Time for caution with the high valuations stocks? (ALL, SEK, A2M, ORE, QUB, RHC)

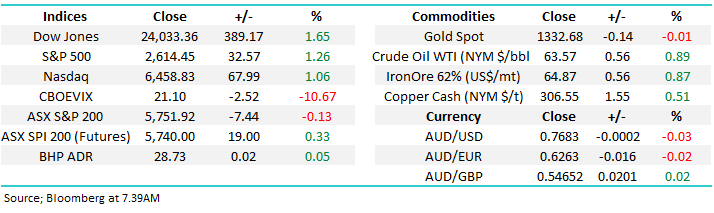

The ASX200 picked last night’s strong rally by US stocks extremely well with the oil and resources sectors leading the strength. There’s no change with our local market – to really start a meaningful rally / recovery we need to see the influential banking sector regain its mojo.

· The Australian Banking sector is down close to 8% for Q1 of this year but remember when banks have a particularly poor Q1 the historical average return for April is +4.3%.

We are confident of a short-term bounce in the ASX200 to around 5850 but still need a close back above 5900 (2.7% higher) to get excited about a potential decent rally to new 2018 highs. We picked yesterday’s recovery in the Morning Report but unfortunately the early weakness was not pronounced enough to warrant us investing our remaining cash considering our medium-term outlook for stocks – markets are getting complacent with the Dow rising / falling 300-500 points.

ASX200 Chart

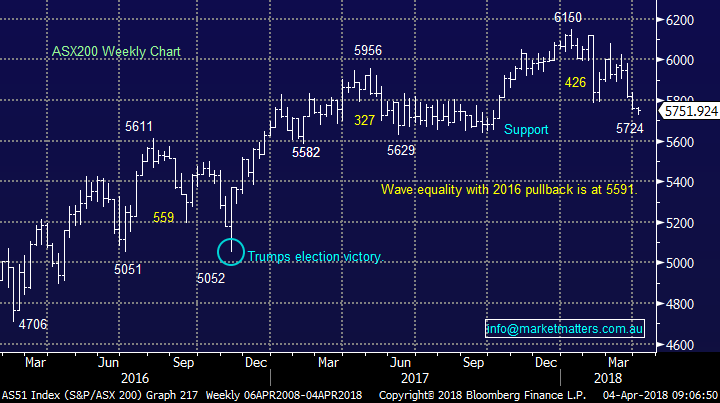

Last night’s +1.26% advance by the US S&P500 was a continuation of the relatively volatile theme for equities in 2018.

· US stocks have already had more 1% swings in 2018 than the whole of 2017.

Markets are currently focusing on any short-term news flow with Donald Trump playing an integral role. However, earnings are soon to take centre stage and they look to be good with revisions up in both 2018 and 2019.

· This market is about focusing on fundamentals / technicals and being active around positioning, ignore the noise!

Interestingly the VIX closed last night at 21, down from the extreme early February panic above 50. The long-term average for the VIX is actually 19 so trading in the low 20’s is not vaguely abnormal.

Fear Index (VIX) Chart

As mentioned overnight the US market enjoyed a great night with the Dow rallying +389-points / 1.65% which creates interesting reading for the last 3-days - +255, -459 and now +389-points, it’s not surprising the local markets is taking these swings in its stride. Our short-term view for US stocks remains bullish but if we are correct this is the last piece of the 9-year bull market puzzle so we feel it’s likely to be a very choppy advance – that view feels correct so far.

US S&P500 Chart

Are we witnessing the end of the high valuation “go to stocks”?

What’s caught my eye of the last few weeks is the ease in which some of the most popular stocks over recent times have corrected. E.g. over the last 5-days the ASX200 is -1.2% but Aristocrat (ALL) is -4.7%, Seek (SEK) -6.1%, A2 Milk (A2M) -8.9% plus our own Orocobre (ORE) -5.2%.

· Remember we’ve warned previously about high valuation stocks historically underperforming in rising interest rate environments.

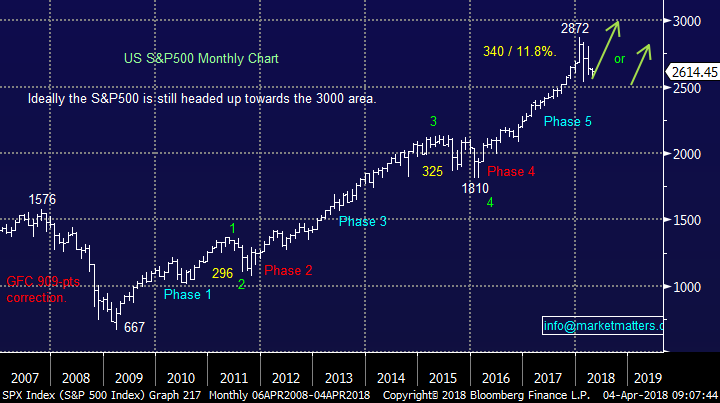

Obviously, there are some individual reasons for the underperformance of the above 4 stocks but over recent times they have been bullet proof to almost any bad news. The US tech-based NASDAQ has also shown us that when stocks are priced for perfection / ongoing (unabated) strong growth the risks increase.

· The high flying NADAQ is still over 10% below its all-time high formed just 3-weeks ago but still up 39% since Donald Trump won the US election.

Privacy laws are likely to be cranked up significantly following the Facebook debacle which is going to be onerous and costly for many on-line companies – just think how banking regulations have hurt our sector.

· We believe the period of significant outperformance by the NASDAQ as a whole is behind us for a year, or 2.

NASDAQ Chart

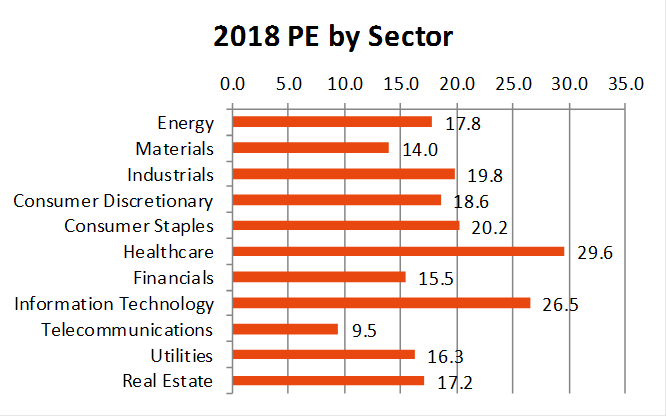

Moving onto the local market when we look at the valuations across the respective sectors Healthcare and IT sectors are standing out as expensive on a relative basis e.g. Seek (SEK) is trading on a an estimated 2018 P/E of 30x while paying a grossed-up yield of 3.5% whereas NAB is trading on a P/E of just 12.5x and is paying a comparative yield of 9.95%. It’s easy to see if Seek fails to grow earnings – fails to deliver on the markets lofty expectations that some pain will be felt in that stock.

Source; Shaw and Partners

A great example of a high valuation stocks which has lost its lustre in a painful way since late 2016 is Ramsay Healthcare (RHC) which has fallen ~26% while the overall market has gained over 5% before dividends.

NB We won’t even start talking about the demise of previous market favourites Vocus (VOC) and TPG Telecom (TPM) although the Telcos are looking cheap but dangerous at present.

Ramsay Healthcare (RHC) Chart

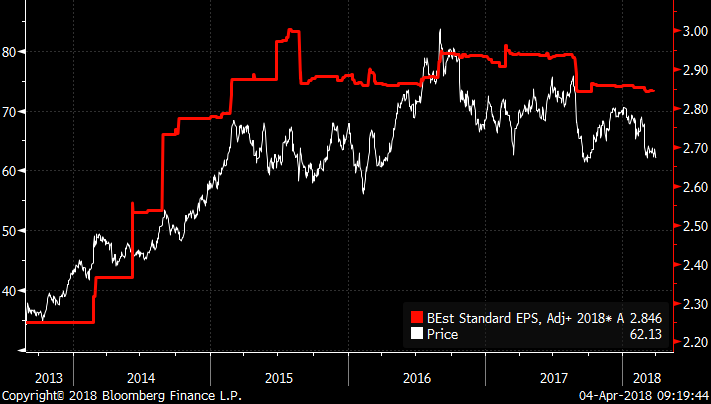

Interesting also to have a look at the profile of RHC earnings over the top of the share price which tells an interesting story. Companies can only sustain growth for so long, and despite RHC being a great business, the earnings profile has been flat since 2015 and therefore the stock’s multiple has been re-rated down. Paying 30x for a company growing earnings at 20% pa is fine, given next year you’ll be holding a stock on 25 times, then ~20 times in year 3, ~17 times in year 4, ~14% in year 5 etc – like my daughter filling her ballet shoes that were too big when she first got them!

Ramsay Healthcare (RHC) Earnings (red) v Share price (White)

However, paying a high multiple for a business struggling to grow earnings will continue to be a high multiple in the outlying years – or worse still, if the market changes is appetite to pay a high a high PE, the then share price will fall, which has been the case with Qube Logistics (QUB)

QUB logistics (QUB) Earnings (red) v Share price (White)

Lastly let’s look specifically at the 4 mentioned stocks, to decide whether the recent weakness is a potential buying opportunity – I’m glad to say MM has made profits from all 4 during their strong rallies

1 Aristocrat (ALL) $23.41

ALL is a great company but we feel the gaming machine operator is in the mature stages of its impressive rally since 2016.

· We are neutral / negative ALL with an eventual target back towards the $20 area.

Aristocrat (ALL) Chart

2 Seek (SEK) $18.32

SEK has clearly been caught up in the recent negative sentiment around tech stocks.

· We are neutral / negative SEK with an eventual target well under $15.

Seek (SEK) Chart

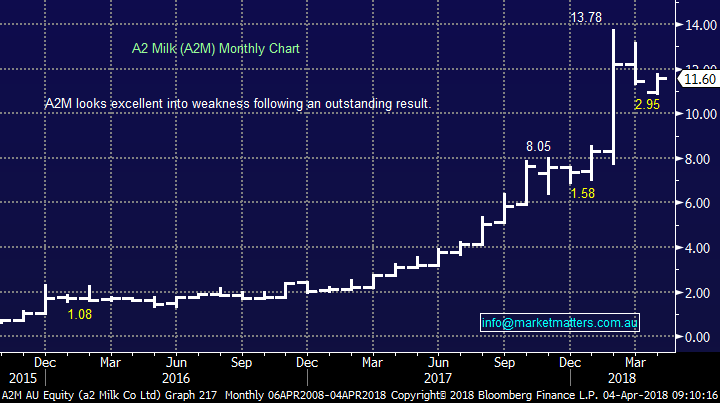

3 A2 Milk (A2M) $11.60

A2M has suffered recently due to news that global giant Nestle was planning to enter the Chinese market in direct competition to A2M in the baby formula sector. Surely nobody thought A2M would continue to make huge profits from China without competition, that’s simply not how business operates.

However, A2M was first and is established with an excellent name / brand.

· The 21% correction in A2M’s share price feels like a potential opportunity although after yesterday’s 7% recovery the risk reward is not as attractive.

We could buy A2M around $11.30, if it pulls back, with stops below yesterdays $10.83 low – however this is now a higher risk play.

A2 Milk (A2M) Chart

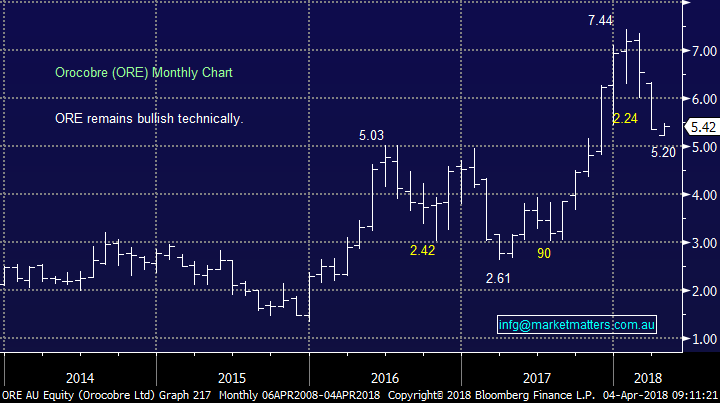

4 Orocobre (ORE) $5.42

ORE has corrected over 30% since we exited the stock although we are down slightly from our recent foray back into the lithium producer. However, we are not excited by a valuation of 30x estimated 2018 earnings and no yield, let’s hope they don’t find a battery which works without lithium!

· We are firm believers in the electric car evolution moving forward but it’s all about value – and we’re cognisant that the market can change its ‘appetite’ for certain sectors very quickly.

Toyota bought a 15% strategic stake in ORE for $7.50 less than 3-months ago (with favourable off–take agreements), I wonder at what price it might add to its position?

Orocobre (ORE) Chart

Conclusion (s)

1. In general, we are not keen on high valuation / “got to” stocks moving forward.

2. We remain comfortable with our ORE holding and see a potential risk / reward opportunity in A2M ~3% lower, but this is clearly higher risk

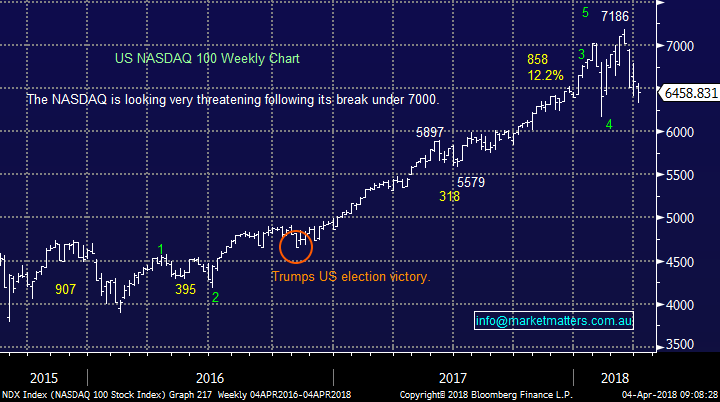

Overnight Market Matters Wrap

· A more settled tone on Wall St saw equity markets supported in a late afternoon rally with all 3 key indices closing over 1% higher.

· The Dow Jones led the charge closing + 1.65%, above 24,000 again. Ten year bond yields, which had a strong rally in March, lost some ground, retreating back to around 2.78%.

· Oil led the commodity complex higher along with copper and aluminium, while gold and iron ore lost ground. BHP was about 1% higher in US trading while RIO was steady. The A$ firmed slightly to around the US76.8 c level.

· Economic data overnight was mixed with Markit PMI data suggesting a slower rate of growth in manufacturing around the globe, but still forecasting a healthy level of global growth of 3.5% in 2018. The local market is pointing to a 20pt improvement on the opening.

· The June SPI Futures is indicating the ASX 200 to open marginally higher, around the 5755 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 04/04/2018. 8.26AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here