MM likes IEL medium-term.

IDP Education (IEL) Chart

3 Australian Agricultural Co (AAC) $1.11

We mentioned AAC in yesterday’s MM Afternoon Report, after further consideration we have included this integrated cattle and beef company which runs the largest herd of Wagyu Beef in Australia in this select group of 3. Being a relatively little known $670m business this is clearly the “speccie” of the bunch but we particularly like its exposure to a growing Asian middle class and their rising consumption of beef.

The company’s latest report showed a record year of Wagyu meat sales +19.7% plus prices were also up by 8%. They saw growth across all key regions, and they delivered their strongest operating cash flow since FY17, while managing to achieve positive cash flow in four out of the last five halves. Their pastoral properties valuation increased $63.6M, the value of livestock increased by $49.6M dropping down to an NTA per share of $1.53 per share vs $1.42 this time last year. Importantly their gearing within the targeted 20-35%, although at the higher side.

MM likes AAC around current levels.

Australian Agricultural Co (AAC) Chart

4 Aristocrat (ALL) $27.34

Just a quick note on ALL which has just reported half year results this morning which look okay however digital growth slightly below expectations – more out later.

This is a stock that has looked after us extremely well since we went long in April but its approaching our initial target area. While it has exposure to land based gaming which has effectively shut down, its digital business has proven a savvy way of diversifying earnings and underpinning growth. While we like the business, this is a volatile stock and on our radar as a sell into strength.

MM is watching ALL carefully with thoughts to taking our $$.

Aristocrat (ALL) Chart

Conclusion

MM is bullish GMG, IEL and AAC as discussed above.

Overnight Market Matters Wrap

· The US followed Australia's lead overnight and rallied, again on hopes of the world economies looking to be back to business sooner than later.

· Dr. Copper gained, hitting 2-month highs on this hope, along with crude oil following a fall in inventory levels.

· The June SPI Futures is indicating the ASX 200 to open 30 points higher, testing the 5600 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.