The MM Growth Portfolio post COVID-19 – Final instalment (IEL, WEB, CBA, BAP, JBH, TPM, TCL)

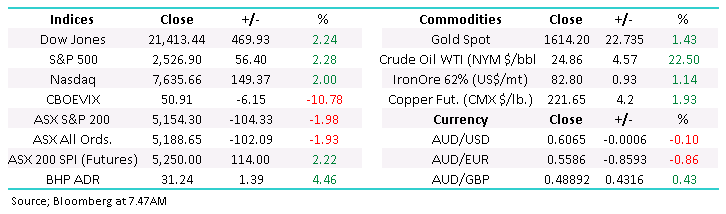

April might only be 2-days old but it’s already trading in a far more subdued manner than March although it would be hard to match a 2100-point plunge in one single month – MM expects market volatility (VIX) to steadily decrease over the next 6-months in a similar manner to the period post the GFC. Yesterday we saw the ASX200 finish down 104-points / 2% with the banks inflicting the major index damage following NZ’s order that banks stop paying dividends in order to conserve capital and no doubt lend more aggressively down the track to dig the country out of the COVID-019 recession – not a disaster to keep cash on hand in these difficult times BUT a business being told how to operate by a government is fraught with danger– more on this below.

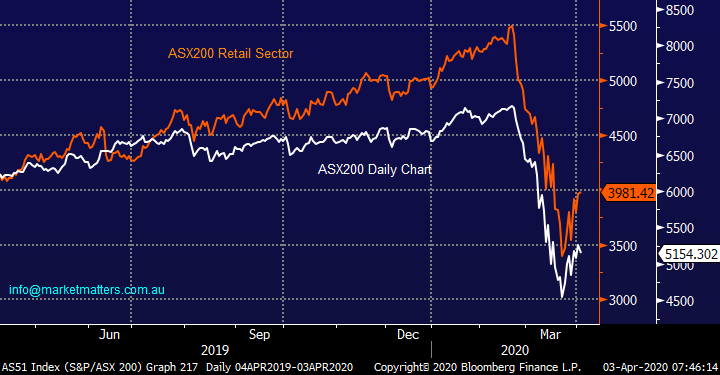

Australian stocks have been relatively resilient over the last few days declining only 3% compared to the S&P500 which has fallen 7% but I fear the latest weakness in the banks is likely to test some of the outperformance in the weeks ahead. Accompanying the weak Banking Sector, we saw decent selling in the IT Sector which enabled MM to “dip our toe in the water” by taking a small position in Xero (XRO), the stock ultimately closed down 5.4%. Alternatively, the Energy and Retailing Sectors found some love which makes our purchase of Santos (STO) on Monday feel good while we ponder if the discretionary stocks are seeing light at the end of the COVID-19 tunnel.

There has been some fairly major news flow overnight even by today’s standards but the VIX still continued to grind lower as stocks become far more resilient.

1 – The US employment data showed Jobless Claims soared to a previously unimaginable 6.65m suggesting 20% unemployment is a distinct possibility as shutdowns roll through the world’s largest economy.

2 – The world now has over 1 million confirmed cases of coronavirus which has led to over 51,000 deaths, this is set to get significantly worse as the likes of the US, India, Indonesia and Africa experience a pick-up in cases. Both the humanitarian and economic damage being inflicted by COVID-19 is simply enormous.

3 – President Trump has flagged a potential truce / agreement between Russia and Saudi Arabia which sent oil surging over +20%, again I’m glad we increased our Energy Sector exposure this week.

VIX Index (Fear Index) Chart

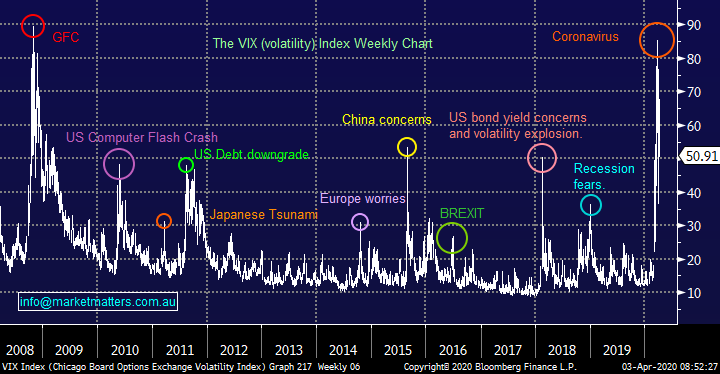

The short-term picture we started painting earlier in the week still hasn’t changed, our preferred scenario, following the recent 1000-point bounce from last Monday, is we see a few more days consolidation. Normally after a huge rally of this magnitude it would be weeks, but things are happening much faster in 2020. We feel that on balance global equities have probably seen their low. However it’s clearly a fluid situation and MM will remain flexible in our approach but a lot of economic panic was definitely being priced in at 4400.

MM believes the 7-day explosive 964-point / 21% rally by the ASX200 is complete and a pullback (rest) towards 4900-5000 is likely i.e. another 4% downside.

We should not underestimate the immensity of this rally from last Mondays low, it was the equivalent to almost 150-points per day, MM is only looking for a 40-50% correction to this advance which is a very common retracement but of course this is not a normal market / set of circumstances.

Importantly at this stage we believe the risks to this scenario are on the upside.

ASX200 SPI Futures Chart

MM continues to make 2 important assumptions which influence to our anticipated investment strategy moving forward:

1 – March’s panic liquidation low at 4402 is unlikely to be breached but if it is the move lower is likely to be a brief news driven dip hence MM are bullish and buyers of equities / risk assets until further notice.

2 –April is likely to be a “calmer” month than March as equities form a base prior to moving higher into 2021, so far so good but it is only the 3rd day of the month.

It remains extremely hard to know if we are going to see a “V” , “U” or more painful “L” shaped style recovery from COVID-19 with much of the world including the US & ourselves still bracing for the worst of the virus outbreak but we are fans of accumulation of stocks believing the panic washout is behind and the forced & panic sellers have already run to hills.

The US has rapidly become the epicentre of the COVID-19 pandemic with almost 240,000 confirmed cases which is already 23% of reported global cases, I really hope President Trump can surprise me and play this extremely tough “game of chicken” with a clear and steady mind. Unfortunately MM feels his ability to manage the outbreak is the largest risk to equities in 2020 as the US election looms in November, internal flights within the US are still prevalent so spread remains likely to be exponential – this assumes we don’t get a vaccine for COVID-19 in record time.

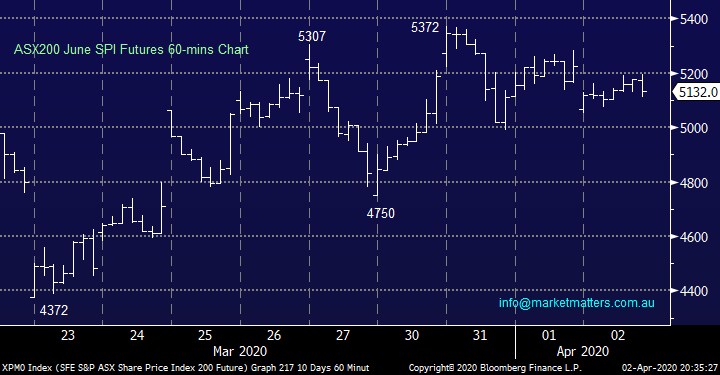

MM continues to believe the ASX has found or is looking for a major low.

ASX200 Chart

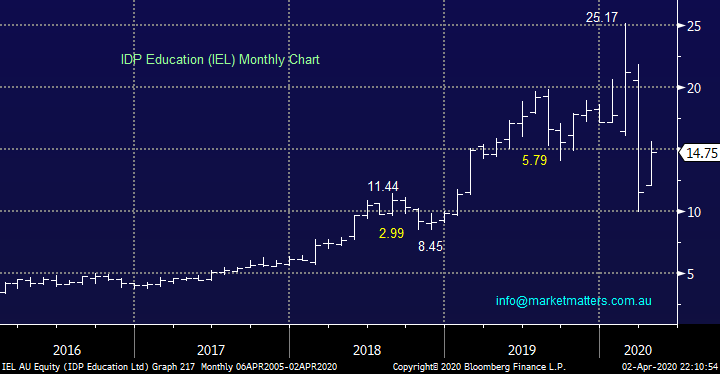

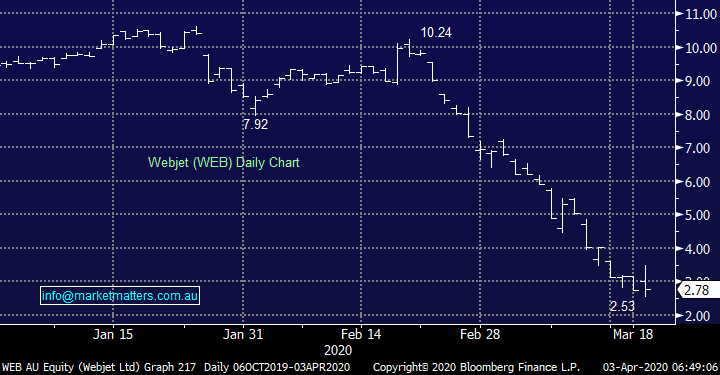

Yesterday we saw Webjet (WEB) and IDP Education (IEL) recommence trading following capital raisings and both performed solidly following in the footsteps of Cochlear (COH) who soared after its raise – as we’ve said previously companies who are able to raise $$ to strengthen their balance sheets are generally well positioned in these difficult times.

History tells us that when we see a deluge of capital raisings at discounted levels it usually heralds a major market bottom; our current synopsis at MM. Stock market bottoms, especially those reached through aggressive declines, are registered during maximum levels of “Fear” and again that certainly felt to be the case in late March but even if more weakness is around the corner MM believes this is the time to be accumulating stocks following this major pullback.

The key is to be constructing solid portfolios in quality businesses that are positioned to evolve strongly in the years ahead.

IDP Education (IEL)) Chart

Webjet (WEB) Chart

Banks

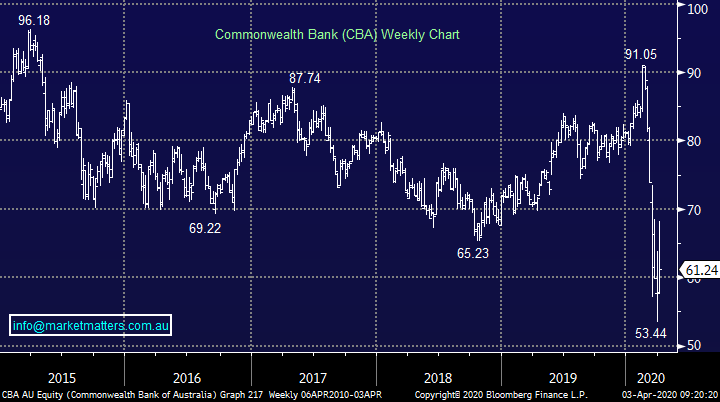

Yesterday the New Zealand central bank, the RBNZ banned domestic banks from paying dividends while this all plays out, understandably, this caused some concern locally. Fortunately, sanity prevailed in Australia with both APRA and the Prime Minister saying bank dividends are a matter for bank boards, which is totally correct. The draconian stance taken by New Zealand on this issue is a poor one in our view.

Key points

- The larger NZ banks are owned by the Australian banks, so that will mean dividends from their NZ offshoots will not be able to come back to the Australian parent.

- ANZ has the biggest exposure here generating around 30% of their earnings in NZ. WBC & NAB generate around 15% of their earnings from NZ while CBA is around 14%.

- ANZ and NAB were the weakest banks on the market yesterday, ANZ for obvious reasons however NAB because it’s not flush with Tier 1 capital and the decision from NZ means they’re Australian dividend is at greater risk

- CBA is by the far the best capitalised bank and this move will impact them the least

- While we expect dividend cuts across the sector by 10-20%, there is little chance in Australia that banks will suspend dividends.

- Hybrids: Cutting dividends completely on bank shares would mean they can cut distributions on hybrids. NZ have already confirmed that will not happen and banks will still pay hybrid distributions.

MM prefers CBA then WBC in the banking sector

CBA Chart

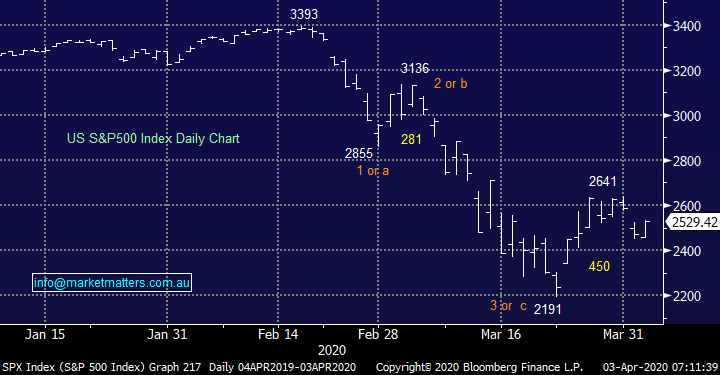

US stocks “embraced the positives” overnight rallying over 2% even after 6.65 million registered unemployed and their government continues to struggle to manage COVID-19, remember one of our favourite lines:

”A market that doesn’t fall or indeed rallies on bad news is a strong market”.

MM is bullish US stocks with surprises likely to be on the upside.

US S&P500 Index Chart

The MM Growth Portfolio post COVID-19 – Part 3

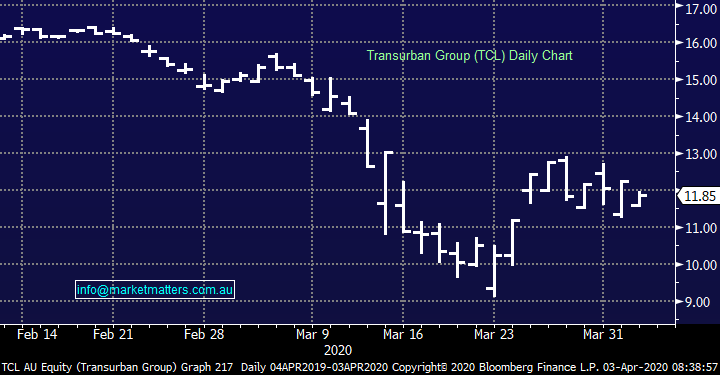

Yesterday MM took advantage of market weakness to increase our exposure to equities through purchases of Xero (XRO) and Aristocrat (ALL) for the Growth Portfolio, and Transurban (TCL) for the Income Portfolio. We are now holding 11% cash in our Growth Portfolio as we continue on our path to increase market exposure into quality ASX stocks for the years ahead : Portfolio Here

Today we have outlined the final pieces of the puzzle which MM is currently considering on the buy side for stocks although we also haven’t discarded the thought of selling / reducing some holdings at appropriate levels.

1 Retail Sector.

The Retail Sector has struggled in-line with the ASX200 in 2020 but it enjoyed some stellar bounces over the last week spearheaded by AP Eagers (APE) +33% and JB HIFI (JBH) +23%. Undoubtedly the average Aussies discretionary spending looks set to be hammered over the next 6-months although parts of the e-commerce platforms are holding up relatively well. The question we must consider is does it feel too early to buy into this battered sector with so many unknowns circling around COVID-19 – Harvey Norman (HVN) have just cancelled their 12c fully franked dividend due this week while directors have taken a 20% pay cut illustrating the pressure being felt in the sector.

While we like parts of the sector such as Super Retail, Nick Scali and HVN at lower levels the risk / reward is not compelling today, in fact only two stocks are currently on our radar.

MM likes selective pockets of the Retail Sector.

ASX200 & Retail Sector Chart

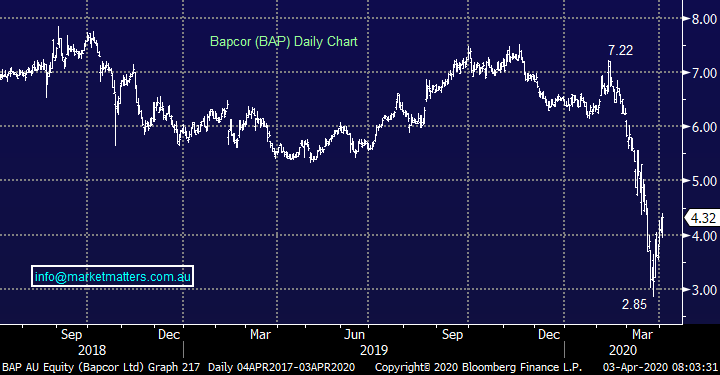

Bapcor (BAP) $4.32

Car accessories / parts business BAP was like many companies performing strongly before COVID-19, posting a greater than 10% increase in revenue to over $700m in 1H of 2020. At MM we feel once the dust has settled it will fairly rapidly regain its mojo.

MM likes BAP ideally sub $4.

Bapcor (BAP) Chart

JBH HIFI (JBH) $31.71

JBH is a quality Australian operator with a decent on-line. The stock looks set for a period of minor consolidation but in today’s market its dangerous to become too fixated by one particular view. However this is a company we like and it all comes down to where’s the ideal price / time to enter.

MM likes JBH under $30.

JBH HIFI (JBH) Chart

Conclusion: MM is currently only interested in most of the Retail Sector at lower levels, JBH and BAP are preferred options for the Growth Portfolio.

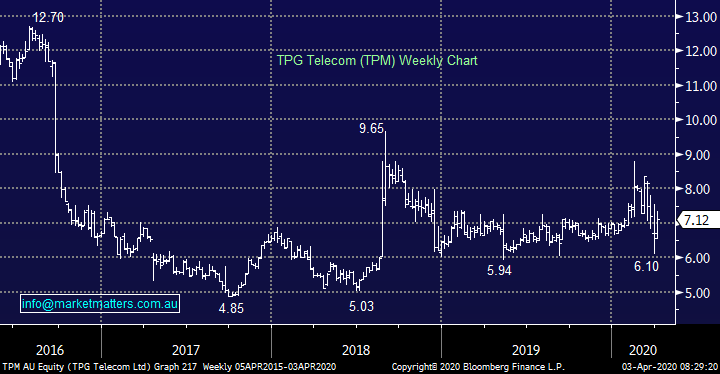

2 Telco Sector

The Australian Telco sector has outperformed during the markets recent plunge which makes sense considering the respective businesses, the question we need to ask is do any components offer better value than some of the battered members of the ASX.

MM is considering one member of the Telco Sector.

ASX200 & the Telco Chart

TPG Telecom (TPM) $7.12

TPM recently won its legal case against the ACCC allowing the merger with Vodafone, another huge waste of taxpayers’ money. We believe they are now well positioned moving forward and from a risk / reward perspective the stock looks good value around $7, in a “normal” market we would be long, the question is around alternative bargains on offer by the ASX.

MM likes TPM around $7.

TPG Telecom (TPM) Chart

Conclusion: MM likes TPM around $7 but its competing with some heavily discounted valuations across other parts of the ASX.

3 Infrastructure Stocks

MM bought TCL for the Income Portfolio but this doesn’t mean it’s off the menu for our Growth Portfolio, on Wednesday the toll road operator withdrew its distribution guidance as traffic numbers plummet across the company’s infrastructure portfolio. Transurban reaffirmed guidance at the half year result early in February of 62 cents and at the time was seeing stable growth in toll usage. Since then, with governments limiting the movement of people, numbers are down significantly.

Despite the hit to cash flow, Transurban says it has enough flexibility in the balance sheet to meet its requirements for the next 15-months and continues to push on with the West Gate tunnel project, covering themselves through FY21. Despite all of the negativity, these issues will pass, and traffic will return. TCL is down around 25% from its highs.

MM likes TCL at current levels.

Transurban (TCL) Chart

Conclusion: MM likes TCL around $12.

Conclusion

There are a number of additional moves MM are considering moving forward including the buy options below:

Retail : JB HIFI (JBH) and Bapcor (BAP).

Telco: TPG Telecom (TPM).

Infrastructure: Transurban (TCL).

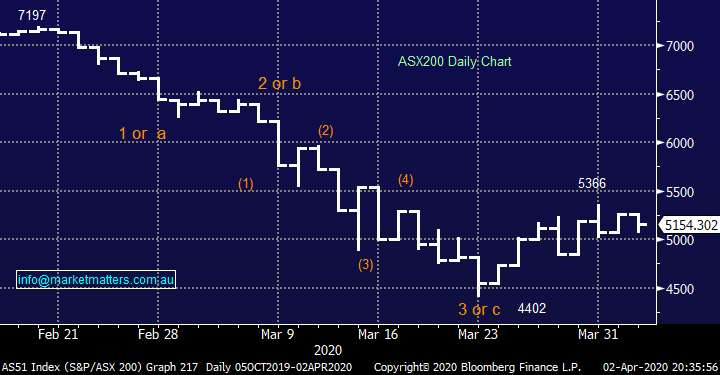

Overnight Market Matters Wrap

- US investors brought risk back on the table, as crude oil spiked over 20% overnight on the back of President Trump’s tweet that he was in talks between the Saudi Crown Prince who had spoken with Russian President, Putin expecting and hoping that they will be cutting its oil production by 10 Million bbl./day

- The weekly US jobless claims expectedly rose, adding another 6.6m

- We’ve unfortunately just tipped over the 1 million mark of confirmed Coronavirus cases in just 18 weeks. Locally however we see this slowly being contained and the projections have been reduced from a week ago. Stay Safe!

- BHP is expected to outperform the broader market after ending its US session up an equivalent of 4.46% from Australia’s previous close.

- The June SPI Futures is indicating the ASX 200 to gain 128 points higher, towards the 5250 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.