Subscribers questions (WBC, CGI, IDX, FMG, CGC, GEM, BLD)

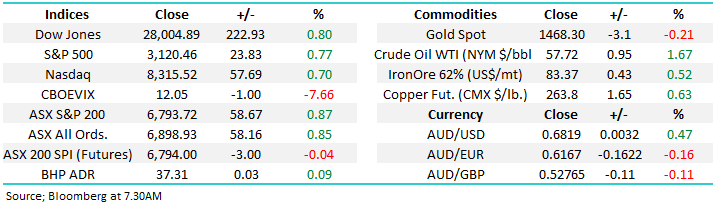

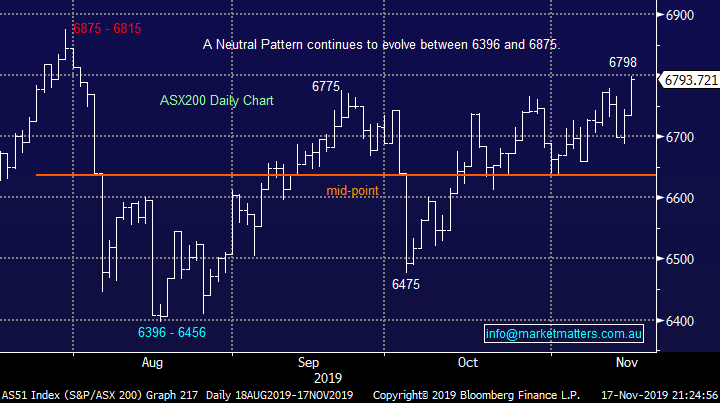

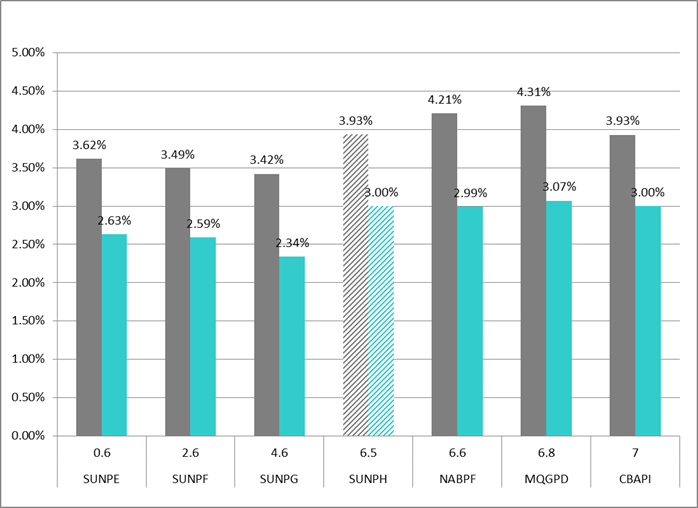

The ASX200 finished last week off with a bang on Friday closing within a whisker of the psychological 6800 level, now only 1.2% below its all-time high. Supportively the US large cap indices continue to climb to levels never witnessed before, the Dow traded and closed above 28,000 for the first time ever on Friday. However interestingly the small cap Russell 2000 remains over 9% below its same milestone suggesting to us that investors are currently only comfortable chasing the more conservative better known companies, as opposed to the speculative end of town – not the classic sign of a major market top.

Over the weekend fresh news was relatively thin on the ground which feels a positive because the path of least resistance is clearly on the upside, the 3 stories that caught my attention were:

1 – Violence is escalating in Hong Kong, I sincerely hope another Tiananmen Square is not looming on the horizon, an event that would surely create some volatility within global markets.

2 – Saudi Arabia has cut its Aramco valuation to a mere $US1.7trillion with the clear goal of achieving a successful IPO i.e. there is a significant volume of energy stock about to hit world markets just when ethical funds are moving away from the likes of fossil fuels.

3 – Another strong weekend of auction results suggests that 2020 is poised to be a strong year on the property front, wealth creation / preservation and rising asset prices should be supportive of equities.

MM remains comfortable with a neutral stance around current levels but our “Gut Feel” remains slightly bullish.

On Saturday morning the SPI futures were pointing to a flat opening by the ASX200 which is a touch disappointing considering the Dow’s 222-point rally, perhaps the relatively strong $A which put on +0.5% deterred some of the bulls after our strong session on Friday.

Thanks again for the questions, an understandable trend is emerging where one subject garners by far the most attention, this week it was MM’s sale of Fortescue Metals (FMG).

ASX200 Index Chart

The US indices have been climbing a “wall of worry” of late, continually making fresh all-time highs but with a diminishing momentum. At this stage we would be buyers of the next 2% pullback, as we saw in early October there appears to be a plethora of buying into periods of weakness but this strategy is of course slowly becoming more dangerous In our opinion.

The small caps have traded sideways for over 6-months illustrating there’s no euphoric buying at present, the classic characteristic of a market top, something we feel too many people appear to be almost searching for.

MM can see another 10% upside for US small caps i.e. then we might see a degree of euphoria to ring some alarm bells.

US Russell 2000 Index Chart

Last week we said “MM is now 50-50 on bond yields, the chart below illustrates the current position of the very influential US 10-year bonds” a week later they appear to have shown their hand i.e. another leg lower to test ~1.4%.

The close back below 1.85% has triggered sell signals for MM targeting a test and probably break of 1.4%, this is very likely to produce a period of outperformance by defensives – a move MM will fade as we believe bond yields are “looking for a low”.

NB If we see US bond yields make a fresh 2019 low the MM Global Macro ETF Portfolio is likely to take a position fading the move in a US bond ETF.

US 10-year Bond Yields Chart

Question 1

“Hi MM team, I recently acted on MMs advice to switch out of ANZ and into NAB & WBC. My question is, will I be eligible to participate in the WBC SPP? Prior to 01/11 I did not own any WBC. On the 01/11 I bought a parcel of WBC.” - Regards, Jan P.

Hi Jan,

Over 600,000 retail investors were offered the opportunity to participate in Westpac’s share purchase plan (SPP) which was part of a $2.5bn capital raise to increase its cash buffer for APRA’s strong capital buffer i.e. unlike a lot of capital raises it was not because the business has its back against the wall. Institutions snapped up the first $2bn pretty quickly a very encouraging sign in our opinion.

To be entitled to the offer investors are required to be on the register at 7pm, Sydney time, on November 1st hence people who switched with MM are indeed entitled to the SPP.

Westpac has now traded ex-dividend, 80c fully franked, on the 12th of this month - even after WBC’s dividend cut the bank is set to yield over 6% fully franked, and obviously higher basis with an entry at $25.20.

MM is keen on the SPP with it being at a greater than 5% discount to Fridays close.

Westpac (WBC) Chart

Question 2

“Hi Guys, do you have any comments on the following new issues? New Issue: Gryphon Capital Income Trust ("Trust") & Suncorp Group Limited Capital Notes 3” – Thanks Scott D.

Hi Scott,

We covered in a recent income note however below for those that may have missed it.

CGI have launched a1 for 3 entitlement offer at $2.01 a share, around about where the trust is currently trading. The trust invests in residential mortgage backed securities (RMBS), which in simple terms is a security that is underpinned by a bunch of housing loans. Gryphon is a specialist in the area, managing over $2b in total in the space for both institutional and retail money. The trust targets an income return of RBA Cash + 3.50% (net of fees), Management cost of 0.96% with no performance and has thus far achieved what it has set out to do since the IPO of the fund in May last year, paying dividends in each month since June 2018.

The deal aims to raise around $100m for the fund, with new shares listing in December they will not be eligible for the November distribution.

What we like: A good portfolio diversifier generally only available in unlisted managed funds.

What we don’t: Exposure to residential mortgages when the bulk of local investors are already very long banks and domestic property

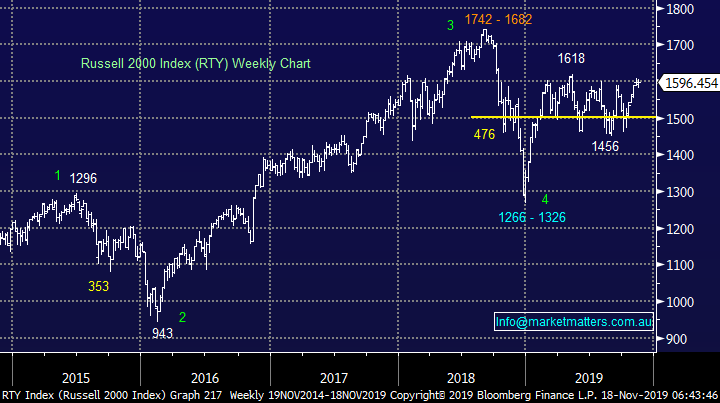

Suncorp Hybrid Reinvestment: Last Monday, Suncorp launched a reinvestment offer for an existing SUN security, being the SUNPE. The relatively small offer ($250m) is being done on a tight margin, guiding to 3-3.2% over bank bill however it will likely to be done at the 3% handle. The offer is for Capital Notes which are perpetual, convertible, subordinated, unsecured notes to be issued by Suncorp which will be quoted on ASX, this is the same structure as recent issues. The Optional Exchange Date is 17 June 2026 and Mandatory Conversion Date is 17 June 2028, meaning that to compare this security against existing, we need to look at that sort of duration.

The chart below compares longer dated issues by a number of banks along with the current SUN hybrids on issue. The most recent comparable is CBA which issued a hybrid with similar duration at a 3% margin CBA is a better exposure on that sort of margin.

MM is lukewarm on the new SUN Hybrid

Yield to first call & Margin over swap for Suncorp and other similar hybrids

Investors can access the Prospectus here.

Question 3

“Hi James Love your work. Do you and Shaw have an opinion on Integral Diagnostics Limited (IDX)” - Cheers Tim N.

Hi Tim,

Firstly as always thanks for the positive vote of confidence!

For subscribers unfamiliar with IDX its an almost $670m medical diagnostics company which has clearly enjoyed strong gains like much of the Healthcare Sector since 2016. IDX run diagnostic imaging facilities across Australia a clear growth area both locally and overseas, it’s just important of course that companies remain at the cutting edge of the developing technology.

In early 2018 IDX rejected a bid from Capital Health Ltd (CAJ), which is a stocks that we cover at Shaw and certainly this was a wise decision looking at today’s price as the business has evolved from being a takeover target to one making acquisitions, I ponder if other larger businesses have started running the ruler across IDX.

IDX is not a company we have invested in previously and at this stage MM would be using technical risk / reward to guide us and any decision making processes.

MM likes IDX technically with stops under $3.

Integral Diagnostics Limited (IDX) Chart

Question 4

“Hi Guys, a comment/question for next Monday. Last Friday FMG closed at 9.58, $0.03 off it's all time high. Monday and Tuesday this week’s it's dropped $0.72 or 7.5%. It certainly bounces around, so this should not be a surprise. Yesterday you .elected to sell the FMG position for a 30% profit in less than 3 months. I fully agree with the idea of taking profits when stocks have had a solid run, but your comment today that "we believe there's a very good chance of re-entering FMG closer to $7" warrants some justification. An FMG price of $7.00 represents a further fall of $1.86 or 21% from yesterdays close of $8.86 which would be fall $2.58 or 27% from last Friday's close of $9.58. Where's the explanation for such a comment, especially as you have been singing the praises of FMG in terms of its free-cash generation and earnings multiples and you are bullish resources. You sell FMG but continue to hold your CGC positions which are down 51%, 53% and 34% respectively, gladly I didn't buy CGC. Maybe include a comment on whether your buy/sell ideas are based on fundamentals, technicals or gut feeling. This would give subscribers a clearer picture on your thinking.” – Regards Cameron A.

I sold FMG following on from your decision to sell . However it appears iron ore prices have stabilised in the last 2 days and FMG around our sell price. I would like your view on whether FMG , could it be bullish from here and get back to last Friday’s price of $9.58 next week.” - Regards Errol K.

Hi Guys,

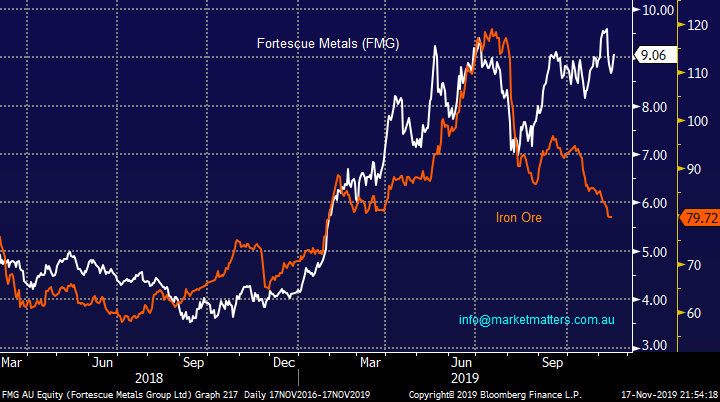

Selling FMG was not the easiest decision we’ve made as we do indeed like the business but as the first chart below illustrates FMG understandably follows the iron ore price extremely closely and the last time the bulk commodity was at todays level FMG was actually nearer $6! Hence we feel the risk / reward for FMG when its trading around $9 is on the downside i.e. the jaws are likely to close. Thus we followed our predetermined plan and sold when the stock failed above $9 – traders often quote “plan your trade and trade your plan” obviously a degree of this is very relevant to investing.

Secondly we also now believe that bond yields are set to test / break below their 2019 lows, the second chart below illustrates this has previously been a bearish lead for base metals, and to a lesser degree iron ore, but overall another reason we like our decision to take the money from our FMG position.

MM likes FMG into weakness.

With regards to CGC obviously we do wish we weren’t long from the price we are but when stocks downgrade they gap lower making exiting far from straightforward as lows are often formed after downgrades - we have to evaluate stocks at today’s price and make a judgement call on whether or not to hold or fold. Re comments in terms of technical, fundamentals & gut feel, as investors we use all tools at our disposal to make informed decisions and that involves combining them to varying degree’s to formulate a view and act on that view. Some views may be tilted technically, some fundamentally and some may be a result of simply being in the markets day in day out for a long time, which nourishes our ‘gut feel’. Ultimately, all our moves combine these to a varying degree so splitting them out is not possible.

Fortescue Metals (FMG) & Iron Ore Chart

Bloomberg Base Metals Index & US Base Metals Index Chart

Question 5

“Hi MM Team, just wondering how companies like GEM can get it so wrong over a short period of time. They don’t have variables like weather, price fluctuations etc but in a 3-month period their forecasts are a huge miss. If that was a private company people would be looking for new work or an l missing something?” - Neil W

Hi Neil,

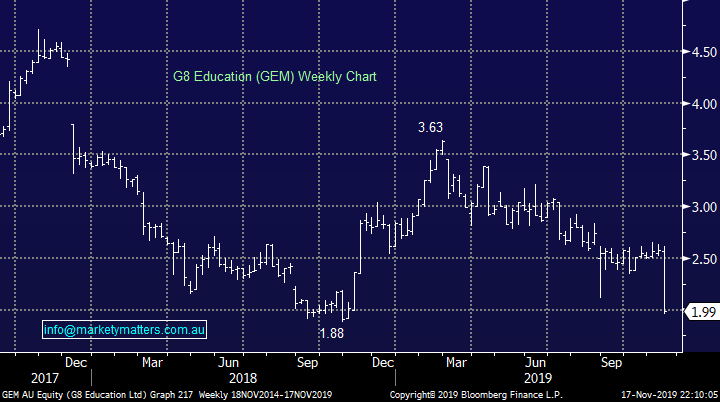

GEM has certainly endured an awful couple of years as their forecasts proved way too optimistic with regards to occupancy levels. I feel you only have to drive around inner Sydney to see childcare centres popping up like weeds on my lawn! Hence simple supply and demand has kicked in and while the number of kids looking for spots has not deviated the choice has increased markedly leading to tougher trading conditions.

The next logical step will be the eventual closing of more marginal day-care centres and GEM will again then be well positioned but there looks to be no hurry just yet.

In terms of getting it wrong in business, I think anyone that runs / has run a business realises that even the best laid plans can come unstuck in the short term. In my view, running a business is all about having a long term vision and working towards that view but importantly having the capacity to deal with the short term blips along the way.

MM we look interesting into any panic selling below $1.88.

G8 Education (GEM) Chart

Question 6

“Hi James The government will have to pump up the economy somehow. Any thoughts how they might do that and which stocks will benefit. I understand infrastructure is the obvious one but not sure that will give the economy and instant injection?” - Cheers Tim N.

Hi Tim,

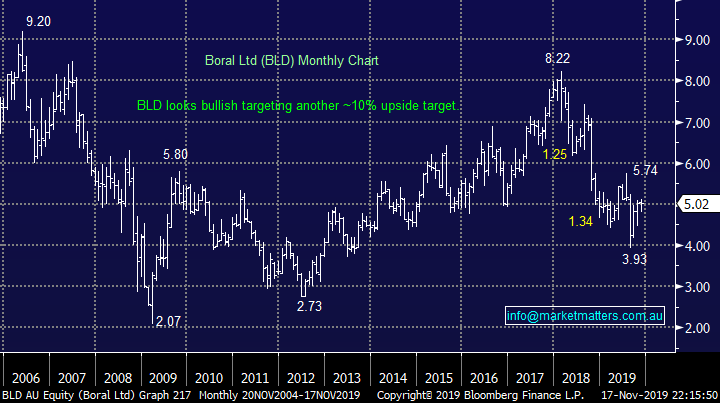

At MM we’ve been lauding fiscal stimulus for a few months to anyone who would listen, including hopefully Scott Morrison. Such spending might be in infrastructure, tax cuts and other areas all of which are likely to be likely aimed at stimulating domestic consumer confidence and growth / spending - A classic ideal environment for value stocks.

Obviously the stocks which benefit the most from fiscal stimulus will depend on the nature of any such government action but we can see benefits flowing into the under pressure building construction stocks and potentially also the discretionary spending group.

Boral Ltd (BLD) Chart

Overnight Market Matters Wrap

- Optimism grew further in the US over the weekend as reports from a US official noted that they are close to the final stages with China in a partial trade deal, helping the equity markets hit record highs again.

- Crude oil gained on the back of this, while the ‘safe haven assets’ as gold and US treasury yields lost on Friday’s session, ignoring US economic growth being at risk of slowing further in the 4Q19 as a decline in most retail and factory production was reported for the month of October.

- On the domestic front, Saracen Minerals (SAR) is reported to have launched a ~$750m equity raising to help fund its recent 50% acquisition of Kalgoorlie’s iconic Super Pit gold mine from Barrick gold.

- The December SPI Futures is indicating the ASX 200 to open with little change this morning, hovering near the 6800 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.