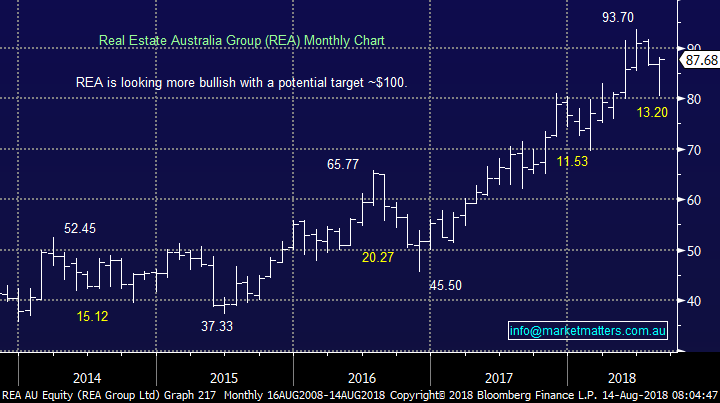

Volatility is increasing above & below the hood! (REA, XRO, NHF, NUF, WSA, ORE, JHG)

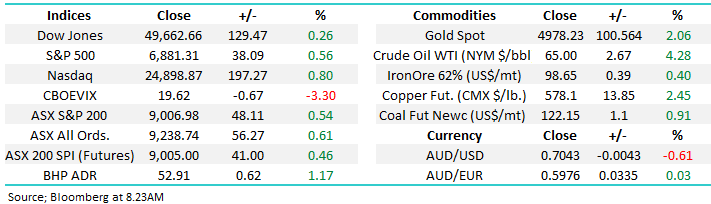

The local market slipped lower yesterday as we expected but although any bounce was extremely short-lived intra-day the decline was not impulsive with volumes remaining subdued. We were surprised to see the volatility in the puts remaining extremely low considering the Turkey situation implying nobody really believes the weakness is going to follow through to any meaningful degree.

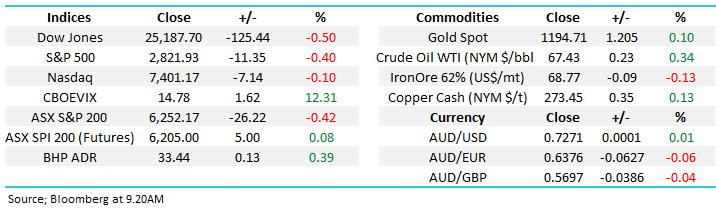

Perhaps it’s simply not yet as bad as it felt at times yesterday and when we stand back and look at the previously discussed “rising wedge” for the ASX200 no sell signals have actually been generated with the index remaining firmly within the tight band of the last 8-weeks. It’s a welcome reprieve that the Australian stock market has discarded its previous strong correlation to the emerging markets whose currencies and stocks plumbed 12-month lows overnight.

- We are neutral the ASX200 while the index holds above 6140 but we remain in “sell mode”.

Overnight stocks ultimately closed exactly where they were when our market closed at 4pm, they even attempted to trade into the green before a late sell-off. The SPI futures are implying the ASX200 will open up around 10-points.

Today’s report is going to look at 7 stocks that caught our eye yesterday.

ASX200 Chart

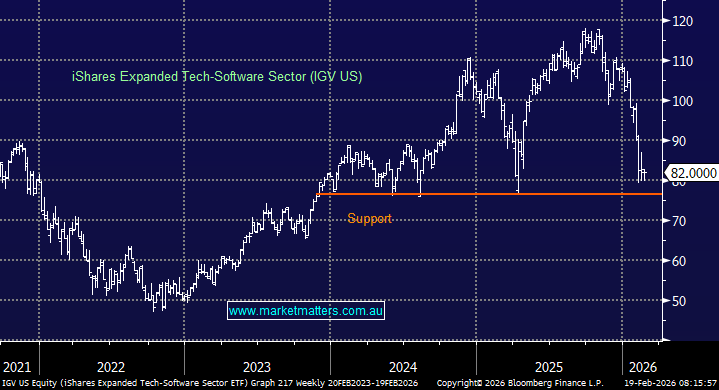

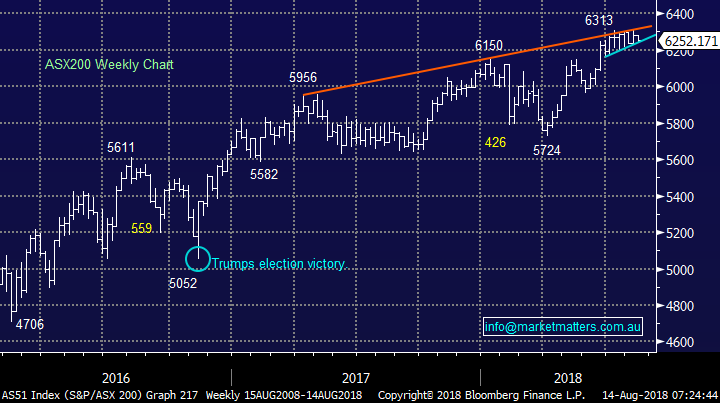

The Fear Gauge (VIX) remains relatively subdued clearly trading well below the average of 2018. Overall this should be no great surprise considering the US S&P500 is less than 2% below its all-time high, this market has certainly shrugged off some potentially scary news e.g. North Korea, rising bond yields, a US-China trade war and now the Turkey crisis - ironically it’s probably going to be something pretty innocuous that finally breaks this 9 ½ year bull market.

Volatility / Fear Index (VIX) Chart

Winners

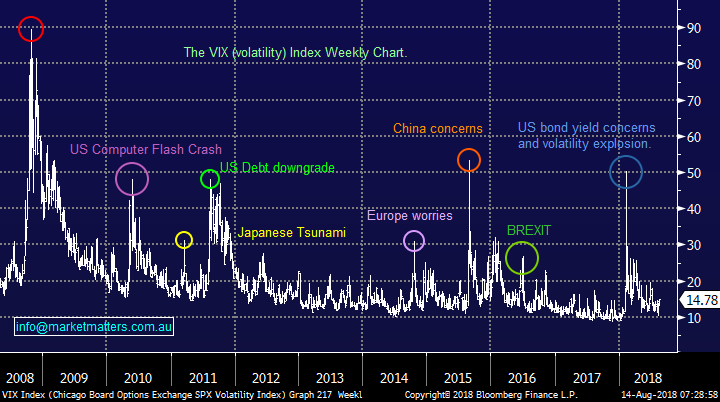

1 REA Group (REA) $87.68

At MM we have been bearish REA for the last few months which proved on the money following the stocks 14% correction.

However following their profit report last week where the online real estate company produced a 23% increase in net profit to almost $280m for the full year, with a 23% climb in revenue, we have changed our opinion. The key to that announcement is not the result itself but commentary around their ability to push through higher prices (shows their market dominance) while they also see a benefit from houses taking longer to sell.

- MM is now bullish REA targeting $95-100, or 10% higher.

REA Group (REA) Chart

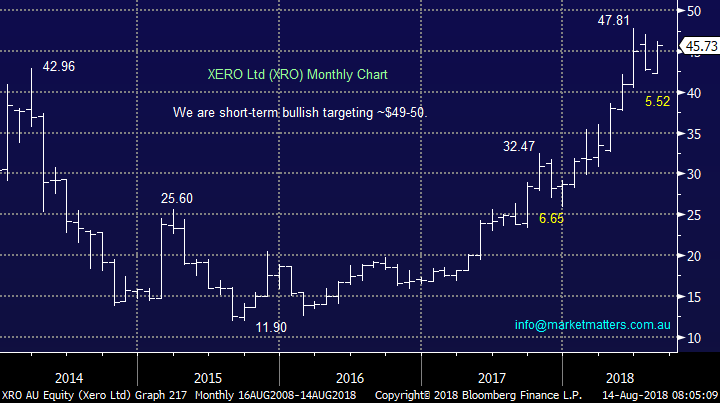

2 Xero (XRO) $45.73

No change of opinion for the online accountancy technology supplier XRO, just one we felt should be reiterated:

- MM is bullish XRO initially targeting the $49-50 area.

Xero (XRO) Chart

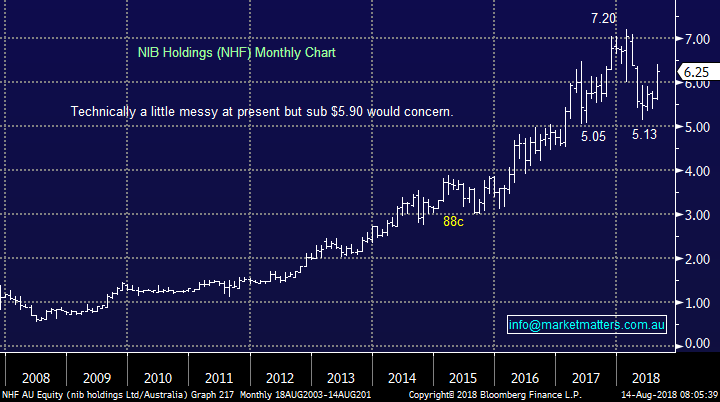

3 NIB Holdings (NHF) $6.25

NHF shares rallied an impressive 9.7% yesterday as the healthcare insurer upgraded guidance by ~14% with policy holders simply not claiming as much as expected (good for NIB and MPL however a negative read through for the private healthcare providers).

- We are overall neutral NHF but the keen could go long with stops beneath $5.90, around 5%.

NIB Holdings (NHF) Chart

The implication to us from the above 3 stocks is there remains a good chance the ASX200 current advance is not quite complete as it would be a big ask for both XRO and REA to rally to fresh 2018 highs in a falling market.

Losers

1 Nufarm (NUF) $6.55

We’ve discussed NUF a couple of times over the last few weeks and are obviously glad we didn’t try and catch the falling knife following yesterday’s 13% plunge.

The stock made a 2-year low on the news that a US civil court has ruled that Roundup, the common weedkiller, had given a former US groundkeeper terminal cancer – he was apparently awarded US$289, although appeals are expected.

NUF has sold Roundup in the past and currently sells Weedmaster which contains glyphosate, the ingredient in focus. NUF have boldly stated that they do not expect these issues will have any impact on their business. NUF is now 36% below its 2017 high due to the double whammy of the Australian drought and the roundup news.

- We are neutral NUF, its P/E of 21.8x Est 2018 earnings does not feel cheap enough under the current circumstances for a countertrend play.

Nufarm (NHF) Chart

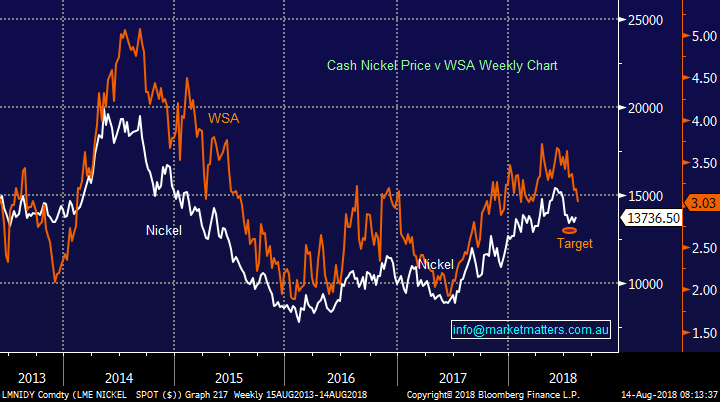

2 Western Areas (WSA) $3.03

Nickel producer WSA has now declined 25% from its dizzy heights earlier in the year. Our ideal buy are of sub $3 is looming fast.

The stock has followed the nickel price closely, just as it has for the last 5-years.

- MM likes WSA around the $3 area.

Western Areas (WSA) Chart

Cash Nickel Price v Western Areas (WSA) Chart

3 Orocobre (ORE) $4.13

Lithium producer ORE has been smacked over recent weeks as the oversupply story has certainly trumped the growth in electrical vehicle belief. Both MM and Toyota appear to have got this one wrong.

- Technically the $3 area is now looming, some bad medicine feels close at hand.

Watch for alerts.

Orocobre (ORE) Chart

4 Janus Henderson (JHG) $37.35

JHG has tumbled since its result and from a technical perspective another 10% lower now feels likely. Also, the picture for fellow sector underperformer IFL feels bleak with sub $8 looking likely.

- Technically 10% lower is now looming, and we’ll likely fall on our sword sooner rather than later.

Watch for alerts.

Janus Henderson (JHG) Chart

IOOF Holdings (IFL) Chart

Conclusion

We’ve given our losers more than a fair opportunity to step-up and show some resilience, it’s medicine time:

- MM is bullish REA and XRO short-term.

- MM is neutral NHF.

- MM is neutral / nervous NUF.

- MM unhappy with both JHG and ORE.

- MM likes WSA around $3.

Our thoughts for MM this morning:

- Switch our 5% exposure of ORE to 3% in WSA.

- Cut our 5% in JHG.

- Wait on adding to the BEAR and / or BBUS.

- Sell another 2% SUN above $16.

Overseas Indices

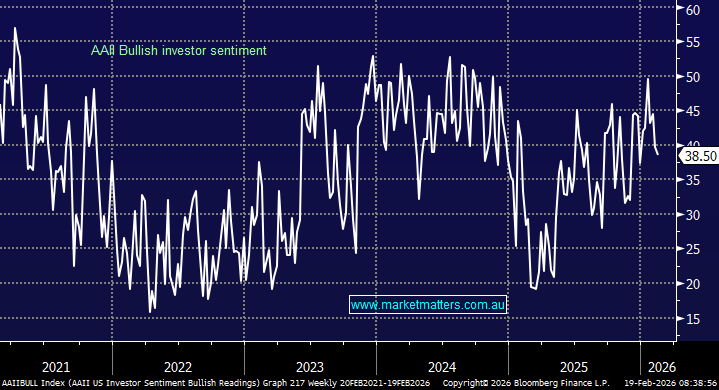

The US S&P500 has now endured its longest losing streak in 5-months although it still remains only 2% below its all-time high set earlier in the year.

- We remain committed to our view that the next 10% is down but are unsure whether it can make fresh highs first.

European stocks continue to tread water generating little signals of interest.

US S&P500 Chart

UK FTSE Chart

Overnight Market Matters Wrap

· Global markets remained under pressure overnight as investors focused on the risks of a full blown financial crisis developing in Turkey and this having a contagion effect throughout global economies and markets.

· Emerging markets in particular were under pressure, falling on average 2%, as were commodities. The gold price slumped 1.5% to hit an 18 month low of US$1200/oz. Both BHP and RIO were once again slightly lower in overnight trading as base metal prices weakened further.

· European banks with exposure to Turkey led the euro markets lower as did US financials on Wall St, with the Dow easing 0.5%. With investors becoming more defensive, the US$ once again rallied, hitting its highest level against the Euro in over a year. The US$ strength saw the A$ easing back further to US72.7c. Locally the futures are pointing to a slightly weaker opening. Reporting season gathers pace today with Challenger and Whitehaven among those reporting.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here