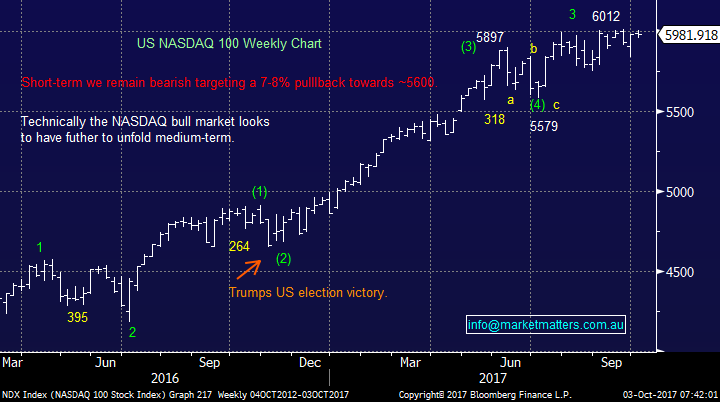

The Glass Remains Half-Full for Stocks… For Now

Firstly, apologies for those that missed the note in the Friday morning email. No reports were due over the NSW long weekend, reports are now back to normal.

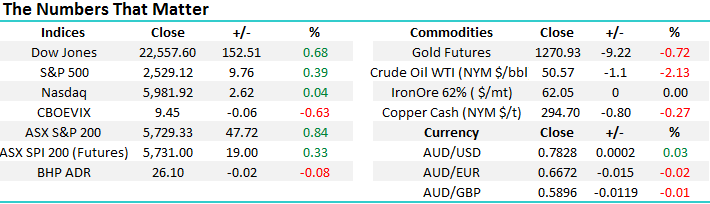

Only a week after threatening to break down under the 5600 level, the ASX200 is poised to challenge 5750 this morning, as the local market moves into its 20th week of range trading between 5629 and 5836. It’s not uncommon for markets to be strong at both quarter end and the start of a fresh month, as fund managers rejig their portfolios / equity weightings, today we should be back to normal albeit with relatively low volume as many people stretch their long weekend into a week off – the roads were extremely quiet into Sydney this morning. Today’s report is a quick summary of where we see stocks moving forward to get everyone back in the groove after the long weekend.

MM remains mildly bullish equities at present, but we will are very prepared to sell into strength, especially when stocks hit our target levels – see CYBG Plc (CYB) later in this report.

ASX200 Weekly Chart

Global Markets

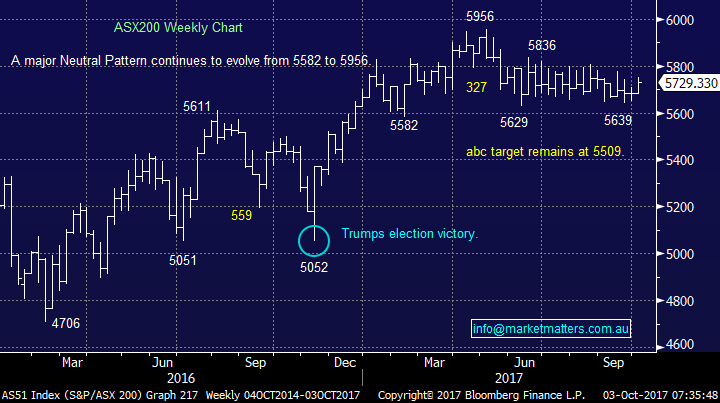

Overall we still expect a generally choppy firm market as this mature bull market evolves, but please remember we still believe a ~20% correction from stocks is likely in 2018. We will keep our finger firmly on the pulse of these exciting markets moving forward as we believe some of the best opportunities since the GFC are looming on the horizon. For now we still see ~7% further upside for global equities with rising volatility, but MM believes strongly the “easy money” from being long stocks since the GFC is over.

MSCI Global World Index Quarterly Chart

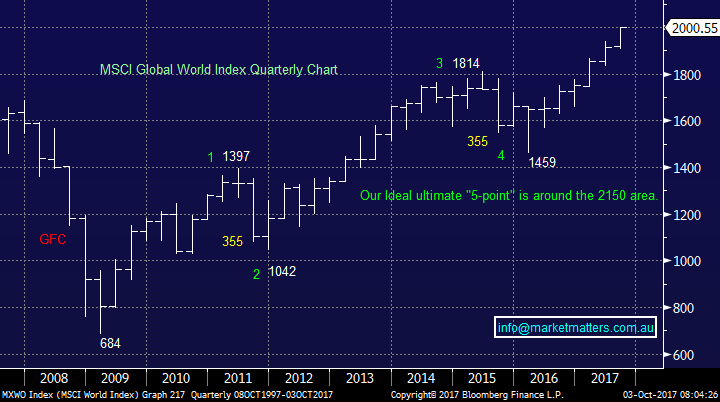

US Stocks

Last night the broad based S&P500 closed up 0.4% at another all-time high, but it’s now been given the very bullish “Tax cuts” plan by Donald Trump which has helped support stocks since the US election last November - the risk remains that most of the potentially good news is already baked into this impressive bull market e.g. improving global economies led by the US and the large Trump tax cuts.

There is no change to our short-term outlook for US stocks, we are targeting / need a ~5% correction before the risk / reward favours buying this market.

US NASDAQ Weekly Chart

US S&P500 Weekly Chart

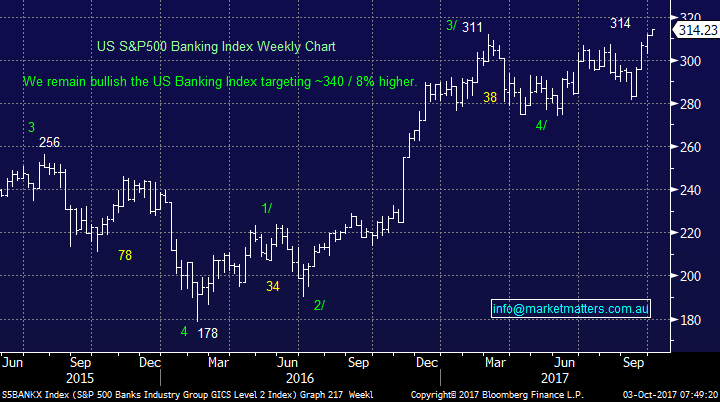

The US banking Index has finally made fresh highs for 2017 which we flagged a few months ago. Although we ideally still see ~8% further upside, the easy money from being long US banks is behind us.

US S&P500 Banking Index Weekly Chart

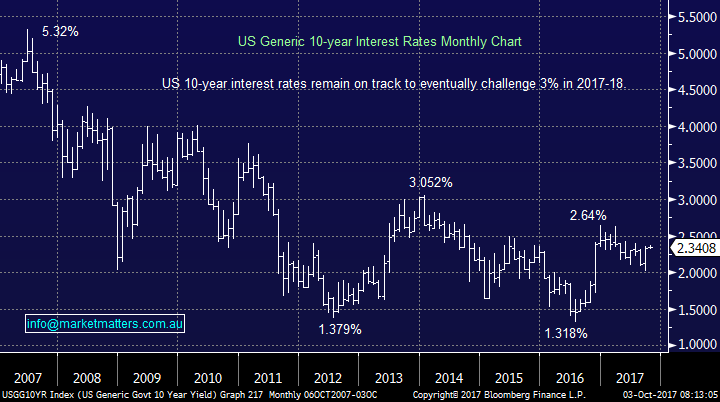

US bond yields remain bullish which is theoretically supportive of banks which ties in nicely with our short-term bullish outlook for the sector. We often get questions from subscribers on bonds, which as a market dwarfs the stock market, a good simple article was on the Bloomberg website this morning titled – “Bonds are more than 500 years old and bigger than ever”.

US 10-year Bond Yield MonthlyChart

European stocks look poised to make fresh 2017 highs in the next few days / weeks, but we would not be surprised to see this rally fail and another pullback towards 12,000 unfold.

German DAX Weekly Chart

Australian stocks in focus

1 Regis Resources (RRL) $3.60 – We have been stalking RRL since it traded under $4, but now it’s fallen ~18% it’s definitely looking more attractive.

We can buy RRL around $3.50 looking for a quick 10% bounce but an ultimate target closer to $3 would not surprise.

*Watch for alerts.

Regis Resources (RRL) Weekly Chart

2 CYBG Plc (CYB) $5.28 – MM is holding a chunky 10% exposure to CYB in our Growth Portfolio. We are planning to take a part profit today over $5.30 with the intention of increasing our holding in NAB and / or Bank of Queensland (BOQ) into some mild weakness looking to pick up their respective dividends in November.

Over the last month CYB is up +11.4% while NAB is +4.6% and BOQ +4%.

*Watch for alerts.

CYBG (CYB) Weekly Chart

Conclusion (s)

We remain happy to increase our market exposure into weakness, but see reason to chase stocks at current levels.

Today we are looking to take a part profit on our CYB holding with a view to increasing our holdings in BOQ and / or NAB into a pullback.

Due to our major view that the current bull market is maturing fast and the equity market volatility should increase over the coming months, we are comfortable holding ~20% in cash for a few weeks if we feel appropriate as our opinion is opportunities will present themselves.

Overnight Market Matters Wrap

· Firstly, our thoughts and prayers to the victims and family from the horrific Las Vegas shooting overnight.

· The US equity markets followed Australia’s lead overnight starting the first session of October by soaring at record highs.

· The US Institute of Supply Management data showed data exceeded analyst expectations with manufacturing at a 13 year high.

· Oil fell on the back of a rise in US rigs and OPEC production.

· On the LME, copper rose, nickel fell. Zinc is at a 10 year high as Chinese mines were shut down for environmental inspections. Chinese markets are closed for the week – so no iron ore changes. Gold continues to fall as geopolitical tensions ease.

· The December SPI Futures is indicating the ASX 200 to open 15 points higher this morning, testing the 5750 area.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 3/10/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here