The Pounds sharp drop will hinder some ASX200 names (NEA, TSLA US, VUK, PDL, BVS)

The ASX200 doesn’t have that “Happy Friday!” feeling about it this morning as it continues to display clear doubt that US stocks, and the tech space in particular, can regain its mojo anytime soon. Yesterday’s 30-points advance felt lacklustre at best with the index down -4.7% over the last few weeks however putting things into perspective we still remain at the same levels as back early June with no obvious signs of finding a fresh level of equilibrium – this mornings renewed weakness on Wall Street shows yet again Aussie stocks picked the overnight US market move extremely well.

With almost 70% of the market rallying on Thursday and every sector closing up the numbers looked far better than the market actually felt however we must remember this is the weakest seasonal period for stocks e.g. over the last decade August & September have combined to fall an average of almost 4% but importantly October has subsequently rocketed up to wipe out all of these losses and some. In other words the market is simply following its usual seasonal path and investors should be looking for a catalyst to turn this market back up into October and then hopefully a “Santa Rally”.

We say it often but the local index “can’t go up without the banks” obviously not strictly true but it is hard work for the index if / when almost a quarter of the market is struggling to advance hence I wouldn’t be surprised to see the above mentioned catalyst be a positive for the banks with either improving housing prices or rising bond yields springing to mind. However renewed belief in the US tech sector is the obvious candidate this morning – we live in fascinating times where week to week the markets regularly taking on a whole new personality.

MM remains bullish the ASX200 medium-term.

ASX200 Index Chart

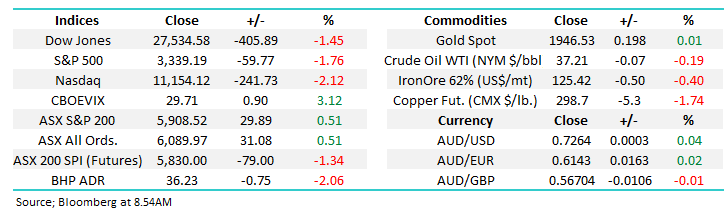

Yesterday saw another equity raising and director sell down by an ASX200 name with $1.3bn geospatial (mapping) business Nearmap (NEA) looking to raise around $90m for North American expansion. In the last financial year NEA’s turnover was close to $100m with 30% coming from North America hence its already a relatively well understood marketplace for NEA.

All the early feedback is the bids were coming at the top end of the touted range, only a 4-5% discount to its last traded price, a pretty good read through for me on both the stock and the sector front once the dust finally settles.

MM is neutral to positive NEA.

Nearmap Pty Ltd (NEA) Chart

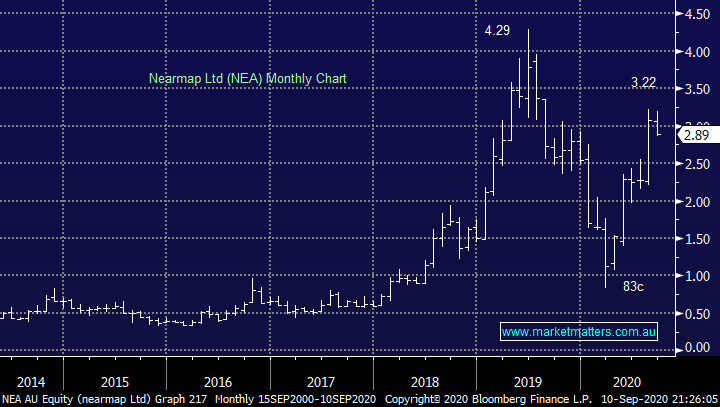

Yesterday we wrote about Spotify which MM is keen on below $US250, today we’ve cast our eyes to a far more volatile US tech beast, Tesla (TSLA US). Over just 5-days TSLA has corrected a painful 34%, we alluded to the risks of chasing companies after stock splits last week but I didn’t think the sell off would be as dramatic, to put things in perspective Elon Musk’s EV maker has just seen $200bn wiped off its valuation in just a few days, that’s the equivalent to five Westpac Banks (WBC) vanishing in a puff of smoke.

Technically TSLA now looks ok from a risk / reward perspective but I certainly wouldn’t be throwing the kitchen sink at it - at MM we would only consider appropriate position sizing to match a stocks historical volatility.

MM is cautiously bullish Tesla (TSLA US).

Tesla (TSLA US) Chart

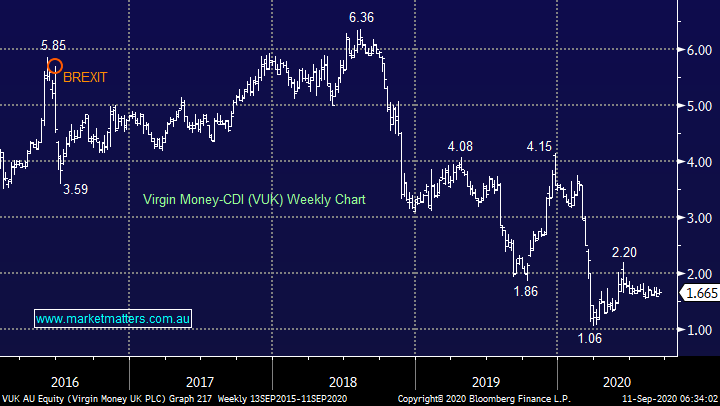

Overseas Indices & markets

Overnight US stocks extended their downside momentum with the Dow falling over 400-points and the NASDAQ leading the falls surrendering over 2% of its 2020 gains. The washout continues and our ideal timeframe for a low is late next week when all of the huge 2-week option position in the US tech stocks expire i.e. the path of most pain remains sideways to down in the short-term.

MM remains bullish US stocks medium-term.

US NASDAQ Index Chart

Overnight we saw another stoush between the Energy & IT Sectors with the former winning the battle this time around, their daily charts as can be seen above and below are almost carbon copies of each other. We remain firm believers in the “Reflation Trade” over the next year hence its our opinion that this is a pullback in crude oil, and the sector to buy.

MM remains the Energy Sector medium-term.

Crude Oil December Futures ($US/barrel) Chart

The British Pounds been clobbered, who are the losers?

Overnight the British Pound continued its recent decline falling another -1.6% reaching levels not seen since July. Boris Johnson has stirred the BREXIT pot again by saying “the UK would prosper mightily” with or without a deal. A perfect little side issue for the government to dilute the news flow of how bad its dealt with the coronavirus – fresh cases have again topped 2000 for the last 3-days.

MM is neutral the British Pound.

British Pound Chart

The government have shown their hand, we expect them to at least cause BREXIT friction into Christmas hence Australian stocks with significant earnings in British Pounds are set to endure a headwind at least for a while. Today I have selected 3 stocks who sit in the crosshairs of Boris Johnson et al, obviously there are a few more but we’ve gone with quality not quality this fine Friday morning.

Other stocks with between ~20% or more UK earning are Link Admin (LNK), Janus Henderson (JHG), Treasury Wines (TWE),QBE Insurance (QBE), Sims Metal (SGM), Iress (IRE), Ansell (ANN), Macquarie Group (MQG) and Computershare (CPU).

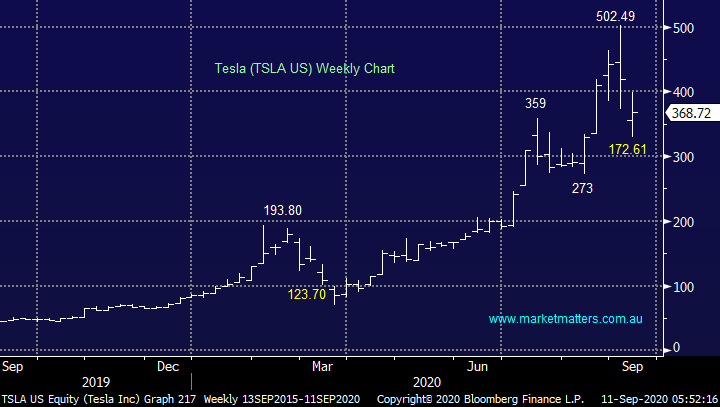

1 Virgin Money UK Plc (VUK) $1.665

The old CYB who was spun-off by NAB is the only UK banking stock listed on the ASX hence its exposure to the currency is huge. The bank has rebranded to the more widely recognised Virgin Money, but the performance has not improved, its cheap but as we often say for a reason. The business has around 3 million customers based predominantly in the industrial heartland across the central / North of the country. The recent poor performance from VUK has seen it drop out of the ASX200 which wouldn’t have helped fund managers appetite for this beleaguered bank, its been the worst of a bad bunch in the Banking Sector.

The stock keeps getting downgraded by analysts although we know they have a habit of going too far in both directions. In its latest 3Q report we saw the important net interest margins remain under pressure not helped by a tough trading environment in the UK but there was strong growth in customer deposits and business lending. We can see a major recovery by VUK shares at some stage in the next 12-months but from what level & when is the million-dollar question, one to watch for us.

MM is neutral VUK.

Virgin Money UK Plc (VUK) Chart

2 Pendal Group (PDL) $5.48

Fund manager PDL has UK revenue above 70%, not good news if the BREXIT shemozzle is going to again raise its head. The stock has bounced well since March with its latest FUM (funds under management) showing a 4% increase to over $89bn, the increase has obviously been helped by rising markets but a strengthening $A is already becoming a noticeable headwind. Overall we like the sector into the current pullback believing PDL’s will not be too hindered by an appreciating Aussie but it shouldn’t be ignored in valuation modelling.

Importantly PDL is relatively cheap and is forecast to pay a 6% slightly franked yield, pretty attractive in today’s environment.

MM likes PDL into the current pullback.

Pendal Group (PDL) Chart

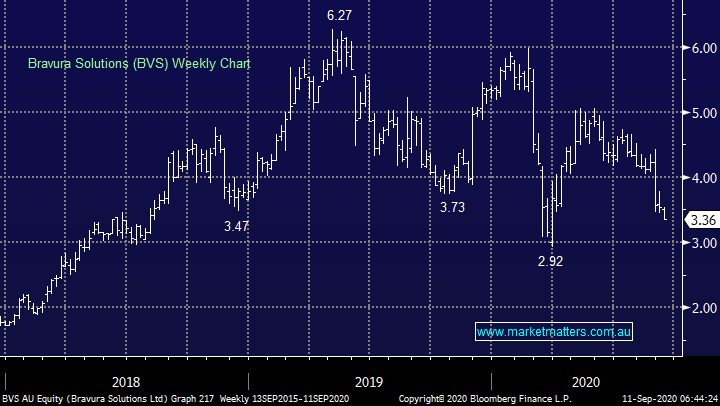

3 Bravura Solutions (BVS) $3.36

Financial Services software provider BVS has ~50% of its business in the UK hence the obvious headwind of a falling Pound. However in the UK Bravura’s expertise with digital administration, investments and wraps etc is being rewarded by regulatory changes driving upgrades across the industry. The stock has also been falling since they warned earnings could be flat in FY21 but considering the pandemic we believe that’s a pretty good result.

Obviously for a “growth stock” it’s disappointing to see flat lining revenue but we must remain cognisant to the uncertain environment. This is a business with a very impressive offering, and we are actually considering averaging into current weakness.

MM is considering averaging our BVS position.

Bravura Solutions (BVS) Chart

Conclusion

Of the 3 stocks we looked at today we like the idea of accumulating both PDL and BVS into current weakness but we have no interest in catching the falling knife VUK.

Have a great Friday – I’m off to lunch in Manly today with a client, should be a good day for it!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.