Weekly Overseas Report including a chat with my friend Charlie Aitken (700 HK, BABA US, MSFT US, AAPL US, FB US, TTD US)

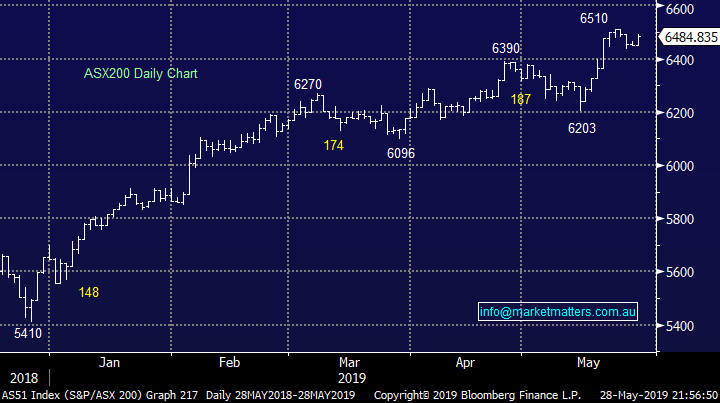

Yesterday the local market rallied strongly following a fairly lacklustre open to close up +0.5% on the day with the buying fairly broad based but yet again the selling remained noticeably thin on the ground. With the ASX200 now sitting less than 0.5% below a fresh decade high its not surprisingly tough to find many too weak pockets in the market as the banks and resources appear to continually pass the baton between themselves to fuel the markets gains. We are outperforming globally in 2019 with the ASX200 up +14.8% compared to Dow which is up a relatively modest 8.8% for the calendar year – interesting as I’m sure many investors would just assume we are the “tail being wagged by the US dog”.

The stock market has become a global beast as traders in Australia continually watch the nuances in Hong Kong, China and Japan plus the US futures extremely closely during our trade day. Fund managers are looking for returns and with global bond yields around their lowest levels in history they aren’t fussed if it comes from BHP, CBA, Facebook, Apple or Tencent because it’s certainly not coming from cash. After the market closed yesterday I had a chat with my old mate and fund manager Charlie Aitken and todays report covers a few stocks we both discussed yesterday.

Click here or on the image below to view

We still believe investors should expect volatility in the days / weeks ahead as the 2 main global economic superpowers continue their arm wrestle for a trade deal, while of course trying to maintain face back at home. Importantly our belief is the current May correction by international markets is either complete, or close to it, and a rally to fresh 2019 highs over the coming weeks / months remains our preferred scenario.

MM believes current weakness in o/s stocks is a buying opportunity while we have no interest in reducing our exposure to local stocks just yet.

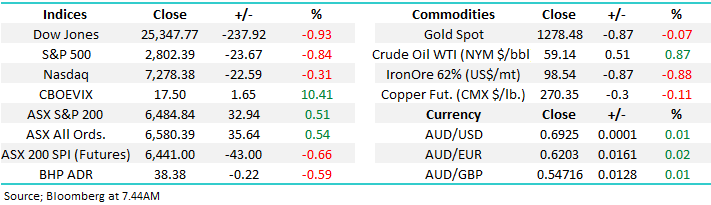

Overnight the US indices retreated with the US S&P500 falling -0.84%, the SPI futures are pointing to a weak start for the ASX200 down around 50-points, with BHP only closing down 22c I assume traders are anticipating some early selling of our Banking sector.

Today we are going to look at some overseas stocks discussed by Charlie and myself in the video above.

ASX200 Chart

The ASX200 has outperformed the best known US index the Dow in 2019 by a significant margin as we benefit from the tailwinds of looming rate cuts, a market favourable election result, a weak Australian Dollar and soaring iron ore prices.

With the RBA likely to cut rates at least twice in 2019/2020 we expect this outperformance to continue through 2019 although we still prefer their offering in the tech space – MM still believes it’s time to invest more “old school” within the ASX200.

ASX200 v US S&P500 Chart

Charlie, like ourselves believe that eventually a US – China trade war resolution will occur but “when” is the big question, the Emerging Market’s ETF shown below is sitting down 23% from its 2018 high dragging with it the likes of goliath tech business TenCent (700 HK) the largest component of the ETF – however remember most of us thought BREXIT would be sorted by now hence we should always be cognisant of the unexpected.

We discussed the Beta of Asian domiciled / based stocks being higher than say the US which is basically a market term for volatility e.g. Charlie holds around 3x more $$ in the US compared to Asia but Beta adjusted regards the holdings as roughly equal because of the much higher volatility of Asian markets / domiciled stocks.

Our feeling is it’s a touch too early to be largely exposed to Asia with the risk / reward favouring buying a news induced spike lower but accumulation from here slowly but surely does make sense.

MM is keen to buy the EEM into a break of recent lows, one adverse comment by President Trump might be enough now.

Emerging Markets ETF (EEM) Chart

Five stocks we discussed yesterday.

Our conversation focused primarily on the big end of town because with both value and volatility emerging in some household names there’s no current need to take on the risk of the relatively unknown / emerging companies, although we have thrown one into the mix we like - the Trade Desk (TTD).

We touched on a few Australian stocks where our opinions differed slightly:

1 – Macquarie Group (MQG) $122.57 – we recently went long for the Growth Portfolio just above $118 while Charlie is considering the bank / asset manager seriously but hasn’t yet pressed the buy button.

2 – Aristocrat (ALL) $29.68 – We still hold the gaming business in our Growth Portfolio whereas Charlie has just taken profit.

Now moving onto 6 overseas stocks, 5 of whom could easily be referred to as goliaths on all matrices.

1 Tencent (700 HK) HK325.60

Tencent is clearly a stock that illustrates the high Beta nature of Asian domiciled stocks, even at the large end of town – the stocks already retraced ~20% from its highs of May illustrating why we regard it as more of a trading / very active stock. This Chinese based internet giant recovered much of its 2018 losses following the relaxation of gaming restrictions by the host country but Communist countries can always be unpredictable but considering the trade talks we feel its more likely to be supportive at this point in time.

MM likes Tencent when / if the EEM makes new lows

Tencent (700 HK) Chart

2 Alibaba (BABA US) $US153.76

Another Chinese internet company Alibaba (BABA) which obviously sits more on the e-commerce side of the curve has also endured a very tough 4-weeks with a look and feel very much like Tencent. BABA dominates e-retail in China with 60% market share while enjoying excellent growth in its “add on businesses” like digital advertising and cloud computing.

We like BABA following its recent 20% fall but believe its one to accumulate not chase “boots and all” just here.

MM again likes BABA into weakness, accumulating slowly.

Alibaba (BABA) Chart

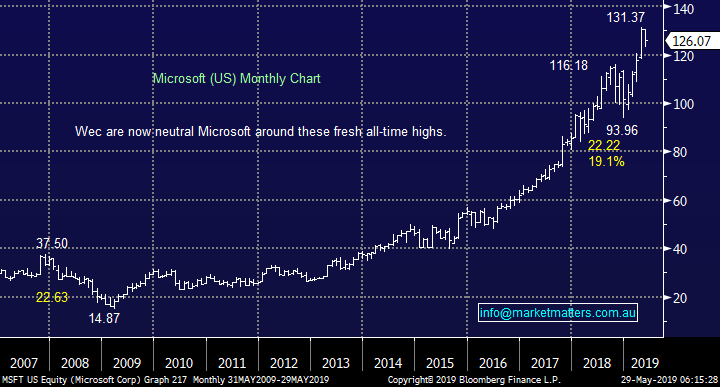

3 Microsoft (MSFT US) $US126.07

Microsoft is a few strong days away from being a trillion dollar business which impressively is still growing at ~16% pa. The company is sitting on $50bn in cash, performing healthy stock buybacks but we are conscious that the stock has run very hard.

We are keen buyers into weakness but at this stage of the stock / economic cycle we will be patient for now.

MM likes MSFT as a business but we are neutral around current levels.

Microsoft (MSFT US) Chart

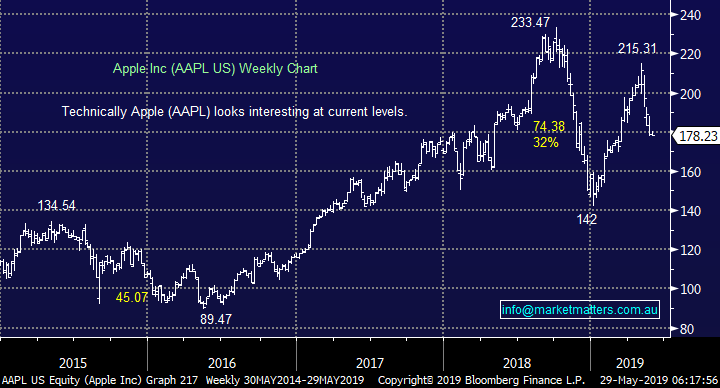

4 Apple (AAPL US) $178.23

Apple needs no introduction but again it looks very similar to both BABA and Tencent as it experiences a China facing fear correction. Like Charlie we see minor growth in AAPL at this point in time but value is emerging into the current weakness with the company sitting on literally “buckets” of cash - further declines are likely to be met with ongoing stock buybacks.

MM believes Apple is an accumulate / back foot buy.

Apple (AAPL US) Chart

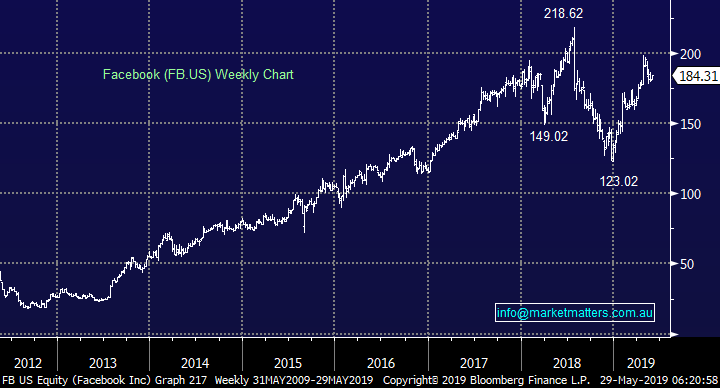

5 Facebook (FB US) $US184.31.

Social media giant Facebook is a stock that Charlie likes a touch more than we do, our concern is the fickle nature of its user – its rapidly becoming “uncool” to use FB and concerns around privacy remains a concern to us. However we do concur that if its was forced to breakup its assets the impact should be positive for shareholders.

Technically we can still see fresh all-time highs by FB but the risk / reward is not too exciting as the stock’s held up well into recent market weakness.

MM is neutral / positive Facebook at current levels.

Facebook (FB US) Chart

6 Trade Desk (TTD US) $US202.09.

Trade Desk is a high valuation growth company which works in the on-line programmatic advertising space optimising customers spend. Essentially, it’s a platform that allows companies to advertise better, and consumers to get more relevant products / services shown to them.

Technically the stock looks great and its was even up nicely last night as US stocks got thumped.

MM remains bullish TTD targeting ~$US250.

Trade Desk (TTD US) Chart

Conclusion

Of the 6 stocks we looked at today our preference is for the currently weaker stocks like Alibaba (BABA), Tencent (700 HK) and Apple (AAPL) to accumulate looking for a sharp snap back when the trade situation improves.

In the smaller (not small with a market cap of $US9bn) end of town we like Trade Desk (TTD US) looking for ~25% upside.

Global Indices

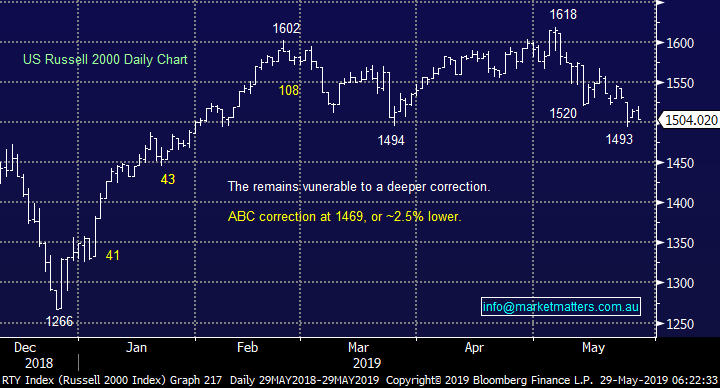

US stocks struggled overnight but we remain short-term bullish ideally targeting fresh 2019 highs with our ideal target for the current pullback around 2.5% lower.

We still see fresh all-time highs by US stocks in 2019.

US Russell 2000 Index Chart

No change with European indices, we remain cautious in this region although we are slowly becoming more optimistic.

German DAX Chart

Overnight Market Matters Wrap

· Risk assets have certainly been taken off the table overnight, as investors focus back on escalating US-China trade tensions. Ten year bonds hit their lowest levels in almost 20 months of 2.26% on lower growth fears.

· Commodities were mixed on resumption of trading on the LME post the UK Bank Holiday, with base metals, oil and gold slightly weaker, while iron ore dropped about 2% below its 5 year high achieved yesterday.

· The June SPI Futures is indicating the ASX 200 to give back some recent gains and open 47 points lower towards the 6440 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.