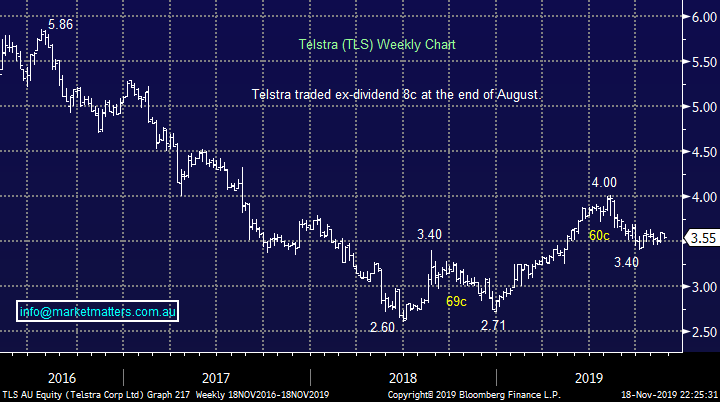

The major Telcos are quiet, is the smaller end of town attractive? (TLS, NXT, MAQ, OPC, OTW, ST1)

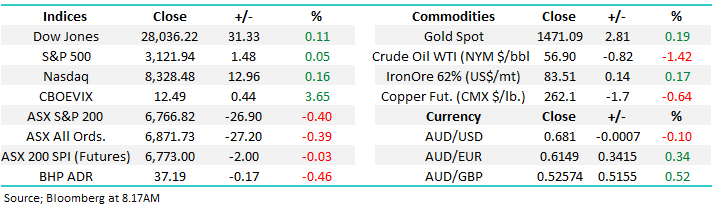

The ASX200 continues to sail the same course, it looked good on Friday at 4pm, the Dow rallies over 200-points in the night session breaking above 28,000, making another all-time high in the process, so of course we get sold off on Monday! The random rotation continues and considering over 70% of the ASX200 closed in the red yesterday the relatively small -0.4% decline by the index wasn’t too bad, on the sector level only the Utilities moved by more than 1% and they fell -1.2% while the Consumer Discretionary sector was the best on ground rallying +0.4%.

The sector rotation within the ASX appears to be also intertwined with some larger index rotation within the Asian region i.e. when Hong Kong fell aggressively last week we rallied but when they bounced strongly on Monday Australian stocks fell away. I believe we’re seeing some index spreading across the region with the ASX currently regarded as the quasi-safety index when either or both Hong Kong and trade war concerns intensify and vice-versa.

The US is enjoying a stellar bullish advance but similar to our market they are also experiencing days when different sectors jockey for performance and investors attention. Overnight, the US enjoyed solid buying in the defensives with both Utilities and Real Estate up over +0.8% while Energy was slapped -1.5%, declining bond yields the clear catalyst.

Short-term MM remains neutral the ASX200 with an upside bias.

Overnight global stocks were quiet with a very slight upside bias, SPI Futures are pointing to an unchanged open by the ASX while BHP was down -0.45% in line with energy stocks in the US.

This morning MM has looked at the Telco sector paying particular attention to some of the smaller players.

ASX200 Chart

Just a quick update on the market which MM believes is controlling equities at present i.e. US bond yields (interest rates). Overnight we saw US 10-years briefly dip under 1.8% as the downside trend resumes. Subscribers are aware that we expect an eventual test / break below 1.44% support which obviously should benefit the defensive sectors as it did last night. However we are looking for a decent low in this area, if we are correct with this hypothesis the sectors are likely to slowly ignore the bond yield decline and move against the grain I.e. value outperforms growth even though bond yields are falling, we will be watching very carefully in the weeks ahead.

MM short-term bearish US10-year bond yields.

US 10-year Bond Yields Chart

As we mentioned previously Hong Kong’s market enjoyed a decent +1.35% relief rally yesterday but as the chart below illustrates the bounce unfortunately is just a blip on the radar compared to its recent declines. We remain very concerned with this ticking “time bomb” and will only cast our hat into the ring ~10% lower at this point in time – the civil unrest appears to be gaining momentum as opposed to fading away.

MM likes the Hang Seng ~24,000 from a risk / reward perspective.

Hang Seg Index Chart

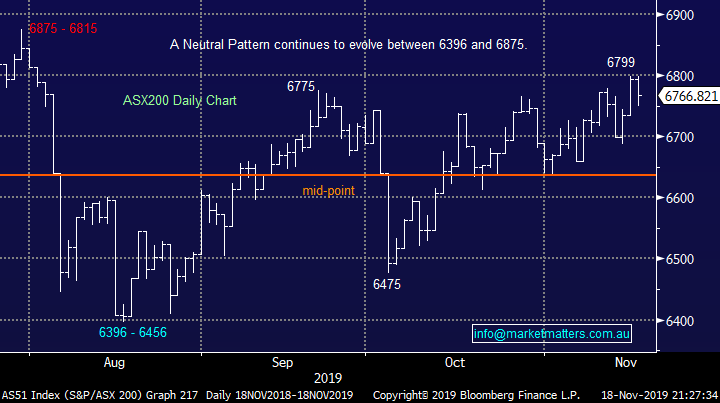

Last month Morgan Stanley downgraded heavyweight equipment giant Caterpillar because they believe risks exist that the economy is running out of steam – bond yields certainly agree. However interestingly CAT shares which have significantly underperformed the Dow in 2019 have actually surged almost 30% in recent months as US – China tensions have diminished. If MM’s outlook unfolds as expected and some fiscal stimulus is looming for 2020 the mining services sector should eventually become a major beneficiary, the miners have to spend some of that cash sometime!

If we are correct its not just the resources who should enjoy 2020 but also the mining services stocks hence we are long Emeco Holdings (EHL) and NRW Holdings (NWH) in our Growth Portfolio.

MM remains bullish EHL and NWH while we like CAT internationally

Caterpillar Inc (CAT US) Chart

Checking out the Telco’s from top to bottom

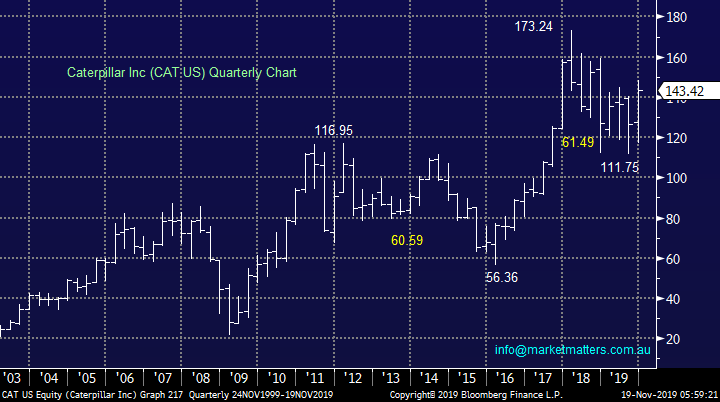

As a sector the Telco’s are dominated by heavyweight Telstra (TLS) which is the 10th largest company in our index, even after its major fall from grace. We see a mixed picture for TLS which is no longer the major yield play it once was, or should I say yield trap. TLS is estimated to pay 4.5% fully franked in 2020 made up of 2 ordinary dividends totalling 10cps plus 6cps worth of NBN payments paid via special dividends. TLS was once referred to by some dangerously as a ‘bond‘ however that is clearly not the case these days, they’re paying out less of their earnings and investing more in future growth.

Obviously TLS should benefit from the larger numbers of mobile devices, internet users, 5G and improving technology in general. What is less clear is the path for the NBN, it needs to be cheaper for resellers to make a decent margin, potentially we may see alternatives to the NBN in the years ahead. TLS’s major investment in 5G may put them in the box seat here but it’s definitely not a short game.

MM is neutral Telstra (TLS) at current levels.

Hence we cast our attention elsewhere within the sector especially with data use growing at over 20% pa and infrastructure cloud services growing ~25%. This impressive growth leaves the sector plump for consolidation, disruption and potential large returns. A basket of small telco’s is up well over 50% over the past year plus we’ve seen exciting M&A starting to raise its head.

MM likes the smaller end of town for the Telco’s with a diverse offering from data operators, infrastructure providers, elastic connectivity for cloud, residential operators and SME bundlers of data/MSP’s. With a number of solid businesses within the sector and strong market growth forecast for the majority of small listings the sector should continue to see outperformance – a great place to start looking for opportunities.

History tells us its better to be the acquired than be the acquirer when we consider that embattled Vocus (VOC) and TPG Telecom (TPM) used to dominate the buyers side of the ledger, a mantle now handed over to Uniti Group (UWL).

Telstra (TLS) Chart

Today we have briefly looked at 5 telco’s that are catching MM’s eye and worth consideration although a few are not suitable for MM due to size / liquidity.

1 NEXTDC (NXT) $6.80.

NXT is the heavyweight data centre operator in Australia with a market cap of $2.35bn – NXT’s customers can use the data centres as both connectivity and content hubs. Obviously this is a mature theme in the group which clearly carries with it a large degree of volatility as can be seen below.

MM is bullish NXT ultimately targeting new all-time highs.

NEXTDC (NXT) Chart

2 Macquarie Telecom (MAQ) $23.29

MAQ is a Sydney based telecommunications provider with a market cap very close to $500m, the group was created shortly after the deregulation of the industry and is largely focussed on hosting services and data centres. The stock looks strong both fundamentally and technically but our upside target is only 10-12% higher.

MM is bullish MAQ initially targeting ~10% upside.

Macquarie Telecom (MAQ) Chart

3 Opticomm (OPC) $4.25

OPC designs, builds and owns wholesale fibre networks and was only recently listed on the ASX, it now has a market cap of over $440m. The positive price action of OPC since the listing illustrates how favourably the market views the sector at present but risk / reward is hard to quantify for new listings as technical’s are largely irrelevant.

OPC looks bullish but it’s hard to quantify.

Opticomm (OPC) Chart

4 Over The Wire Holdings (OTW) $4.80

OTW is a conglomerate which operates data centre colocations, internet, back-ups, hosting and general IT support, the business has a market cap of $248m. Technically OTW looks bullish targeting ~20% upside with a “pop” feeling almost imminent.

MM’s is bullish OTW targeting ~20% upside.

Over The Wire Holdings (OTW) Chart

5 Spirit Telecom (ST1) 22c

ST1 is certainly in the small cap space where MM doesn’t usually venture but this $75m Australian business is interesting – it offers voice, fibre Broadband, internet and business services.

I stress this is not a stock which MM can / would invest in but we have been asked at times for a few ”speccy’s” so here you go!

MM likes ST1 as a very aggressive or “speccy” play.

Spirit Telecom (ST1) Chart

Conclusion (s)

MM likes the smaller end of town with the telco’s, of the 5 we looked at today our favourite 2 are OTW and MAQ.

Global Indices

No major change, we had given the benefit of the doubt to the post GFC bull market and fresh all-time highs have been achieved as anticipated, a close well under 3020 for the S&P500 is required to switch us to a bearish short-term stance.

MM is now neutral / positive US stocks.

US S&P500 Index Chart

European indices continue to “climb a wall of worry” at this point in time MM is neutral but we maintain our slight positive bias with a target ~10% higher looking realistic.

Euro Stoxx50 Chart

Overnight Market Matters Wrap

- The US closed with marginal upside overnight as investors soldier on with their hopes of progress in US-China trade talks.

- The greenback fell following discussions on the economy with the President Trump, Treasury Secretary Steven Mnuchuin and Fed Reserve Chair, Jeremy Powell as investors wait for jobless claims data and housing starts tonight.

- BHP is expected to underperform the broader market after ending its US session down an equivalent of -0.46% from Australia’s previous close.

- The December SPI Futures is indicating the ASX 200 to open with little change, around the 6770 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.