Subscribers questions (TCL, WEB, KDR, RWC, WHC, AWC)

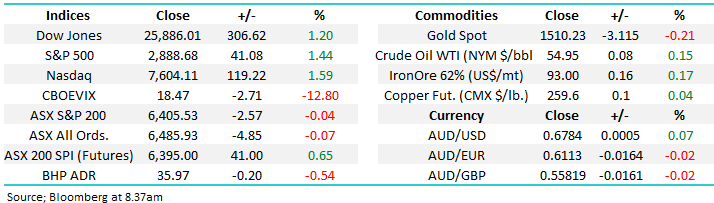

Last week was another very tough week for equities with the damage basically all inflicted on Thursday when the ASX200 plunged almost 200-points following the carnage on Wall Street. Market sentiment is changing almost daily as a number of global macro-economic issues continually raise their heads although support continues to offered by interest rates which are plunging towards zero. Volatility “under the hood” has also been elevated as we plough our way through a particularly messy August reporting season.

Companies reporting through August: Click here

Over the weekend fresh news was net positive with yesterday’s huge protest for democracy in Hong Kong being a peaceful one however the sheer numbers suggests China has a tough road ahead to resolve these issues. Elsewhere President Trump has sent out another of his tweets, this time informing everyone that the US is talking with China, nothing fresh there in our opinion but it’s not negative plus his key economic adviser has done the rounds of US talk shows over the weekend confirming a deal is progressing. We are watching out closely for more central bank stimulus following Hong Kong last week and rumours that Germany will follow suit.

The SPI Futures are calling our market to open up around 40-points this morning following a strong session on Friday by US stocks as hopes rose of a US-China resolution; unfortunately any gains recently have felt vulnerable to a quick reversal as market sentiment continues to change almost day to day as fresh news crosses our screens.

Ideally we will a bounce short-term towards 6600 for the ASX200 but our view is it’s an opportunity to become more defensive, at least for a few months.

Thanks for the great quality and diverse questions this week, a few less than recently and I wonder if the market weakness is scarring a few investors, if so usually a good sign that a bounce is close at hand!

ASX200 Index Chart

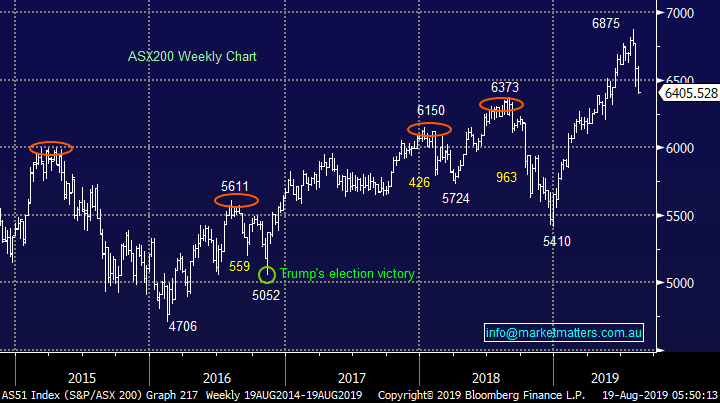

US stocks have generated the technical sell signal we anticipated for most of July, the current negative news flow has helped the bears take the upper hand, even as bond yields / interest rates continue to tumble. MM still believes we have entered a new short-term cycle for US stocks where bounces should be sold for the active trader.

After a number of major swings last week the Dow finally closed down 400-points, only a drop of 1.5%, it certainly felt much worse.

MM is short-term bearish US stocks initially targeting a move by the S&P500 towards 2750, ~5% lower.

US S&P500 Index Chart

Bond yield inversion was the talk of the town last week as US 10-year bond yields fell below the 2-years, historically a leading indicator that a recession is around the corner. We believe this triggered some major technical selling in the S&P500 futures which led to Wednesdays 800-point aggressive fall.

Locally our actively traded 3’s and 10’s (bonds) have not inverted but they are both trading around fresh all-time lows as the gap slowly narrows towards inversion.

MM agrees with the market that the RBA will again cut rates in 2019 / 2020 although we are not as dovish as some.

Australian 3 & 10-year bond yields Chart

Question 1

“Hi, what are your current thoughts on ASX:WEB? It has a strong record of beating results and has been weak since mid-May, is this a potential buy before it reports on the 22nd of August?” Mitchell N.

Morning Mitchell,

You’re right in terms of beats last year with WEB beating expectations by 13% for FY18 however the year before they missed by a huge 17%. Over the past 8 years, they’ve beaten 6 times and missed on 2 occasions.

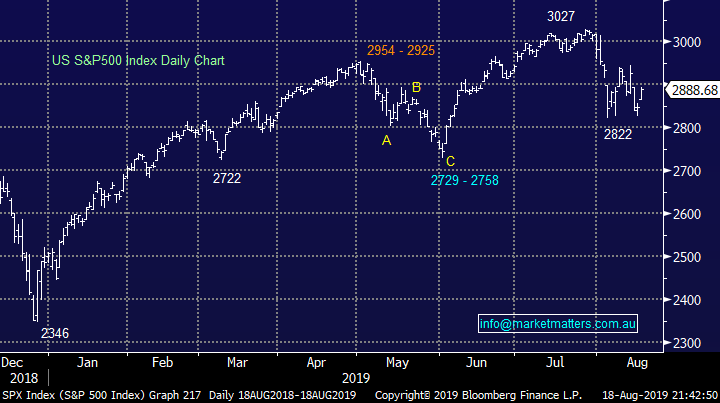

Webjet (WEB) has now fallen ~25% over the last 3-months putting it clearly in the underperformers corner. The issue has been its strategic partner UK based Thomas Cook who has issued 3 profit warnings in under a year which has seen its shares plunge by around 95%, many analysts are now describing the stock as worthless.

WEB paid over $20m to Thomas Cook for an accommodation supply agreement which looks likely to yield diminishing returns at best. However only in April WEB reconfirmed its full year guidance, a brave call under the circumstances. However the on-line travel business is trading on an est. P/E of 20.2x for 2019, not a scary valuation for a growth business. Its been a game of Russian roulette holding positions through the current reporting season but I agree historically WEB has often performed well around its reports but MM is not considering buying WEB at this point in time.

MM is currently neutral WEB.

Webjet (WEB) Chart

Thomas Cook (TCG LN) Chart

Question 2

“Hallo. What is MMs view on the TCL SPP?” - Thanks John V.

Hi John,

Transurban (TCL) is raising $500m via a capital raising at $14.70 basically where the stock closed on Friday. Also an additional $200m share purchase plan is being made available to fund the acquisition of the M5, plus providing some monies for general corporate costs. Shareholders can buy up to $15k worth of stock at $14.70, or if the stock price is lower than that through the pricing period of 15th – 30th August, the price is calculated at a 2% discount to the average price over the last 5 days of the pricing period.

Hence the real question is do we like TCL at today’s prices. TCL and its reliable dividend has revelled in the current low interest rate environment propelling the stock up +20% over the last 6-months alone, it’s one of the primary “yield plays” on the Australian market. Not surprisingly we feel the stocks likely to remain solid until interest rates threaten to turn higher, or perhaps just plateau as stocks tend to lead underlying macro themes.

After its stellar run we feel the risk / reward for TCL is not exciting but below $14 and the picture will start to improve.

MM is neutral TCL at this point in time.

Transurban (TCL) Chart

Question 3

“Hi MM Team, JHG is starting to look like a disaster area with a wilting stock price and very little support from analysts. The dividend was healthy at face value but the capital losses are starting to hurt badly. Any recent thoughts?” - Thanks, Errol K.

“Hi Guys, Would be interested in your thoughts on Janus Henderson (JHG). My holding is down 42% and I think you hold it in your Growth Portfolio. I keep waiting for a recovery, but alas, nothing doing. Any thoughts on maybe averaging it or is there some consideration in regard to the eventual outcome of Brexit or is it just a Dog!?” - Cheers, Michael H.

Morning Guys,

A tough question for a Monday morning as JHG has probably been our most disappointing position over recent years. However the quandary remains the same, what should we do at todays price, we cannot invest with “what ifs”.

The stocks trading on an extremely cheap valuation, an Est P/E for 2019 of 7.44x, primarily because the business has been struggling to maintain its FUM (funds under management). However we have seen some explosive turnarounds when other members of the sector have arrested their negative funds flow, we believe JHG will eventually be the same but the million dollar question is from where.

On balance we can easily see JHG recovering at least back towards $36 but we don’t feel comfortable enough with today’s price action to average our position.

MM is planning to hold JHG for now but not add.

Janus Henderson (JHG) Chart

Question 4

“Hi market matters. New member so hope this is correct area for member questions of which I have 2 please. 1/ Kidman resources is entering an mutually agreed takeover by Wesfarmers yet I see UBS fund manager and alpine both becoming substantial shareholders over the last couple weeks even at the agreed takeover price of $1.90. Is there something I am missing or is there going to be a challenge ? 2/ your opinion on reliance ,RWC, has it been oversold.” - Regards Ian

Hi Ian,

Welcome on board and thanks for your first question.

The WES takeover is being backed by its 3 largest shareholders and the stock’s not moved in weeks. The last substantial shareholder notice was lodged by UBS on the 15th July, however it looks like this is on behalf of various UBS clients – not UBS themselves. There is reference to various custodians and other entities. I doubt this notice actually relates to buying of stock, more administrative in terms of how stock is being held by UBS clients. For that reason, we wouldn’t read anything in to it.

We are hoping that a similar deal will unfold for our Orocobre (ORE) holding, with major shareholder Toyota a potential suitor.

MM is neutral KDR around the $1.90 area.

Kidman Resources (KDR) Chart

The plumbing parts business has struggled over the last 12-months with its shares down by over 50% hence I’m not surprised its caught your attention. Mays ~10% profit downgrade reaffirmed what the share price was warning, with the obvious question what comes next? The company believes issues are more around timing as opposed fundamental demand implying that investors shouldn’t be too scarred medium term.

The shares are reasonably priced at current levels but the downside momentum feels entrenched, technically we can see another 10% downside.

MM may consider RWC around $2.75.

Reliance Worldwide (RWC) Chart

Question 5

“Hi, with the Whitehaven Coals record profit result and today’s lower share price is it time to top up.” – Cheers Errol K.

Hi Errol,

WHC just keeps drifting lower putting the stock on an estimated yield for the next year of 6.6%, basically WHC has followed Coal prices, which makes sense but not good news for shareholders. We like WHC as an income play but we would need to see a decent turn in Coal prices before considering as a growth play.

The company’s recent report was a beat with a better than expected dividend, although unit costs are forecasted to be 2% higher than anticipated in 2020 which has lead to bid downgrades from brokers. Cost pressures are hurting earnings at a time when Coal prices remain under pressure – not a good combination.

MM is neutral WHC just here as a growth play.

Whitehaven Coal (WHC) Chart

Question 6

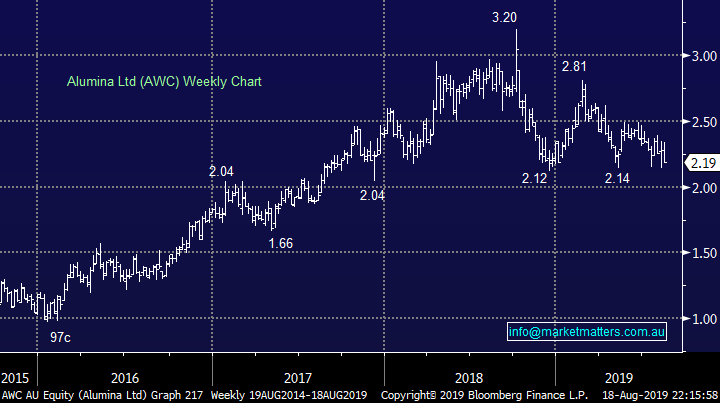

“Hi MM team, AWC had a very healthy final dividend earlier this year, which I enjoyed with MM, and I wonder what the market consensus is for the upcoming interim div. With AWC sitting on strong support at $2.20 would a purchase prior to the Half yearly report on the 23/8/19 meet risk/reward targets?” – John M.

Morning John,

Alumina (AWC) has struggled to hold onto its gains in 2019 and technically we can see the producer testing the $2 in the months ahead but the yield is undoubtedly attractive.

The estimated dividend for this month is US8.9c fully franked, hence any spike under $2 on a disappointing result later in the week will be very tempting for both of our Income & Growth Portfolios.

MM is neutral AWC ahead of its result.

Alumina (AWC) Chart

Overnight Market Matters Wrap

· Global markets ended the volatile week with solid gains last Friday, led by the tech. heavy, Nasdaq 100.

· Commodities were mixed. Oil and iron ore recovered some of its recent losses, while base metal prices were little changed and gold eased back 0.5% from recent highs

· Locally, investor focus will remain on corporate results in what will be the busiest week of the corporate results season, with numerous blue-chip companies reporting including BHP, Brambles (BXB), Stockland (SGP), Santos (STO) and Qantas (QAN).

· The September SPI Futures is indicating the ASX 200 to start the week on a positive tone and open 42 points higher, testing the 6450 level this morning

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.