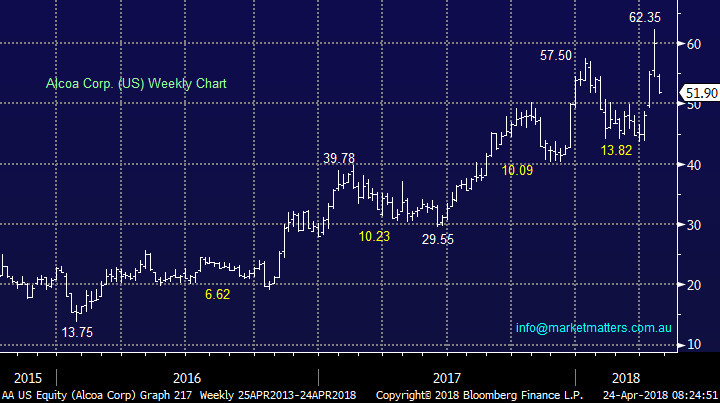

The $US is slowly starting to pressure the resources (EVN, AWC, BHP)

Yesterday the ASX200 enjoyed a stronger day than many expected, as the banking sector managed to bounce +1.7%, following a lower opening in the morning – perhaps the market is looking for an end to the bad news from the Hayne royal banking commission. The “big 4” banks make up a colossal 22.7% of the local index so if they are going to finally find some love, investors should expect the ASX200 to outperform many global markets, at least for a while. Remember we believe that the bank’s dividends are largely sustainable - hence yields like CBA +5.9% and NAB +6.9%, both fully franked, are very attractive to the Australian investor.

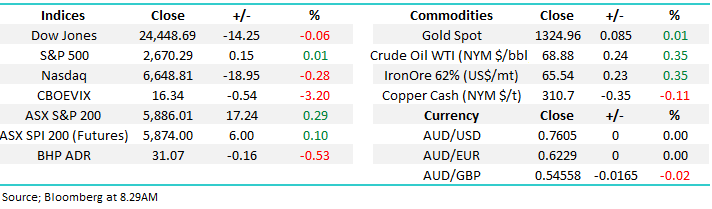

Since global stocks commenced their most recent advance from late 2016 the NASDAQ is up 65% compared to the ASX200 which has only gained 25% - note this is before dividends.

- MM believes the ASX200 will outperform the US tech based NASDAQ over the medium-term, potentially this may mean by falling less when the post GFC bull market does experience a meaningful correction.

ASX200 v NASDAQ Chart

Our view of the local market remains unchanged – we need a close above 5900 to regain a mildly bullish outlook. We note this level is again likely to be in striking distance today and the more time we can spend between 5850 and 5900 the greater the platform becomes for a potential assault on the major psychological 6000 area.

ASX200 Chart

The $US is gaining strength in a quiet but significant manner

We feel that the $US is like a volcano bubbling away which may be about to explode higher, subsequently altering the short-term investment landscape in a dramatic fashion.

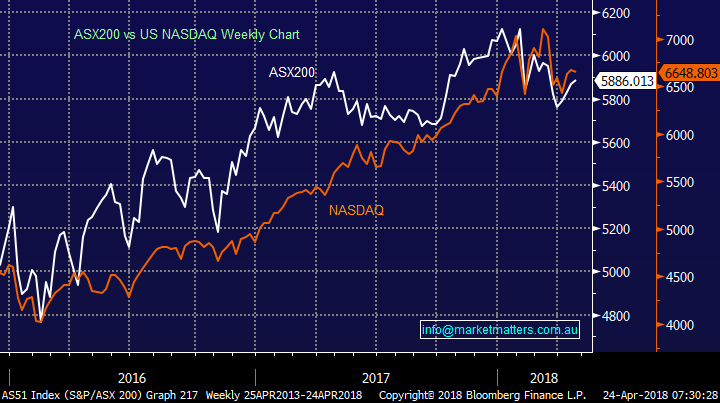

This morning the $US is trading at its highest level since mid-January, our initial target remains ~5% higher. The catalyst for this bout of strength appears to be interest rates / bond yields as we saw US 10-year bond yields challenge 3% overnight, their highest level since early 2014. We’ve been calling the 3% level for months but the current momentum, especially in the shorter-dated 2-year bonds, suggests markets may be underestimating how far / quickly these bond yields can rise following the end of the multi-decade bear market in interest rates.

- We remain both long and bullish the $US – we recently bought the Beta Shares ETF USD.AXW.

$US Index Chart

US 10-year bond yields Chart

The inverse correlation between the $US and the underlying commodities is noticeable and one of the reasons we have been following our plan to sell our resources positions into current strength e.g. overnights small +0.7% pop in the $US led to a fall of $US12.30/oz in gold and $US2.60/lb in copper, both a slightly higher percentage than the appreciation in the $US.

The chart below shows how closely the inverse relationship holds true for gold, more importantly if we are correct and the $US is headed back towards the 95 area then gold looks poised to tumble ~$US75/oz. Hence if we cast our eyes back to Evolution Mining (EVN), which was discussed in a question yesterday, when gold was $US75/oz. lower, EVN was trading below $2.40, well over 20% lower.

- MM has no interest in the gold sector at this point in time.

$US Index v Gold Chart

Evolution Mining (EVN) Chart

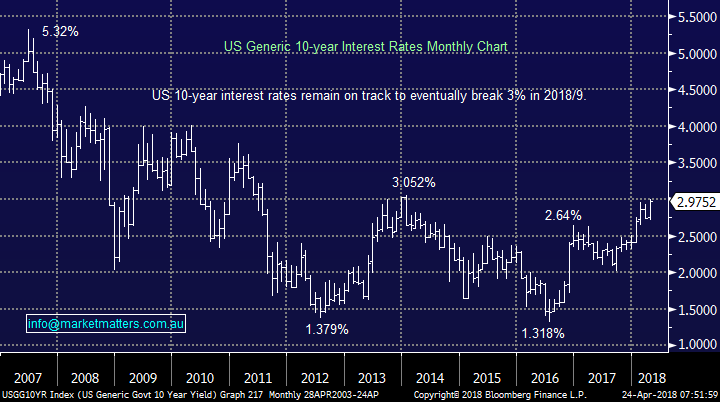

Overnight we saw Aluminium plunge over 9% as tensions between Russia and the US were perceived to be easing. US aluminium giant Alcoa has fallen from grace with a huge bump, closing over 16% below last weeks high and technically we can see this pullback extending another ~10%.

We’ve mentioned this volatile move in aluminium because at MM we are firm believers that resource stocks are more active vehicles for the investor as opposed to stocks to be held for years. Simply, resource companies cannot determine their profitability, it’s virtually totally down to the volatile / unpredictable price of the respective underlying commodities

In this case we made a healthy ~25% from our holding in aluminium company Alumina (AWC), but we got off the train a touch too early. However, this never bothered us as we are now seeing resource stocks are volatile beasts and opportunities are never too far away.

US Alcoa Chart

Alumina Ltd (AWC) Chart

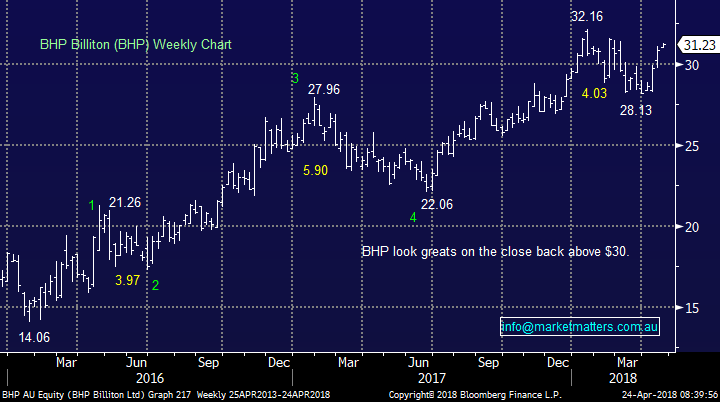

In the MM Growth Portfolio we still hold 6% in BHP and 3% in OZ Minerals (OZL) – our lithium play via Orocobre (ORE) is a certainly not a “classic” resources play. Having recently taken profits in Alumina (AWC), Woodside (WPL) and RIO Tinto (RIO) we are comfortable to give these positions a touch of room as planned a few weeks ago.

BHP looks excellent fundamentally with a large capital return on the horizon and OZL is simply excellent value on current matrices. However if the $US does tear higher and commodities fall over 5%, both stocks are likely to struggle. Investors should never underestimate the volatility of resource stocks with BHP having corrected -18.7%, -21.1% and -12.5% over the last 2-years alone.

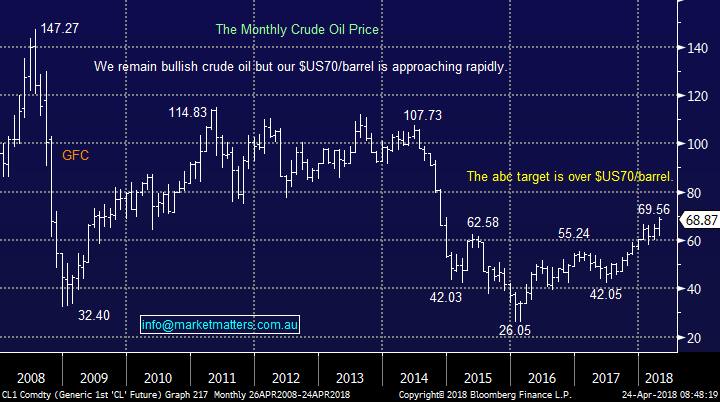

Importantly at MM we have been bullish crude oil for almost a year, targeting a test of $US70/barrel - a psychological level that’s now extremely close. This strength in oil is being helped by talk of sanctions with Russia, Saudi simply “talking” it higher to float Aramco and overnight escalating conflict in the Middle East - it’s all forming a perfect storm to reach our long-term bullish target. Hence with everything looking good for BHP we are considering selling our holding in 2 halves in case the “Big Australian” fails to reach our $32.50-$33 target area.

- We are buyers of decent weakness in BHP liking the current fundamentals but we are not afraid to sell current strength.

*Watch out for alerts.

BHP Billiton (BHP) Chart

Crude Oil Chart

Time to go out on a limb again!

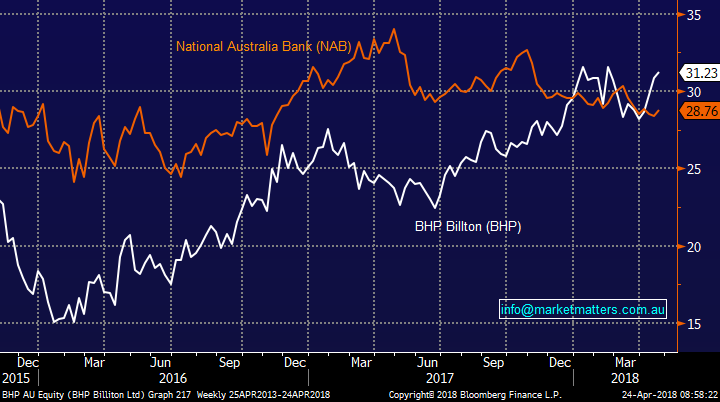

We believe that the underperformance of our banks compared to the resources, an almost 2 ½ year old trend is looking for / has found an end.

- We like the switch from resources to banks, perhaps half to start with just in case!

BHP v National Australia Bank (NAB) Chart

Conclusion

1. We remain bullish the $US which implies resources are close to another decent correction.

2. We believe that the banks are likely to start outperforming resources sooner rather than later.

3. We will buy BHP into the next decent correction but are looking to reduce / sell BHP and OZL in the short-term.

Watch for alerts.

Overnight Market Matters Wrap

· The US markets closed mixed with marginal change as investors are growing wary of the US Treasury yields reaching the alarming levels from previous months.

· The last time the US Treasury Yields were making recent fresh highs back early February, the broader S&P 500 lost ~9% in a span of 2 weeks.

· The aluminium price plunged nearly 10% at one stage overnight from its recent highs, before settling 7% lower, after President Trump gave American customers of Russia’s major supplier Rusal, up to 5 months more to comply with his recently imposed sanctions.

· He also appeared to pave the way for sanctions to be lifted altogether if Rusal’s major shareholder, oligarch Oleg Deripaska, ceded control of the company. Aluminium producers sold off aggressively, with Alcoa slumping 13%.

· The June SPI Futures is indicating the ASX 200 to open marginally higher, testing the 5900 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/04/2018. 8.29AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here