The washing machine keeps tumbling (QBR, BRG, TLS, NCK, IVC, ILU, MIN, ORG)

Yesterday the ASX200 had a simply cracking day shrugging of weak global indices plus an extremely sick resources sector to close down less than 1-point, amazing considering at one stage on Thursday night the futures were pointing to an almost 90-point decline. It certainly has been a long-time since I can remember Telstra (TLS) and QBE Insurance (QBE) propping up the local index.

Patience continues to be a necessity for the bears and as we’ve said before “jumping on the sell train too early can often be a very painful experience as bull markets have a tendency of lasting longer than many expect and by definition rallying further than anticipated”.

Remember at MM we believe that any eventual weakness, our current estimate is ~10%, will predominantly come from the stocks that have run the hardest but as we saw yesterday with the likes of CSL and Computershare (CPU) the bears are still being run over by the top performers.

- We are neutral the ASX200 while the index holds above 6240 but we remain in “sell mode” albeit in a patient manner.

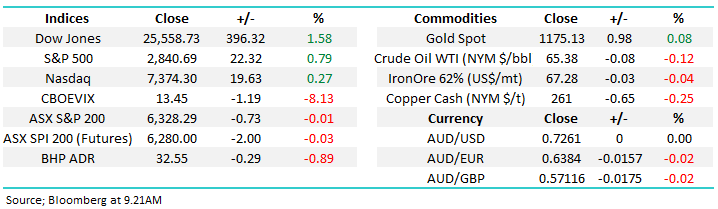

Overseas markets were strong with the S&P500 rallying +0.8%, the Dow led the charge gaining almost 400-points courtesy of Walmart surging ~9%, we ponder if they can turn around so dramatically could say our own “dog” Myer (MYR)?

The futures are pointing to a flat open not being helped by BHP which is set to fall almost 1% in early trade implying the resources selling is not over.

Today’s report is going to be split in 2 halves:

- We are going to look at 8 stocks that caught our eye yesterday, due to the sheer volume of company reports on a very hectic Thursday we will keep the notes / views succinct.

- Also, we are going to briefly examine the re-occurring chart pattern that many stocks / indices are following and by definition one that we believe will determine when it’s time to significantly increase cash levels.

ASX200 Chart

1 The 8 stocks that caught MM’s eye yesterday.

Winners

Happily, MM owns 3 of the 4 across our MM Platinum and Income Portfolio’s.

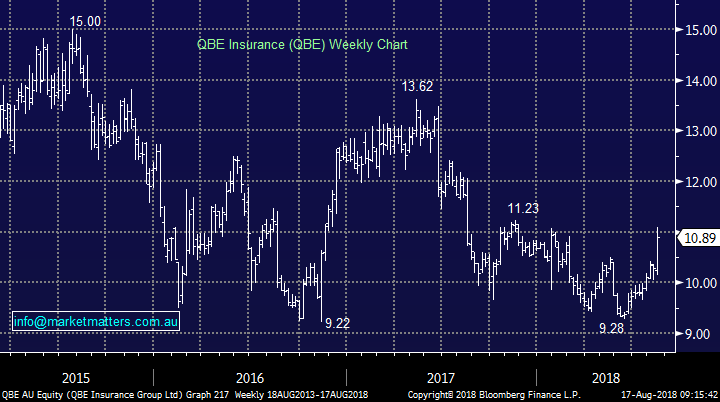

1 QBE Insurance (QBE) $10.89

QBE rallied +6.8% following its result, finally rewarding some patient investors like ourselves.

While the result was ok it wasn’t as bad as many had feared and we’ve enjoyed an initial relief rally, the obvious question “is how long can it last?”.

QBE is trading on an Est. P/E for 2019 of 14.2x compared IAG Insurance (IAG) which is on 19x. Also, after such a terrible run the stock is clearly “under-owned” although there is no meaningful short position.

- MM remains optimistic / long QBE looking for ~15% further upside.

QBE Insurance (QBE) Chart

2 Breville Group (BRG) $13.10

Kitchen appliance business BRG surged +12.5% yesterday following its annual results which showed net profit up +8.7% on revenue up +7.7% i.e. still growing but its P/E of 25.3x for 2019 has us cautious at today’s share price.

- BRG looks strong with a technical upside target ~$14.50.

Breville Group (BRG) Chart

3 Telstra (TLS) $3.06

TLS rallied +5.9% after beating guidance with an important key the improvement in the mobile market plus guidance for 2019 was a healthy 2% above market expectations.

This rare glimpse of good news by TLS set off aggressive buying which is no surprise as the market is likely to be heavily underweight this serial underperformer.

- MM remains optimistic / long TLS potentially looking for the $3.50 region.

Telstra (TLS) Chart

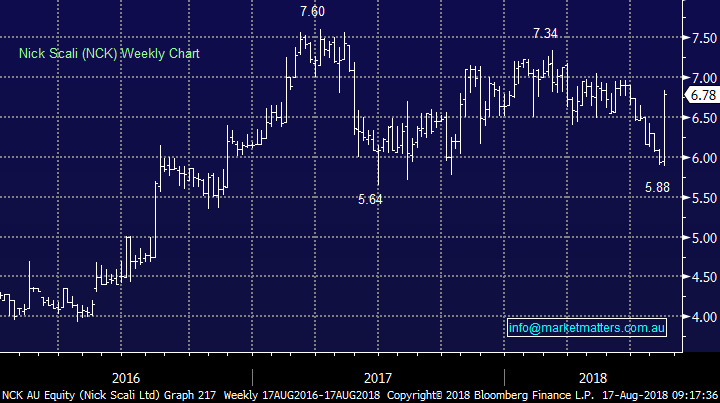

4 Nick Scali (NCK) $6.78

NCK continued with its usual pattern of under promise / over deliver as the furniture retailer shrugged off fears around a housing downturn.

The stocks trading on an undemanding P/E for 2019 of 12.4x while yielding an attractive 5.3% fully franked, hence its position in our Income Portfolio.

- MM remains optimistic on NCK still looking for ~$8.

Nick Scali (NCK) Chart

Losers

Unfortunately, MM owns 1 of the 4 in our MM Growth Portfolio.

1 Invocare (IVC) $13.14

IVC tumbled -8.8% as its profits declined even with revenue slightly higher, not ideal for a stock trading on a fairly rich P/E for 2019 of 24.1x. Just for good (bad) measure they downgraded expectations moving forward.

The company is on the acquisition trail at present and we can see value in say 12-18 months as these like businesses bed down as unfortunately people do still die, but we have no interest at current levels.

- MM remains bearish targeting ~$10.

Invocare (IVC) Chart

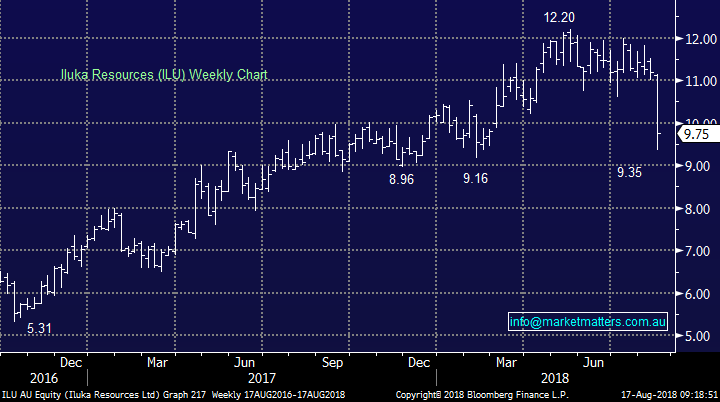

2 Iluka (ILU) $9.75

Mineral sands company ILU fell -7.7% yesterday putting the stock on a valuation of 13.5x while yielding 3.2% fully franked.

We initially felt the numbers looked impressive but the market clearly did not agree, at least for now e.g. revenue rose 24% and net profit after tax increased 255% to $126m.

Some concerns appear to be around the zircon price and usage moving forward plus the future looming increased supply at these elevated levels i.e. the classic commodity cycle.

- MM likes ILU but in this shaky resource environment we prefer between $9 and $9.25.

Iluka (ILU) Chart

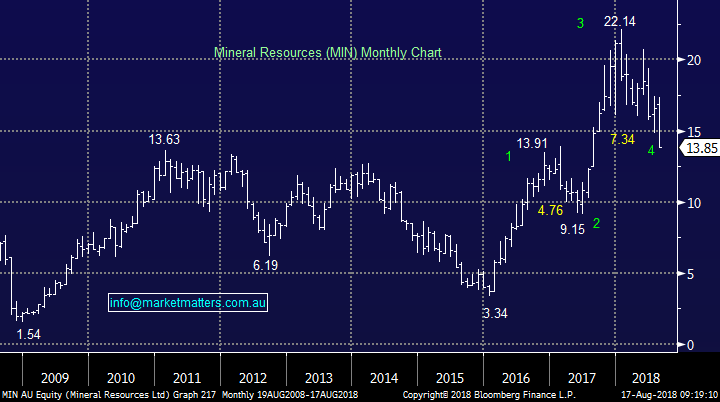

3 Mineral Resources (MIN) $13.85

MIN declined -7.5% after reporting good numbers on Wednesday BUT they failed to give guidance moving forward basically saying all will be revealed in November and as we know markets simply hate uncertainty.

MIN trades on relatively cheap P/E of 9.8x for 2019 while yielding 4.2% fully franked.

- Our painful exit from ORE yesterday allows us to give MIN more room at levels we perceive to be cheap.

Mineral Resources (MIN) Chart

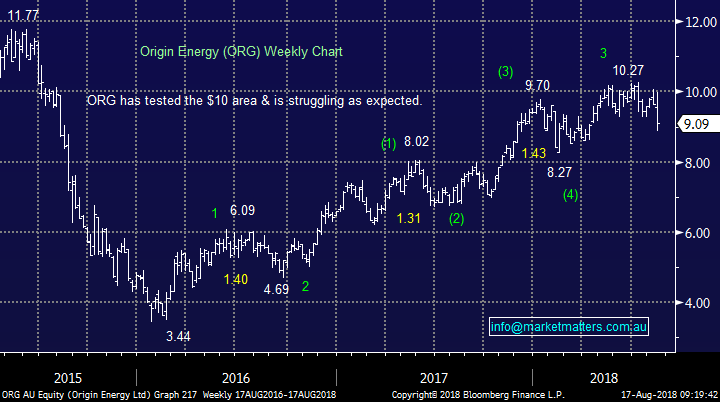

4 Origin Energy (ORG) $9.09

ORG retreated -6.4% after announcing what amounted to a profit downgrade and any profit growth may become a big ask.

- MM remains bearish ORG initially targeting ~$8.50.

Origin Energy (ORG) Chart

2 The dominant chart pattern (s).

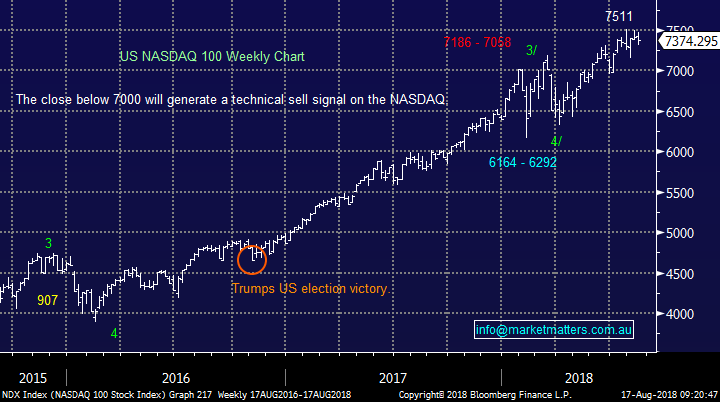

At MM we continue to feel US stocks will make fresh highs for 2018 before becoming vulnerable to a decent correction – we’ve now held this opinion basically for ~6-months.

- Prior to potential failure we envisage the S&P500 testing 2900 – only 2% higher.

Interestingly a large number of our strong performers since the 2015/6 correction are following a very similar path, with the group basically splitting into 2 simple halves i.e.

1. Have already made all-time high – CSL Ltd (CSL), Aristocrat (ALL), ResMed (RMD), Computershare (CPU) and Sonic Healthcare (SHL).

2. Close to making fresh all-time high – Xero (XRO), Cochlear (COH), Seek (SEK), Fisher & Paykel (FPH), REA Group (REA) & Treasury Wine (TWE).

Remember we believe it’s time to be reducing market exposure into strength hence the more stocks that make fresh highs, in-line with the S&P500, the more aggressive we are likely to be on the “sell button”.

We will cover this in more detail in the Weekend Report while considering a few “alerts” that suggest the odds of a top are increasing.

US S&P500 Chart

Conclusion (s)

MM’s views at a glance of the 8 stocks covered today:

Bullish – QBE, TLS, BRG and NCK i.e. the winners to remain strong.

Bearish – ORG and IVC.

Neutral / bullish ILU and MIN – cautious in current resources environment.

Overseas Indices

No change, the S&P500 still looks destined to make fresh all-time highs in the next few weeks, this has been our preferred scenario for months with the big question “will it fail around 2900?”.

Last night’s outperformance by the Dow finally suggests it may follow the broader indices higher but interestingly the NASDAQ that led the bull market continues to lag.

- MM intends to increase our BBUS short US ETF position into further strength.

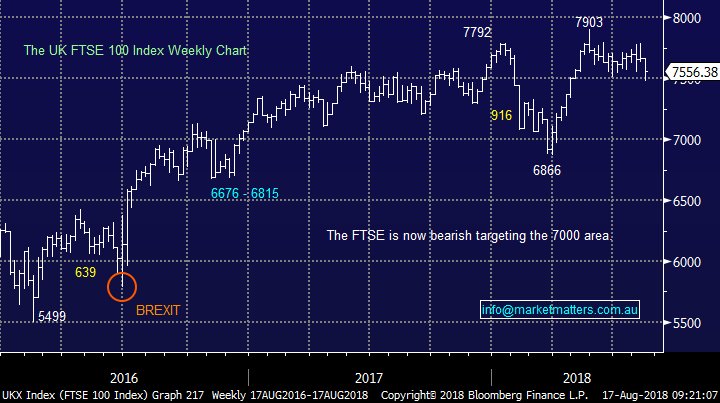

European indices continue to trade sideways in a very similar and relatively uncommitted manner to the ASX200.

US NASDAQ Chart

UK FTSE Chart

Overnight Market Matters Wrap

· Wall St and European markets rebounded overnight with the Dow in particular leading the charge rallying over 400 pts, as China revealed it would send a delegation to the US next week to try to resolve the escalating trade tensions between both nations.

· The Dow was also boosted by a stronger than expected earnings report from Walmart, with the stock rallying over 9%, along with strong moves in Boeing (+4.3%), Caterpillar(+3.2%) and Cisco (+3%), which also reported a strong set of numbers. The S&P 500 and the Nasdaq posted 0.9% and 0.6% gains respectively.

· Commodities also recovered some lost ground with copper, which has lost over 20% from its June highs, rising 1.8% above US$2,60/lb. Brent crude was 0.8% stronger at US$71.30, but gold continued to languish at 18month lows around US$1180/oz. The A$ recovered a little lost ground to US72.60c while both BHP and RIO were slightly firmer in overnight trading.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/08/2018.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here