Subscribers questions

Well here we go again; will it be yet more of the same this week? The ASX200 has now experienced exactly 3-months of trading in the tight range between 5629 and 5836, while a break out undoubtedly feels imminent we have now been thinking that for a few weeks! The local market is due again to open almost exactly in the middle of its clearly comfortable state of equilibrium but a few signs are emerging from US indices that the slumber may soon be coming to an end.

Although this frustrating slumber on the index may continue, we are confident that the recent huge volatility on the stock level will continue as some big names are due to report their earnings including heavyweight miners BHP Billiton (BHP), South32 (S32), Alumina (AWC), and Fortescue (FMG) to name just a few. **FMG has actually just released theirs, missing (slightly) mkt expectations in terms of earnings ($2.09bn) however beating on the dividend which has been the norm this reporting season amongst the miners. FMG gave final divi of 25cps adding to the interim of 20cps, totalling 45cps – well ahead of 37cps mkt expectations. Importantly, dividend guidance provided by the company this morning is a HUGE uplift from current mkt expectations**

Last week even with the ASX200 closing up less than 1% for the week we had 15 stocks finish with a gain / loss of over 5%. Clearly analysts have been caught off guard in a number of instances led by Telstra (TLS) which plunged ~10% after announcing an almost 30% cut to its dividend for the next financial year.

ASX200 Daily Chart

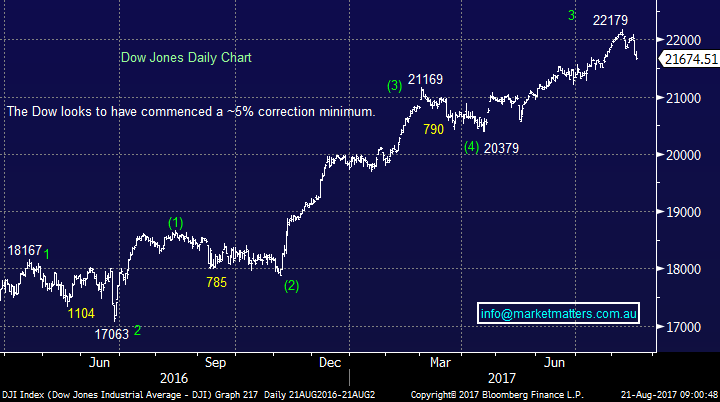

In the Weekend Report, we looked at the S&P500 over recent weeks to ascertain whether we felt a decent short-term top was in place, today we looked at the Dow and not surprisingly the picture is very similar. We again have 2 scenarios we see playing out over the rest of August:

1. The Dow has formed a major top on August 8th and the market is likely to accelerate down ~500-points in fairly quick time.

2. The Dow is going to hold onto its bull market status for a bit longer and a close back over 21,850 will trigger some excellent buy signals i.e. 180-points higher.

Unfortunately, the second half of the equation is will the Australian market actually pay any attention to our US friends, a tough question within itself.

US Dow Jones Daily Chart

Question 1

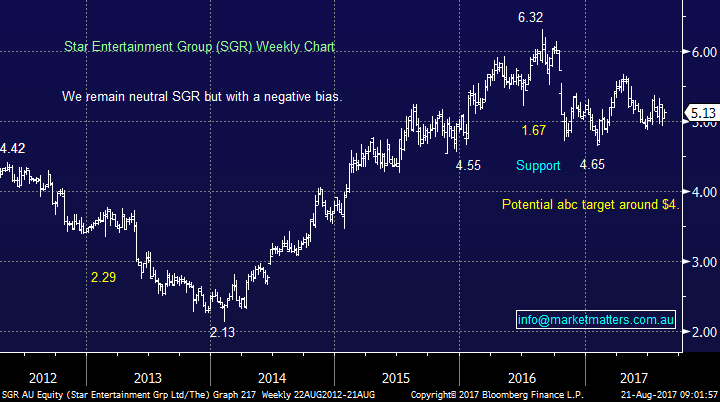

“Hi, James roughly two weeks ago, in one day's morning report, you mentioned you are keen on the SGR and ready to buy it when opening, however, in the morning trade, SGR jump more than 2%, and you didn't press the button to load it. However, during the two weeks trading, SGR was pulled back to low level, what is the reason you didn't buy it again when pulling back. what is your current view about the Star group?” thanks Michael S.

Morning Michael, a great question as this was a stock that the team discussed in length before deciding to remain on the sidelines. As you know we’ve owned Star Entertainment in the past, buying in February of this year at $4.76 and selling in May at $5.61 - we also picked up a nice 7.5c fully franked dividend along the way for a total return of +19.43%.

The stock is obviously in the tourism space which we like and enjoys a strong balance sheet, good future growth, Chinese Tourism, plus the stock has come back to relatively attractive levels having corrected ~20%. However, the combination of the following 3 factors finally led us to pass on SGR, for now:

1. We simply cannot buy every stock and currently only have a 16% cash position in the MM Growth Portfolio.

2. We do remain concerned over the average Australians declining free cash position i.e. spending power.

3. The strong move higher on that day you mentioned, and subsequent failure to hold those levels, makes SGR neutral / negative on the Technicals with a potential $4 target area.

Star Entertainment (SGR) Chart

Question 2

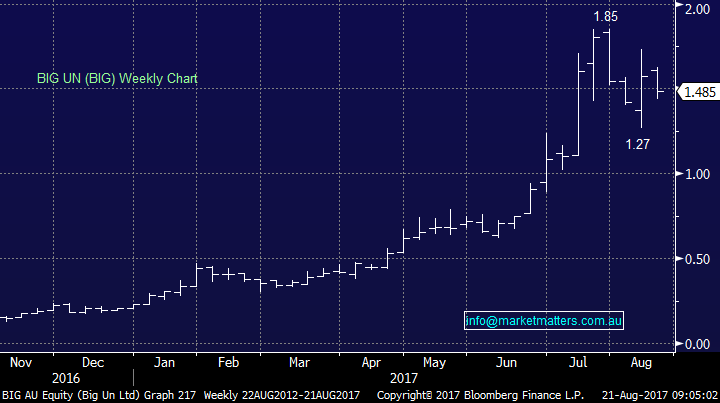

“Hi Team, Enjoyed your reports to-date. Keep it up! I like to have your comments on the stock called "Big Un - BIG" Thanks. Michael C.

Morning Michael, thanks for taking us back into unchartered territory! BIG is a video production and review platform company which operates in the UK and USA as well as locally. I’ve recently bought a new house and the agent I bought through asked me about it straight after the auction – hence, the stock is most likely near a top! This is clearly in the speculative space having tripled since June and then falling ~30% in July / August. Earnings are yet to support the valuation and plenty of blue sky is now factored in. That said, their top line revenue is tracking in the right direction with a recent upgrade of $10m following strong sales growth i.e. a 10% increase on previous guidance and a whopping +50% quarterly increase.

Technically, we like BIG ~$1.50 as an aggressive position but technically a move under $1.20 would concern us.

BIG UN Ltd (BIG) Weekly Chart

Question 3

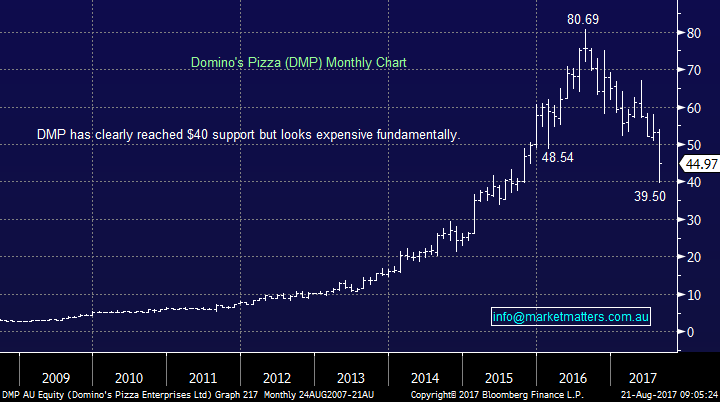

“Hi, following the demise of Domino’s and Telstra last week there was often mention of short-selling in the news, could you explain what this means and can I do it?” Thanks, Steve E.

Hi Steve, certainly a hot subject doing the rounds today following some sharp share price declines during this reporting season. Mainly traders / sophisticated investors short sell companies looking to benefit if the respective shares fall in price but always remember they lose if the shares rally.

Let’s use DMP as an example, a huge ~11% of DMP shares have been sold short, this means that sophisticated / professional traders believe DMP is significantly overpriced if they are prepared to be short over 10% of the company – never forget these guys generally get it right more than wrong! DMP is trading on a valuation of 26.7x earnings compared to say CBA at 13.7x.

The traders sell the shares, which they do not own by borrowing them from an existing holder and subsequently paying a few % interest on the shares, hence they lose if nothing happens. They hopefully then buy the shares back at a lower price making a profit and then give them back to the loaner – sounds simple. It’s also important to understand that the risks are huge, if a company is taken over while you are short its shares losses are likely to be very substantial.

Investors can also short companies using exchange traded options and CFD’s. We strongly recommend a discussion with your financial advisor before embarking on this high-risk journey.

Domino’s Pizza (DMP) Monthly Chart

Question 4

“Hi There, do you have any plans or view on Fortescue as it reports today? I have followed most of your previous trades on the stock and have enjoyed the 100% success rate!” Thanks Ron J.

Hi Ron, as you say we’ve had a lot of success with FMG since our inception and it actually has provided MM its greatest returns on both the trading and investment front. FMG’s shares often get way overbought and oversold but patience is a virtue with stock which regularly rallies / falls ~20% in a few days / weeks. Interestingly, the average move in FMG shares the day they report (since 2006) is a 6% move, so clearly this is a very volatile stock.

Unfortunately, / boringly we are neutral FMG around this $5.50 area but watch this space as it often throws up opportunities.

Fortescue Metals (FMG) Daily Chart

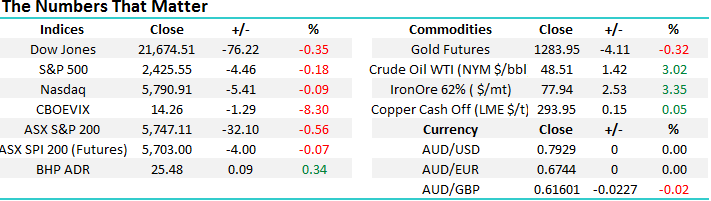

Overnight Market Matters Wrap

· The US closed lower, late in the session as investors continue to lose faith with the Trump administration.

· Jackson Hole summit starts this week, with expectations of significant policy statements. The theme is “Fostering a Dynamic Global Economy”, with discussion expected in growth and inflation.

· Bluescope Steel (BSL) announced a $150m buyback and CEO announces he is to retire at ends of 2017. We see short term weakness here with the uncertainty risk growing.

· The September SPI Futures is indicating the ASX 200 to open with little change this morning with a negative bias.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/08/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here