The US – China tensions unsettle global markets (BEAR, IEM, USD, WBC, MQG, ILU, WSA, CSL, COH)

Local stocks were smashed 85-points / -1.38% yesterday with almost 90% of the ASX200 closing in the red as the local index endured its worst day in over 6-months. The previously buoyant resources sector led the declines with BHP -2.8%, OZ Minerals (OZL) -4%, South 32 (S32) -5.4% and Alumina (AWC) -6.9% to name but a few.

China’s return to business from its Golden Week holiday created huge volatility in the region’s indices with an overall large negative influence as the Chinese Shanghai Composite Index closed down -3.7%. Over recent weeks we’ve been looking for a panic downside spike in the emerging markets led by China and it certainly felt underway by the end of the first day of this week, our buy levels in many stocks / positions are now approaching rapidly.

Remember our comment from the Weekend report with regard to the rapidly escalating US – China trade war and political tensions:

“The US mid-term elections are looming on November 6th, it feels highly unlikely that President Trump is going to vaguely back down on his trade stance over the next 3 weeks”.

The ASX200 had previously seesawed in the tight range of 6102 – 6230 for 22-trading days but yesterday the market closed at a fresh 15-week low, following Asia’s unwind in late afternoon trade, albeit by only a couple of points.

· MM remains negative the ASX200 short-term with an initial target ~5965, now around -2% lower.

NB MM will now lose this bearish technical bias if the index can close above 6125 i.e. a failed breakout of the trading range which has constrained the market since early September.

Overnight stocks in the US largely recovered from early aggressive selling with the Dow managing to close in the black although the more China influenced tech based NASDAQ still closed down -0.6%. Interestingly the trend remains the same as US stocks get aggressively bought in the last hour of the day - we continue to believe it’s primarily a safe haven bid. European stocks were hit hard like our own and the SPI futures are pointing to a an open down another 20-points for the ASX200.

In today’s report we are going to focus closely in a number of different markets as we look to rejuvenate the MM Growth Portfolio into the anticipated current market volatility and position ourselves for the likely moves into Christmas, and beyond into 2019. It’s an opportune time to quote one of old favourite trading mantras:

“I will tell you my secret if you wish. It is this: I never buy at the bottom and I always sell too soon“ - Baron Rothschild

Similarly we are likely to commence tweaking our Portfolio (s) soon to add practicality and flexibility to our actions in case things don’t unfold as we expect.

Watch out for alerts.

ASX200 Chart

The market issues overnight were not confined to just China as Italy again raised its head as a major issue for Europe. The Italian 10-year bond yield hit a 4 ½ year high as the populist led government refused to alter its planned budget to keep the European Union happy - BREXIT mark 2 may be looming.

It seems the market has not been focussed on the issue of rising interest rates over the last few days but it will remain an issue once China quietens down.

Italian 10-year bond yields Chart

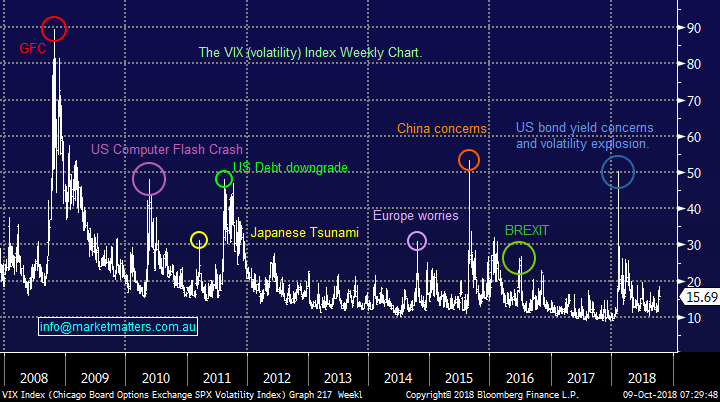

The VIX which basically measures “fear” in the market has bounced over 50% over just 2 days as worries around both China and Italy slowly unnerved many complacent investors

· We believe the VIX is still dangerously low but it can stay at these levels for extended periods e.g. 2012 and 2015.

The VIX Volatility Index / Fear Gauge Chart

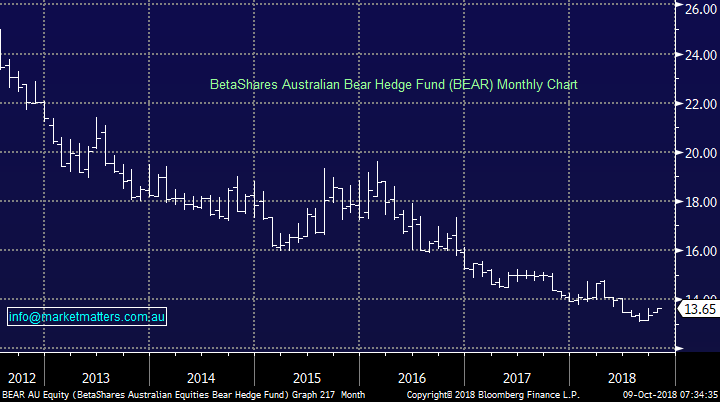

1 Australian BetaShares Bear ETF (BEAR) $13.65

A simple one to start with – we are looking to take profit on our 5% position under 6000 in the ASX200, or if the market rallies back above 6125.

BetaShares Bear ETF (BEAR) Chart

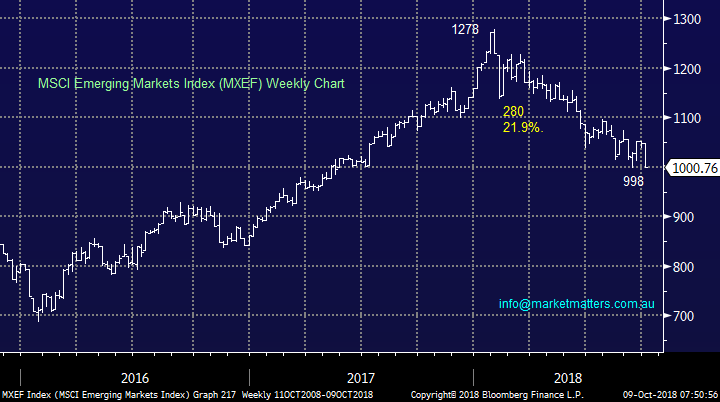

2 Emerging Market ETF (IEM) 58.09

The emerging markets made the anticipated fresh 2018 lows in the last 24-hours, the correction from its January high is now well over 20%.

As planned MM is looking to add to our IEM BetaShares ETF into this weakness. NB We are initially only looking for a 10% bounce not a change in trend hence this is unlikely to be a long term position.

MSCI Emerging Markets Index (MXEF) Chart

3 The Australian Dollar ($A) US70.78c

Alarm bells should have gone off for the short-term bears in the $A yesterday when the Australian Financial Review proclaimed “Aussie dollar is set to struggle to hold US70c”.

While we remain long term bearish the $A we believe there’s a very strong possibility that the next 2-3c moves is on the upside.

MM is considering taking a profit on our 3% holding in our long USD ETF, switch to the IEM with the funds, and potentially re-establish a short $A position around 72.5c.

Australian Dollar ($A) Chart

4 Banks

No change here, we are keen to increase our exposure to the sector if / when we see further weakness. The vortex of negativity is hitting the banks, yesterday we had ANZ taking an earnings hit from the RC and today CBA has announced $270m is remediation to customers of their wealth business. Without sounding flippant, putting these numbers into perspective is always key from an investment standpoint. CBA will likely do revenue of ~$26B in FY19 booking a net profit of ~10B. While the RC has clearly raised some major issues within the banks and the headlines have been shocking, from an investment perspective, the numbers are manageable.

Our preferred 2 options are Westpac (WBC) around $26.50 and Macquarie Group (MQG) below ~$116 – both areas look likely to need another 2-3% downside in the index to be reached.

Westpac (WBC) Chart

Macquarie Group (MQG) Chart

5 Resources & energy

The resources were hit hard yesterday which makes sense as they are clearly very China facing, we think they may follow in the NASDAQ’s footsteps overnight and again underperform.

Our macro opinion of higher interest rates and inflation should see resources perform ok in a minefield of relative performance. However we believe entry levels are vital after the strong sector performance since early 2016.

We have a number of stocks on our radar into weakness with 2 standouts WSA under $2.20 and Iluka (ILU) around $8.50.

Western Areas (WSA) Chart

Iluka Resources (ILU) Chart

6 High end Healthcare

We’ve had market favourites CSL and Cochlear on our radar for many weeks and they are slowly coming down to our buy zones. In very simple terms, CSL now trades on a multiple of 31x forward earnings. Over the last 2 years, CSL has traded on an average multiple of 29.3x, which would correspond to a share price of $183.37, or in terms of its 5 year average of 23.2x, that would equate to $145.37. We think growth metrics over the last 2 years better reflect the future.

No change, we are considering both CSL and COH below $190.

CSL Ltd (CSL) Chart

Conclusion

We are looking to restructure our Growth Portfolio in particular into the current market volatility to better position for upside when it eventuates.

Firstly we are likely to take profit on our $US ETF and average our emerging markets position (IEM)

Secondly we are looking to take profit on our short ASX200 ETF under 6000 but will now run stops above 6125.

Thirdly due to our view that equities are in a very mature bull market we intend to be fussy on increasing our net market exposure via stocks, a number of which are mentioned above.

Ideally we will be buying basis the ASX200 under 6000.

Overseas Indices

The US Russell 2000 small cap index has hit our target area i.e. a 7.2% correction.

We are net bullish from this area with stops on acceptance below 1590.

US Russell 2000 Chart

Following last night’s clobbering European stocks are within striking distance of our retracement targets e.g. the German DAX ~5% lower.

German DAX Chart

Overnight Market Matters Wrap

· A mixed session was experienced overnight in the US, with Nasdaq 100 underperforming the most out of the majors. Earlier, European markets sold off over 1% after a rout on Asian markets, especially the 3.7% selloff on the Shanghai index, as Chinese investors returned from the golden week holiday and focused on the increasing US trade war risks to the local economy.

· Commodities were once again mixed with gold tumbling over 1% , while oil also lost a little ground as reports circulated that the Saudis had filled the production gap left by Iranian am sanctions. Aluminium continued its selloff, falling 3% while copper was a touch firmer.

· Crude oil however jumped above US$70/bbl. helping the assisting the energy sector to outperform the broader market, up 1.4%. This will likely assist BHP to claw back most of its losses overnight, as the US session ended up an equivalent of 1.2% from Australia’s previous close.

· The December SPI Futures is indicating the ASX 200 to open 17 points lower, testing the 6080 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 09/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.