Subscribers questions (ECX, SYD, TCL, TSLA, GXY, PLG)

Global markets have again received limited fresh news over the weekend, it will be interesting to see if the local stock market will embrace this lack of negative geo-political influence and give us another strong relief rally. With BHP set to open down another 10c it’s probably going to need continued optimism from the banking sector if we are going to mirror last week’s strong start. However, the weekends worst property auction clearance rates since 2015 may create some jitters within our banking sector, especially with the outer Western Sydney region seeing a scary result well under 50%.

The ASX200 again closed on Friday only around 1% above its major long-term support but no clear catalysts have yet emerged to push the market outside of its comfortable 5629-5836 trading range which has now been in play for a remarkable 17-weeks.

We remain net short-term bearish stocks targeting ~5525 for the local market, approximately 3% lower but no clear sell signals are yet in play.

ASX200 Daily Chart

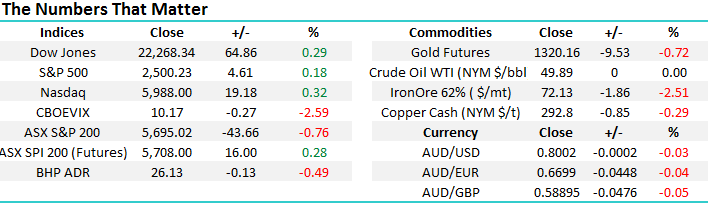

With regard to US stocks, while we still currently anticipate an eventual pullback towards the 2360 area for the S&P500, or around 5% below Fridays close, there are no sell signals in play at present.

US S&P500 Weekly Chart

Question 1

“I am finding your weekly email about your Income Portfolio really good. The summary of the portfolio's performance and the wrap of stocks brings together a good summary and helps me determine what to do with my own portfolio. Would you be able to do the same style report for your Growth Portfolio please?” – Thanks Paul H.

Morning Paul, firstly thanks for the “pat on the back” we’re really happy with the overall reception of the income portfolio and report have both received to-date as we continue to strive to grow the MM offering / service. I believe this is an excellent idea and something that could easily / sensibly incorporated into the Weekend report – or potentially another day during the week - watch this space.

Question 2

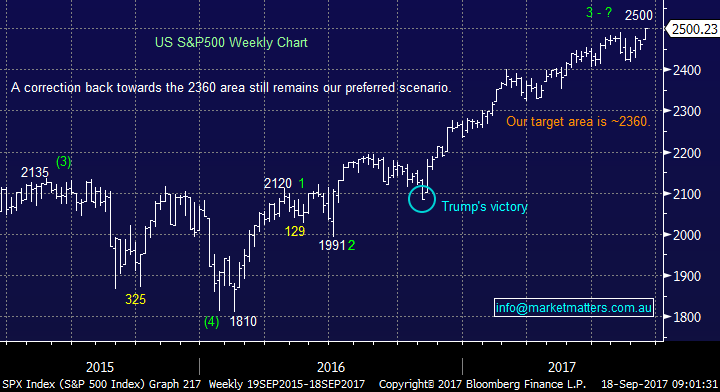

“Guys. Do you have an opinion on ECX? How does the chart look?” – Cheers Peter S.

Hi Peter, the Eclipx Group (ECX) is a vehicle fleet leasing and financial services company which is currently trading on a conservative P/E 15.5x valuation for 2017 while paying a 3.7% fully franked yield. ECX simply looks great Peter and technically appears to be headed towards $4.50 / 15% higher, traders could use stops back under $3.75 which provides excellent risk / reward.

Recently the stock has been trading ~2 million shares a day which negates any concerns we often have with liquidity outside of the ASX300 – thanks Peter for taking our attention back to this stock!

Eclipx Group Ltd (ECX) Weekly Chart

Question 3

“Query, this may be suitable for weekly subscriber questions. For those of us not holding Centuria is PropertyLink Group a suitable investment?” - Robert W.

Hi Robert, we wrote about this in the Income Report on Wednesday – available here – concluding that yes, PLG looks interesting given that Centuria is clearly keen on them and they offer a similar exposure to CNI. I’ve always thought it’s better to hold the prey than the predator and as such, PLG fits the bill nicely here. That said, we are still keen on CNI and are targeting a move up towards $1.50 so given we have the exposure here, and see it going higher, we will retain it. Each individual subscriber will need to determine what is best for them given we offer general information only.

Here’s what we wrote on Wednesday for those that missed it….

Another current holding in the MM Income Portfolio that is doing well - with the 7% weighting showing a +10% profit in the last 2 months (in reference to CNI). Again, for those not familiar with the company they’re a diversified funds management business largely exposed to property. They recently acquired a 9.3% strategic stake in listed property play Propertylink (PLG) for $53m. Its common knowledge that CNI hopes to increase their funds under management and this will involve acquiring others. What’s also interesting is that one of the funds managed by CNI – the Centuria Industrial REIT, has acquired a 7.7% stake in PLG as well, so combined, Centuria entities have a 17% investment in PLG.

They’ve already announced that they will initiate discussions with PLG regarding potential strategic initiatives – however is a takeover of PLG on the cards? PLG owns 30 industrial assets with a book value of ~$695m and also has $1.2b of external funds under management so it’s the sort of exposure CNI would like to have. As a holder of CNI, any takeover may involve the issuance of new shares, which is probably not a good thing and something we should be conscious of. PLG on the other hand, is clearly in their sites it would seem. A strong yielding stock with good assets and takeover to boot. If we were not holding CNI, we would consider PLG.

PLG yields 6.89% (Unfranked) and is on a PE 10.31

PropertyLink Group Weekly Chart

Question 4

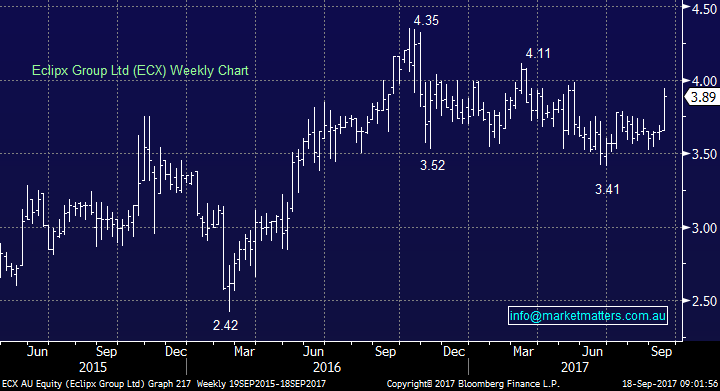

“Hello James, you have been negative on SYD and TCL for quite some time, your negativity on these 2 yield plays started late last year it eventually got to me so I sold 10k shares in SYD at 6.10 and have watched it go to $7.50 plus the dividends I have missed. I currently hold TCL, one observation you seem to miss on both SYD and TCL is pricing power and barriers to competition, remember as times get tough or as you mentioned previously as US interest rates go up both SYD and TCL are in the beautiful position of saying ok we increase our fees 'x' amount and what do users do look for the alternative I don’t think so. So hopefully I getan opportunity to buy back SYD at under $6 fingers crossed at the end there are not many good companies with good growth prospects left in the ASX.” – Frank M.

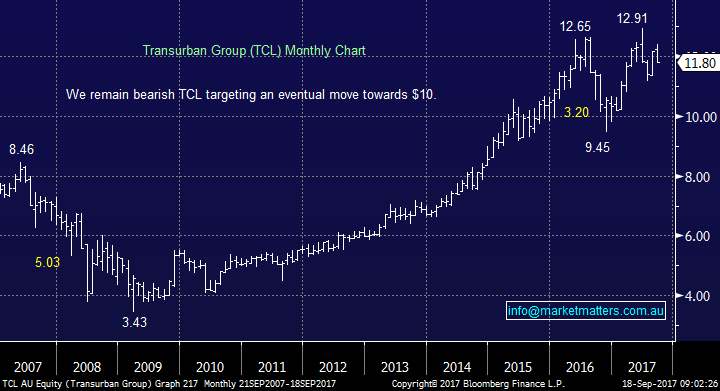

Hi Frank, thanks for the question. We held a negative view on SYD a long way above $6 so we’re obviously sorry that you sold out around that level, in fact to be fair SYD fell ~25% after we went negative. You are right in terms of pricing power - the strength of their assets (in both cases) and they clearly do have the ability to hike rates to support earnings, however everything is relative in the investment world.

TCL for instance is attractive on a 5% yield when a Treasury yields 2.2% i.e. a spread of 2.8%. Is it as attractive if Treasuries go to 3% and the spread drops to 2%? If they can grow earnings and therefore dividends at the same clip as yields are rising then they will remain in a holding pattern, if they can’t, the share price will decline which is not a reflection on the company itself, but a function of the macro environment.

These stocks are viewed as defensive bond like exposures and are priced off their yield. Remember CBA remains a world class bank but its shares still fell almost 30% from the dizzy heights of mid-2015 when investors thought they could not go wrong buying bank shares – sounds like property 6-months ago. We are bullish global bond yields and as such remain bearish both SYD and TCL targeting ~$6 and ~$10 respectively but we reiterate this is no negative reflection on the company, or their business.

Sydney Airports (SYD) Monthly Chart

Transurban (TCL) Monthly Chart

Question 5

“Dear MM, Thanks for everything that you do. An email arrived today claiming that: “the need for Lithium is growing to Tsunami Proportions” and “Goldman Sachs says Lithium is the new gasoline”. However, there is some credibility in the email, because the Tesla Nevada battery factory is well ahead of schedule and Volvo is dropping their traditional cornerstone engines in favour of electric vehicles. We also know that:

- Electric vehicles are being produced by both Traditional Car makers and also Technology Companies.

- Plus, every major motor cycle company, including Harley Davidson, are releasing electric (motor) bikes.

- Electric assisted cycles (push bikes) are popular for commuting in Australia.

- Lithium is being used for industrial and household energy storage.

- While Wind and Solar power is less expensive than Coal fired power, they need Lithium Battery systems to maintain what was previously known as “Turbine Spinning Reserve”.

- In South Australia, Tesla is building the world’s largest Lithium battery system, located right on the bottom end of which (at 5,000klm and 40,000klm of cable) is the world’s longest interconnected power grid.

Please advise:

What you see for Lithium Investing in 2018 and 2019? Some analysts are predicting a 500% growth in the next 10 years. How does that compare with Gold and other minerals? What other minerals are required to make the lithium batteries work correctly (Graphite and Nickel)?" - Regards Phil B.

Hi Phil, a great question on one of the most interesting subjects for both investing and the earth moving forward. A few colleagues visited California in the last year and one big thing that caught their attention was the excellent infrastructure already in place for electric cars – they clearly feel like the future. There was a great article on Bloomberg on this subject this morning and we recommend all subscribers read / listen to it, overall very encouraging for our children and the planet.

The points that caught our eye were:

1. Big batteries are just getting started on the coat tails of iPhones and cars, global lithium usage looks poised to continue rising.

2. Battery prices have already halved since 2014, they need to halve again to make a major impact v fossil fuels but that feels close at hand.

3. Our power transformation is destined to come down to the “experience curve” i.e. every time the number of solar panels made in the world doubles the cost to make them drops by 28%!

4. Solar power already has recently become the cheapest electricity in the world and it’s going to get much cheaper.

5. Long-term fossil fuels look doomed.

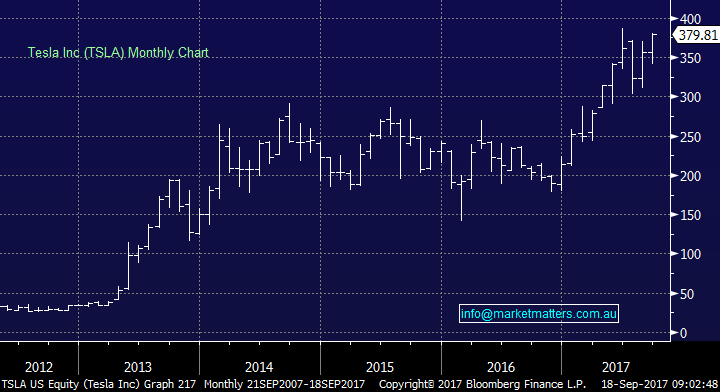

In Australia, we have plenty of sun, at last something looks very good for our future moving forward. Investors should also be careful as when new technology occurs the first players often get left behind. I’m sure most readers used a Nokia and / or Blackberry phone in the last 20 years – where are they now? Tesla is a company who we believe is priced for perfection and an extremely risky investment for a company which lost yet another $336 million in the June quarter. The big German and Japanese car makers will be playing hardball in this space over the next decade.

Technically we see a test of $US400 by Tesla prior to a correction back towards its recent $US300 low.

We will write a morning report dedicated to lithium and batteries in the coming weeks.

Tesla Inc (US) Monthly Chart

Question 6

“Hi guys. We are starting to see some strong upwards movement in Galaxy share price. Is lithium coming back into focus?” - Thanks Mike C.

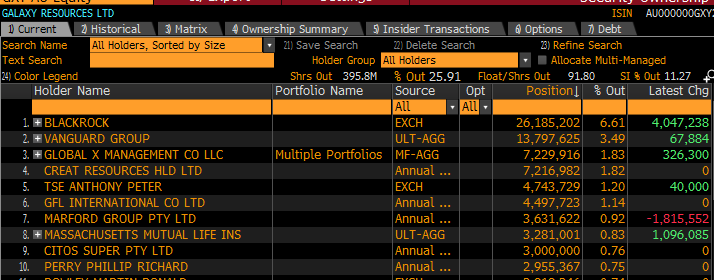

Hi Mike, great timing on the question after the very comprehensive previous examination of the sector by Phil. Obviously this lithium company is in the “hot sector” at present but the volatility of its share price should not be overlooked with it having both doubled and halved in the last year.

From an investing / trading perspective we could buy GXY around this $2.60 area but we’d be very concerned if weakness under $2.25 followed. Interestingly, a good article in theFT over the weekend also focussed on the sector, highlighting Blackrock’s positioning. Blackrock is the world biggest asset manager and they have now become the largest shareholders in Galaxy (GXY), however interestingly, they have sold out of Orecobre (ORE)

Top Shareholders in GXY

Galaxy Resources (GXY) Weekly Chart

Overnight Market Matters Wrap

· The US closed marginally higher across the board of its major indices overnight, as investors wait in anticipation of the tapering of its current program, with rates expected to stay on hold.

· Copper was better on the LME, while aluminium and nickel were weaker. Oil was better, but gold continues to come off recent highs. Iron ore fell 2.51%.

· Expect BHP to underperform the broader market today, after ending its US session down an equivalent of 0.49% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to open 14 points higher, testing the 5710 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/09/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here