That was carnage, do we retreat?

Yesterday the ASX200 was absolutely smacked falling over 2.3%, a significantly greater fall than Asia and even over the ditch in New Zealand. The problem from a points perspective was the banks which had performed strongly over recent weeks but not at the start of this week where the average decline of the “Big Four” was ~3%.

The huge underperformance from our local market and especially the Finance Sector appeared to be from a perfect 1-2 combination of ASIC / APRA regulatory issues and escalating concerns around the Australian housing market, while falling bond yields globally haven’t helped. Sentiment is reaching a frenzy with the media certainly pushing from the doomsday corner, it’s easy to comprehend why any buyers sat well and truly on their hands yesterday.

I’m not sure if we have many Monty Python fans with MM but Mondays tumbling market reminded me of a classic line from their movie the Holy Grail i.e. “runaway, runaway!” – on exhausting negative days like these we have to try and smile.

MM mildly remains bullish the ASX200 short-term targeting a “Christmas rally” but we need to see a close above 5600 to reignite our confidence.

Overnight markets were volatile with Europe closing down around 1.5% while the Dow rallied strongly from being down around 500-points early on to close positive with the standout buying emerging in the tech / growth based NASDAQ index which closed up over +1%. Unfortunately with BHP closing slightly lower our SPI is only calling the ASX200 top open up around 20-points, hardly a dent in yesterday’s 128-point fall – it feels like some left over selling is around.

Today’s report is going to focus specifically on how we are planning to deal with our MM Growth Portfolio as the local market tests 2-year lows.

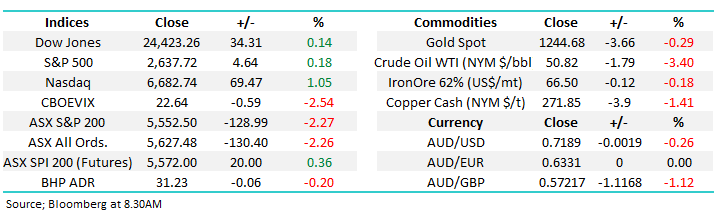

ASX200 Index Chart

At MM we must remember our medium term bearish view for stocks, both global and local into 2019. That bearish opinion was mocked by many at the start of the year when industry plaudits were targeting 6500 and even 7000 for the ASX200 by Christmas. However here we are closing almost 13% below Augusts high and our 5000 target feels almost weeks away! We remain comfortable with our eventual downside target but the question remains do we bounce first?

In both of the major +1200-point declines since the GFC the ASX200 has managed a reasonable “bounce” during its decline, on the monthly chart shown below the current 824-point / 12.9% correction has not enjoyed a vague reprieve, although as we know it did manage to bounce 317-points in October.

Hence the MM quandary:

We are bearish medium-term but still believe a decent bounce is a strong possibility although we would be delighted with anything near 5900 at this point in time.

ASX200 Index Chart

If we stand back and look at the ASX200 Accumulation Index since the GFC the first thing that catches our eye is this pullback is hardly significant and it feels likely to have further to unfold before it even tests the uptrend / support channel i.e. at least another 4% to fall.

ASX200 Accumulation Index Chart

Global equities have literally had the kitchen sink thrown at them over recent weeks from a potential escalation of a US-China trade war, collapsing BREXIT negotiations and increasing concerns about a US recession in 2019/20 – plus of course locally housing remain front and centre. We do like to consider risk assets when everyone else is negative although it was clearly not the horse to be riding yesterday.

Overnight the US S&P500 made a fresh 10-month low before rallying strongly and amazingly generating a bullish technical signal by closing back above 2630.

MM is now bullish the US S&P500 into 2019 unless last night’s low is broken, which provides a more bullish / optimistic read through for Aussie stocks than the technical picture above would imply

US S&P500 Index Chart

Looking closely at the MM Growth Portfolio

Firstly lets break down our Growth Portfolio into groups that we may sell / add to in the days / weeks ahead:

1 Banks – CBA, Westpac and NAB for 30%.

2 Insurance – QBE and Suncorp for 8%.

3 Telco’s – TLS for 7%.

4 Finance – Janus Henderson and Challenger for 8%.

5 Resources – RIO, Western Areas, Newcrest and Orica for 18%.

6 Emerging Markets (IEM) for 5%.

7 Healthcare – CSL, Cochlear and Ramsay Healthcare for 9%.

8 Growth - Aristocrat, Xero, Altium and Appen for 14%.

9 Cash 1%.

Clearly we are uncomfortably long a market we believe will fall another 10% in 2019/20 and our aggressive purchases in October when the market plunged towards 5600 may prove premature. MM was looking to add value / alpha targeting a rally at the time towards the 5950 area which did unfold, however we gave the market the benefit of the doubt believing a Christmas rally could take us above 6000 - this now feels very unlikely.

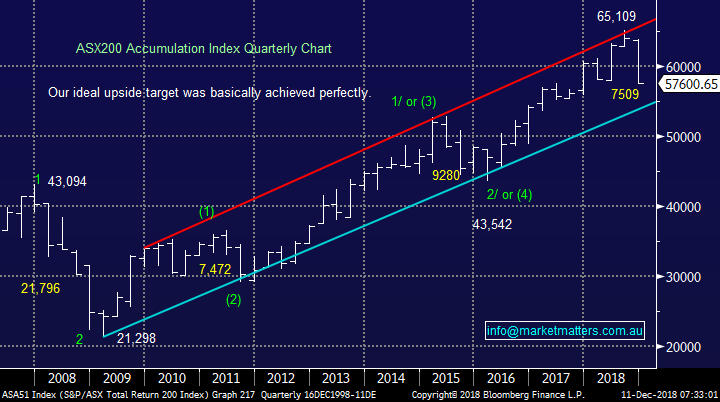

1 Banks

We remain comfortable with our slightly overweight banking exposure. Our feeling is the regulatory and housing concerns are pricing in a disaster and the room for surprises is actually on the upside.

MM is not considering reducing our banking position at this point in time.

Commonwealth Bank (ASX: CBA) Chart

2 Insurance Stocks

We own both SUN and QBE in the sector, we have been looking to exit both positions into strength which has not materialised. The likelihood is we will sell one or both of these holdings in the next few weeks.

MM is considering selling our SUN or QBE position.

Suncorp (ASX: SUN) Chart

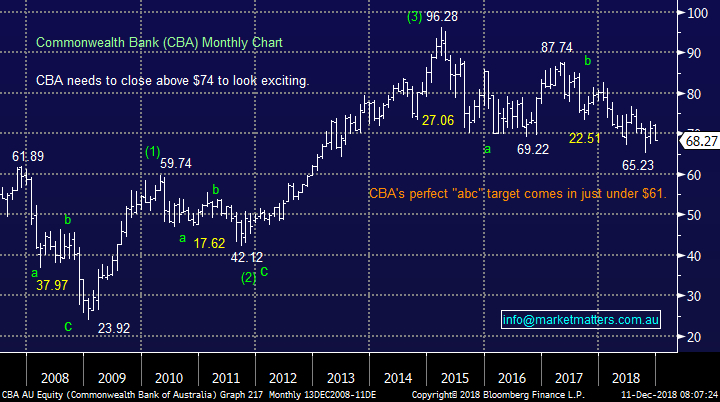

3 Telco’s

We own TLS in the sector and continue to believe it will outperform in 2019 / 20.

MM not considering selling TLS at this stage.

Telstra (ASX: TLS) Chart

4 Finance Stocks

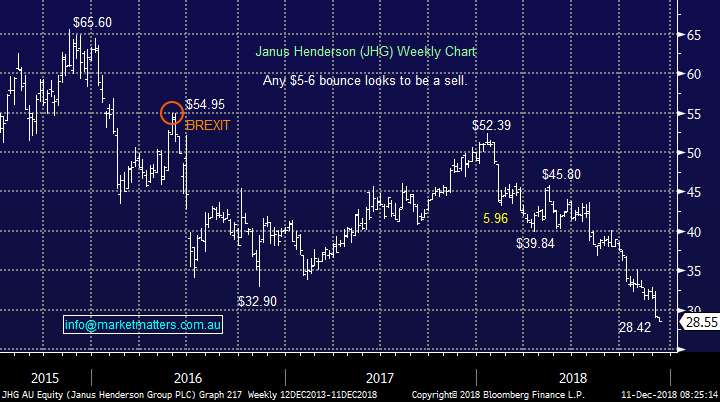

We own Janus Henderson and Challenger in this battered sector with JHG causing us some real discomfort as BREXIT falls apart in front of our eyes – politicians!

MM is considering selling JHG in the coming weeks.

Janus Henderson (ASX: JHG) Chart

5 Resources / Materials

We own RIO, Western Areas, Newcrest and Orica for a reasonable 18% market weighting. We have been considering increasing this exposure into weakness hence we‘re comfortable to give the positions more room.

Yesterday NCM closed up +1.57% hitting our short-term target of a new high above $21.56, albeit only just in yesterday’s weak market.

MM is considering taking a small profit on our 3% holding in NCM this morning.

Newcrest Mining (ASX: NCM) Chart

6 Healthcare

MM owns CSL, Cochlear and Ramsay Healthcare for a 9% exposure to the sector.

We clearly pulled the buy trigger early with both CSL and COH but over recent days they have shown their ability to bounce strongly from depressed levels.

MM is not currently considering selling these stocks at today’s levels.

CSL Ltd (ASX: CSL) Chart

7 Emerging markets (IEM)

We currently have 5% exposure to the Emerging Markets (IEM) in our portfolio.

MM is considering selling our IEM position around 5% higher at this stage.

Emerging Markets (EEM) Chart

8 Growth stocks

Following MM’s recent aggressive purchase of this sector we hold 14% of our Portfolio in growth i.e. Aristocrat, Xero, Altium and Appen for 14%.

Our plan remains to sell into a further strength.

MM not considering selling these 4 stocks at current levels.

Appen Ltd (APX) Chart

9 Cash

MM is looking to increase its cash position in the weeks ahead.

Conclusion

We are now bullish US stocks, at least in the short-term which provides a more constructive backdrop for local stocks than the technical picture would imply

Stocks in the MM Growth Portfolio which are first on the chopping block, to increase our cash levels are:

1 Newcrest Mining (ASX: NCM) – probably today.

2 Suncorp (ASX: SUN) we are looking to sell.

3 Janus Henderson (ASX: JHG) we are looking to sell.

Overnight Market Matters Wrap

· Another volatile session overnight in the US, with the Dow falling over 500 points early in the session, only to recover with all 3 major indices closing in positive territory, led by the tech heavy, Nasdaq 100.

· Across to the European region, European markets were under pressure after UK PM Theresa May announced she would pull the vote and go back to Brussels to try to negotiate more acceptable terms to get the support of her party. The UK market fell~ 0.8% while the German Dax and French CAC markets lost ~1.5%.

· Commodities also retreated with the oil price tumbling 3.4% as the market digested the OPEC production cuts announced at the weekend, while base metals and gold were also generally easier.

· The December SPI Futures is indicating the ASX 200 to open 16 points higher, testing the 5570 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/12/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.