The Financials are looking “heavy” (CWN, SGR, SGM, CGF, ASX, JHG, PPT, MQG, AMP)

The market struggled yesterday considering it woke to no bad news from overseas markets, ongoing strength from the iron ore sector plus a $10bn takeover for good measure - the bulls would have been disappointed to see the market close unchanged. Yesterday a weak Banking & Financials sector did manage to offset gains in the Resources & Energy stocks but the story of the day was gaming with Crown (CWN) surging +19.7% and Star Entertainment (SGR) +5.4% - more on that later.

Under the hood the market reflected the days “weak feel” with just over 55% of the market closing in the red, basically the combination of the resources and some stock specific news is holding the market around the 6200 area – for now. One piece of news that caught our eye was mortgage rates being cut by some players in an attempt to rekindle demand. However, -0.3% from a mortgage compared to the tough new regulations to even get such a loan approved while the press keeps reminding us how housing prices are falling feels unlikely to change things anytime soon, although it’s clearly a step in the right direction. Home loan approvals fell 14% in February, their 17th consecutive decline, this all amounts to pressure on banks margins / earnings.

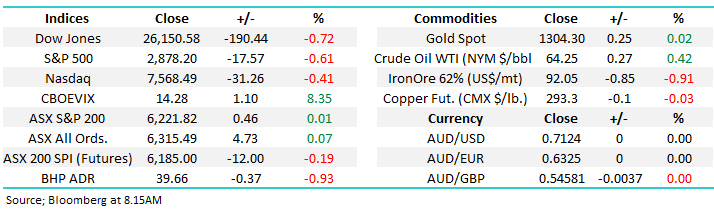

No change, if we are correct and the market is positioning itself for a begrudging pullback towards 6000 we would not be surprised to see a few more days consolidation around the psychological 6200 area but a close below 6180 will be technically bearish initially targeting 6100 – today will be a test of these levels. If the current huge variance in sector performance reverted just slightly with a few days pullback in the likes of BHP, RIO and FMG our target area will loom quickly, interestingly BHP closed down almost 1% in the US.

The ASX200 has now achieved our upside target area switching us back to a neutral / bearish stance short-term.

Overnight US fell relatively hard with the broad based S&P500 closing down -0.6% fairly close to the days lows, the SPI is calling the ASX200 to fall ~0.5% on the open this morning.

Today we are again going to look at the Financials sector where the relative performance over the last 6-months is some of the most diverse I have ever witnessed within a sector e.g. Magellan (MFG)N +65%, Macquarie (MQG) +20% but Challenger (CGF) -19% and Eclipx (ECX) -66%. The question being is it time to be switching to the scary underperformers.

At MM we believe this is the period in the market to buy “cheap value stock” but this can clearly be a dangerous game at times. Within the stock market we are witnessing aggressive value gaps in many of areas where MM believes, and history supports us, investors should be doing the arguably tougher trade of buying the lower quality stocks who have simply become too cheap – hence our small portfolio of “dog” stocks.

ASX200 Chart

Crown Resorts (CWN) $14.05 & Star Entertainment (SGR) $4.47

Both Crown (CWN) and Star (SGR) rallied strongly yesterday leading to the obvious question “should I buy or should I sell now?”. The press has been full of the details / scenarios but I don’t think anyone expected Wynn Resorts to walk away as they did overnight while citing premature disclosure as the reason why – seems strange to us, sure that’s annoying but if you get the asset you want at the correct price so what?

1 – Crown (CWN) closed 70c below the reported bid by Wynn Resorts as investors speculated what path major shareholder James Packer would ultimately follow. On balance we believed a deal would probably go ahead but the upside of 5% compared to over 15% if it failed was not exciting, that same risk / reward is likely to hurt the investors in CWN this morning, we expect the stock to give back at least $1 of the $2.31 yesterday’s rally.

2 – Star Entertainment (SGR) was more frustrating to MM as we have been considering the stock seriously since it traded below $4.20, only 6% away but still frustrating. At the last traded prices basis 2019 earnings CWN was trading on a P/E of 25x while Star (SGR) is trading significantly cheaper at 16x.

MM now would like to see the dust settle for a few days unless there’s carnage today – however we now believe the sector is ‘in play’.

Crown Resorts (CWN) Chart

Star Entertainment (SGR) Chart

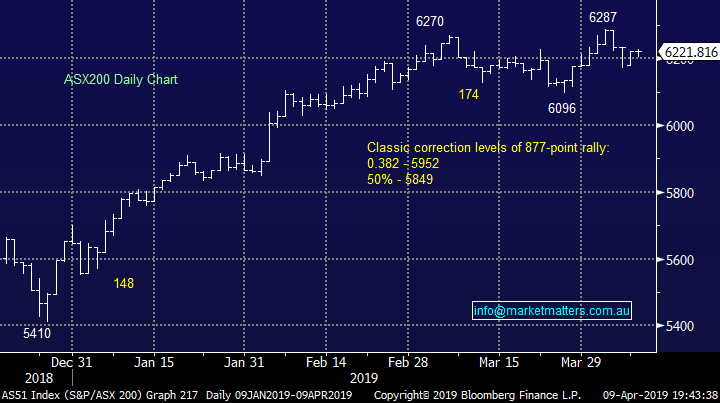

Sims Metal (SGM) $11

Often in the markets “when it rains it pours” and at MM that’s exactly how it felt yesterday following SGR’s surge without us and SGM’s decline with us on board!

We still like the fundamentals with SGM moving forward even if the short term gains from capital returns appear to have vanished – we may average if the opportunity arises around $10.20 depending on alternatives at the time. SGM is a lower quality, cheap stock, mentioned earlier.

Sims Metal (SGM) Chart

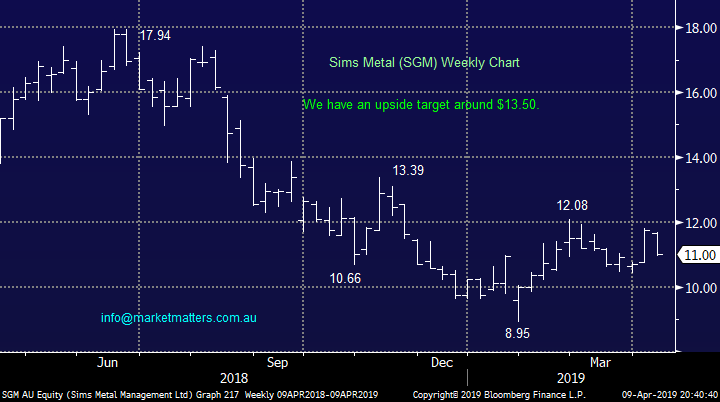

Some of the Diversified Financials look tired at best

The divergence in performance within this sector has been immense in 2018/9 leading us to question whether opportunities are existing at the “cheap” end of town.

Technically the sector looks capable of a 5-6% correction but as we’ve already seen that is likely to have little bearing on many individual stocks – our best guess is if we do see such a pullback it will be dominated by profit taking in the likes of Macquarie (MQG).

ASX200 Diversified Financials Chart

Now moving onto 6 individual shares within the Australian Financial sector where as we’ve said the performances have been very different.

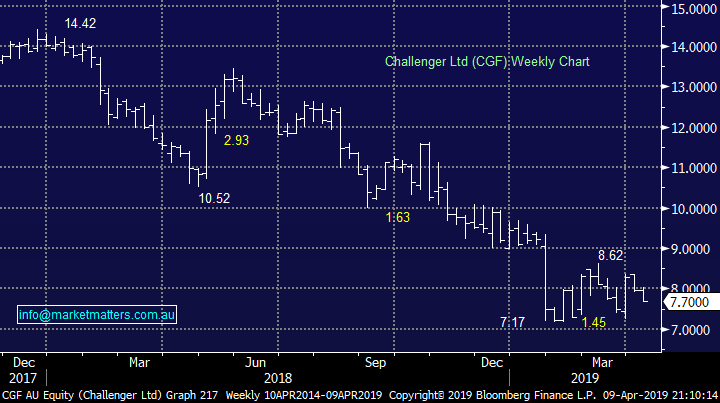

1 Challenger Ltd (CGF) $7.70

Challenger (CGF) recently bounced 20% following the news that the company had furthered its strategic relationship with Japanese MS & AD Insurance Group plus the company intended to increase its stake in CGF above 15% while requesting a spot on the board. At MM we believe the deal should prove to be overall positive for CGF hence its disappointing to see the shares fail to hold the gains while the underlying market has remained strong – a market that cannot rally on good news is usually a weak market.

Investors clearly have not forgotten / forgiven Februarys report which disappointed the market, largely because it showed CGFs soft underbelly when market volatility spikes – that should be a concern for holders.

While CGF looks ‘technically interesting’ below $7, falling margins remain a concern. Not one for MM at this stage.

Challenger Ltd (CGF) Chart

2 ASX Ltd $70.68.

The ASX has rallied as we anticipated last year but our target area of the $75 region is now very close, especially if we take into account Februarys $1.14 dividend.

The stock is now trading on a fairly rich 27.9x P/E for 2019 while yielding 3.16% fully franked, certainly nothing like as attractive as in late 2018.

MM is now neutral the ASX.

ASX Ltd (ASX) Chart

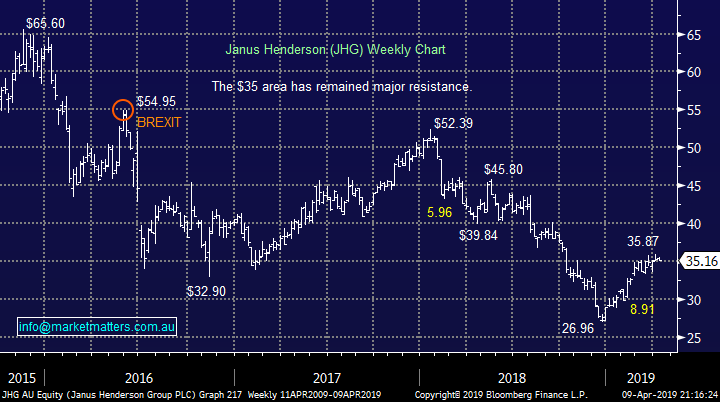

3 Janus Henderson (JHG) $35.16

We hold JHG in our Growth Portfolio and it’s been a tough journey but we gave the stock room because it had simply become too cheap, following its 33% bounce I wish we had averaged – a great illustration of how stocks in this / any sector can recover when they have become “too cheap”.

JHG still trades on an Est P/E for 2019 of under 10x while yielding 5.6% unfranked – still cheap but clearly not as cheap. If / when the business can return to positive fund inflows the stock should enjoy a positive and rapid rerating. Also, BREXIT remains a wildcard which markets are currently discounting, or are simply over!

MM is neutral just here but will be interested if the stock corrects in line with US equities.

Janus Henderson (JHG) Chart

4 Macquarie Bank (MQG) $130.39

MQG is a stock we like fundamentally but we have been too fussy with price on a couple of occasions with entry. In the short-term we believe the “silver doughnut” will correct back towards the $125 area , or 4% lower.

The company has transformed itself over recent years and we believe it’s well positioned for the years ahead but the share price has a strong correlation to US indices hence while we expect a period of weakness in the US patience makes sense. The stock is trading on undemanding Est P/E of 15.1x for 2019 earnings while yielding 4.1% part franked, not an unattractive income stream.

MM is neutral MQG at current levels but keen at lower levels.

Macquarie Bank (MQG) Chart

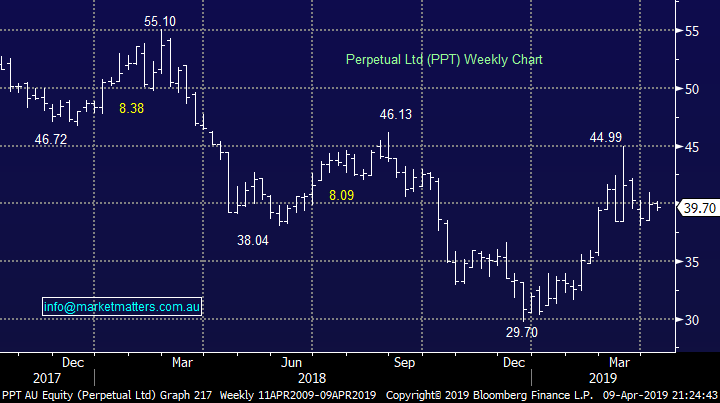

5 Perpetual Ltd (PPT) $39.70

Wealth manager Perpetual (PPT0 pulled back to the $38 as we forecast in a recent Weekend Report, now it’s a touch more tricky! The stock is yielding an attractive 6.68% fully franked making it especially attractive into any decent weakness but the P/E of 15.2x for 2019 is not cheap compared to some of its peers leading us to sit on the fence just here - the yield has it justifying a place in our Income Portfolio.

There are rumours that they are looking to sell their corporate trust business with a price of $600m being mentioned, we believe the sale is a tough ask at that price but if successful should give the stock a healthy “shot in the arm” as capital returns would likely eventuate.

MM is neutral PPT at current levels.

Perpetual Ltd (PPT) Chart

6 AMP Ltd (AMP) $2.18

If this was Beauty and the Beast we all know what roll AMP would be handed on a silver platter but we ask whether it’s finally showing an interesting risk / reward opportunity.

The stocks trading on a P/E of 11.5x for 2019 Est earnings while yielding 6.4% fully franked but history tells us that AMP will more than likely throw some hand grenades into the mix again in 2019. The question is how much bad news is built into todays share price because I hear very few positive expectations on the streets of Sydney.

Our “gut feel” is AMP is a buy around current levels targeting a decent bounce but not one for the faint hearted.

MM likes AMP as an aggressive play around $2 looking for ~30% upside.

AMP Ltd (AMP) Chart

Conclusion

Not as interesting as we anticipated, MM likes MQG around $125 and AMP as a very aggressive buy / trade.

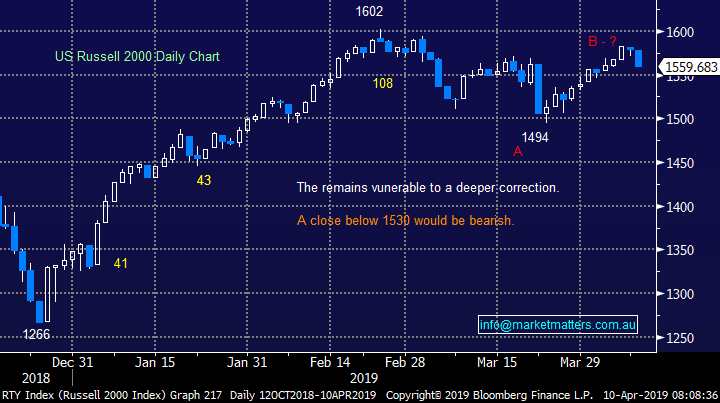

Global Indices

US stocks sold off fairly aggressively last night with the small cap Russell 2000 leading the way, a bearish indicator to us and a 4-5% pullback is our favoured scenario.

Medium-term we still think the NASDAQ has another ~6% upside medium-term but the next few weeks look more questionable.

With both the S&P500 and tech based NASDAQ reaching fresh 2019 highs we have turned mildly neutral / negative US stocks.

US Russell 2000 Chart

No change with European indices even as the BREXIT fiasco rolls on, markets are encountering some resistance from our targeted “sell zones”, we remain cautious or even bearish the region at this stage, especially into fresh 2019 highs.

German DAX Chart

Overnight Market Matters Wrap

· The US equity markets closed in negative territory after the IMF had downgraded both the US and global growth forecast further overnight, where the main issue is seen in the Euro region.

· The VIX index – a measure of volatility in the US increased by 8.35%, however remains at ultra-low complacency levels, below 15.

· Emerging markets are expected to lose some steam from the outlook, with BHP expected to underperform the broader market after ending its US session down an equivalent of -0.93% from Australia’s previous close towards the $39.65 area.

· The June SPI Futures is indicating the ASX 200 to ease off further and test the 6200 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/04/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.