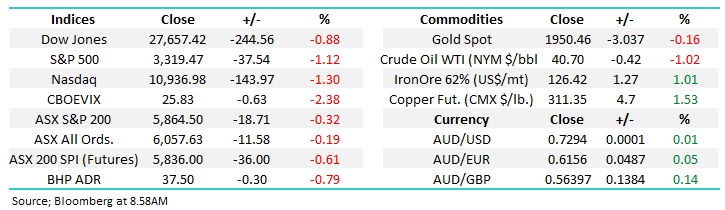

Subscribers questions (WSA, MNY, DEG, JHG, TLS, SSM, CSR, WZR, MYS, Z1P, CLW)

This week stocks are likely to kick off on the back foot following further declines on Wall Street, the SPI futures are targeting a fall of around -0.6%. However, with the financials holding well in the US and copper making fresh 2-year highs there are likely to be some decent pockets of support this morning. Also the COVID numbers continue to improve with Victoria only recording 14 new cases yesterday and 2 in NSW, Australia appears to have again shut out the virus but until a vaccine is established how can we operate our day to day lives without creating further outbreaks is my first question. The other is how can we reconnect to the rest of the world as they struggle with 2nd waves and potentially more due to their more open policies.

Over the weekend President Trump appears to have given his blessing for Oracle to takeover TikTok providing the buyers with instant access to a social media foothold – I don’t expect many unpopular decisions out of the White House with only 54 days left before the election. Last night Sportsbet had Joe Biden at $1.80 favourite compared to Trump at $2.00, its rapidly getting too close to call. The markets likely to rally if Trump and the Republican Party nudge ahead, just read some of Bidens rhetoric, it doesn’t bode too well for stocks:

“Throughout this crisis, Donald Trump has been almost singularly focused on the stock market, the Dow and Nasdaq. Not you. Not your families,” Joe Biden last week in Pennsylvania.

With plenty of uncertainty around we feel more choppy action is likely on the index level although as we approach support ~5750 MM remains comfortable with our bullish equities’ exposure. Importantly over the next fortnight almost $9bn worth of dividends are paid into investors bank accounts and a decent chunk of this usually finds itself being deployed back into the stock market helping the seasonally strong period for local stocks.

MM remains bullish Australian stocks short-term.

ASX200 Index Chart

The “Aussie” continues to defy its doubters and trade around its highs of the last 2-years. Moving forward short-term we anticipate one more decent challenge of 74c before we see some rotation /consolidation. This implies the resources might be getting tired on the upside, at least for now but the picture looks good over the next 12-18 months with our target still above 80c, or more than 10% higher.

MM remains bullish the Australian Dollar medium-term.

Australian Dollar ($A) Chart

Thanks again for the much-appreciated questions, as we’ve said previously were delighted to have such an engaged subscriber base.

Question 1

“Hi James and team. Excellent announcement by WSA, not only because of the copper and nickel but the other associated elements. I read about the Pt and Pd concentrations and this is the bit I like. Little comment is generally made about these "by-products" - but they handsomely pay for the Ni and Cu processing. In fact I’d like WSA for its PGM capability and accept the base metals as by-products. Pt and Pd are the key elements that go into catalytic convertors for ICE cars and will be key to hydrogen fuel cells. So, all round an exciting announcement.” - Cheers, Jan P

Morning Jan,

WSA did deliver a solid result in last August which revealed a 14.8% lift in sales revenue to almost $310m, the nickel producer just needs Ni its main income stream to follow the likes of copper significantly higher. Guidance was encouraging from the board, but the stock hasn’t really embraced news as it continues to drift. The company then followed this up with a healthy update on its Odysseus mine earlier this month as you mentioned but again the stock hasn’t rallied as we would have hoped – a little patience feels required at this stage.

MM likes WSA, especially medium-term.

Western Areas (WSA) Chart

Nickel ($US/MT) Chart

Question 2

“Dear James, I found the MM Newsletter very valuable. My trading is in front following your suggestions. Thank you. 2 questions: 1. Can I have your view on MNY (Money3) in the BNPL sector? 2. Is there a min. amount for joining your International Port Folio?” - Regards Gregory C.

Morning Greg,

Great news, adding value as at the end of the day our ultimate goal. MNY is a $370m niche provider of finance more akin to a traditional alternative finance business than a buy now pay later offering. The companies market advantage comes from not trying to be a one stop shop for everything, they focus on specific areas where they look to be the best especially from a service perspective etc, they currently have more than $1bn worth of vehicles financed under its umbrella.

The companies latest report showed a ~35% lift in revenue to $124m, they’re cheap while yielding ~4% fully franked making it a good candidate as a small cap candidate for an investor’s portfolio. However, after a strong period for car sales I can see things leveling off as the next chapter of the COVID tale unfolds hence entry levels may improve.

I spoke about this stock with Jono Higgins from Shaw a few months ago: Click here

MM likes MNY especially into weakness.

Money3 Corp Ltd (MNY) Chart

Regarding our international portfolio, it is listed on the MM website and subscribers can follow it in part or in full. For those that are looking for a broker to execute international orders, we can assist through Shaw and Partners, brokerage is charged on a per trade basis. Taking it a step further, if you are looking for my team and I to manage a portfolio of international stocks for you, (through Shaw and Partners), there is a $350k minimum investment.

At this stage we do not offer the international portfolio as a Separately Managed Account (SMA) as we do with the Growth & Income Portfolios. About the MM SMA’s

Question 3

“Hi MM, I have a few questions about resource explorers, mostly how do you determine when to sell and at what price? In particular DEG and KAI which have had a good run? Also PAN which has jumped? The resources webinar you held was great thank you. ATU, SVY & STA, which were favoured picks, what would be a sell price for them or let them run for 12-months?” - Cheers, Jill C.

Morning Jill,

The reason to sell should be part of initial plan when any stocks are purchased i.e. “plan your trade and trade your plan”. However, news both on the stock, sector and macro level can always change the backdrop and investment decisions need to be fluid and flexible, as well as disciplined which is why it can be tough at times. Importantly running profits and cutting losses is a vital ingredient to successful investing although in the more “speccy” end of town aggressive gains can often vanish as fast as they arrive hence we often advocate taking a little part profit along the way.

For example DEG shown below has exploded in 2020 and we would be using technical stops below $1.45 and / or considering taking a little part profit at current levels – in other words we use technical triggers as an important part of our armoury in these circumstances.

In terms of ATU & STA specifically, both are likely to have looming catalysts which could be positive for the share price.

De Grey Mining Ltd (DEG) Chart

Question 4

“Hello James and crew, Just re Income Portfolio, have you considered Janus Henderson (JHG). I know you scotched it from your International Portfolio, but here it trades on a P/E of 8.1 times, has a Div. Yield of 7.7% EPS of $3.25 and a 12 month DPS of $2.05 (unfranked) paid quarterly.

Unless there is some underlying problem with JHG it looks pretty good value to me – your thoughts?” - Cheers, Mick H.

Morning Mick,

JHG does undoubtedly tick many boxes for our Income Portfolio on paper although if it keeps losing FUM (funds under management) the dividend will unfortunately decline. The largest issue is undoubtedly that of capital preservation as can be seen from the chart below, its already lost ~25% over recent months. Also, we already hold Perpetual (PPT) in the portfolio which has struggled implying to us it’s too early to jump on fund managers at this stage in search of yield.

MM is neutral JHG.

Janus Henderson (JHG) Chart

Question 5

“I notice Aussie Broadband are listing on the ASX soon, I have been with them for years, they are a hot little business, what are your thoughts. The shares are being offered at a $1 each.” - Thanks for the good work, regards Tom A

Morning Tom,

Aussie broadband is looking to raise $30-$40m and from what I understand it will likely be a very good IPO. Stock was very scarce in the institutional component of the raise and now the retail component is being prioritised to their customer base, which is a smart way to do it in MM’s view. The company are in growth mode and will not be paying a dividend any time soon.

The sector has been struggling over recent years and although MM has just dipped our toe in the water with Vocus (VOC) and Telstra (TLS) in 2 portfolios hence while the sector underperformance cloud has not fully evaporated we believe its approaching fast.

MM is positive the raise.

Telstra (TLS) Chart

Question 6

“How weird. You guys trimmed SSM while Lincoln indicators re initiated coverage of SSM” – Regards Frank M.

Morning Frank,

By definition that’s what makes a market, for every buyer there’s a seller etc. Our decision to sell was more about the expectation for better relative performance in what we bought, while we’re comfortable to have sold out of SSM it doesn’t mean we won’t re-enter again in the future, were comfortable acknowledging when we are wrong and buying a stock at a higher price than we exited.

MM is neutral SSM.

Services Steam (SSM) Chart

Question 7

“Hi, are you still positive about the AUD and what time frame are basing your judgements on.” – Cheers Peter W.

Hi Peter,

MM remains bullish the $A medium-term targeting the 80c region although a period of consolidation after recent aggressive gains would not surprise. The main timeframe we are looking at here is the monthly chart shown below where at the very least we are looking for an ongoing correction of the 10-year decline from 1.10 to 55c – our initial target remains the 80c region.

MM is bullish the $A.

The Australian Dollar ($A) Chart

Question 8

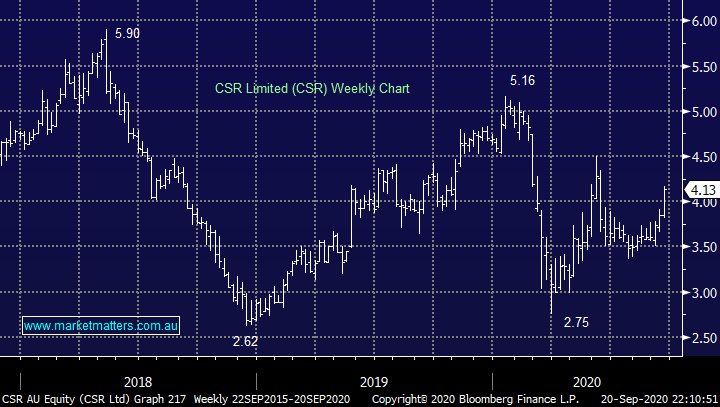

“Hi James and Team 1. CSR has had a good run up recently. What is the current price target for CSR and would you be holding for further upside? 2. WZR - (WISR Ltd) I purchased at 20cents - seen it as high as 27.50cents and fall back to 18 cents. Do you still see this as a Buy? What is your current view?” - Regards Debbie G.

Hi Debbie,

1 – we like CSR and the building sector at current levels, I could easily see a retest of $5 as many governments pour stimulus into the global economy.

CSR Ltd (CSR) Chart

2 – WZR is back to an area where the risk / reward is interesting, we could consider an aggressive play with stops under 15c, the recent share price weakness seems to be a result of the lack of commentary about current trading conditions to start FY21. The FY20 result delivered in August were slightly ahead of expectations, however they didn’t provide any detail / trends about what’s happening at the start of FY21, as most companies did. We think that’s a missed opportunity, investors have been spooked and sold. From what we understand, the business is still tracking along well.

Wisr Ltd (WZR) Chart

Question 9

“Hi Adam, what are your thoughts on MyState (MYS)” - Regards Randy JC.

Hi Randy,

Credit union MYS enjoyed a nice advance last week after enduring a tough year. A recession and excessive loan defaults is bad news for MYS hence the struggle street since the coronavirus hit town. The stock now looks interesting technically with stops under $3.50, I would term it a second variation on the recovery play.

MM is neutral / positive MYS.

MyState Ltd (MYS) Chart

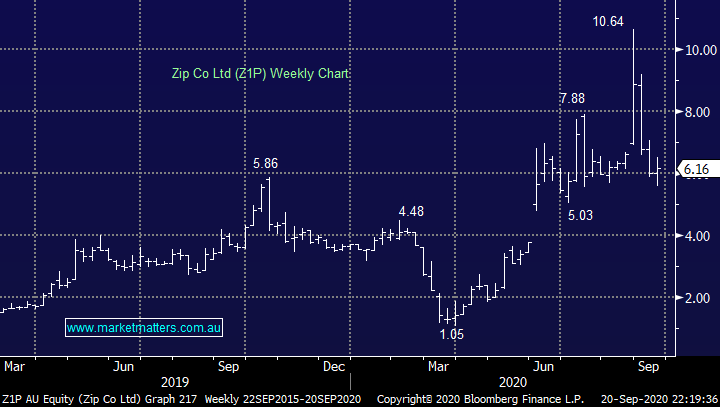

Question 10

“Hi James, if I recall correctly, some weeks ago you suggested that ZIP were going into the ASX200 this month. Is that still a possibility and if it does will it have an impact on the share price?” - Thanks Colin H.

Morning Colin,

Z1P was actually added to the ASX200 at the start of September. The influence is generally positive given large cap managers can spread their BNPL exposure across APT and Z1P, however we also see some small cap managers offload them as a consequence of being added to the 200. Overall a net positive in my opinion but it currently pales into insignificance compared to the underlying sentiment driven volatility in the tech and BNPL space.

MM is bullish Z1P around $6.

Zip Co Ltd (Z1P) Chart

Question 11

“Hi MM. First question submission from a 2+year subscriber. I hold some CLW Charter Hall Long WALE REIT. They are doing a SPP to fund purchase of petrol stations in New Zealand leased to BP plc. I am considering selling half my MQGPD which you were not so supportive of recently or all my SCG Scentre Group which may be short on distributions for some time to fund a SPP application. I think CLW is looking at a 5.7% distribution. Do you think this is a worthwhile swap, esp from an income perspective.” - Best wishes to all working there. Peter D.

Morning Peter,

A reminder that we provide general advice around views only and don’t take into consideration individual investor circumstances.

1 – MM does intend to participate in the SPP, especially as the underlying stock looks great as its rallies above $5.

2 - At this stage MQGPD still does screen expensive to us and we are considering cutting it.

Hopefully that simple summary conveys our opinion on the potential switch, we like it.

Charter Hall REIT (CLW) Chart

Have a great day

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.