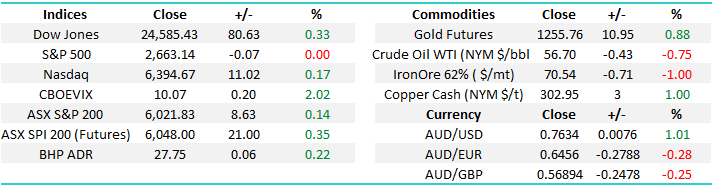

The Fed raises interest rates and flags 3 more for 2018.

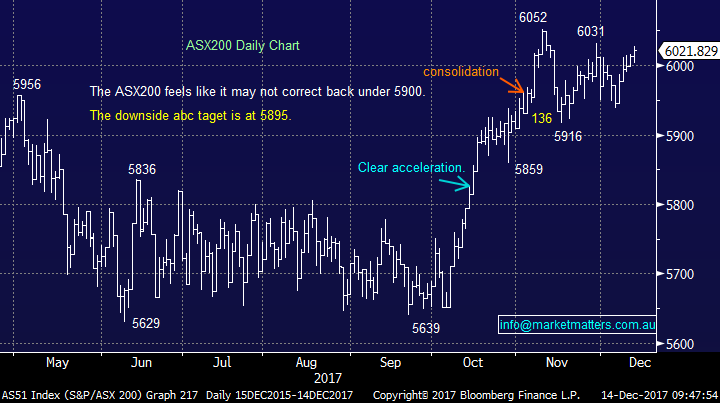

The ASX200 closed marginally higher yesterday as Westfield (WFD) resumed trading following its takeover announcement – basically the 13.65% advance in WFD handed the local market its gains. Interestingly we were on track for a far better day until the news crossed our screens that the Republicans had unexpectedly lost the Alabama election hence reducing Donald Trumps control in the Senate.

However, this morning following a pretty much as anticipated FOMC statement from Janet Yellen (Fed Chair) which included modest upgrades to growth projections and the expected 3 interest rate hikes flagged for 2018. So again, after an early news driven fall by US stock futures we have seen a recovery and the Dow is up 100-points while I type this report.

“A market that does not fall / rallies on bad news is a strong market”.

Hence, we have no change to our market view that the local market is heading towards 6125 this month, we actually would not be surprised to see a breakout to fresh 2017 highs this morning.

ASX200 Daily Chart

Today was a perfect example of “buy the rumour / sell the fact” as we see the $US lower, gold stocks up ~3.5% and US indices higher following the rate hike – admittedly a disappointing CPI inflation read helped this morning’s moves.

As is often the case once markets get the expected news they unwind positions producing a counter-logic move. We think in this case some players were hoping the Fed would become more bullish and imply 4-rate hikes in 2018, a -1.2% fall in US financials certainly points to this.Today we are going to review our thoughts on 3 key macro issues moving into 2018.

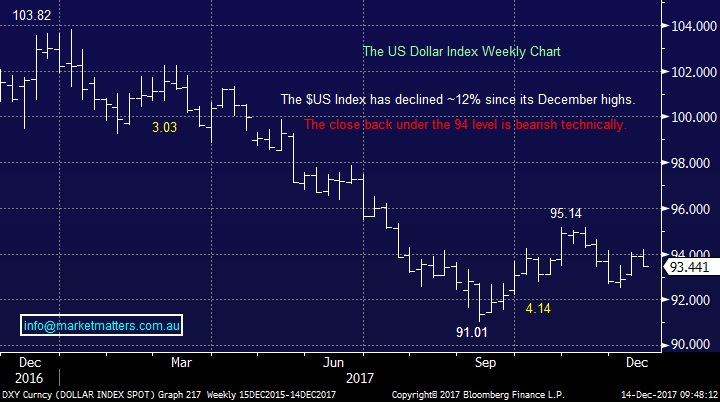

The $US

Arguably our best call at MM for 2017 was the contrarian bearish view on the $US Index which has subsequently fallen over 12% this year. At this point in time we remain negative targeting the 90 region, or close to 4% lower.

The $US Weekly Chart

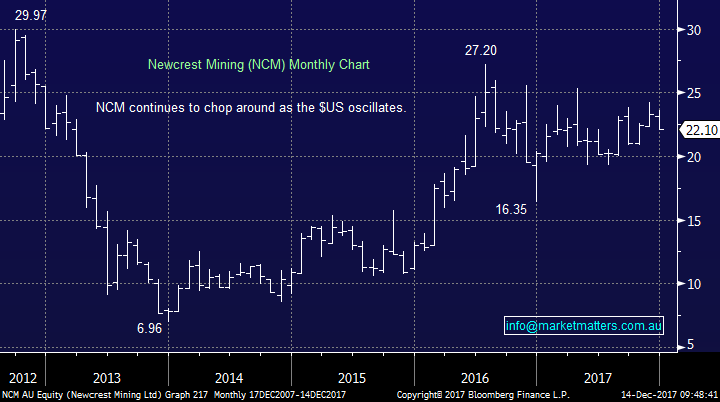

A weak $US is theoretically bullish gold and its related stocks e.g. last night gold ETF’s rallied an impressive ~3.5%. The sharp decline in the $US this year has assisted the gold price rallying over $US100/oz. to-date.

This morning we should see a sharp rally in our gold stocks following US ETF’s higher. We remain hopeful, a bad word for investing I know, of taking profit on our Newcrest (NCM) position around $25.

Newcrest Mining (NCM) Monthly Chart

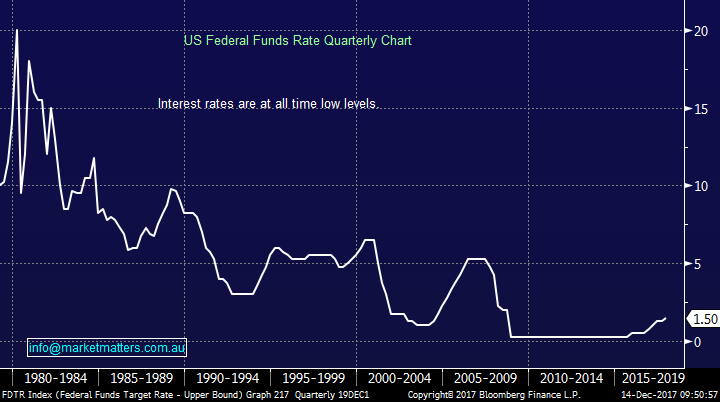

Interest Rates

Last night the Fed hiked US rates to 1.5%, still amazingly low compared to the average of the last 40-years, but well above their GFC lows. We firmly believe the world has seen the end of the bear market for interest rates and we all should be prepared for higher rates over the years ahead.

The question for the bigger picture is when, not if, will higher rates start to damage the long-term bull market for assets, including stocks.

US Fed Funds Rate Quarterly Chart

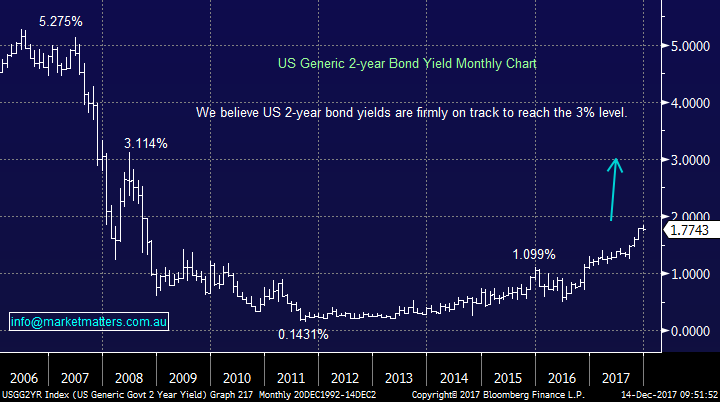

Last night US 2-year bond yields edged lower as traders were obviously positioned / hoping for an even more bullish outlook for the Fed. We remain bullish US 2-year bond yields, eventually targeting the 3% area.

US 2-year bond yield Monthly Chart

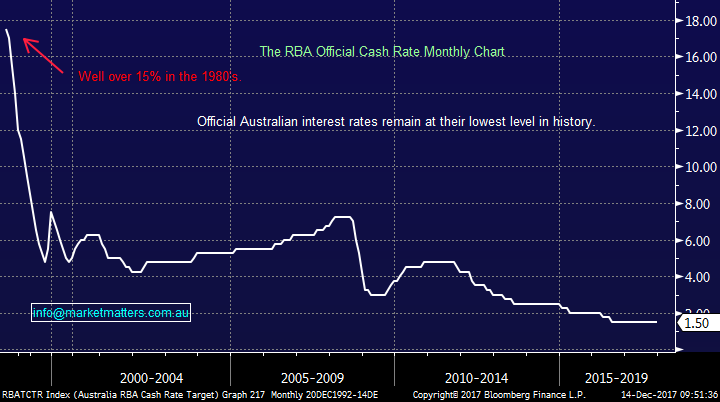

Unlike the US the local RBA is caught between a rock and proverbial hard place. We feel they want to commence normalising interest rates but are very concerned around the potential impact on property prices which are already softening and the subsequent knock on effects.

Our best guess at MM is that the RBA will raise interest rates next Melbourne Cup Day but the fears around housing will have us behind the curve compared to our global counterparts, which will help drag the $A down towards 65c against the $US.

RBA Official Cash Rate Monthly Chart

Inflation

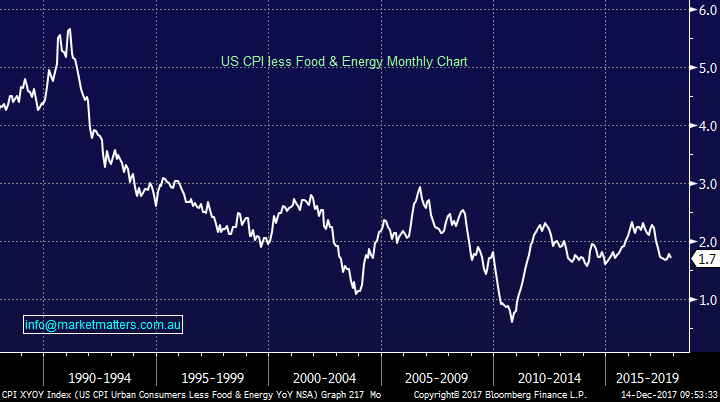

We believe global inflation is a wild card as it remains stubbornly low, last night’s US CPI print of 1.7% ex. Food & energy compared to the expected 1.8% was yet another example of this. At this stage inflation hovering around 2% is no threat to equities but what if 8-9 years of aggressive Quantitate Easing (QE) kicks into wages for example, global central banks will definitely struggle to contain the inflation beast.

Europe and Japan are still stimulating their economies while the US raises rates and most economists agree things are improving. It feels to me these guys are behind the curve and have fallen into a multi-year money printing habit which may just bite them down the track. Countries like Germany are almost overheating, if inflation accelerates too fast we believe it will more than likely derail the current second longest bull market in history. Hence, we are watching these reads very carefully.

US Inflation Monthly Chart

Global Indices

US Stocks

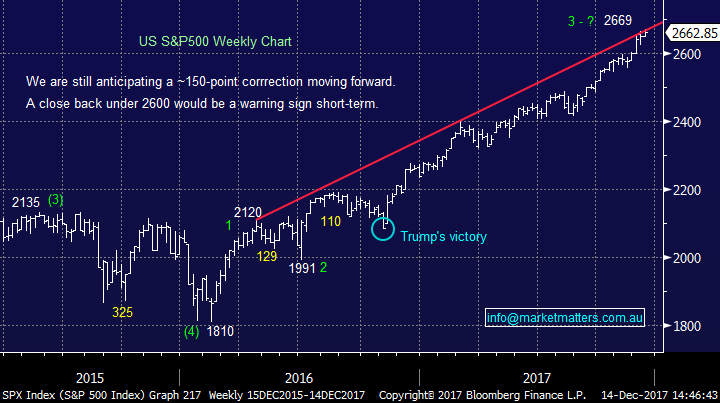

US equities are following our recent thoughts where the selling of any new all-time highs if / when they occur has paid dividends at least for 24-48 hours as the market slowly looks for a top. Overall there is no change to our short-term outlook for US stocks, where we would advocate patience ideally targeting a ~5% correction for the broad market to provide a decent risk / reward buying opportunity.

US S&P500 Weekly Chart

European Stocks

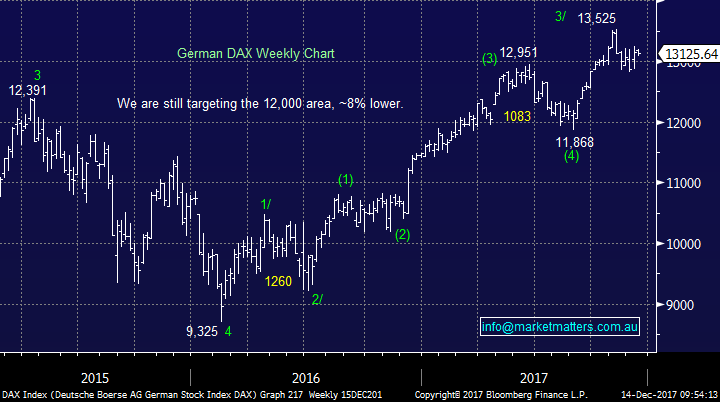

No major change with our preferred scenario for the German DAX a 7% correction back towards the 12,000 region.

German DAX Weekly Chart

Conclusion (s)

Be patient and look for strength in local stocks for the opportunity to increase cash levels.

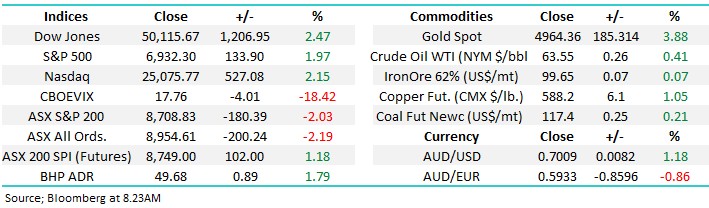

Overnight Market Matters Wrap

· The US markets reached new highs prior to giving back most of its gains overnight, as the US Federal Reserve increased its key interest rates by 0.25% as widely expected.

· The Australian dollar bounced from the US75c handle back towards US76.34c following the recent US CPI data indicated to ongoing low inflation which may alter the US Fed’s rate hike anticipation of 3 times in 2018. Traders earlier in the week viewed only 2 rate hikes in 2018 at present.

· Aside from US data, congressional leaders noted that a tentative agreement has been made on a tax overhaul package, markets gave most of its gains as the details have yet been provided, so risk off the table is the current stance.

· The December SPI Futures is indicating the ASX 200 to open 25 points higher towards the 6045 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/12/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here