Wednesday with a “twist”(Z1P, MNY, DTC)

**I’m travelling today unfortunately to a funeral hence this morning’s report takes a slightly different tact. I hope you enjoy the catch up I had with Jono Higgins in Melbourne yesterday. There will be no Income Note sent today nor an afternoon report this afternoon, while tomorrow mornings note will be a brief one. Thanks for your understanding and I’ll be back in full capacity come Friday. Today’s a reminder for me that we should all be very thankful for the simple things in life, wishing you all good health & happiness**

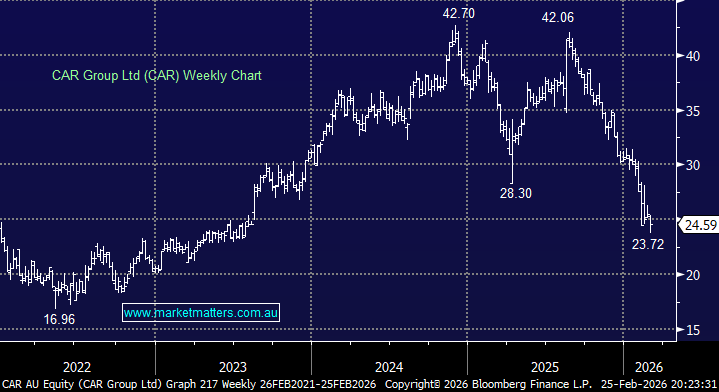

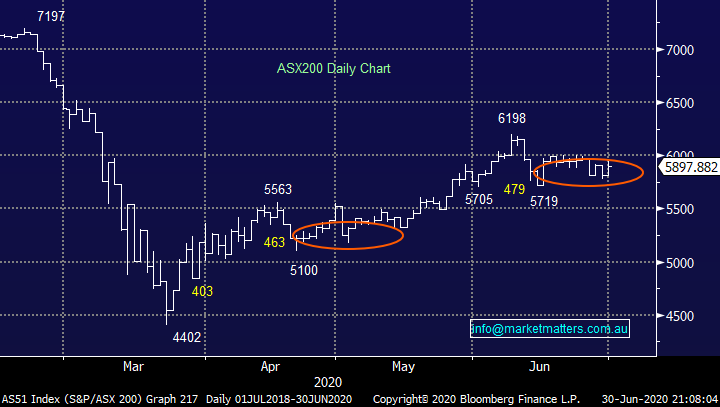

The ASX200 ended the volatile 2019/20 Financial Year on the front foot with the market rallying 82-points as over 80% of the main index closed in positive territory as “risk on” came back into vogue, the property sector was noticeably the weakest with 14 of its members closing down. The usual EOFY shenanigans were not too apparent with the exception of a market 1% dip after 4pm, all in all pretty tame stuff for this time of year. The real proof in the proverbial pudding MM believes will be over the next 24-48 hours as we watch and see if stocks can continue to shrug off bad news around COVID-19 e.g. over 300,000 Victorian residents have gone into strict lockdown this morning. A deeper pullback as we start a fresh quarter is not off the table in my opinion but our ore view into Christmas remains bullish.

We feel the big difference this time around with COVID-19 is the scary “fear of the unknown” is no longer in play plus much of the message being delivered by the press - is if things again slow down governments will simply stimulate harder alleviating the pain to stocks. One fact I may not have spelled out strongly enough is that while MM is bullish stocks were aren’t too optimistic on the global economy, a fact that many will feel is a contradiction but MM believes interest rates around zero plus massive stimulus can support a market for longer than many anticipate – remember share prices reflect the markets interpretation of a companies worth in the future, as opposed to today.

Overnight US stocks squeezed higher into their end-of-quarter with the NASDAQ finishing only 1.5% below its all-time high. The SPI is implying the local market will open marginally higher after closing at a premium to fair value yesterday.

MM still remains overall bullish equities medium-term.

ASX200 Index Chart

Below I have quickly summarised MM’s thoughts around the 3 main stocks covered in today’s video. One important aspects of these companies highlighted in the video is their high Beta i.e. when the market corrects they are highly likely to fall harder and vice versa when equities take their next leg higher – we clearly saw this in March.

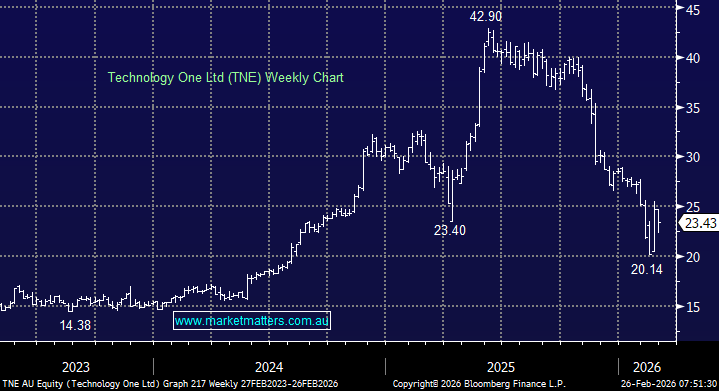

1 Zip Co. Ltd (Z1P) $5.23.

We’ve been a fan of Z1P through 2020 and still feel this $2bn business is presenting good risk / reward around the $5 region following its almost 30% pullback – as we said above don’t underestimate the volatility.

MM likes Z1P around $5.

Zip Co. Ltd (Z1P) Chart

2 Money3 Corp Ltd (MNY) $1.55.

MNY is a more mature business which specialises in automotive lending, sounds more “risky” but of course the margins are attractive. Impressively the stock has paid a 6.4% fully franked yield over the last 3-years making it arguably an aggressive ~$300m yield. Technically the markets not a believer at present hence we would be more inclined to monitor MNY for better risk / reward opportunities.

MM is currently neutral MNY.

Money3 Corp. Ltd (MNY) Chart

3 Damstra Holdings (DTC) $1.31.

Work place management solutions business DTC has a market cap now approaching $200m after rallying strongly after the panic sell-off in March. The stock looks good at current levels but we would advocate stops under $1.10 which is a fairly chunky risk

MM likes DTC with stops under $1.10.

Damstra Holdings (DTC) Chart

Conclusion

Our favourite stock of the 3 covered today is Z1P.

Global Markets.

Overnight the US S&P500 US stocks rallied into month end but there’s no change to our core outlook. We continue to patiently watch 2 potential scenarios:

1 – we are correcting the whole advance from the March 23rd low with our ideal target below 2900.

2 – stocks will again shrug off coronavirus fears and were heading ~10% higher before MM will consider reducing risk / market exposure.

At this stage the former looks slightly more likely for the S&P500 but if you looked at the tech based NASDAQ you might find it hard to be anything except bullish. Considering we’ve moved more towards the bullish corner short-term for the ASX if this proves correct the likelihood is the US will follow suit and cashed up buyers waiting to buy the market cheaper will remain unsatisfied. However July does simply feel like a logical time for a pullback before a run into Christmas – let’s wait and see.

MM remains bullish US stocks medium-term.

US S&P500 Index Chart

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.