The MM Growth Portfolio post COVID-19 – Part 2 (VAH, QAN, CSL, RHC, HLS, XRO, ALU, ALL, CWN)

March left us with the same massive volatility that was the norm during this historic month, we witnessed an unprecedented 2122-point / 32% plunge by the ASX200 courtesy of the infamous COVID-19 pandemic. Monday saw a strong morning by the local bourse before we ground lower from lunchtime to end the session down 2%, yet another large daily swing from top to bottom of 6%, remember the average annual gain over the last century is only 11%, we’re currently gyrating around this degree almost every 48-hours!

Yesterday saw less than 50% of the ASX200 close down on the day but when the markets 3 largest companies Commonwealth Bank (CBA), BHP Group (BHP) and CSL Ltd (CSL) plunge 3, 4 and 5% respectively it’s going to have a huge impact on the index – these 3 stocks make up over 20% of the ASX200. Interestingly under the hood we saw a very mixed market with CBA falling -3.3% while National Australia Bank (NAB) gained +2.3% - classic end of month / quarter “book squaring”.

MM took advantage of the early strength yesterday morning to increase our cash holding to 17% with the objective of buying into future weakness, things ended the day looking ok for this course of action as we look to fine-tune our Growth Portfolio. Today’s report will be focusing on what next for our flagship portfolio following on from yesterday’s moves i.e. selling Janus Henderson (JHG), reducing Westpac (WBC), Beach Petroleum (BPT), NRW Holdings (NWH) & Emeco Holdings (EHL) and buying Santos (STO). The usual Wednesday Overseas Report will be on Thursday this week.

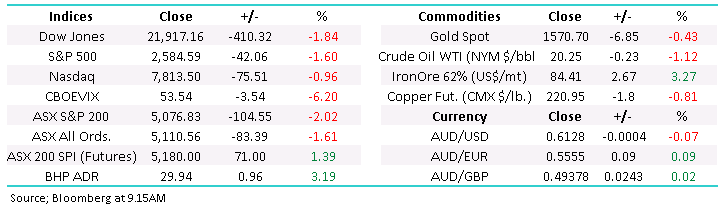

Normally we wouldn’t look at markets too short-term but during the current volatility we have to be open-minded and adjust the time frames MM monitors closely, after all the market is moving through a normal 1-3-month range almost every 24-48 hours. Following yesterday’s false break out to fresh 7-day highs the technical picture appears to have provided some clarity short-term, at least until the next news-based twist.

MM believes the 7-day explosive 964-point / 21% rally is complete and a pullback (rest) towards 4850 is likely i.e. another 4% downside.

We should not underestimate the immensity of this rally from last Mondays low, it’s been the equivalent to almost 150-points per day, MM is only looking for a 50% correction to this advance which is a very common retracement but of course this is not a normal market / set of circumstances.

ASX200 SPI Futures Chart

MM is now making a couple of important assumptions with regard to our strategy for investing moving forward:

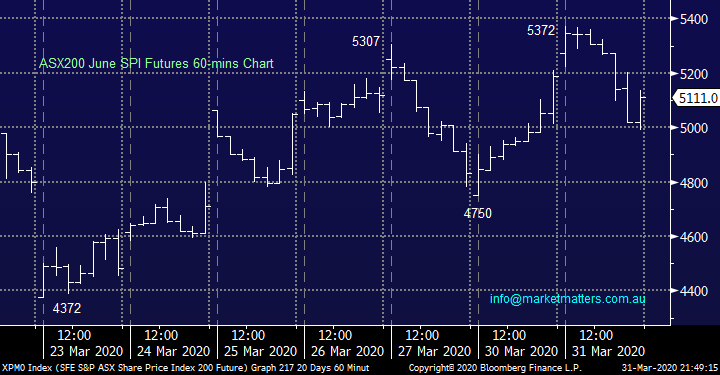

1 – March’s panic liquidation low at 4402 is unlikely to be breached but if it is the move lower will only be a brief news driven dip hence MM are bullish and buyers of equities / risk assets moving forward.

2 –April is likely to be a “calmer” month than March as equities form a base prior to moving higher.

It’s extremely hard to know if we are going to see a “V” , “U” etc style recovery from COVID-19 with much of the world including the US & ourselves still bracing for the worst of the virus outbreak but we are fans of accumulation of stocks believing the panic washout is behind us i.e. the last quarter was the worst in over 30-years when the ’87 crash shook the world.

MM continues to feel the ASX has found or is looking for a major low.

ASX200 Chart

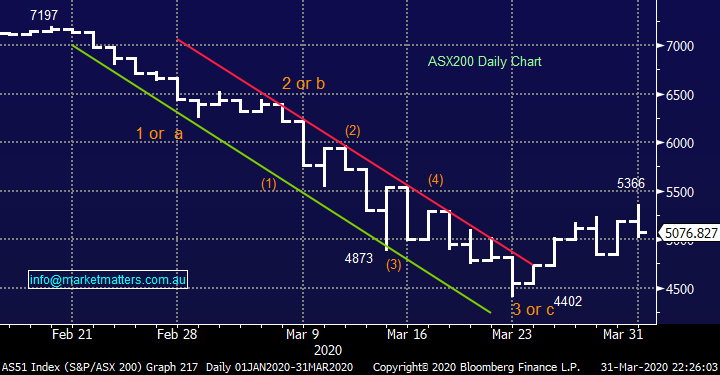

Big business is starting to ask for support, Virgin Australia (VAH) has run cap in hand to the government looking for a $1.4bn bailout package, while QANTAS (QAN) doesn’t want / need assistance for now, they are making it hard for the Government by demanding proportional support should VAH get a bailout – the smart Alan Joyce plan all along no doubt!

VAH only has a market cap of $802m which makes my initial reaction “let them fail”, they were struggling prior to this outbreak and this has simply been the proverbial straw. Some companies undoubtedly will fall over during this period and is it fair to make the Australian Government act like God when considering all of their futures – in VAH’s case the Abu Dhabi government is the largest shareholder followed by Singaporean and Chinese Investment vehicles, why can’t they bail them out as opposed to the Australian taxpayer?

However I know many will accurately say we need competition to protect the public from price hikes from the likes of QANTAS, hence our government has been committed to at least 2 domestic airlines but the chart below shows the debt laden VAH has been struggling way before COVID-19. I feel there must be a better way, thoughts from our subscribers on Monday perhaps?

MM has no interest in VAH or QAN at today’s prices.

We will look at some tourism alternatives we prefer to airlines later in today’s report.

Virgin Australia (VAH) Chart

QANTAS (QAN) Chart

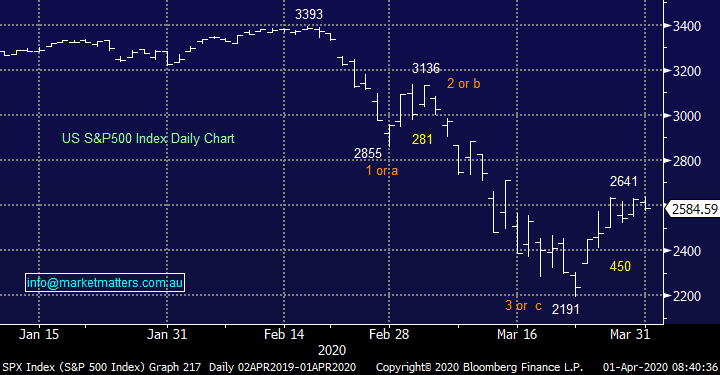

US stocks followed a similar path to our own overnight, making fresh recent highs only to roll over and close down on the day. No real change to our current outlook, we see no urgency to chase strength but we do like the market into pullbacks with our ideal “buy region” for the S&P500 between 2400 and 2450, not too far away in today’s volatile market.

MM is bullish US stocks, but we believe the advance will remain choppy at least for now i.e. buy pullbacks.

US S&P500 Index Chart

The MM Growth Portfolio post COVID-19 – Part 2

Earlier I outlined our current view of how equities are positioned, this is obviously a fluid stance in this period of elevated volatility but by definition the regular major swings by stocks and indices should offer the prepared investor some ideal entry / exit opportunities to establish the ideal portfolio as we speculate on how life will unfold after COVID-19. At this stage we have no idea whether a vaccine or containment will win Round 1 against the virus although the latter is favourite but obviously a vaccine is desperately required to avoid a reoccurring annual issue in the years ahead.

Today I have looked at 3 sectors where MM is looking to gain / increase exposure now we’ve increased our cash holding to 17%.

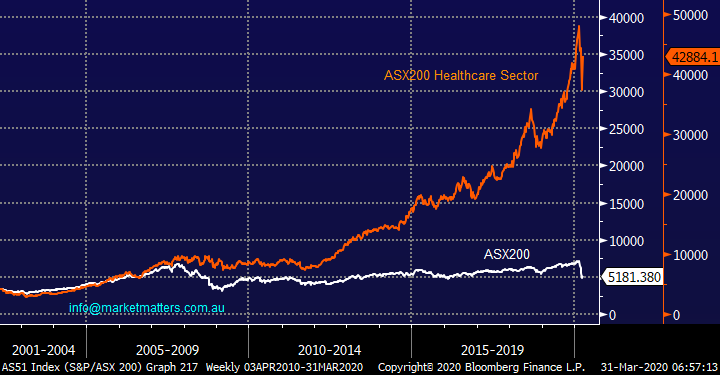

1 Healthcare Sector.

The Healthcare Sector has produced the best performing local stocks post the GFC but as COVID-19 has illustrated we must keep our eyes firmly on the road ahead as opposed to the rear-view mirror. The tricky situation for the investor in today’s environment is these stocks have largely become the “go to group” hence reducing the value on offer, even in todays depressed market. MM is very mindful that after this savage correction investors are going to be far more cautious to push valuations to their dizzy heights of January and February.

MM likes selective pockets of the Healthcare Sector.

ASX200 & Healthcare Sector Chart

CSL Ltd $296.68

CSL is now a $140bn business making it the second largest stock in Australia, a truly amazing success story but at what price do we try and board the train? CSL has outperformed during the aggressive pullback and its now sitting only 13% below its all-time high while trading on an estimated P/E for 2020 of almost 40x, not exciting with so many alternative bargains on offer. Overall, this is a quality operation but its only appetising at lower levels to MM.

MM likes around 10% lower.

CSL Ltd (CSL) Chart

Ramsay Healthcare (RHC) $57.28

Private hospital operator RHC has fallen aggressively with the overall market and MM believes it’s now offering good medium-term value and will be especially attractive on a pullback to the mid / low $50’s.

MM likes RHC here and into further weakness.

Ramsay Healthcare (RHC) Chart

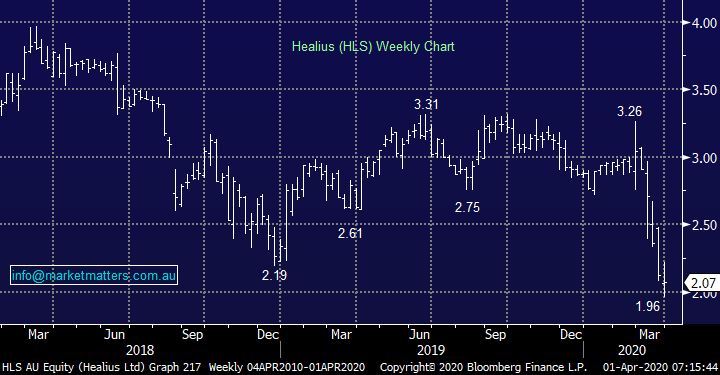

Healius (HLS) 2.07

Before the coronavirus HLS was on a number of private equity companies shopping list for a classic buy and break-up scenario to make some quick and substantial gains. However COVID-19 has seen debt markets dry up hence the market has lost confidence that the vultures can raise money for such a bid however when things improve we think it will be back on the menu, and of course a number of parties have most of their due diligence already worked out – HLS has already received bids at $3.25 and most recently $3.40, I’m sure most investors wish they had a say in what the board considered a fair price now the stocks ~40% below the respective offers.

MM likes HLS around $2.

Healius (HLS) Chart

Conclusion: Around current levels we like RHC and HLS as a speculative / situation play.

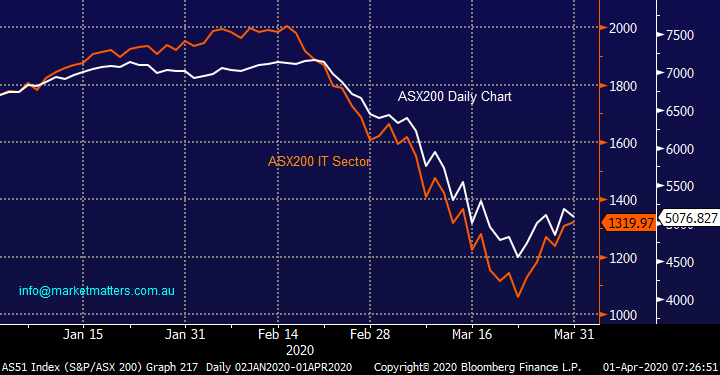

2 IT Sector

We felt the IT Sector was largely too rich in mid-February which has proved correct from a relative performance perspective, following the savage correction there are a couple of stocks attracting our attention at MM. One of the main attractions of a number of these stocks is relatively constant revenue flow combined with the on-line presence i.e. no expensive labour-intensive shopfronts.

MM likes selective pockets of the IT Sector.

ASX200 & its IT Sector Chart

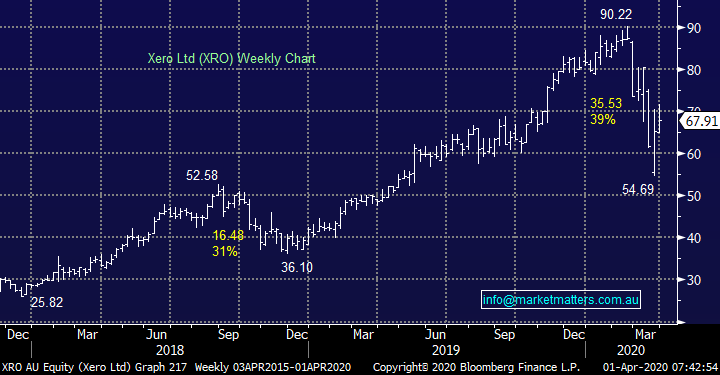

Xero (XRO) $67.91

MM is a large fan of this on-line accounting business, it has low debt a sustainable revenue stream with excellent growth prospects, it’s not cheap but we believe this is one case where the business justifies the price.

MM likes XRO into weakness, ideally sub $65.

Xero (XRO) Chart

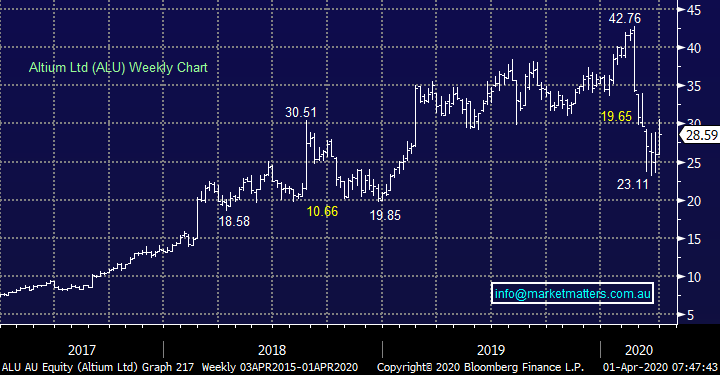

Altium (ALU) $28.59

We like this multinational software business its debt free and actually had $US80m cash on hand at the end of 2019 – a long time ago now! Technically I can see another dip towards $25 but this is stock we like moving forward around current levels.

MM likes ALU into weakness.

Altium (ALU) Chart

Conclusion: Around current levels we like XRO and then ALU in that order.

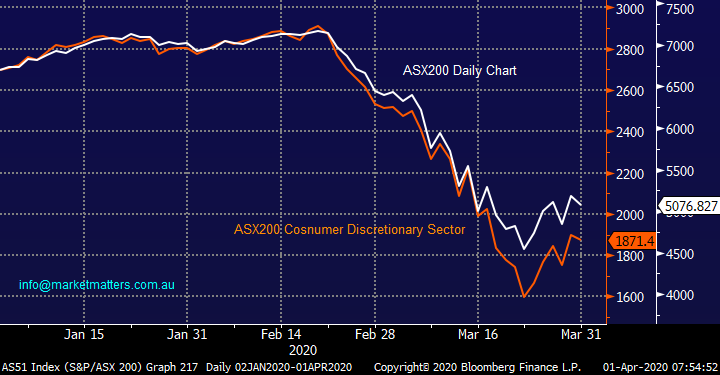

3 Consumer Discretionary Sector

The Australian consumer has gone into forced hibernation with plenty of speculation around whether it’s going to be a 1 or say 6-month siesta, either is clearly damaging to businesses likes casinos and hotels. However, like with much of the ASX200 if the businesses are strong enough to weather this storm their current share prices are attractive from a medium-term time horizon.

MM likes selective pockets of the Consumer Discretionary Sector.

ASX200 & the Consumer Discretionary Sector Chart

Aristocrat (ALL) $21.35

ALL has been crushed over 50% as investors scrutinised the business due to closure of casinos and licensed venues but we feel they have focused on the bad while ignoring the companies casino apps which should help soften the virus blow, we regard this as an excellent opportunity to buy a quality business.

MM likes ALL around $20.

Aristocrat (ALL) Chart

Crown Resorts (CWN) $7.60

Casino and resorts operator Crown have been in the eye of the storm of the fallout from COVID-19, but we feel in 1-2 years’ time this is a business that may look very cheap. Before lockdown I rode the Triumph over the Harbour Bridge each morning and looked across at Barangaroo always thinking that it will become an impressive strategic asset, one which will be extremely hard and expensive to trump in the future.

Obviously CWN’s income has been slashed by the virus but the stock is trading at an almost 50% discount to its historical book value plus apartment sales (75% under contract) will deleverage its balance sheets fairly aggressively from 2021, although defaults are a concern in the near term the % deposits taken are substantial .

MM likes CWN into weakness.

Crown Resorts (CWN) Chart

Conclusion: MM likes both ALL and CWN into a little further weakness.

Conclusion

There are a number of additional moves MM are considering moving forward including the buy options below:

Healthcare: Ramsay Healthcare (RHC) and Healius (HLS).

IT: Xero (XRO) and Altium (ALU),

Consumer Discretionary: Aristocrat (ALL) and Crown (CWN).

Overnight Market Matters Wrap

- The Dow Jones has just posted its biggest quarter loss since 1987 and the broader S&P 500 since the GFC.

- Oil closed higher overnight, however it too had suffered a bad quarter and much worse from the equity markets, ending over 60% lower for its quarter. On the bright side, ‘Safe Haven’ Gold gained and is on track for a sixth consecutive quarterly rise.

- The June SPI Futures is indicating the ASX 200 to start the second quarter of calendar 2020 on a positive note, up around 135 points, testing the 5200 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.