Thoughts from Westpac’s increase in variable home loan rates (WBC)

The ASX200 surged +0.75% yesterday with over half of the gains unfolding in the last hour of trade following Westpac’s (WBC) increase of its variable home loan rates 14pts to 5.38% - the RBA cash rate remains fixed at 1.5%. Similarly, WBC closed up 77c / 2.74% with well over 65% of these gains occurring after rate news around 3pm. From the major banks only National Australia failed to rally over 2% and it still managed a healthy +1.8% advance.

Overall the banks led the charge rallying +1.9% as they attempted to shake off the weakness that followed the liberal party’s implosion last week. As a sector retail gave a helping to the index rallying 1.1% but we are a bank dominated index and as we often say “the market cannot go up without the banks” – obviously not an exact science but when the “big 4” make up over 21% of the ASX200 they have an enormous influence.

· We remain neutral the ASX200 but still in very cautious “sell mode” but only just.

Overnight stocks were again strong as optimism that Canada may join the US and Mexico in a new NATA trade agreement gathers momentum. The broad based S&P500 rallied +0.57% to fresh all-time highs, led by the tech sector which gained over 1%. This morning the ASX200 should make a fresh decade high and we will be watching closely if it can look comfortable back above the 6350 region.

Not surprisingly we will discuss some potential ramifications of Westpac’s action in today’s report.

ASX200 Chart

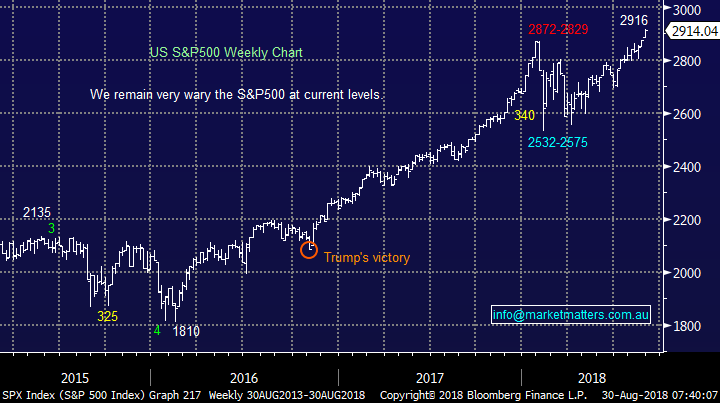

US stocks have now made fresh all-time highs for the past 4 trading session and people are starting to question if we are set for a market “melt up”.

I found the below chart on Bloomberg this morning illustrating that hedge funds are significantly uncorrelated to the S&P500, to be precise the lowest in 5-years, raising the question of when / if will some of them be forced into stocks.

Over recent days as we have witnessed US stocks make fresh all-time highs but interestingly option volatility is increasing as traders / fund managers appear to be buying calls as “melt-up” protection

At this point in time optimism is the main game in town as market players continue not to buy arguments of peak earnings / elevated valuations and continue to shrug off any macro-economic concerns like Turkey and a China-US trade war.

Technically we get no sell signals until a break of 2850 ~2% lower hence until then “don’t fight the tape”.

One major factor that is catching my attention is how many times a week I hear discussions around the pending market pullback, they generally happen when least expected. This adds weight to the argument for further gains from equities leaving us watching our 2 bearish ETF positions very closely.

US S&P500 Chart

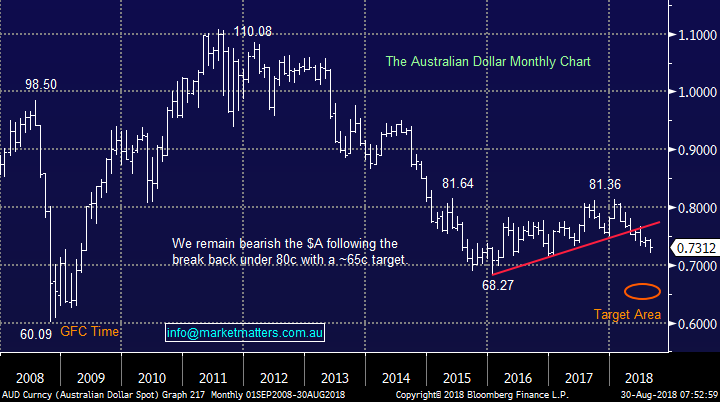

The Australian Dollar

The downtrend in the $A remains firmly intact and although the local currency has bounced ~1c from this year’s 72c low against the $US we still believe the 65c area is looming on the horizon.

Westpac’s increase in its mortgage rate is basically doing the RBA’s job for it by putting yet more pressure on housing prices and the average Australians debt servicing ability. The net result being the interest rate differential between Australia and the US is likely to continue to widen, hence investors receive greater interest income on $US as opposed to $A, hence increasing the appeal of the greenback.

· MM remains bearish the $A targeting ~the 65c area.

We would add that the $A has already fallen significantly since its 110 highs in 2011 and further declines are likely to be far more orderly.

If we are correct with our $A opinion the stocks with $US earnings are likely to continue their outperformance of recent years e.g. Aristocrat (ALL), Cochlear (COH), CSL Ltd (CSL), ResMed (RMD) and potentially the resources whose commodities are priced in $US.

The Australian Dollar ($A) Chart

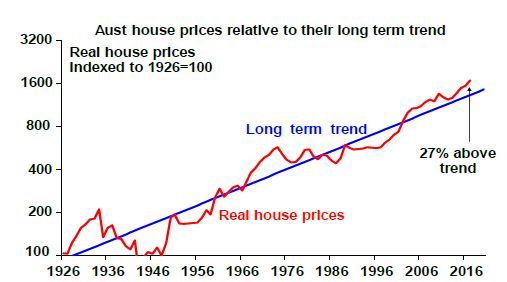

Australian Property prices

I recently read an excellent article on Livewire by Shane Oliver from AMP Capital where he discussed the Australian property market. The below chart illustrates simply that housing prices were well overdue a rest with only the most optimistic expecting they would continue to surge higher unabated.

On the weekend I spent some time with a friend who owns a real estate business in the inner west of Sydney and his opinion is prices have correct ~15% from their peak, that feels about right to me but they still remain well above say the 2011 flat period.

Undoubtedly the spectacular boom in Australian property prices has finished including officially as national prices have recorded their first negative year since 2012. Just look at the experts – billionaire Harry Triguboff is no longer buying land for future developments.

With the huge amount of interest only loans due to mature in 2020 and be forced onto principle + interest terms we expect it’s a few more years until property can start to rally again but we are not looking for a “crash” like many for 3 simple reasons:

- There is no sign of a recession and employment remains firm.

- Any hike in official interest rates is likely to very gradual hence the move by WBC yesterday is unlikely to be repeated to a significant degree.

- Supply and demand issues look likely to be addressed in the coming years as the construction boom follows prices lower.

We stated, unpopularly at the time in 2016 that equities were likely to outperform property for the next few years, this has played out and the trend may be maturing fast but I wouldn’t be jumping off just yet.

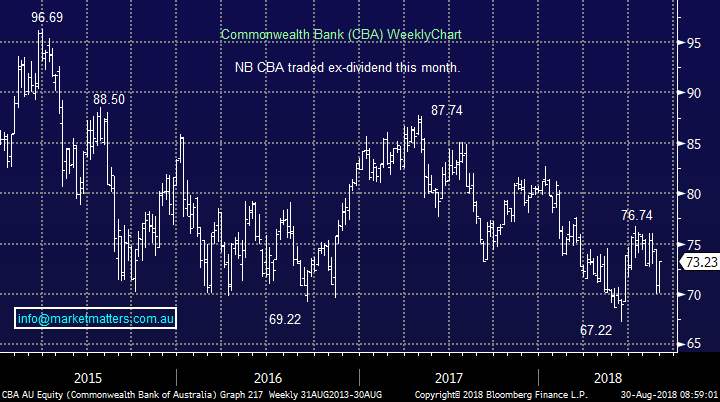

The Australian Banks

The local banks rallied strongly yesterday on the news that declining margins would simply be addressed by raising rates i.e. good for shareholders but not mortgage holders.

Australian banks have had a tough few years as the market understandably labels them ex-growth. They clearly have some headwinds over the coming years as loan approvals decline as Australians tighten their belts but if property doesn’t crash their bad debts are unlikely to rise to any great degree.

Westpac is trading on a conservative P/E for 2018 of 11.87x while yielding 6.51% fully franked i.e. not a bad investment if the shares do not fall.

· We believe the banks will outperform in 2018/9 hence we are overweight the sector but we won’t be afraid to take some $$ off the table if they rally “too hard”.

Westpac Bank (WBC) Chart

· Technically CBA looks capable of testing $80 while last week’s lows hold.

Commonwealth Bank (CBA) Chart

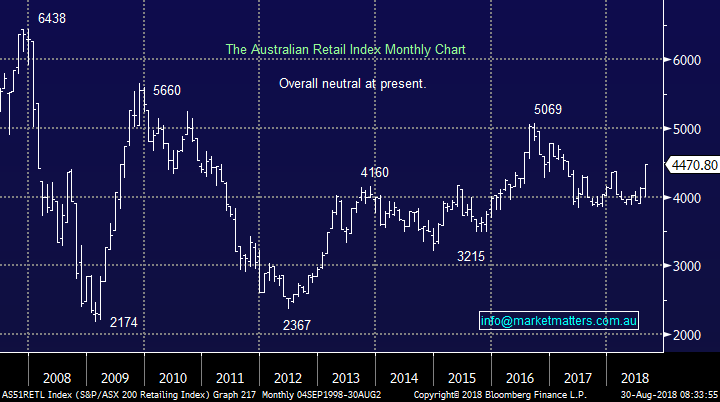

The Australian Retail sector

The retails stocks have bounced strongly this month a move that looked likely technically but we couldn’t follow it from a fundamental perspective, in fact we are bearish fundamentally leaving us happily square the sector.

- Falling property prices and rising debt levels is likely to hurt retailers due to the negative ‘wealth effect’ on consumer sentiment.

- CBA has pointed out that personal loan / credit card arrears has risen significantly since the start of the year, this will stop spending at some stage.

- Home loan arrears is also trending higher, again putting pressure on discretionary spending.

- Even AGL reported an increase of bad and doubtful debts of over 20% i.e. people are struggling to pay their utility bills.

- Loans for renovations have fallen significantly, creating less work for tradies, and lower demand for new appliances, furniture etc.

However amazingly consumer confidence in July was at a 4-year high, it’s certainly not with the people I talk to! I wonder how the next reading will look after the recent Liberal shake up.

· MM is negative the retail sector until further notice.

Australian Retail Index Chart

Conclusion

We have a few takeout points from today’s report:

- There is a risk of an stock market “melt up” but it’s not our preferred scenario.

- MM remains bearish the $A targeting the 65c region.

- We expect Australian property to continue its drift lower into at least 2020.

- We expect Australian banks to outperform in 2018/9 especially as they are “under owned” by many fund managers.

- We remain negative the retailing sector.

Overnight Market Matters Wrap

· The US major markets edged higher overnight, led by the tech. heavy Nasdaq 100, up 1.19% with all major indices at new all-time highs once again.

· A stronger than expected US quarterly economic growth of 4.2% and President Trump saying he was optimistic that a trade deal would be done with Canada by Friday were the culprits that brought optimism to US investor’s minds.

· Corporate earnings expected today are ALX, GXY, PPT, RHC & SFR.

· The September SPI Futures is indicating the ASX 200 jump 50 points higher off the gates towards the 6380 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here