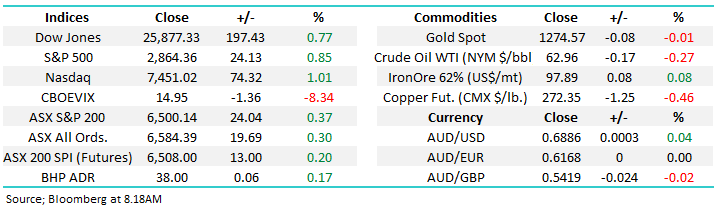

Weekly Overseas Report – is it time for Australia or International exposure? (FB US, AAPL US, AMNZ US, NFLX US, GOOGL US)

Yesterday the local market recovered from an initial dip to rally ~1% over the day to again make fresh decade highs, the ASX200 eventually managed to close up 24-points marginally above the psychological 6500 area – impressively the ASX200 is now only 5.4% below its all-time high after rallying aggressively by more than 20% from its late December panic lows, yet again illustrating how it so often pays to buy when things both look and feel their worst – but similarly selling when all looks rosy is often a winner and we are slowly approaching this look / feel. Under the hood the market was dancing to very different tunes with the financials rallying +1.7% while most other sectors slipped lower led by the IT sector which tumbled -3.5% - remember as we often say at MM “the market (ASX200) doesn’t go down without the banks”.

Yesterday was all about the RBA and APRA with 2 major positives gifted to the market, and the financials in particular:

1 – RBA governor Philip Lowe informed the market that higher unemployment was putting pressure on inflation and hence “interest rate cuts may be appropriate” – MM expects a rate cut in June, along with basically all the market.

2 – APRA have suggested removing the 7% serviceability buffer on home loans to help the housing market recover, or at least stabilise.

As would be expected bond yields fell towards all-time lows, stocks rallied and the $A fell – same old tune. This is a trend we believe is slowly becoming mature but has a little further to run. The obvious high yielding candidates have enjoyed the buying so far like the Banks and Telcos but we feel the slightly less obvious candidates will soon garner some market attention starting with the resources and then moving through the market.

Investors should expect further volatility in the days / weeks ahead as both economic superpowers continue their arm wrestle for a trade deal while trying to maintain face back at home, importantly our belief is the current May correction by international markets is either complete, or close to it, and a rally to fresh 2019 highs over the coming weeks / months remains our preferred scenario.

MM believes current weakness in o/s stocks is a buying opportunity while we have no interest in reducing our exposure to local stocks just yet.

Overnight the US indices rallied strongly led by the tech based NASDAQ which closed up 1%, the ASX200 is pointing to a small 10-point gain by local stocks on the open this morning.

Today we are going to look at 5 overseas stocks that interest us today while at the same time briefly considering domestic alternatives.

ASX200 Chart

As mentioned earlier the bond market again marked yields lower yesterday but there’s only so far they can go, already investors are assuming the RBA cash rate will be cut from 1.5% to 1% but what then?

Or view at MM is the risks are slowly manifesting themselves towards the expectations of lower interest rates, when we hit 1.25% in June (our view) will markets start to talk 0.75% in 2020, that’s when we believe they are likely to go too far – the dovish analysts may become disappointed later in 2019.

Australian 3-year bonds v RBA Target Cash Rate Chart

My intention was to avoid commentary on the $A this morning simply because it’s becoming a touch boring as our view remains unchanged but we believe yesterday’s price action offered a few clues moving forward:

1 – The “ScoMo” victory on the weekend failed to ignite any meaningful optimism in our currency leading us to believe that another test of 67c was likely in the weeks / months ahead.

2 – The comments from the RBA yesterday had relatively little impact on the $A telling much of this news is already built into today’s 69c level.

MM remains bullish the $A in 2019 / 2020 and keen to buy a downward spike towards 67c.

Australian Dollar ($A) Chart

The ASX200 has doubled since its 2011 low whereas the US S&P500 has almost tripled although this does not include dividends where the Aussie market is the big winner.

With the RBA likely to cut rates twice in 2019/2020 we expect this US outperformance to be over in 2019 although we still prefer their offering in the tech space – MM believes it’s time to invest more “old school” within the ASX200.

ASX200 v US S&P500 Chart

Five potential candidates to buy this last week.

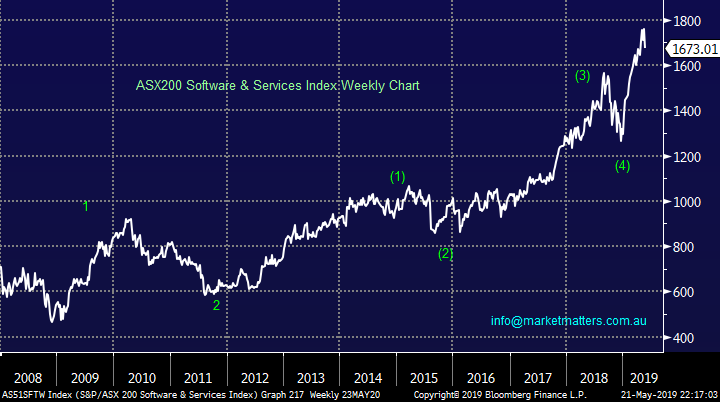

MM’s probably unpopular opinion is the high flying Software & Services sector is too hot to handle and with stocks like Wisetech (WTC), Appen (APX) and Altium (ALU) trading on huge P/E’s for 2019 we believe the risk / reward is not compelling and we would not be surprised to again see the music stop playing later this year leading to painful declines just as they were in late 2018.

MM has moved to a neutral / negative stance on the high growth end of town.

Conversely we believe there’s still some good risk / reward available in the US tech space where valuations are far more realistic e.g. Apple’s comparative valuation is amazingly close to one tenth of one the above, although when pegged to growth (as it should be) this becomes less compelling !

ASX200 Software & Servicers Index Chart

If we are correct and US stocks are set to make another all-time high they are likely to be led by the high performing NASDAQ stocks and in particular the FANG’s which we have focused on today plus heavyweight Apple.

It is fun at times to go looking for the diamond in the rough or a stock that nobody’s ever considered before but today we believe its time to KISS (keep it simple stupid) with regard to overseas stocks; locally we are watching for a recovery more in the resources space.

US NASDAQ Index Chart

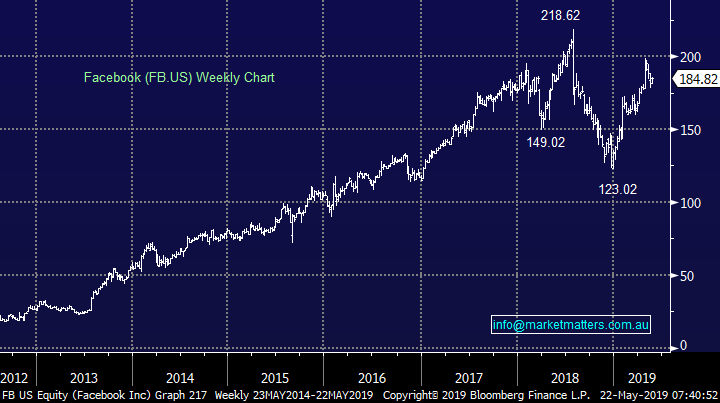

1 Facebook (FB US) $US184.82

Facebook has pulled back in line with the NASDAQ but it’s now offering some solid risk / reward we are bullish FB here with stops below $US170, a risk of 8%.

MM likes Facebook targeting fresh 2019 highs.

Facebook (FB US) Chart

2 Apple (AAPL US) $US186.60

No change or introductions required here as many subscribers will actually be reading this very report on an Apple device. The tech giant remains almost 20% below its 2018 all-time high and we like the upside potential in the stock if / when the US – China trade war is resolved.

MM feels Apple is a buy at current levels.

Apple (AAPL US) Chart

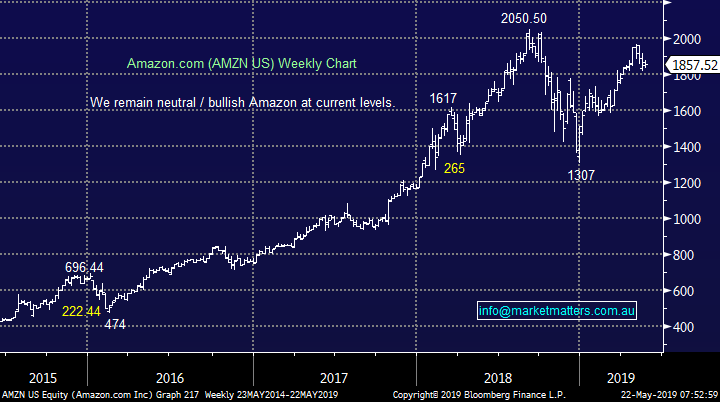

3 Amazon (AMZN US) $US1857.52

Goliath e-retailer Amazon actually fell last night in a strong market, not a characteristic we like at MM. We are net bullish AMZN looking for fresh all-time highs but it’s not as appealing as the previous two stocks.

MM likes AMZN but it’s not our preferred vehicle at this stage.

Amazon (AMZN US) Chart

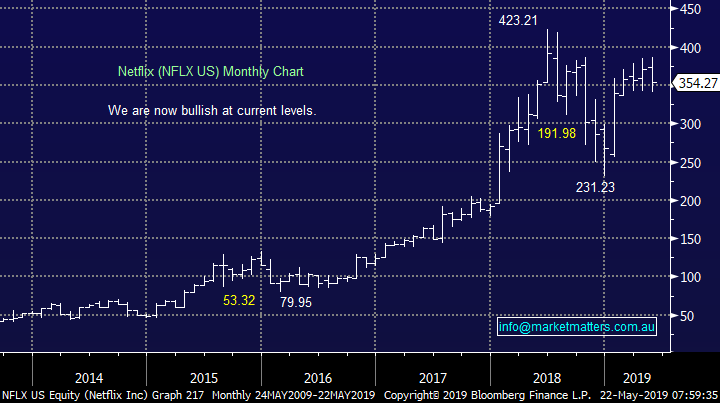

4 Netflix (NFLX US) $US354.27

Netflix has been a standout story of the last few years and our view is the subscription entertainment service has further to run. We are bullish from around this $US350 area targeting fresh all-time highs, stops are a bit trickier and need to be under $US300 at this stage.

MM is bullish NFLX with a target ~20% higher.

Netflix (NFLX US) Chart

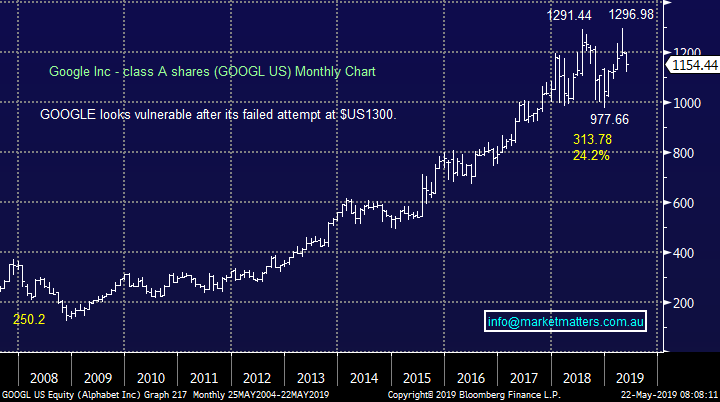

5 Google Alphabet (GOOGL US) $US1154.44.

Web based search and advertising business, to name a few, GOOGL looks and feels a touch heavy at current levels and is probably our least preferred pick of the 5 stocks today.

MM is neutral Google at current levels.

Google Alphabet (GOOGL US) Chart

Conclusion

Of the 5 stocks we looked at today our preference is Netflix while Google is our last pick.

However due to the nature of the late cycle pop higher we are expecting a more prudent play we believe is via an ETF which tracks the FANG or NASDAQ Index, for example the BetaShares NDQ.

US FANG+ Index Chart

Global Indices

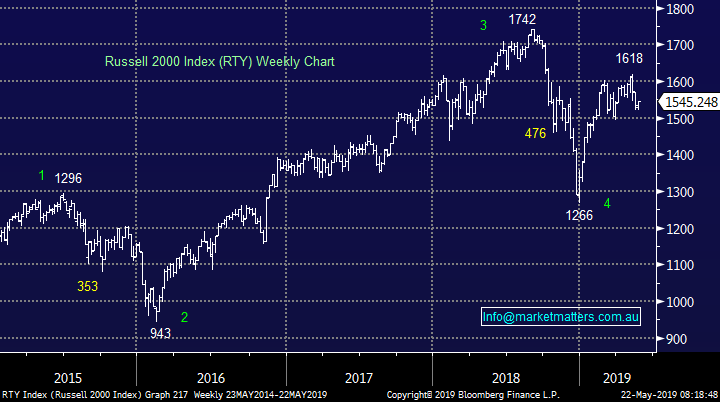

US stocks bounced reasonably well overnight and while we remain bullish targeting fresh 2019 highs another dip lower obviously cannot be ruled out – its about picking trade location for aggressive players but investors we believe should just stay long.

We still see fresh all-time highs by US stocks in 2019.

US Russell 2000 Index Chart

No change with European indices, we remain cautious in this region although we are slowly becoming more optimistic.

German DAX Chart

Overnight Market Matters Wrap

· US equities traded higher after the White House said it would grant temporary exemptions for companies that supply or are customers of Huawei.

· On the commodities front, copper fell and underperformed against its peers, but the rest of the metals on the LME rose. Iron ore eked out a small gain, while Chinese steel futures rose 4% to its highest level in 8 years. Steel margins remain high as Chinese authorities spend up big on infrastructure, while cutting taxes on manufacturing and industrial sectors.

· BHP is expected to trade higher this morning after ending its US session up an equivalent of 0.17% from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open marginally higher, hovering above the 6500 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.