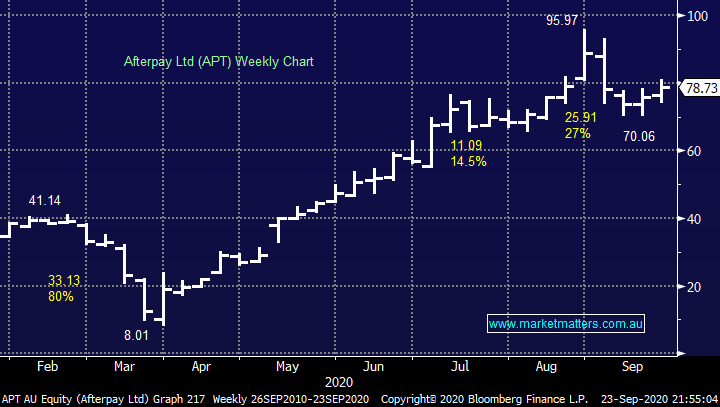

The gold sectors back in our sights (APT, FMG, NCM, EVN, NST)

The ASX200 roared higher yesterday finally closing up 140-points / 2.4% with an impressive 12% of the market rallying by over 4%, outside of the perceived safe haven of the gold sector there were very few losers on the day. In quick fashion the local index is up over 1% for the week and taking into account the seasonal factors we’ve been discussing of late the market might now be off and running into October, on average the strongest month for the ASX over the last decade. After last nights Fed inspired plunge on Wall Street today will be an interesting test, I read a comment from previous Fed Chair Alan Greenspan this morning which summed up what we might be hearing from politicians moving into the election, plus it made me laugh!

“If I turn out to be particularly clear, you’ve probably misunderstood what I said” – Former Fed Chair Alan Greenspan.

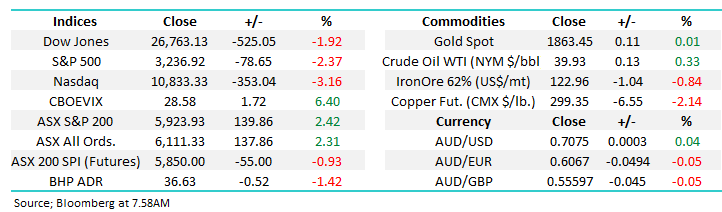

Australian stocks enjoyed a strong start to Wednesday courtesy of solid gains by overseas markets and after dovish comments by prominent Westpac economist Bill Evans we just went from strength to strength – he surprised bond markets by predicting the RBA would cut rates from 0.25% to 0.1% at its next meeting on October 6th, basically zero in my humble opinion. However, it’s not an outlandish call as the overnight interbank lending rate (the rate at which institutions deal) is already almost at 0.1% while June 2021 bank bills are now changing hands at 0.08%, both well below the official cash rate.

Mr Evans view evolved after the RBA deputy governors speech on Tuesday where he alluded to expanding the available monetary toolkit, probably flexing their muscles before the JobKeeper is reigned in. Importantly as rates approach zero they have the firepower to support the economy if required through reducing 3,4 & /or 5-year bond yields which would flow through to cheaper mortgages; in our opinion the property market is front and centre in the minds of the RBA, they certainly don’t want it falling too far too fast.

At MM we can now see lower rates in 2020 but our great conviction belief is that the RBA will be propping up housing if required for the foreseeable future.

RBA Interbank Overnight Cash Rate Chart

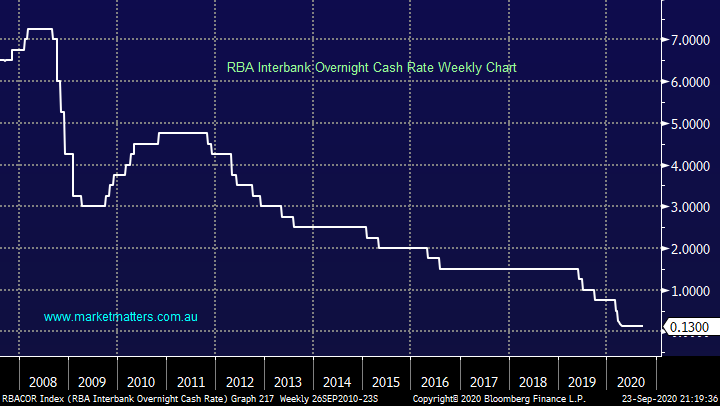

The local index has again bounced from the 5700 area and our preferred scenario is stocks rally strongly over the coming weeks hence our Growth Portfolio only holds 5% in cash and we moved into the higher beta Megaport (MP1) and Appen (APX) stocks earlier in the week. The technical picture suggests a test of 6300-6500 but the banks will need to regain some mojo for this to unfold but alas, declining bond yields is not good backdrop for this to happen. Also we need to see US markets regain some composure which was looking good last night before the Fed flagged the need for more stimulus to lift the world’s largest economy from a coronavirus induced recession.

MM remains bullish the ASX200 short-term.

ASX200 Index Chart

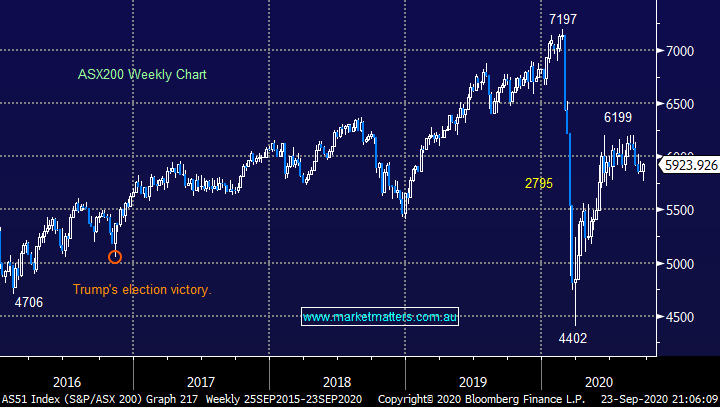

Yesterday we took a quick look at Xero (XRO) which MM holds in our Growth Portfolio, after yesterday’s 3.7% rally its already well on its way to our targeted all-time high. Another high profile IT stock we’ve been watching carefully is BNPL heavyweight Afterpay (APT) which ideally will make another challenge on the psychological $100 area but I wouldn’t be surprised, even if we do see the tech rally that MM is targeting, that the BNPL names struggle to follow the likes of XRO and challenge / break their August highs – we will simply just watch the tape and evaluate at the time. Again, we need to see US tech regain some stability first however it was obvious yesterday that the wider BNPL sector had an anaemic move relative to the broader market.

MM is short-term bullish APT.

NB BNPL is the acronym for buy now pay later.

Afterpay Ltd (APT) Chart

This morning Westpac (WBC) have announced they’ll pay $1.3b to settle the outstanding AML/CTF proceedings that have hung over their head for some time. The number is a big one however we doubt it will be a big shock for the market, and a resolution could actually be a positive. Our analyst had $1.1b built in so it’s not a material difference and will not force a change of numbers. At $1.3bn, WBC will retain a strong capital position (tier 1 at 10.8) and will likely pay a full year dividend.

Overseas Indices & markets

Overnight US stocks succumbed to the realistic comments from Fed Chairman Jerome Powell, he simply just reiterated there’s a long way to go for an economic recovery plus it will likely need more support from Government’s on the fiscal side. The issue is Congress have all but ended its pursuit of a bipartisan agreement spending bill to focus on a replacement for Ruth Bader on the Supreme Court – with only a matter of weeks before the US election its all about politics in the US, not what’s best for the country – I felt the Feds rhetoric was almost a plea for help from the politicians but it’s a big ask this time of year. There’s a couple of market sensitive events occurring this week:

1 – Jerome Powell and Treasury Secretary Jerome Powell will testify before a senate committee on the economic response to COIVID on Thursday – he could easily send stocks higher if he so wishes.

2 – Employment data will be released on Thursday.

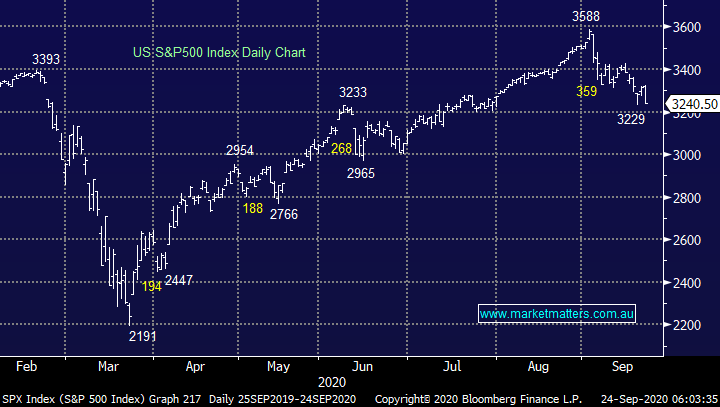

MM still believes that US stocks are “looking for a low” as markets head into October but we do anticipate ongoing high levels of volatility in Q4 which is no great surprise with Novembers election starting to form a cloud over stocks.

US S&P500 Index Chart

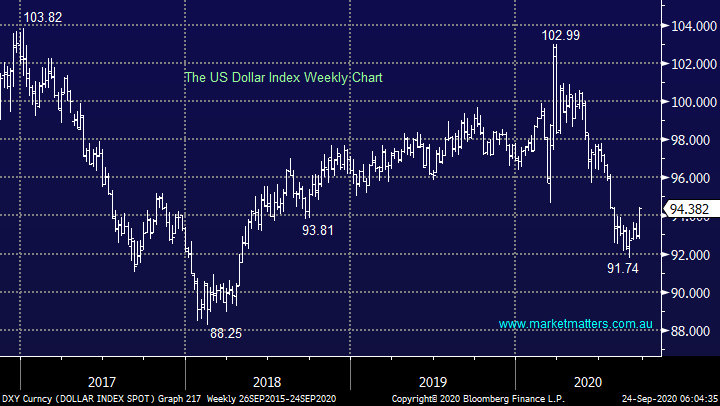

Comments from the Fed appeared to have sent investors fleeing to the $US, if we are correct this should reverse shortly and the greenback’s downtrend will resume. The current rally should enable MM to buy silver this morning for our MM ETF Portfolio via the physical silver ETF - MM is leaving a “resting bid” in the ETPMAG at $31 limit for another 5% position.

MM remains bearish the $US into Christmas.

$US Index Chart

Silver ($US/oz) Chart

The Gold Sectors back in our sights.

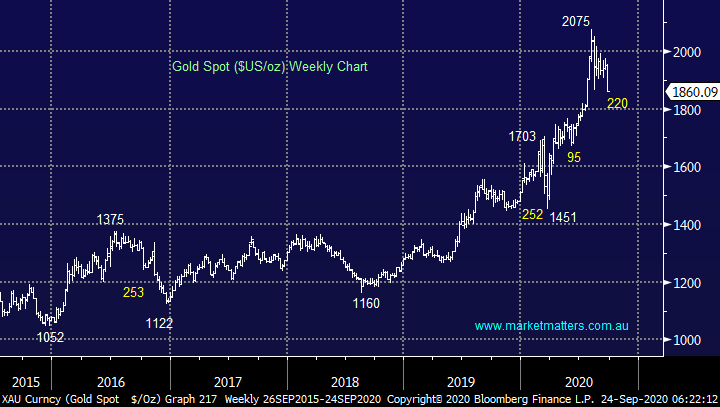

One definite characteristic of 2020 has been the blow-offs in the hot stocks / sectors followed by fairly aggressive corrections, just think precious metals, BNPL and the tech space. When the enthusiasm and optimism goes too far, a characteristic which can be easily identified by the degree of media coverage, its often time to lock in some cash and definitely not the time to be sucked into the “FOMO trade” (Fear of missing out) chasing of strength. Fortunately we have been patient in establishing a major precious metal position, currently we just hold just 3% in Newcrest (NCM) which actually rallied +1.3% yesterday when the sector was clobbered.

Gold was the topic dujour in early August with the most column inches being drawn into the gold narrative since the last price cycle 2009-2011. Everyone had an opinion and in typical situations like these the underlying security price was ready for a correction, now we’ve seen an almost 11% washout, MM believes it’s time to reassess.

The question today is do we add to Newcrest (NCM) or look elsewhere in the local sector. Also, how should we consider funding such an acquisition.

MM is keen on gold into current weakness.

Gold ($US/oz) Chart

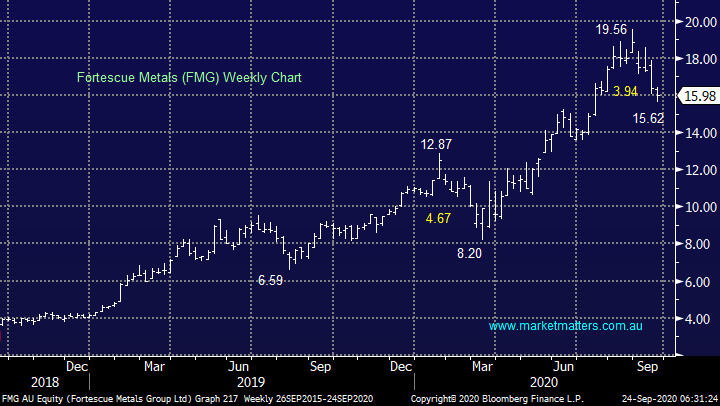

Another “hot stock” which has fallen from grace with a thud over recent weeks is Fortescue which has been a major underperformer tumbling over 20% since its late August high. A plan is forming in our minds following the Feds impact on markets overnight.

MM is keen on FMG into current weakness.

Fortescue Metals (FMG) Chart

Firstly, to keep today’s report succinct I have only briefly looked at our favourite 3 options for increasing MM’s gold exposure.

1 Newcrest Mining (NCM) $31.88

Following its 20% correction heavyweight NCM has just started to outperform the sector for the first time in a long time which is encouraging but being the $26bn goliath in the room its unlikely to be the best performer if precious metals do enjoy a strong reversal from current levels i.e. it’s the low Beta option in the gold sector. However, our buy zone of 4-5% lower is likely to be challenged this morning.

MM is keen on NCM into current weakness.

Newcrest Mining (NCM) Chart

2 Evolution Mining (EVN) $5.84

We like EVN but from both a technical and valuation perspective MM’s buy level is ~8% lower.

MM is keen on EVN ~8% lower.

Evolution Mining (EVN) Chart

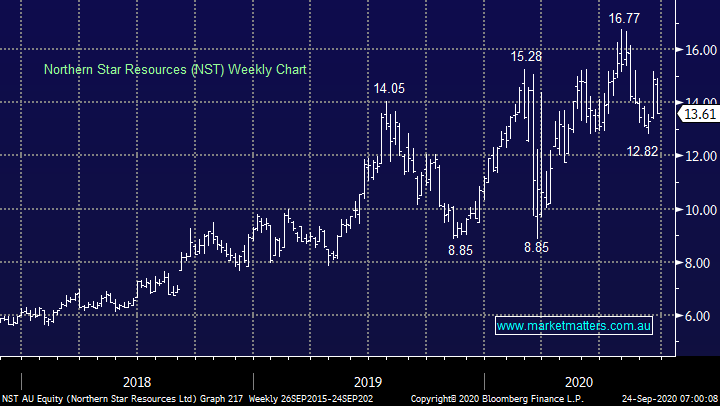

3 Northern Star Resources (NST) $13.61.

NST has proved to be a more volatile of the 3 stocks over recent week first falling almost 24% then bouncing strongly when the $US pulled back i.e. it’s the high beta play.

MM is keen on NST around $12.50.

Northern Star Resources (NST) Chart

Funding vehicle

Lastly moving onto a funding vehicle, the comments from both Bill Evans yesterday and the Fed overnight imply interests will be lower for longer and in the case of the RBA further cuts appear to be now in the offing – not good news for bank margins. Currently MM has decent holdings in both Commonwealth Bank (CBA) and National Bank (NAB), we are considering trimming one of these holdings to increase our gold exposure.

ASX200 Banking Index Chart

Conclusion

MM is considering to portfolio tweaks today and moving forward:

1 – Trim our banking exposure and increase our position in Newcrest Mining (NCM). A slightly more conservative option but we believe golds rally since 2015 is maturing fast and this is not the time for aggression.

2 – Buy Fortescue Metals (FMG) into weakness, at this stage we are weighing up different ideas around funding including of course just cash.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.