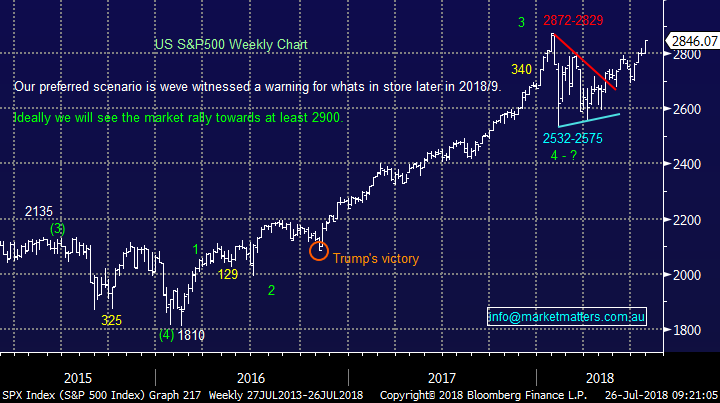

$US earners struggle as trade war fears evaporate (CSL, COH, MQG)

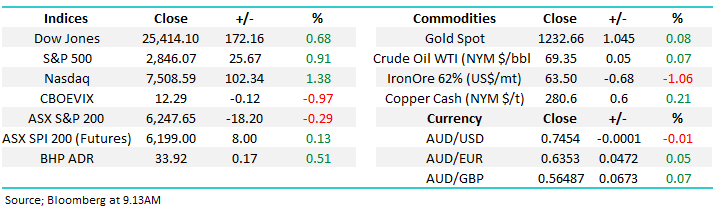

The ASX200 had a poor Wednesday ignoring solid gains from overseas markets – perhaps it’s another classic case of the Australian share market trading one, or two, steps ahead of Europe / US. The futures market again spent most of the day trading at a 60-point discount to the ASX200 implying fund managers were not looking to allocate any fresh cash to the local market.

On a sector level we noticed definite weakness in the $US earners like CSL, Macquarie (MQG), ResMed (RMD) and Cochlear (COH) a likely move we have flagged in recent reports – all 4 stocks significantly underperformed in yesterday’s weak market

The $A has gained strength around the 74c area – even after a disappointing CPI print in the morning (i.e. low local inflation) after an initial 0.5c “knee jerk” retreat back under 74c the Aussie rallied higher all day to close on its highs around 74.5c.

· MM is overall neutral the ASX200 with a close below 6140 required to seriously concern us but importantly we remain in “sell mode”.

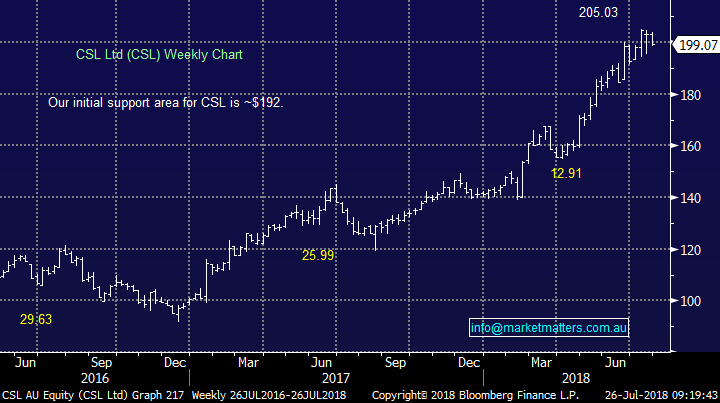

Overseas stocks were mixed with Europe struggling all night while the US S&P500 rallied almost 1% on the news of an EU / US trade deal – Trumps kicking negotiation goals yet again! However, the local futures are only pointing to marginally higher opening continuing on from yesterday’s lacklustre performance.

NB Facebook’s shares have dropped a massive 20% in the after-market on revenue / growth forecasts, volatility abounds. That has put pressure on the NASDAQ Futures which are trading down 0.71% at 9.12am

Today’s report is going to refocus on 3 $US earners that we may consider buying into weakness – its important to keep very focused on levels as any correction may be rapid due to their strong gains over recent years.

ASX200 Chart

Yesterday MM allocated 8% of the Growth Portfolio to the market reducing our cash position to 16%, plus 8% in 2 negative facing ETF’s.

The question subscribers may be asking is “why MM bought Mineral Resources (MIN), IRESS (IRE) and Healthscope (HSO) if they believe the market is rapidly approaching the end of its 9 ½ - year bull market?”.

The answer is in two halves, firstly the reasoning behind each purchase is a mixture of excellent risk / reward plus a low correlation to the ASX200 of the 3 stocks:

1. Mineral Resources (MIN) $17.10 – we like MIN fundamentally & are targeting over $22 with a stop below $16.

2. IRESS (IRE) $11.93 – we like IRE fundamentally & are targeting well over $13 with a stop below $11.10.

3. Healthscope (HSO) $2.24 - we like HSO believing there remains a strong possibility of further takeover activity while stops will be below $2.10.

Secondly, having increased our stock specific market exposure will make it easier to add to our 2 short ETF holdings if / when sell triggers are generated by the local and / or US indices.

NB We still have a buy order for CIM and a sell for SUN live in the market but the CIM is likely to cancelled in the next 1-2 days given the strength of the stock.

Today we have again looked at 3 “$US earners” which MM likes as companies but loath at today’s prices. We feel strongly they have been the go-to / safe stocks where retails investors and fund managers have heavily invested without enough thought to risks to future growth – look at Facebook this morning. A slight wobble and a 10% correction may prove optimistic.

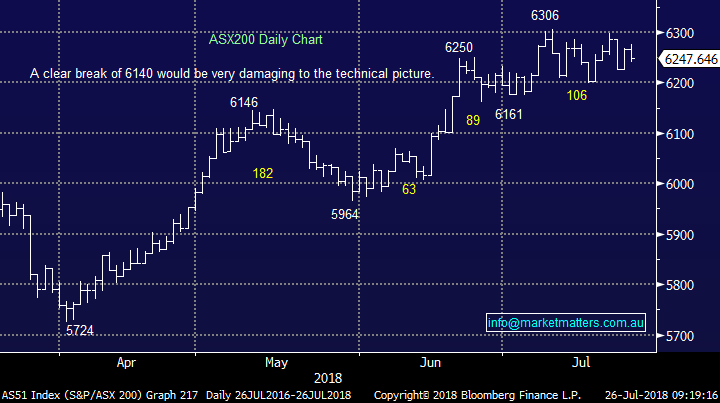

1 CSL Ltd (CSL) $199.07.

CSL has been a huge success story in the ASX200 over the last few years but we are wary as to where the marginal buyers will come from at such elevated and optimistic levels for the stock, although nobody doubts the quality of the business.

CSL is currently trading on a forward PE of 39x 2018 earnings while yielding less than 1% - clearly all about growth.

However, the current valuation assumes ongoing strong growth in demand for its current / future products moving forward without major competitor intervention, the risk / reward is not exciting ~$200 a share.

· MM has interest in CSL ~$180, lowered from the $192 we had considered previously.

CSL Ltd (CSL) Chart

2 Cochlear (COH) $204.04.

COH is a great Australian company which has gone from strength to strength over recent years but the shares have rallied almost fourfold since 2011 yet the company has only increased its sale of units by ~30% putting pressure on pricing to justify current levels.

COH is currently trading on a forward PE of 47x 2018 earnings while yielding less than 2% - again clearly all about growth.

· MM has interest in COH below $180, over 10% lower than its last trade.

Cochlear (COH) Chart

3 Macquarie Bank (MQG) $124.93

We took profit on our latest foray into MQG too early in hindsight but at MM we look forward, not back, and are comfortable buying stocks at higher prices than we previously exited if the reasoning is sound.

MQG is currently trading on a forward PE of 15.7x 2018 earnings while yielding 4.2% part franked.

This morning MQG have provided an earnings update at their AGM in Sydney with some large announcements around personnel announced. Current CEO Nicholas Moore is to retire and be replaced by Shemara Wikramanayake. A very smart cookie and the first female CEO of Macquarie in its history. Shemara has been with the bank for around 30 years and was the Global Head of Asset Management. She’s very well regarded internally at Macquarie and the market likes her - she was clearly the obvious successor to Nicholas Moore.

In terms of earnings, the bank has had a very good FY18 with a strong uplift in earnings, however the market has been positioned well for it. FY19 guidance is key to this morning’s announcement and they have guided to ‘Broadly inline with FY18’. The market was looking for growth of around ~5% in earnings, so the guidance looks light on, even though MQG tends to under promise and over deliver.

· MM has interest in MQG below $118, but preferably below $115.

Macquarie Bank (MQG) Chart

Conclusion (s)

We are cautious around the market in general hence our interest levels on CSL, COH and MQG are well below yesterday’s prices. In fact, we are actually on the bearish side for the 3 at current levels.

· MM is interested in CSL (under $180), COH (under $180) and MQG (under $115) at levels indicated.

Global markets

The US market rallied strongly overnight with the S&P500 closing less than 1% below its all-time high however Facebooks plunge in the aftermarket is likely to test its resolve in tonight’s session.

US S&P500 Chart

European stocks have struggled to live up to their recent technical promise and we have switched to neutral the region.

Euro Stoxx 50 Chart

Overnight Market Matters Wrap

· The 3 US majors ended their session in positive territory, however weakness is expected in the tech sector tonight, with Facebook revenue is expected to fizzle.

· The head of the European Union, Jean-Claude Juncker, met with President Trump to talk about trade barriers. Trump said "we agreed today, first of all, to work together toward zero tariffs, zero non-tariff barriers, and zero subsidies on non-auto industrial goods."

· 30% of S&P 500 companies have reported so far and 85% beat analyst expectations. Tech stocks outperformed, while Telcos were the worst performing sector overnight.

· Plenty on the domestic front, with Nine Entertainment (NEC) merging with Fairfax (FXJ) and Macquarie Group (MQG) naming Shemara Wikramanayake its new CEO.

· The September SPI Futures is indicating the ASX 200 to open 13 points higher towards the 6260 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here