The Real Estate Sector looks to have a little more juice in the tank (AAPL US, CBA, GMG, SCG, DXS, MGR, SGP)

The ASX200 put in a stellar performance yesterday rallying over 1% to within striking distance of its January all-time high, the banks and resources were the backbone of the rally but with winners out numbering losers by over 3:1 it was undoubtedly a solid broad-based rally. Reporting season is kicking into gear and Janus Henderson’s (JHG) 7% surge yesterday after an initial lacklustre reaction to its numbers implies fund managers have gone into this season with a cautionary bias.

Also interestingly in January investors withdrew the largest amount of funds from the US based ETF’s tracking the ASX in more than 15-years, MM’s interpretation is overseas players are nervous at best going into our reporting season which is understandable considering the international coverage by the press of our bushfires but if companies results are ok, like that of JHG, we feel further upside surprises are a strong possibility – a move that we would see MM look to reduce its market exposure.

No change to the MM viewpoint: we believe that 2020 will continue to be a choppy year as waves of optimism and pessimism look set to wash through stocks, our current best guess is the ASX200 will make fresh all-time highs up towards 7200 before enduring another ~5% correction. As we often say MM are not traders but if we can add some alpha /performance by tweaking our market / sector exposure around the edges it makes 100% sense to us, especially with the flexibility now offered by index ETF’s such as the bearish BBOZ.

MM is currently bullish short-term the ASX200 targeting a test of 7200.

Overnight US stocks rallied another +0.3% in a fairly mixed night where Energy Stocks again dragged the chain, the SPI futures are calling the ASX200 to open up marginally higher this morning.

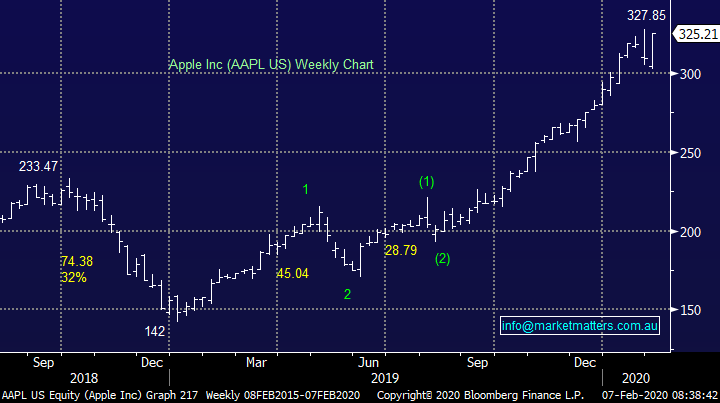

Today we’ve delved into the Real Estate Sector which like much of the market is testing its post GFC highs even as questions are being raised whether the RBA will maintain its easing bias.

ASX200 Chart

US equities have rallied strongly to fresh all-time highs, our preferred scenario is the S&P500 will now rotate between 3200 and 3400, or in simple terms it’s time for a rest. It will be interesting to see if US stocks continue their recent trend of struggling on Fridays on likely concerns around fresh coronavirus news over the weekend.

MM is now neutral US stocks after they’ve made fresh all-time highs.

US S&P500 Index Chart

China’s stock market has maintained its strong rebound from Mondays sell off and following yesterday’s +1.7% gains the index is only down -2.6% for the week, as we mentioned yesterday it’s a very brave investor whose prepared to take on the PBOC (People Bank of China) – over the weekend they told the market they intended to support financial markets which has clearly worked. However, the Chinese index sitting close to unchanged while the coronavirus remains a huge uncertainty feels too optimistic to me, the risk premium for buyers should be higher in China.

China’s Shenzhen CSI 300 Index Chart

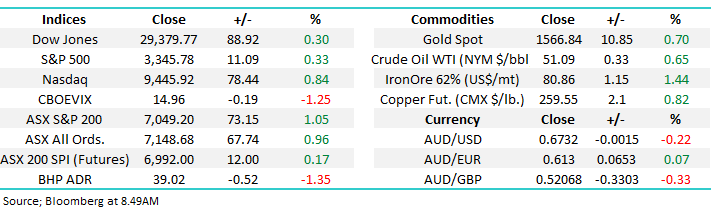

At MM when we find a stock or market that’s perfectly in step with our anticipated market rhythm we watch it carefully and in this case its household name Apple, the world’s largest stock by market cap. Similar to what we anticipate with the S&P500 a period of consolidation within its impressive uptrend looks to be very close at hand but short-term we still feel fresh all-time highs up towards $US340 looks likely.

MM believes Apple’s likely to rotate between 275 and 350 over the months ahead with a test on the upside feeling more likely first.

Apple Inc (AAPL US) Chart

Similar to Apple (AAPL US) Australia’s largest stock Commonwealth Bank (CBA) has an evolving chart pattern which suggests new highs, in its case between $86 and $87, before another 3-5% correction. However, with CBA trading ex-dividend in a few weeks’ time the chart pattern will obviously become clouded in the near future.

MM is considering taking profit on our CBA position between $86 and $87.

Commonwealth Bank (CBA) Chart

How does the Real Estate Sector look & feel?

Over recent weeks MM has expressed its opinion that the market might get disappointed with its projected 2 further interest rate cuts by the RBA in 2020, from 0.75% to 0.25% - even with the impact on growth from the coronavirus we feel “one & done” was the likely most optimistic scenario. The Australian Financial Review (AFR) has ran a well-timed story this morning “Economists see an end of RBA’s rate cut cycle” citing a number of factors including the RBA’s governor saying that the “economy had reached a gentle turning point”. Hence the question we ask, how will interest rate sensitive stocks / sectors perform in 2020?

MM anticipates one more rate cut in 2020, at most.

When we look at the index as a whole it’s not unlike some of the larger underlying indices, both here and abroad. The Real Estate Sector looks poised to push ~3% higher, to fresh post GFC highs, when MM will turn neutral with a probable negative bias. Today we’ve briefly looked at 5 of the most widely followed and largest stocks in the sector searching for more clues on what comes next for the sector and index alike – out of interest from a number of stocks perspective this sector makes up 10% of the ASX200 but by market cap. its only 7.4% of the underlying index.

ASX200 Real Estate Index Chart

1 Goodman Group (GMG) $15.30

GMG has been an impressive market performer over the last few years making it the largest stock in the sector and 15th in the ASX200 with a weighting of almost 1.3%. This integrated industrial property group is already up more than 12% over the last 3-months illustrating the excellent execution of plans and growth by the company which reaffirmed guidance last November.

From a technical perspective we still anticipate another ~5% upside in the stock but it’s not cheap with an Est P/E for 2020 of almost 27x while its yield is now under 2%, however the trend of recent years of chasing the quality end of town without too much concern towards price / valuation feels unlikely to change overnight.

MM is short-term bullish GMG.

Goodman Group (GMG) Chart

2 Scentre Group (SCG) $3.82

MM has been neutral to bearish shopping centre operator SCG for well over a year and nothings really changed, we continue to dislike the internets impact on shopping centres, to us they’re in the too hard basket at present. However, I would say the group which operates the well-known Westfield Centres is at the quality end of the curve which we do like and its 6% yield is clearly attractive to many.

MM remains neutral / bearish SCG.

Scentre Group (SCG) Chart

3 Dexus Property Group (DXS) $12.88

Real estate manager & operator DXS reported this week and it delivered no real surprises with the stock reacting accordingly, the stocks 4% yield feels sustainable, but the share price is not exciting at current levels.

MM is neutral DXS.

Dexus Property Group (DXS) Chart

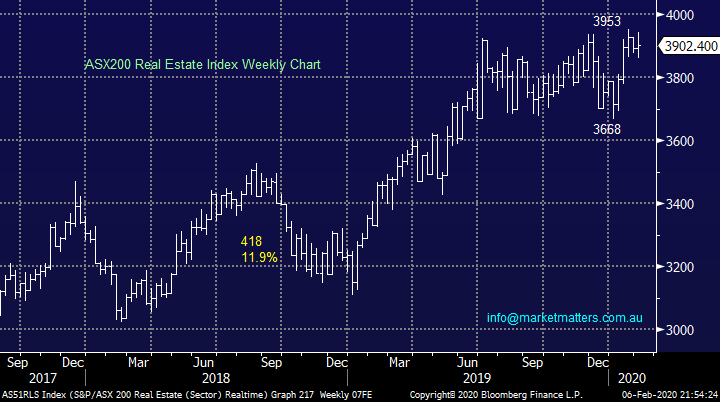

4 Mirvac Group (MGR) $3.33

MGR disappointed the market yesterday with its half-year results, expectations had been high with the more than 20% increase in operating profit not cutting the mustard. The stocks not too expensive and its yield of 3.7% unfranked clearly beats the bank, back around $3 this stock will become interesting.

MM continues to feel the next 5-10% for MGR is likely to be on the downside.

Mirvac Group (MGR) Chart

5 Stockland (SGP) $4.89

Lastly and importantly diversified Australian property group SGP which MM owns in our Income Portfolio hence we have particular interest in this companies’ prospects. We like the company’s exposure to residential communities and retirement living as our population continues to age, like us all! The stocks relatively cheap trading on a P/E for 2020 of 14.2x and its 5.6% unfranked yield is clearly attractive although we don’t anticipate any major capital gains this year.

MM is now neutral SGP around $5.

Stockland (SGP) Chart

Conclusion (s)

MM has no major interest in the Real Estate Sector at this point in time, except for yield in our Income Portfolio, and like the ASX it looks vulnerable into fresh post GFC highs.

Overnight Market Matters Wrap

- US equities hit record highs overnight, yet again following reports that China plans to cut tariffs on some US goods.

- Most metals on the LME were higher as was crude oil, while nickel fell. Chinese companies are refusing to take delivery of some shipments of oil and copper as the coronavirus clogs up supply chains.

- BHP is expected to underperform the broader market after ending its US session off an equivalent of -1.35%

- The March SPI Futures is indicating the ASX 200 to open marginally higher, testing the 7065 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.