The Fed has spoken – rates lower for longer, buy Gold (HVN, APX, NCM, EVN)

The ASX200 managed to reclaim early losses to close marginally higher on Wednesday, solidly almost 1% off its low as the Healthcare & IT stocks found some love again. MM felt the mean reversion in sectors was overdue as we alluded to in yesterday’s International Report, even when a markets in the very mature phase of a trend it fights hard to maintain its momentum before finally gives up the ghost usually in fairly dramatic fashion – aka the Australian growth stocks in Q4 of 2018 when all the momentum traders appeared to bolt for the exit doors at once on the expectation of higher interest rates.

With winners & losers evenly matched on Wednesday the market provided us with little fresh information come 4pm except simply reinforcing the characteristic that there remains plenty of buyers of dips. As is always the case the buyers of dips will win “until one day” but considering MM is bullish medium-term it’s our opinion that a deeper pullback if it unfolds in June / July is still a buying opportunity. Today will be an interesting test given the influential banking sector was hit hard overseas on the back of Jerome Powell’s commentary.

As subscribers know in our opinion the best place for the majority of investors’ funds will be the “Value” end of town when the market does finally pull back, however that doesn’t mean we’ll completely shun selective growth opportunities, some companies will of course run their own race such as Trade Desk (TTD US) which has again made fresh all-time highs overnight, as did Apple (APPL US), Microsoft (MSFT US) & Tesla (TSLA US).

This morning we have dissected the Feds statement from overnight because it will dictate the $$ supply side of the equation which has fuelled the markets recovery from the hefty losses in March.

MM remains bullish equities medium-term

ASX200 Index Chart

Retailer Harvey Norman (HVN) surged over 7% yesterday to levels not enjoyed since early March. The catalyst was Gerry & Co. delivering a 6c special dividend offsetting some of the disappointment felt when they pulled their scheduled 12c interim payment at the height of the pandemic. The retailer saw local sales boom with the rush for electronics helping local sales rise 17.5% in the second half. Unfortunately, overseas trade didn’t fare as well with many stores closed for extended periods weighing on performance, many locations are in fact still closed.

We believe the important takeout from this decision by HVN is the potential knock-on effect across the ASX as a number of businesses are likely to follow suit in the coming months, correctly identify a few candidates and outperformance feels a strong possibility i.e. the key being who held back on dividends out of prudence as opposed to necessity.

MM likes HVN technically into its next 30c pullback.

Harvey Norman (HVN) Chart

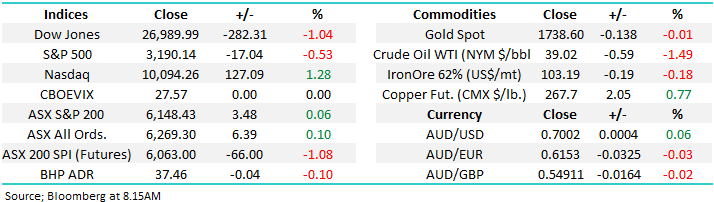

Earlier we mentioned that the IT Sector was likely to fight tooth and nail to maintain its performance dominance hence we cast a quick glance across the sector especially as the US NASDAQ again made all-time highs overnight. Appen (APX) caught my attention after its quick 12% decline as the buyers flocked to the banks with some flighty players undoubtedly switching between the 2 groups, we can envisage the “fast money” again chasing the long-term trend in the next few weeks sending APX towards $33 but if we are correct it may then be time to reduce exposure and sit back and observe.

Also, we shouldn’t forget that last week we witnessed profit taking by a few members of the board from this artificial intelligence data provider, they cited both a “number of personal reasons” and the directors favourite “tax obligations”. Whatever the reason we weren’t phased by their cashing in some chips considering they steered this ship to all-time highs only a few months after the coronavirus pandemic – we can now see a fairly tight trading range between $29 and $33 for at least a few weeks.

Technically APX looks set to target $33 before MM would become cautious i.e. 10% higher – short term trade potential

Appen (APX) Chart

The Fed & overseas markets

This morning the Fed pointed to zero interest rates until ~2022 while committing to maintaining their bond buying program overall, we feel their statement drops into the market neutral corner from the 3 potential scenarios we identified in the Afternoon Report:

Neutral for stocks: No change to interest rates or QE, with the Fed saying they’ll continue asset purchases “in the amounts necessary” and the dots show no rate hikes through 2022. This is broadly what’s expected by markets, and this outcome is largely priced in.

The Fed chair was fairly pessimistic towards the global economy suggesting the pandemic could inflict “longer-lasting damage on the economy” even as the Fed signalled its intention to maintain rates around zero for years to come. A definite huge tailwind for stocks but not a surprise to the market. Interestingly Treasury Secretary Steve Mnuchin said the US “definitely” needs additional fiscal stimulus but while we did see a volatile session in US markets it was Jerome Powell who had centre stage.

Below are the key 5 market takeout for MM.

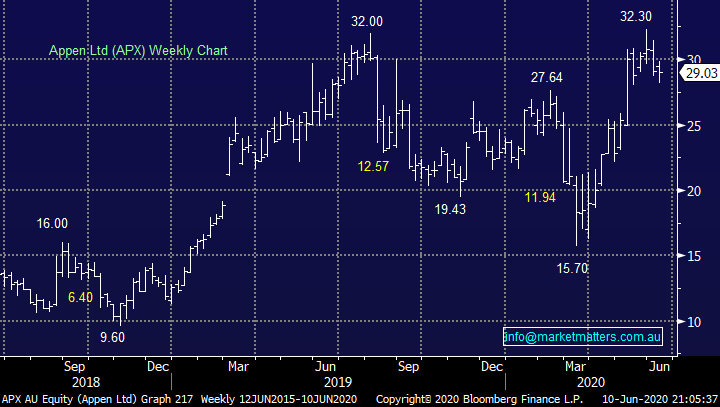

1 Interest Rates

Bond yields followed the expected path on Jerome Powell’s update with the “lower for longer” key take out sending US Bonds up and yields subsequently down. All very logical and until we see the US economy kick back into gear with some gusto and inflation raise its head, we might see the likes of the US 30-year yield oscillate around 1.5% for months to come.

US 30-year Bond Yields Chart

2 Stocks

US stocks had a mixed night with the key S&P500 slipping -0.5% as no surprise positive news was forthcoming whereas the tech based NASDAQ surged +1.3% through the psychological 10,000 level on the outlook of lower interest rates – in the bigger picture we believe the NASDAQ is showing the path of least resistance but until we see some economic stability / pick-up traditional valuations are undoubtedly stretched.

MM remains bullish global stocks medium-term but short-term they still feel “rich” or vulnerable to a pullback.

US NASDAQ Index Chart

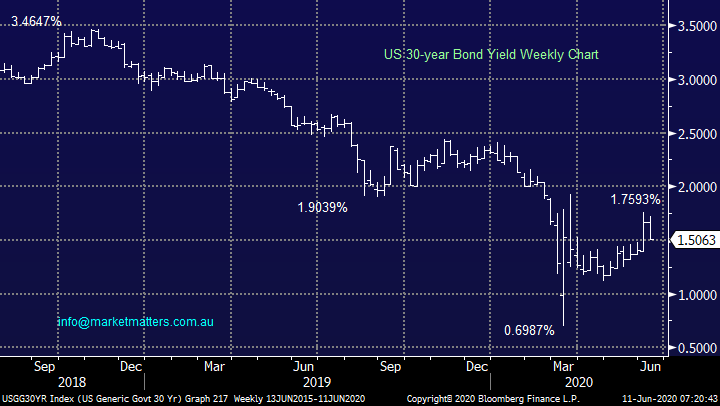

3 Sectors of stocks

US growth stocks trumped value on performance overnight following the Feds outlook for interest rates, we feel this is likely to be the final stretch in the post COVID-19 outperformance by the sector but it might as always go further than many anticipate.

MM believes this is the start of the last leg of outperformance by the Growth Sector.

US Value & Growth Indices Chart

4 Currencies

The $US slipped lower thanks to the Feds downbeat outlook for their economy but the growth currency the $A maintained most of its recent gains hovering around the 70c mark – we continue to believe the $US will fall in the next few years and the $A will challenge the 80c region.

MM remains bullish the $A.

The Australian Dollar ($A) Chart

5 Base Metals

Base Metals did their own thing over night which makes sense as the Feds influence doesn’t match the underlying supply / demand impact on prices. The standout to us was Copper which rallied strongly even on a dour economic outlook from the Fed while oil was also strong gaining +1.3% but the US Energy Sector tumbled almost 5% - they must have expected more.

MM remains bullish commodities for the next 1-2 years.

Copper Futures ($US/lb) Chart

6 Gold

This brings us to Gold and a longer term thematic that we expect to play out following the Federal Reserve’s declaration of lower rates for longer. The Fed Dot Plot overnight (which shows committee members expectations for interest rates) showed expectations that rates will be below the level of inflation until at least 2023, which is known as negative real rates.

Gold and other stores of value typically do very well during periods where inflation is above official cash rates. While it’s not often that we get to map out a multi-year view on an equity/commodity, the negative real rate and gold price journey will likely be a multi-year phenomena that we should be very conscious of, and it is this thematic that is underpinning our positive stance towards gold and gold equities, despite the fact we still don’t own any (yet)!

At MM we think the Gold price and Gold equities will rally over the coming years and we’re now looking for optimal entry.

Overnight Gold rallied +1.5%.

Gold Spot ($US/oz) Chart

Newcrest (NCM) screens cheapest on pretty much all metrics however their performance in recent years has clearly been underwhelming relative to the underlying commodity.

MM is neutral/bullish NCM

Newcrest Mining (NCM) Chart

Evolution Mining (EVN) has been a much better way to play gold strength in recent years.

MM likes EVN below $5.00, although we may pay up for an smaller initial weighting.

Evolution Mining (EVN) Chart

Conclusion (s)

No great surprises by the Fed, it will be interesting to see if the broad market and our local banks can remain firm in the face of interest rates “lower for longer”, we suspect they may struggle short term.

We are bullish gold in the medium term, looking for optimal levels to get exposure to this view.

Overnight Market Matters Wrap

- The tech. heavy, Nasdaq 100 outperformed overnight and making fresh highs while the Dow and broader S&P 500 ended down

- The US Federal Reserve meeting left rates unchanged and said it expected rates to remain near zero until 2022. It plans to continue to provide support for the US economy at the current levels, predicting a 6.5% slump in GDP this year and unemployment of 9.3% by year’s end.

- The OECD also predicted a slump in global growth of 6% this year but said Australia was one of the best placed economies to emerge from the virus related crisis with GDP forecasts to fall 5% this year followed by a 4.1% recovery next year

- Commodities were generally stronger with copper leading the way, currently sitting near 4-month highs at US$267.7/lb.

- The June SPI Futures is indicating the ASX 200 to open 85 points lower, testing the 6065 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.