Weekly Overseas Report (700, WMT, BABA, WFC, BA)

The market struggled yesterday under the weight of a weak banking sector led lower by regional Bank of Queensland (BOQ) which delivered a weaker than expected 1H result highlighting some of the risks in the sector. The ASX200 finally closed down just -0.4% although it did feel heavier and we noticed some of the risk averse stocks like Telstra (TLS) enjoying a bid tone with our largest Telco closing within 1c of a fresh 6-month high. Under the hood our weak impression of the day was confirmed with only 32% of the market managing to close in the green highlighting how the index managed to hold up ok all things being considered.

The much loved healthcare sector, which is dominated by $US earners, also struggled as the $A had the 72c area in its sights. Cochlear (COH) in particular fell to within a few cents of fresh 2019 lows, who would have thought over the last 3-months that Estia Health (EHE) would have outperformed the hearing implant company by over 35% - as we repeatedly say its vital to remain open-minded when investing, especially when a bull market is a decade old. Following a strong night by the $US overseas some of these falls may be recovered today.

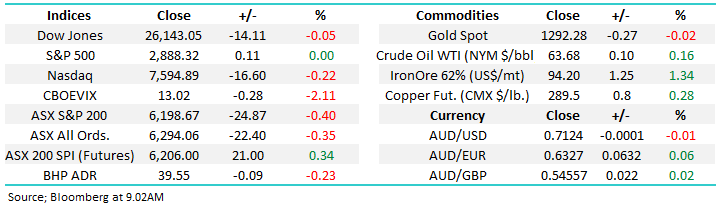

No change, we continue to feel the market is positioning itself for a begrudging pullback towards 6100 and potentially 6000 with the recent 5 days of consolidation around the psychological 6200 area fitting our negative picture but a close below 6180 is required technically for us to feel on the money.

The ASX200 has now achieved our upside target area switching us back to a neutral / bearish stance short-term.

Overnight the US indices were extremely quiet but the SPI was surprisingly strong calling the ASX200 up ~0.5%, looks like some buying’s around in our banks and healthcare sectors, especially as BHP was mildly lower in the US.

Today we are going to look at 5 international stocks who have caught our eye over the last week – we have found that sticking to Wednesday as the Overseas Report tough with obvious limitations when we have interesting action locally – moving forward we will simply make this the Weekly Overseas Report.

ASX200 Chart

Bank of Queensland (BOQ) $8.95

Yesterday the Bank of Queensland (BOQ) tumbled almost 5% following a disappointing 1H report, the regional bank saw profit slide 10% from the same period in 2018, despite growing the loan book by 3%. The net interest margin (NIM) fell 4bps over the 6 months to an extremely tight 1.94% due to rising funding costs and increasing competition. Although they still remain at low levels, bad debts are starting to creep higher in the quarter – an area which has helped support bank earnings over the past few years.

The bank will pay a 34cps dividend for the half, about 10% below each of last year’s dividends, and importantly below expectations of 38cps. It does still trade on a yield of over 7%, grossed up to over 10% but after the company guided to a flat second half we may see some investors start to doubt how sustainable the payout is over the years ahead.

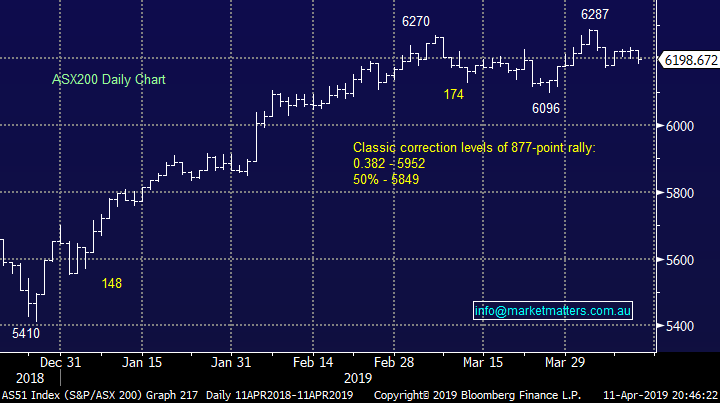

The papers are again talking this morning that BOQ will need to merge with the likes of Suncorp (SUN), Bendigo Bank (BEN) or Macquarie (MQG) to eventually deliver to shareholders – perhaps this talk might ignite the sector at some point moving forward but its hard to imagine any quick fix.

MM has reduced our banking exposure by trimming both NAB and CBA in the last month which has increased our flexibility for such falls in the sector.

1 - We are now actually watching Bendigo in the regional banking sector with the $9 area currently our ideal entry level, or around 5% lower - at this level the bank will be yielding ~7.8% fully franked providing a buffer for disappointment moving forward.

2 – Also, we still like Macquarie Bank (MQG) around the $125 area.

MM is watching the banks carefully but we’re not yet close to the “buy trigger” just yet.

Bendigo Bank (BEN) Chart

Sims Metal (SGM) $10.06

Yesterday became a tough day at the office for MM with our stop being triggered in Sims Meta (SGM) but this is a market for discipline as we have explained a number of times in 2019. We are proud of our transparency at MM but unfortunately running real money portfolios does at time necessitate taking some unpleasant medicine.

While taking losses is never a nice experience, investors should always remember that the optimum route to successful returns is to “cut your losses and run your profits”.

MM is now neutral SGM and the market has voted with both feet that they are not happy with the company’s growth plans.

Sims Metal (SGM) Chart

Five international stocks catching our eye this week

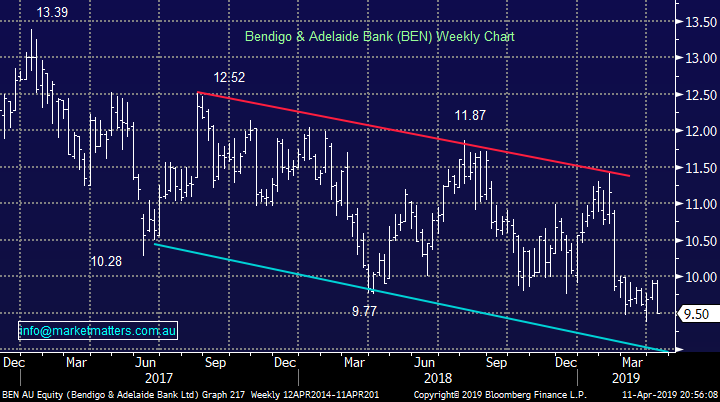

Global stocks have enjoyed one of best rallies / recoveries in history assisted by central banks who have donned their dovish hats in an attempt to fan post GFC global growth - bigger picture we are slowly becoming concerned that a decade on we still need such economic stimulus to avoid a worldwide recession.

However fighting the Fed and other central banks when they are in a stimulatory mood is fraught with danger and the current policy shift and market momentum looks highly likely to take equities to fresh all-time highs – now under 5% away for the MSCI Global World Index. Short-term we see major resistance around the October 2018 highs which would enable investors who held on and hoped during the markets +20% correction to “get out” with their money back, usually an area that encounters meaningful psychological selling.

MSCI World Index Chart

Now moving onto 5 stocks who have caught our eye during a fairly benign week for international strocks – as usual we have looked at both end of the spectrum i.e. winners and losers.

1 Tencent (700 HK) HKD391.40

Asian goliath Tencent has been one of the huge recovery stories in 2019 with the stocks +3.5% appreciation over the last 5-days helping investors who were left stunned by the stocks almost 50% plunge from its early 2018 high. The market has clearly become more relaxed around the Chinese regulators stance on the video gaming industry following Beijing restarting approvals for video games in December.

At this point in time MM are struggling to identify a decent risk / reward opportunity for Tencent following its strong recovery but we will keep an eye on the company moving forward.

MM likes Tencent as a business but are neutral at this point in time.

Tencent (700 HK) Chart

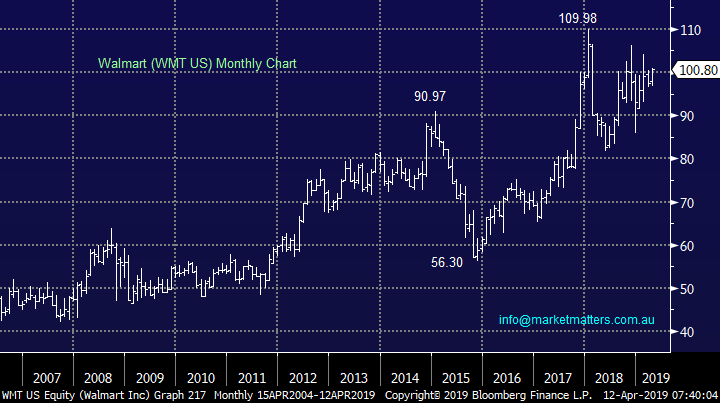

2 Walmart (WMT US) $US100.80.

Walmart rallied another +2.7% over recent days demonstrating correctly run and positioned retail stocks can still provide good returns for shareholders.

The company soared in February after beating earnings estimates including growing e-commerce sales by an impressive 43%.

MM believes WMT will ultimately make fresh highs above $US100 but the risk / reward is tough just here.

Walmart (WMT US) Chart

3 Alibaba (BABA US) $US184.98

Internet giant Alibaba looks very similar to many international stocks, its rallied strongly following aggressive declines in 2018 leaving us neutral at current levels – the risk / Reward is tough.

The companies share price enjoyed a beat to earnings expectations in January and a disciplined approach to spending was clearly appreciated by investors.

MM is neutral at current levels with the risk reward is more attractive around $US170.

Alibaba (BABA US) Chart

4 Wells Fargo (WFC US) $US47.74

WFC has fallen almost 3% over recent days and the stock looks vulnerable to further declines plus the Feds current dovish stance does not help the sector fundamentally.

MM is neutral / bearish Wells Fargo (WFC).

Wells Fargo (WFC US) Chart

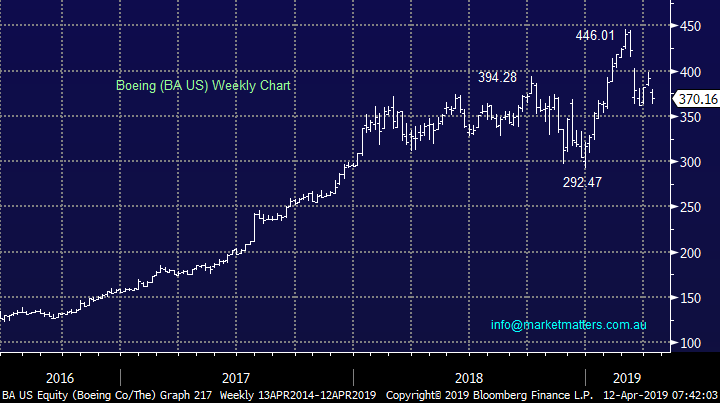

5 Boeing (BA US) $US370.16

Boeing has fallen another -6.5% over the last 5-days and the stock is again testing its March lows as the negative news flow following recent plane disasters continues to weigh on the stock.

No change, MM remains bearish Boeing (BA) looking for another 10% downside.

Boeing (BA US) Chart

Conclusion

Of the 5 international stocks looked at today MM is neutral Tencent (700 HK), Walmart (WMT) and Alibaba (BABA) looking for lower levels to consider buying while we are bearish Wells Fargo (WFC) and bearish Boeing (BA).

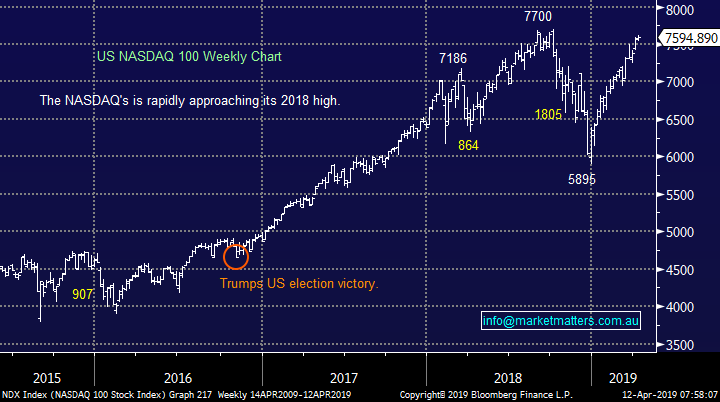

Global Indices

US stocks were very quiet last night as Easter approaches. Medium-term we still think the NASDAQ has another ~5% upside medium-term but a pullback feels overdue – importantly our 8000 target for the NASDAQ is only a good week or two away in today’s market!

With both the S&P500 and tech based NASDAQ reaching fresh 2019 highs we have turned mildly neutral / negative US stocks.

US NASDAQ Chart

No change with European indices with BREXIT gaining an extension it’s again become yesterday’s “fish and chip paper”, we remain cautious or even slightly bearish in this region.

German DAX Chart

Overnight Market Matters Wrap

· The US equity markets closed with little change overnight, as investors get ready for US reporting season tonight, with analysts forecasting the first quarterly profit fall since 2016. Some of the most keenly watched results will be released by JP Morgan and Wells Fargo with forecasts of soft market related revenue.

· China-US trade talks are progressing well, while Fed officials said that the domestic and global soft patch of growth is behind us, with GDP expected to rebound. Meanwhile US weekly initial jobless claims came in below consensus.

· All metals on the LME were lower, in particular nickel which fell 2%. Iron ore rose 1%, crude oil fell and gold is down to $US1292.28/oz.

· The June SPI Futures is indicating the ASX 200 to open 27 points higher, testing the 6230 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/04/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.