Weekly Overseas Report as Trump pressures market (FMG, DWDP US, BABA US, CRM US, MC FP, AAPL US)

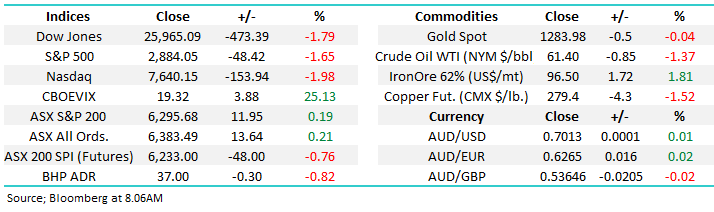

Yesterday we saw no rate cut by the RBA and it felt like more than the touted ~30% of players were looking for a cut - immediately following the announcement we saw the $A surge 0.5c and the ASX200 tumble 40-points. The stock market selling appeared to be more SPI futures led as opposed to being sector specific with the Resources sector performing the best rallying +1.3% while the Industrials and Financials had the worst of things both falling -0.3%, by the days end the ASX200 closed up a mere +02% providing little insight to investors in the short-term.

Overall with the Federal election only 10-days away and the US-China trade talks reaching their last furlong the RBA opted for the wait and see approach – hey after 32 meetings of leaving interest rates unchanged at their lowest level in history what’s one more meeting of inaction!

We are now well into May and the US stocks are exhibiting classic volatility for this time of year, and this morning we have woke to see the Dow off close to 500-points / 1.8% while the VIX (Fear Index) gauge of volatility has spiked 25%. It’s all about US – China trade talks as President Trump has put the cat amongst the proverbial pigeons, a snapshot update:

1 – Trump has threatened huge tariff increase on Friday.

2 – A smaller than initially intended Chinese delegation now arrives in the US on Thursday.

3 – It feels suddenly extremely unlikely that a deal / compromise can be implemented in time to avoid Trumps tariffs hence the plunge by US stocks overnight.

Conclusion is investors should expect further volatility in the days / weeks ahead as both economic superpowers struggle to negotiate a deal which looks / feels like a win to their people at home – markets don’t enjoy ego and brinkmanship by influential political leaders.

MM believes current weakness in stocks is a buying opportunity in cyclical areas like the resources as opposed to defensive plays such as healthcare.

Overnight the US indices were sold off aggressively with the broad based S&P500 closing down -1.65% but it did manage to bounce 0.8% from its intra-day low. The SPI futures are calling the ASX200 to open down around 40-points this morning with BHP looking fairly resilient only falling 30c below its local close in the US.

Today we are going to look at 5 overseas stocks that have moved noticeably since President Trump has again started his Tweet campaign – this may present an ideal opportunity to commence publishing MM’s International Portfolio!

ASX200 Chart

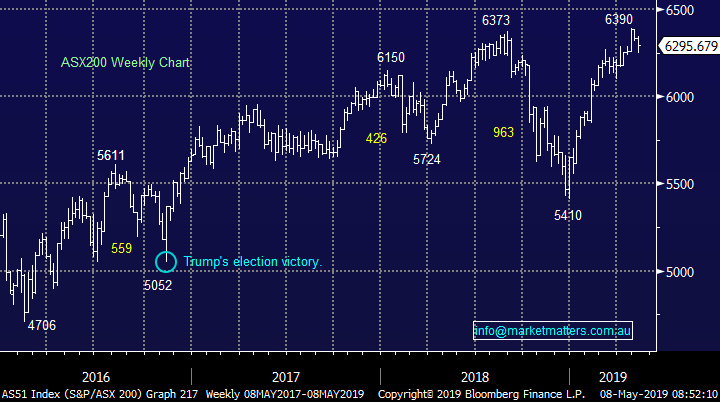

Following Mondays alert to buy Fortescue Metals (FMG) with a limit of $7.10 the stock surged over 6% yesterday – we hope subscribers ignored our limit and paid a few cents more – how frustrating the low was at $7.11. We remain bullish FMG and are still considering buying the iron ore miner but we are reticent to chase strength with the space / stock becoming very news driven around Vale’s production in Brazil. However volatility in the US may offer an opportunity in the near future.

MM remains bullish FMG targeting fresh 2019 highs.

Fortescue Metals (FMG) Chart

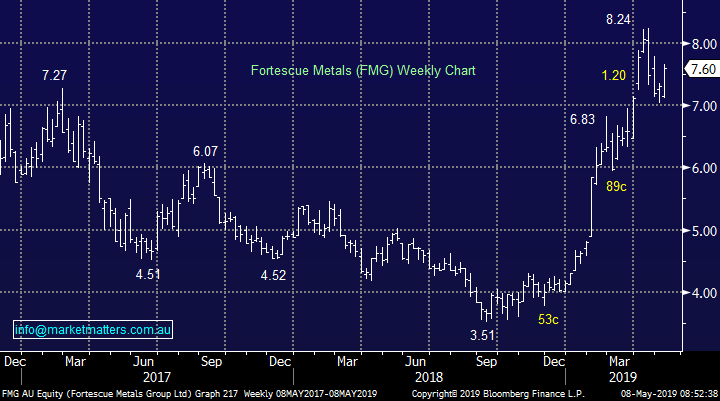

On Monday President Trump’s Tweet led to aggressive selling in equities across Asia while some monies flowed into safe havens especially the $US which not surprisingly sent the $A back under 70c BUT in our opinion the “little Aussie battler” held up pretty well only falling ~0.4%. However when we saw the RBA stay put on interest rates the $A actually shot up to fresh weekly highs – who cares about the “big bad Trump”!

If the $A can hold onto the psychological 70c area it will confirm to us that its gaining strength around these decade lows.

MM mains bullish the $A into 2019 / 2020 initially targeting a break above 80c.

NB This both technical and fundamental view is not precise / pedantic enough not to allow another spike down towards the mid 60c region.

Australian Dollar ($A) Chart

Five standout overseas stocks over the last week.

With only 6 stocks in the world’s largest 100 companies closing in the black over the last 24-hours this morning we have focused primarily on the weaker end of town as we regard the current stock market weakness to be a buying opportunity especially in the cyclical stocks. We have briefly looked at 5 stocks most importantly sharing where ideally we are buyers.

The chart below illustrates how the current pullback in US stocks hardly registers on the 2019 scoreboard.

NASADAQ Index Chart

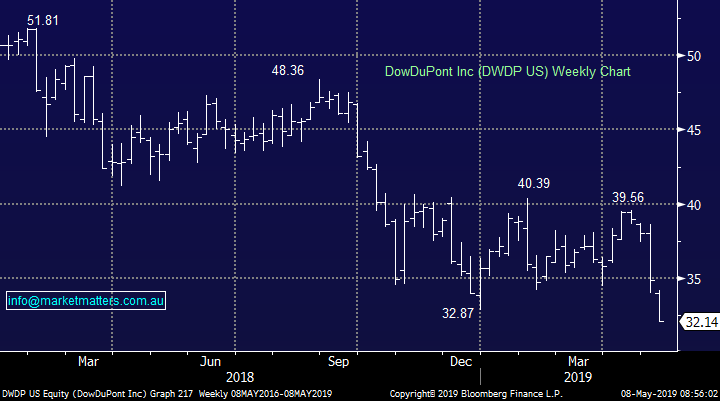

1 DowDuPont (DWDP US) $US193.40

Overnight DWDP made fresh 18-month lows as it continued with its recent market underperformance – at MM we would rather buy strong stocks that correct with the masses as opposed to businesses with clear structural issues.

MM feels this is a stock to avoid.

DowDuPont Inc (DWDP US) Chart

2 Alibaba (BABA US) $US181.43.

Overnight BABA fell almost $US7 and the shares are approaching levels we would like to become buyers. Bigger picture we remain bullish targeting a fresh break of its 2018 highs.

MM likes BABA around $US175.

Alibaba (BABA US) Chart

3 Salesforce (CRM US) $US156.90

Overnight Salesforce fell over $US5 but it needs to be closer to the $US145 before the risk / reward becomes appealing to us.

MM likes CRM around $US145.

Salesforce Inc (CRM US) Chart

4 LVMH Moet Hennessy Louis Vuitton (MC FP) Eur335.05

Overnight luxury brand business LVMH fell over Eur9, we like the stock moving into 2019 but after its strong rally entry levels are more important than ever – we like the concept of accumulating between Eur320 and Eur330.

MM likes LVMH between Eur320& Eur330.

LVMH Moet Hennessy Louis Vuitton (MC FP) Chart

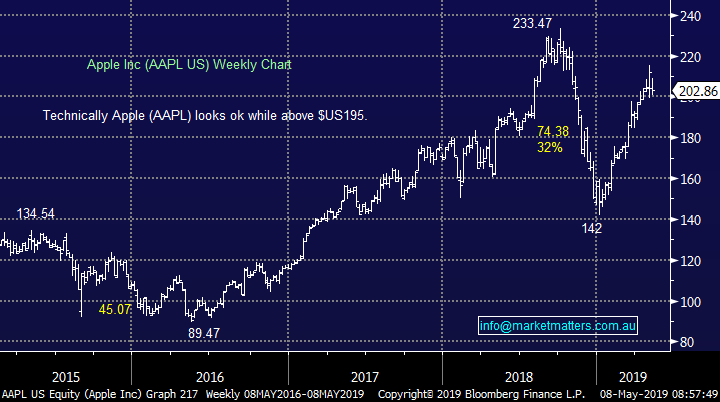

5 Apple (AAPL US) $US202.86

Apple fell almost 3% last night which is encouraging because we like the stock into weakness with a target potentially 20% higher. Ideally we would look to buy in 2 tranches, on weakness below $US200 with the optimum price closer to $US190.

MM likes Apple below $US200.

Apple (APPL US) Chart

Conclusion

Of the 5 stocks we looked at today Apple and Alibaba are the most appealing a few % lower as we look to buy this unfolding market correction.

Global Indices

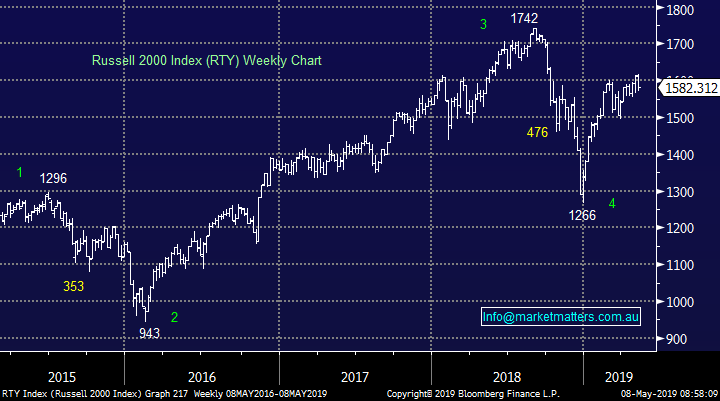

US stocks were weak overnight following our short-term roadmap lower but we reiterate we are buyers of weakness, ideally ~5% lower.

With both the S&P500 and tech based NASDAQ recently reaching fresh 2019 highs we have turned mildly neutral / negative US stocks very short-term.

US Russell 2000 Chart

No change with European indices with BREXIT gaining an extension it’s again become yesterday’s “fish and chip paper”, we remain cautious or even slightly bearish in this region.

German DAX Chart

Overnight Market Matters Wrap

· The US sold off overnight as the US-China trade wars reconvene, with the broader S&P 500 losing 1.65% and the tech heavy Nasdaq 100 off nearly 2%.

· The VIX index (measure of volatility) crept has now crept up above ultra-low complacency, currently at 19.32.

· Today, the resource sector is expected to underperform the broader market, with BHP down an equivalent of -0.82% in the US from Australia’s previous close, following a lawsuit in UK over its 2015 Brazil dam disaster.

· The June SPI Futures is indicating the ASX 200 to open 50 points lower, testing the 6260 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 08/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.