Westpac defers interim dividend (WBC, APT, FLT)

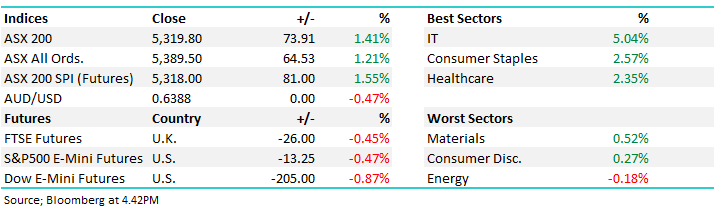

WHAT MATTERED TODAY

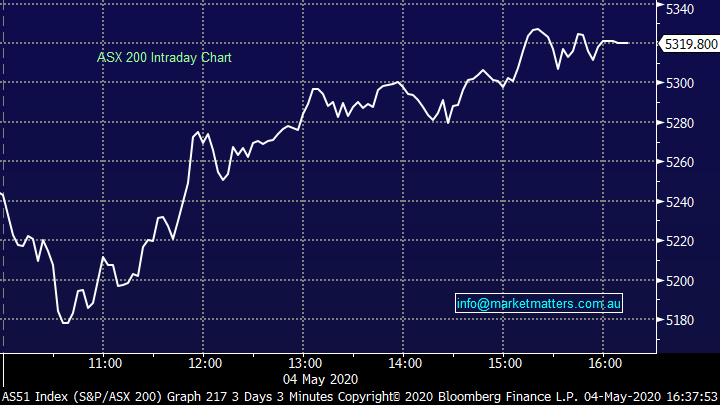

The ASX recovered ~30% of Fridays aggressive sell-off today despite US futures trading lower throughout the local session. It was actually a strong turnaround today from the early morning lows – a frustrating day for the bears given Futures were down ~90pts on open before recovering more than 180pts. Westpac (WBC) a drag early however when the sticker shock of a deferred dividend wore off the stock rallied to close nearly 3% higher, Afterpay (APT) was the clear star after Tencent (700 HK), a stock we hold in the International Equities portfolio revealed a 5% equity stake, while Gold miners put last week’s poor effort behind them and rallied strongly.

All in all, a good way to start the trading week and it implies there are buyers out there into weakness.

Today the ASX 200 added +73pts /+1.41% to close at 5319 - Dow Futures are trading down -205pts/-0.87%

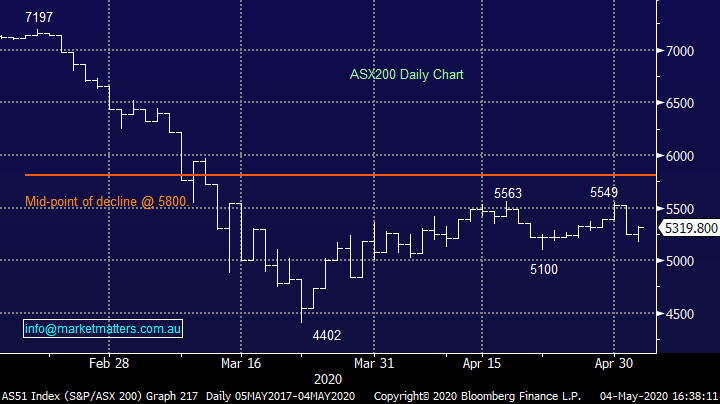

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

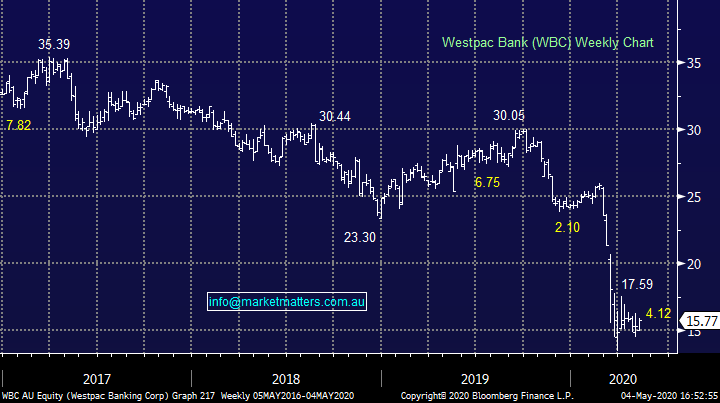

Westpac (WBC) +2.80%: Westpac this morning released 1H20 results and there wasn’t a lot of new news from an earnings perspective - 1H20 was very similar to 2H19 with a few swings and roundabouts. Net interest income increased by 1% from 2H19 to 1H20 as a result of no change in net interest margins and a small increase in loans. Non-interest income declined by 18% from 2H19 to 1H20 with the insurance businesses responsible for most of the decline. Banking fee income declined as well. Expenses increased by 3%, excluding notable items, from 2H19 to 1H20 and a decision on the interim dividend was deferred and I expect it will probably not be paid. WBC’s cash net profit fell from $3.5B in 2H19 to $1B in 1H20 as a result of a $1B charge for AUSTRAC and $2.2B bad debt charge in 1H20. The size of that provision suggests WBC is being more conservative than both ANZ and NAB, however like the others, they are using the base case of a V shaped recovery in their economic assumptions.

WBC forecast a 5% contraction in GDP in calendar 2020, before growth of 4% is achieved in 2021, a similar dip then recovery in both unemployment and house prices. Time will tell if this is accurate however as Buffet said over the weekend, there is a very wide set of possible economic outcomes from this global pandemic. All up, the underlying result today was better than feared, the bad debt charge had been flagged, a known known while their decision to defer the dividend is sensible. Tier 1 capital sits at 10.8x and they have flagged the potential of asset sales, which I think is a real positive in today’s update, particularly the advice business, it’s all too hard in that space. By deferring the dividend and flagging asset sales, WBC are trying very hard not to raise capital, and at this stage, it’s unlikely they will need to. We own WBC.

Westpac (WBC) Chart

Afterpay (APT) +23.8%: continued its run today, nearly topping $40 again for the first time since late February. News broke on Friday night that Tencent had taken a chunk of APT stock to the tune of around $400m. Tencent is a Chinese based payments, communications and social media company owning the likes of WeChat & Weixin Pay, the leading mobile payments service in China. Afterpay welcomed the news and talked up the potential for a strategic partnership with the Hong Kong listed company. The Tencent stake certainly opens the Afterpay model for a push into Asia, potentially being about to reach hundreds of millions of people from day 1 if they were to launch across Tencent’s platforms. The news was helped other BNPL names higher – Zip co jumped over 5%, OPY +15% and SZL nearly 10%. The stake is further justification of the business models and more than one name will not only survive but thrive.

Afterpay (APT) Chart

Flight Centre (FLT) -6.27%: provided an update to the market of activity seen in the midst of the collapse in travel. According to the company, it is running at just 5-10% of ‘normal’ levels in April in a sign that people are still keen to travel despite the problems raised by CV-19. Flight Centre also talked up a few contracts wins for the corporate travel business though limited volume will be seen until restrictions are lifted. They have been working on cutting costs with 40% of local shops closed among a number of measure that have reduced costs by more than 70% while the JobKeeper subsidy and a government backed loan in Europe is helping keep the balance sheet supported. Not one for us here though there will be a time to buy. Travel will be one of the last areas of the global economy to recover, and may never return to the levels seen pre-virus.

Flight Centre (FLT) Chart

BROKER MOVES:

- Telstra Cut to Neutral at New Street Research; PT A$3.50

- Austal Cut to Underweight at JPMorgan; PT A$2.40

- Lendlease Group Raised to Outperform at Macquarie; PT A$14.92

- Tyro Payments Rated New Underperform at Macquarie; PT A$2.50

- Orica Raised to Outperform at Macquarie; PT A$21.51

- JB Hi-Fi Cut to Neutral at Macquarie; PT A$34.80

- GrainCorp Raised to Buy at Morningstar

- Regis Resources Raised to Hold at Morningstar

- Growthpoint Cut to Hold at Morningstar; PT A$3.25

- ResMed GDRs Cut to Underweight at JPMorgan; PT A$21.90

- NextDC Raised to Buy at Jefferies; PT A$10.50

- Woolworths Group Raised to Buy at Shaw and Partners; PT A$42.50

- Janus Henderson GDRs Raised to Neutral at Goldman; PT A$30.75

OUR CALLS

Growth Portfolio: Took profit on JB Hi-Fi (JBH), Bought Lend Lease (LLC)

Income Portfolio: Sold Spark Infrastructure (SKI), Bought Sydney Airports (SYD)

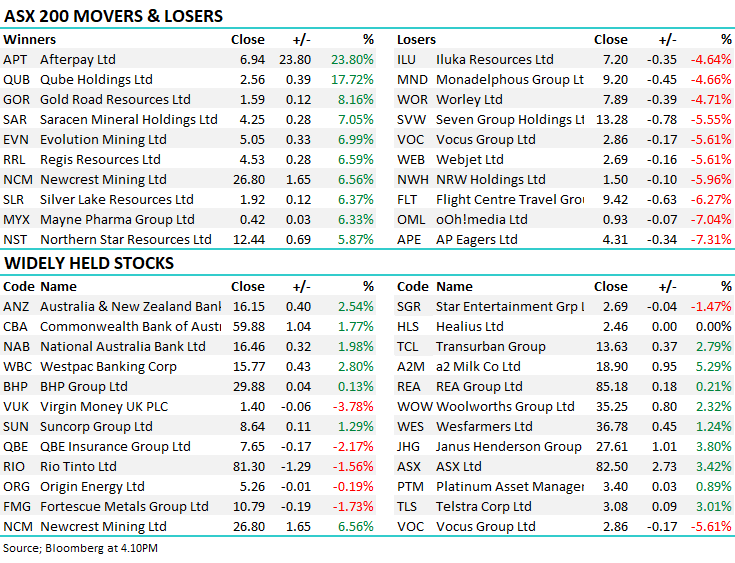

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.