Subscribers questions (KDR, HLS, VOC, CBA, LNK, BLD, WOR, SGM, TLS, MXT, NBI, BIN, WSA)

The AX200 remained “in the bullish groove” last week testing the psychological 6600 area and making fresh decade highs in the process. Equities are undoubtedly revelling in the decreasing bond yield environment with our own closely monitored 3-years closing on Friday at 0.98%, below 1% for the first time in history – its hard not to like stocks when term deposits are only paying ~2% with many forecasting they could be closer to 1% in 12-18 months’ time.

Over the weekend 2 pieces of news caught our attention and in both instances they should add some extra optimism to this week’s early trade:

1 – The Australian housing market appears to have been sparked back to life by the combination of a Liberal election victory, changes to serviceability standards and the RBA cutting interest rates to 1.25% - auction clearance rates look set to finish above 60% for the first time in over a year.

2 – Chinese President Xi Jinping has made a conciliatory backflip on Hong Kong ahead of the G20 meeting, potentially a sign of flexibility moving forward with US – China trade talks next week.

MM remains bullish the ASX200 while it can remain above the 6500 area plus overseas indices look ok short-term.

We have again received a great number of excellent questions, please keep them coming!

ASX200 Index Chart

The below chart illustrates perfectly the greater than 50% decline in Australian 3-year bond yields since November 2018, a tremendous example of when a markets caught on the “wrong foot” i.e. all the worries were around rate rises in late 2018.

Prior to the latest dive in yields the 3-years were trading around 2% for ~1 ½ years and this is what we anticipate will unfold again – the market will decline to a new level of equilibrium before consolidating for many months. The million dollar question is clearly how far will they fall, especially as we now know the logical 0% is not a floor as the equivalent German bonds are yielding almost -0.7% (yes minus).

To clarify any confused subscribers this means you invest in German bonds and you are guaranteed to receive less money back – again making Australian equities look good.

MM expects the ASX200 to remain firm until the below downtrend is complete.

Australian 3-year bond yields Chart

Last week we touched on FedEx shares saying “this weeks likely to see the stock make fresh 2-year lows”, in hindsight only just. While the global package and freight deliverer has been unpopular with investors we now believe the risk / reward has returned for the buyers, it would certainly bounce on good news from US – China trade talks.

FDX now looks an aggressive buy targeting ~20% upside, back towards its April highs.

FedEx (FDX US) Chart

Question 1

“Hi guys, Just signed for another three years with MM. Great service and your advice has paid for your subscription time and time again. Sometimes your advice is a tad conservative, ( I am still holding ALU with $5k profit) but I guess better than too aggressive. I have $2k and $8k profit sitting on HLS and KDR respectively. Both companies subject to offers. What benefits do I gain if I retain these two stocks, if the probable outcome remains where the price is located now? What are the alternatives. A better $ offer? In the case of KDR, I think the Board said the offer was acceptable. Not sure what HLS Board thinking. Or, the offer(s) could be withdrawn, meaning the price will reduce. Or I guess we could be offered a money and shares arrangement? In cases like these, who buys the shares from us? Do we still pay Brokerage? Looking forward to the ETF portfolio. I need some serious hand holding here.” – Geoff B.

Morning Geoff,

Great to read you’ve re-subscribed, we really appreciate the thumbs up and support. I will obviously split your question in 2 with one fairly easy answer followed by a slightly trickier scenario:

1 – Kidman Resources (KDR) $1.885: Wesfarmers (WES) bid $1.90 for KDR in early May and this appears to be a “done deal” with both parties happy, we see no reason in owning KDR shares less than 1% below the takeover bid.

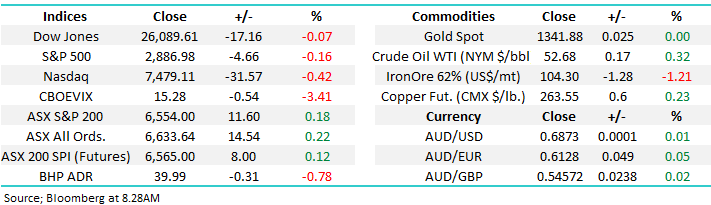

2 – Healius (HLS) $3.16: Jangho Group previously bid $3.25 for Healius (HLS) which was quickly rejected by the board so this is all about whether a new higher bid will come in from the Chinese company. In May rumours were circulating that Jangho, who already own 15.9% of the medical & pathology centres, were seeking $1.5-2bn from private equity which may well be directed at HLS. We are watching the sitcom carefully but at this time we feel a higher bid is likely.

MM remains positive on HLS in anticipation a higher bid in 2019.

Healius (HLS) Chart

Question 2

“Hi MM, I have a parcel of VOC shares that I bought after the last failed bid. Given that this is the second attempt by AGL do you think it is worth holding on for a binding agreement at the price of $4.85.” - Cheers, Brad H.

Hi Brad,

The market clearly doesn’t believe AGL’s bid for VOC has a high likelihood of success with the stock closing ~10% below the $3bn bid. The concerns are around the results from the pending due diligence, the period in the takeover cycle when European private equity business EQT walked away from its $5.25 bid.

This scenario is all about risk reward, on the upside we have around 50c but if AGL walks away like EQT the fall is likely to be more. However AGL appear keen on VOC with this being their second bite at the cherry but on the flipside we have already had 3 private equity firms over the years come and then go on the bid side, its feeling like now or never for VOC with my “Gut Feel” this offer will go ahead.

MM is neutral VOC at present.

Vocus (VOC) Chart

Question 3

“Amazing how the ASX is approaching all-time highs! Interest rates at 1.5% for over 30 months couldn't get the economy going. Apparently even lower rates will do the trick though - really? Surely it's just like pushing on rope at this point in time! Global economy is also clearly slowing, yet the market still goes higher! But apparently the RBA rate cuts will save us? The economy is fast approaching "life support" rates (less than 1%). The problem is too much household debt - apparently the solution is more debt via lower rates - madness! Lower rates are just likely to (1) encourage some people to borrow more; or (2) enable other households to repay their high mortgage faster. 'Some' money may flow into the economy - but the recent history suggest that this won't be enough to get the economy going. Houses are still way too expensive, and household debt is still way too high.

Here are my predictions: Interest rate will go lower, house prices will also go lower, GDP growth will slow and the ASX - will continue to go higher (no it actually won't!) ” – thanks, Scott T.

Hi Scott,

We do live in an interesting economic world with many moving parts and “financial engineering” but with investing obvious logic is not always the best path.

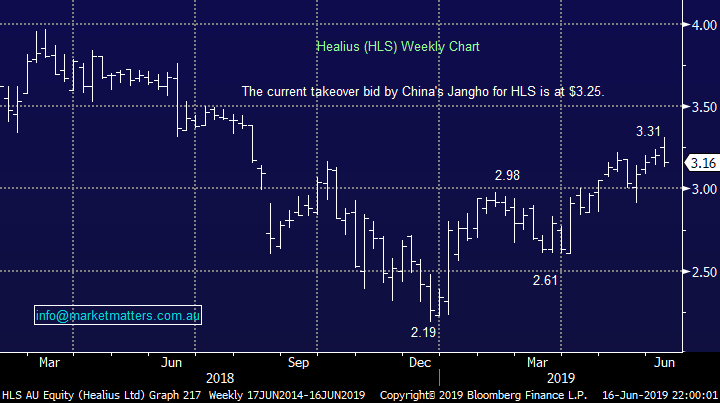

At MM we simply believe its not the time to fight the tape with the post GFC bull market still clearly intact. Over the last decade numerous macro concerns have threatened stocks from a US debt downgrade to BREXIT and of course a potential US – China trade war but while stocks may have wobbled for few months the uptrend has remained intact. The US S&P500 and VIX charts illustrate this phenomenon perfectly.

At MM we believe its time to be slowly increasing our cash levels into market optimism but no reason to panic has yet unfolded.

MM remains short-term bullish stocks but we are always flexible to evolving conditions.

US S&P500 Chart

US VIX (Volatility Index) Chart

Question 4

“Hi James & M&M, with regards to the banks, M&M have a buy recommendation for each of them. Is your expectation that they will all reach and exceed their entrance levels? Also with NAB lagging behind the other 2 would you recommend buying Nab at its current levels if you had to choose between the 3 of them? Thank you and keep up the good work.” - Tony. K

Hi Tony,

The banks have enjoyed 2019 with CBA rallying well over 20% from its late 2018 lows. Its important not to lose sight of the healthy fully franked dividends on offer from this group with CBA paying ~$4.20 pa since its top in 2015 hence if we were to actually to include this income into the equation on an accumulation basis CBA is actually trading close to its all-time high before the benefits of franking.

The banks are yielding strongly as bond yields / interest rates continue to fall with the “Big Four” paying from CBA at 5.4% ff to NAB at 6.8% ff. Our holdings actually reflects our current view on the group i.e. a mix makes more sense than all our eggs in one basket – we are long CBA, NAB and WBC.

NB The next dividend by the group is payable by CBA in August, around $2.

MM remains positive the banks, especially on a relative performance basis.

Commonwealth Bank (CBA) Chart

Question 5

“Hi, Does MM have a view on LNK? Looks interesting with the price drop.” – Julien K.

Hi Julien,

Link Admin (LNK) certainly has experienced a price drop, the record keeping technology and information solutions business warned the market last month of its tough trading conditions downgrading earnings - the stock reacted accordingly.

The companies UK businesses have suffered like many due to BREXIT uncertainty and while that may slowly be reaching a conclusion its unlikely to be without further volatility. We simply have LNK in the too hard basket at present, especially as its not particularly cheap trading on an Est P/E of 15.1x.

MM is neutral LNK.

Link Admin. (LNK) Chart

Question 6

“Hello James and the Team. Recently you gave a Commentary and opinion on (BLD) Boral. The Share Price had fallen to a Low of $ 4.40 on the 27 March, due to slowing Residential Property Markets, weak Infrastructure and it’s US performance. Since then it has risen to $5.40 following the Investor Day Presentation on 31 May, 2019 on strong Momentum and Volume, with Broker calls rating a Strong Buy. With a Dividend Yield of 5.0 -5.2%, with 50% Franking, it offers a compelling inclusion for SMSF’s suffering on -going decline in Fixed Income. If my recollection is correct, your opinion at the time of your Commentary, was that Boral was unlikely to meet its Guidance for the Second Half of 2019 and that now was not the time to Buy. I have held off buying the Stock and ask if you still expect Boral to miss it’s guidance come the Annual Report announcement in August 2019?” – Thanks Richard O.

Hi Richard,

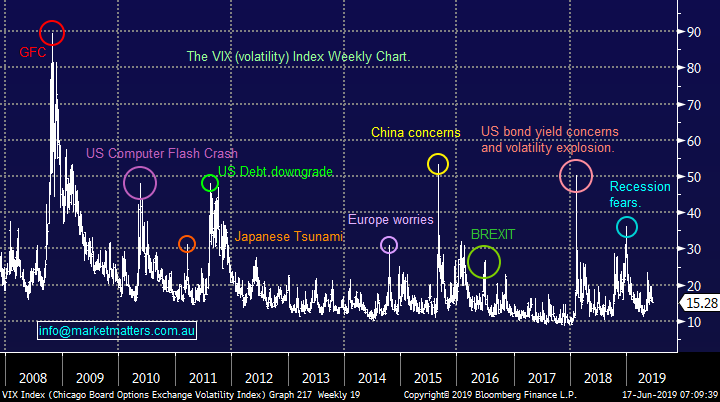

Boral (BLD) has enjoyed a bounce post the election and following the recent rate cut but the recovery is relatively small compared to its decline from above $8.

We can still see disappointment for the company in August as building activity declines with the main question being how much is currently factored into the stock. Technically the shares have bounced towards $5.50 as we expected and they are now neutral on a risk / reward basis. We see better value elsewhere – CSR is the stock we hold in the Income Portfolio exposed to building.

MM is neutral BLD at current levels.

Boral (BLD) Chart

Question 7

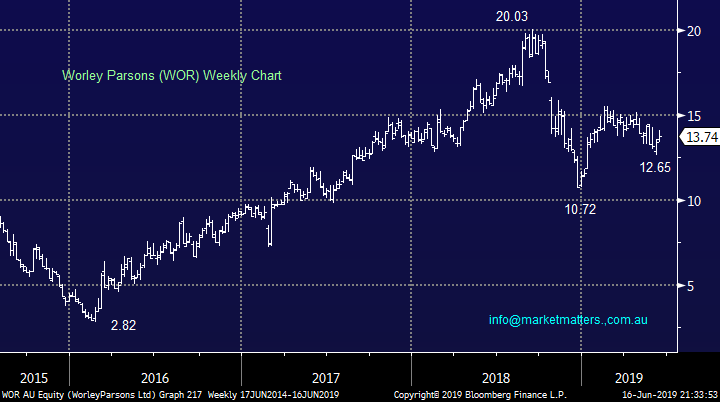

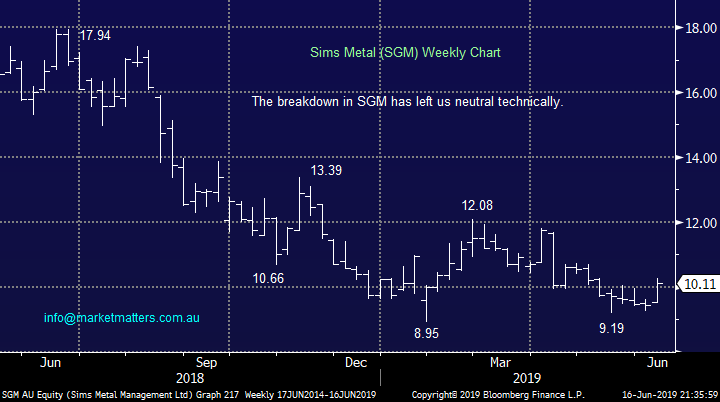

“Can I please have your thoughts on WOR & SGM please. I see a number of brokers now have price targets of approx. $20 on WOR. What do you see as a buy in price range.” - Thank you Ian.

Hi Ian,

Two stocks that have struggled in the last year with our opinion different on both.

Worley Parsons (WOR) $13.74 – The engineering company’s shares have struggled following their $4.55bn acquisition of Jacobs Engineering Group’s Energy, Chemicals and Resources division. However over the last 6-months the stocks calmed down and we believe it’s now providing a reasonable risk / reward opportunity for investors prepared to accept 9% downside potential.

MM likes WOR with stops below $12.50.

Worley Parsons (WOR) Chart

Sims Metal (SGM) $10.11 - has endured a tough 2019 disappointing ourselves who felt the stock was poised to revisit its $13 pre-Christmas levels. The main issue in recent months occurred after the business announced plans to target longer term growth at the expense of near term capital management - our yield hungry market was looking for capital returns (special dividends / buybacks) hence the stock was thrown in the naughty corner. We actually like their plans / outlook it’s a matter of gauging when the market also embraces their mantra of a “world without waste”.

MM is currently neutral SGM.

Sims Metal (SGM) Chart

Question 8

“Hi James Thanks for your excellent report ...in Friday's report you briefly touched on TLS and mention that you are reassessing the decision to sell TLS ...for those of us that have still hung on ..what is the recommendation ...is there a price target that you feel can be identified for this move up...it just appears to want to continue going higher at present (a welcome change).” – Don H.

Hi Don,

Thanks for the thumbs up! Telstra (TLS) is looking good and as you noted at MM we are looking for an optimum re-entry level – we are unafraid to buy back into stocks at higher levels than we exited although it’s never our intention!

We like the business even in today’s competitive environment and the boards current plans moving forward look to be ticking all the correct boxes plus of course the fully franked dividend is now at a more sustainable level and attractive when compared to the RBA cash rate of 1.25%.

MM is now bullish TLS looking for an optimum level to re-enter.

Telstra (TLS) Chart

Question 9

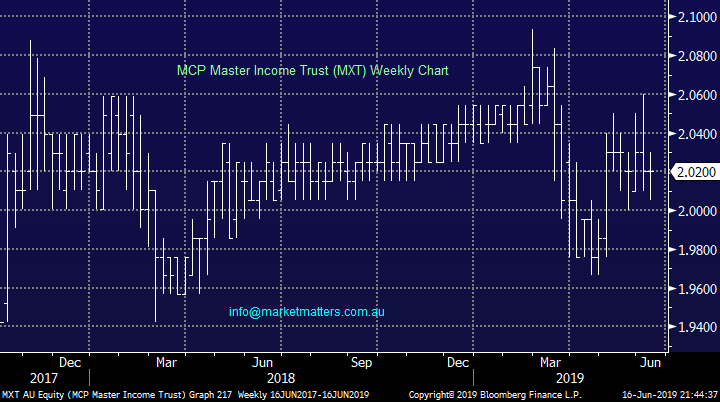

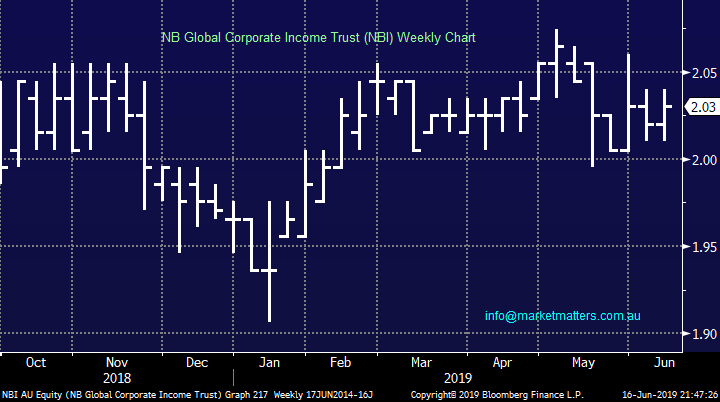

“Dear All, how would you compare MXT with NBI please? Thank you and warm regards” - Victor K.

Morning Victor,

MXT invests in mostly commercial mortgages while NBI holds mostly international bonds. Refer to this income note for a more in-depth discussion of them: https://www.marketmatters.com.au/blog/post/income-report-a-look-at-3-new-deals/

MCP Master Income trust (MXT) Chart

NB Global Corporate Income Trust (NBI) Chart

Question 10

“Hi Guys, 2 weeks ago you wrote: "Our major concern as we kick of June is EOFY (end of financial year) selling we have a number of stocks in our “dog group” that could easily have a tough time in June as investors lock in some losses, hence MM is considering seriously sweeping the decks of all / some of Bingo (BIN), Pact Group (PGH), Ausdrill (ASL) and Emeco Holdings (EHL)" In the end, to my great relief, you did not send out Sell alerts on these stocks.

When we bought into these stocks we bought in based on the fact we deemed them oversold based on fundamentals, yet when you considered selling, the fundamentals had not changed much. The technical picture may have, although the trend was mostly down when we bought. But surely when using the out of favour "dog stock" philosophy you don’t sell as the stock falls more out of favour, else it makes a mockery of the basis for buying in the first place.

An oversold dog stock is always going to be closer to its bottom than when it was flying high, surely. Anyway, glad we didn't sell, because that day was pretty much the bottom for PGH, ASL and EHL, with ASL, BIN and PGH all rising nicely since, and looks like EHL is ready for a gallop.

One more related question.... $2.10 was your target for BIN, which is now at $2.11. Brokers have issued upgrades, and I am thinking that an increase in waste fees in Qld could slow the transfer of waste from NSW. And now with the recent Chinese and Malaysian rejection of our waste, this will open up the potential for domestic recyclers to fill this void, surely. Bingo looks like it has further to run. What is your current thinking on this?” - Thanks, Charlie

“Just a quick question about the MM holding in BIN. Last week on Livewire ( " 4 Big Shorts" ), there were 2 opinions that BIN is now a strong "short", i.e. sell position. Do you have a view ?” - John K.

Hi Guys,

An excellent question / set of thoughts Charlie and at the end of the day we were both on the same page following our decision to stay with our “dogs” but we were becoming a little uncomfortable!

Moving onto BIN which as you both say has met our initial $2.10 target, the number of pundits still negative the business given the risks around the integration of large acquisitions plus the almost 10% short position we believe could be a catalyst to drive the stock higher fairly quickly, like last week. We don’t always strive to be contrarian investors but it can yield great results when you’re correct, this week we will watch BIN closely but we feel there is now a good chance of another ~10% upside. They have an site tour on the 26th July which could be the next positive catalyst to prompt short covering.

MM still likes BIN but are watching the stock carefully.

Bingo (BIN) Chart

Question 11

“Hi MM, are you able to provide your targets for MQG, BIN, CGC, and WHC please." Cheers Nath

Hi Nath,

A quick snapshot answer on the 4 stocks Nath:

1 Macquarie Group (MQG) $122.09 – should follow US indices higher assuming we are correct, we are considering taking a small profit in the $125-$130 region.

2 Bingo (BIN) $2.11 – discussed above, we are giving it a little room for now.

3 Costa Group (CGC) $3.94 – After averaging into the recent carnage we are giving the stock time to find a base and recover. It will take 3+months before we get more insight into earnings here.

4 Whitehaven (WHC) $3.75 – We ae now monitoring carefully following its fresh 2019 lows last week. There was a major shareholder selling out last week, which put the pressure on the stock. It either bounces from here, or we’ll cut it.

Question 12

“Hi James, you referred to WSA in your morning report today as one of the losers . I am interested to know whether WSA is now entering the buy zone.” - Regards Errol K.

Morning Errol,

Nickel producer Western Areas (WSA) was indeed a loser last week and as the below chart illustrates its been a volatile beast over the last few years.

The current downside momentum looks capable of taking the stock to fresh multi-year lows but any panic selling at these levels we believe will provide value hence we have the stock on our watchlist.

MM is interested in WSA below $1.80.

Western Areas (WSA) Chart

Overnight Market Matters Wrap

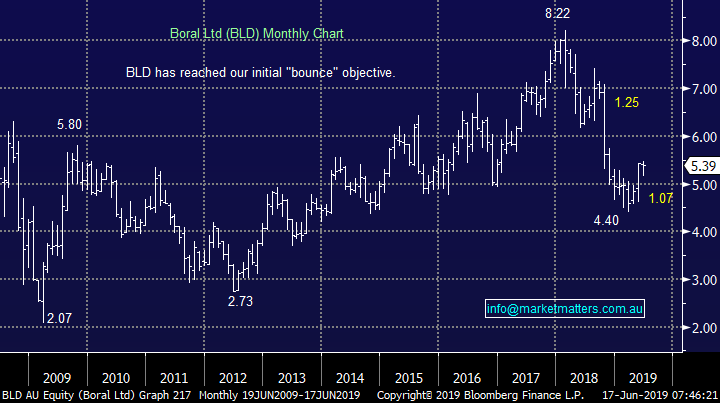

· The US grinded lower on Friday, led by the Nasdaq 100 as US President Trump said he is in no rush to put an end to US-China trade tensions.

· All eyes will be on the Fed this week. No rate cut is expected, but more dovish commentary is anticipated, leaving the possibility of a rate cut in the coming months. Back in Australia, the RBA will release its meeting minutes tomorrow and Governor Lowe will be making a speech on Thursday.

· All metals on the LME, bar nickel, were lower on Friday night, while iron ore eked out a small gain. Oil rose as the US blamed Iran for the attack on two oil tankers in the Middle East last week.

· The June SPI Futures is indicating the ASX 200 to gain marginally higher, towards the 6565 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/06/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.