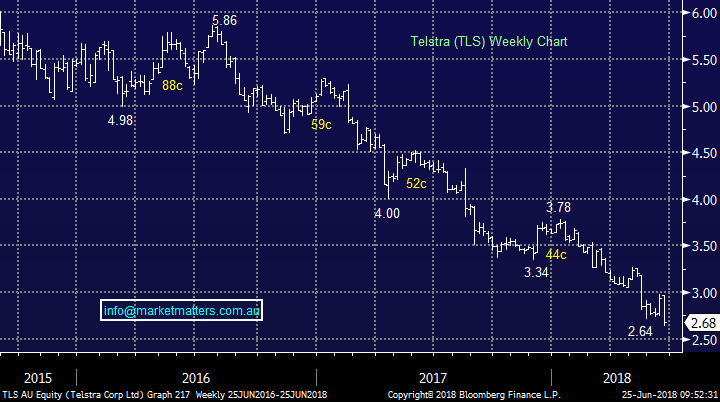

Subscribers questions (TCL, TLS, A2M, RHC, WEB, CBA, WTC)

A few articles caught our eye over the weekend which may influence local stocks this week although EOFY is likely to be the main driver of both individual stocks and the index. The markets set to open up around 10-points today and we expect a choppy week ahead.

1. The Liberal government have now ruled out further compromise on their proposed company tax cuts, sounds like they may be confident of victory which would be net positive for stocks.

2. Home auction rates remain subdued with the national clearance rate looking likely to remain below 50% and differing opinions as to the markets health are being written almost daily.

3. In between rounds of golf Donald Trump is now talking about putting a 20% tax on European cars, a poor sign for free trade BUT cars in the US are so cheap, about half price the price of Australia.

4. China is cutting the cash reserves banks must hold by over $100bn - not unexpected but the opposite to what’s recently happened locally to Australian banks.

Overall interesting reading but unlikely to change the course of the ASX200 this week.

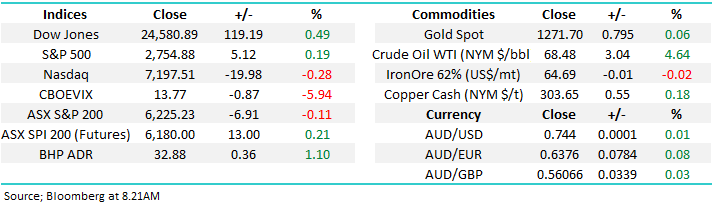

· The upside momentum is strong and we must remain cautiously positive as overhead technical resistance looms in the next 1%.

ASX200 Chart

We have again received a very encouraging number of questions this week, thanks and please keep them coming! I understand at times answers are longer than some people would prefer, while shorter than ideal for others, which is a reflection of a large diverse subscriber base and hence we attempt to answer in a manor that we believe is optimal at the time.

Question 1

“Hi James, defensives such as TCL and SKI are enjoying a short-term resurgence currently. Is this just a case of 'a rising tide lifts all boats'? Such stocks have suffered from being considered as bond-proxies in a longer-term environment of higher interest rates and high debt levels. Or has the market forgotten about their desirability when time are uncertain (risk-on)? Perhaps their dividends are more certain than the banks?” - reading your newsletter daily, thanks Rob J.

Morning Rob, the timing of your question on the money as we touched on this in point 5 of the Weekend Report.

We are surprised the Australian market has not rerated the sector at this point in time but you simply cannot argue with price action, its usually a financially painful exercise.

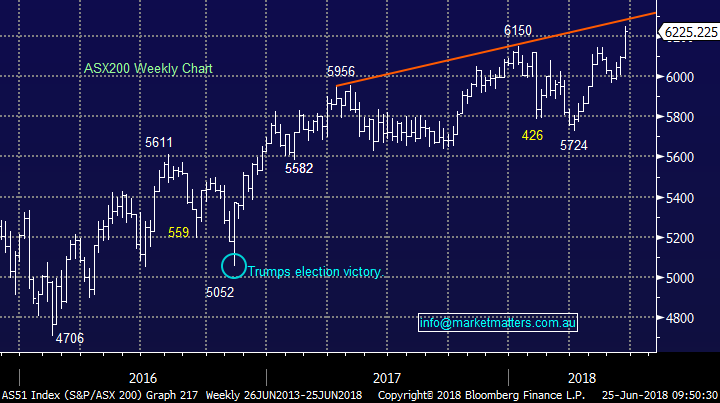

In the US the trend has followed our expected path with the S&P500 up 3% over the last year but real estate and utilities sectors are both well down i.e. the traditional “yield play” stocks. With bond yields feeling like they are due to consolidate in the US we can see their trend revert slightly, or at least consolidate.

However locally the story is very different as our bond yields are struggling to get off the canvas with falling house prices potentially stopping the RBA even considering raising rates – last week the RBA actually stopped saying the likely next change in rates is up, not too optimistic on our economy.

· Australian 3-year bond yields have rallied just over 0.5% to around 2.1% but in the US their 2-year bond yields have increased 500%.

I think this is a domestic issue and the Australian yield play stocks will struggle when the RBA starts increasing rates, or at least when the market can see it say 6-months away.

At MM we have no interest in this sector but acknowledge they are stronger than we expected and may have more upside short-term.

Transurban (TCL) Chart

US 2-year bond yields Chart

Question 2

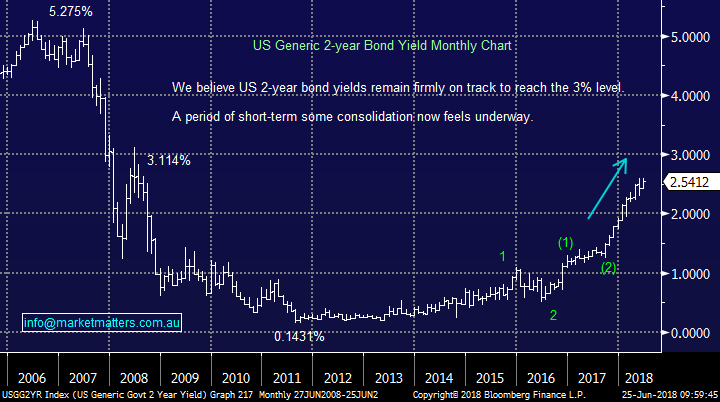

“Hi James, I can’t help but admire your courage buying more Telstra. The strategy day seemed to be all about cost cutting and reorganising the cargo. Couldn’t see anything about growing earnings which is what’s needed to see share price growth.” - Paul H.

Hi Paul, as it stands, Telstra (TLS) is clearly not the easiest company to value with a number of major uncertainties moving forward however we think the market has positioned too negatively towards their prospects – in short, it’s trading too cheaply in our view. We think much of the risk moving forward is priced into the stock while any potential improvements to the companies’ earnings in the years ahead are being ignored – it’s what happens when everyone’s bearish. We saw the resources sector recover dramatically from early 2016 with BHP more than doubling after being in the naughty corner for around 5-years, we are not forecasting TLS to double from here but we do believe their upside more than outweighs the downside from current levels. We think the stock is worth around $3.60

Telstra (TLS) Chart

Question 3

“Hi MM, I really wonder about the trade war between USA and China and if it might help our own exports to China. Traditionally USA used to be self-supplying in that they were big and smart enough to survive internally, it seems that this what they want to do again. Might be a good discussion topic for your report.” - Regards, Phil.

Hi Phil, certainly a huge subject. Overall the markets certainly are not considering a global trade war as a likely scenario moving forward, complacency is high and risk measure (volatility) are very low. Obviously like in most things their would-be winners and losers e.g. a company exporting to China whose competition is from the US could be cheering but the resources sector is likely to struggle as China’s growth would probably be curtailed – which ultimately is a net negative for Australia. At MM we see risks in US equities at current levels and perhaps we are going to get an eventual “straw that breaks the camel’s back” scenario as Trump keeps firing off aggressive Tweets on trade.

US S&P500 Chart

Question 4

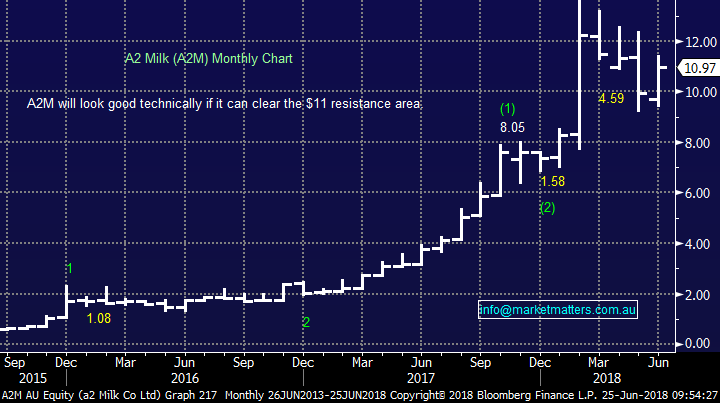

“Hi James, as your aware I hold A2 Milk (A2M) although I have sold more than half my holding in a2 it still holds a big position in my portfolio. Your note today, my understanding is you expect fund managers who have done really well on a2 over the last year to sell off to show a handsome profit to their clients for fy18 or am I misunderstanding your note and if so why are you guys sellers.” - Thanks in advance Frank M.

Morning Frank, congratulations again on what has I’m sure been a very successful investment.

Second guessing on what fund managers will do into EOFY is just speculation and our decisions are not based on this alone but we do keep it in the back of our mind in case opportunities arise.

A2M has enjoyed a stellar year so its unlikely to be a candidate for classic tax loss selling but of course some people may want to lock in some profits if they are taking loses elsewhere - its impossible to know. We sold 50% of our holding because the stock had rallied almost 25% from its lows in a few weeks and we felt more comfortable with a smaller holding moving forward – 3% of our portfolio rather 6% we view as a more comfortable weighting.

· A2M has become very volatile recently as its high valuation has recently come into question and taking some profit was an easy decision remembering that at MM we are in general “sell mode”.

A2 Milk (A2M) Chart

Question 5

“Got to say you guys seem to have a strange trading strategy. Sell stuff like WEB and A2M going up and buy stuff heading down, like RHC today. Both would seem to reduce profits” – Cheers Peter K.

Morning Peter, I can fully understand this conclusion considering our activity over recent weeks - time will tell if we are correct.

In terms of RHC we have targeted this move for well over a year and we’ve simply put our plans into action. Remember, RHC have simply said growth in earnings will be ~7% rather than the ~9% growth implied by the market. I recall receiving similar comments when we started buying BHP as it fell to around $20 in 2017, our first attempt was too early but the strategy was correct – we had been bearish BHP for a number of years and avoided the losses that many incurred.

1. When we bought WEB we always had a target of $13-$14, its reached that area and MM took profit and will revaluate moving forward. When we bought WEB it had just fallen ~30% on short term concern about it earnings

2. We have been bearish RHC for years for a number of reasons, targeting around $55, we like the sector in general and hence followed our plan to buy.

As you can see above Peter we bought WEB when it was heading down, following our plan at the time, we believe at MM that active investing is about planning and preparation – time will tell if our recent actions are correct but we have enjoyed an excellent 2017-2018 financial year.

Webjet (WEB) v Ramsay Healthcare (RHC) Chart

Question 6

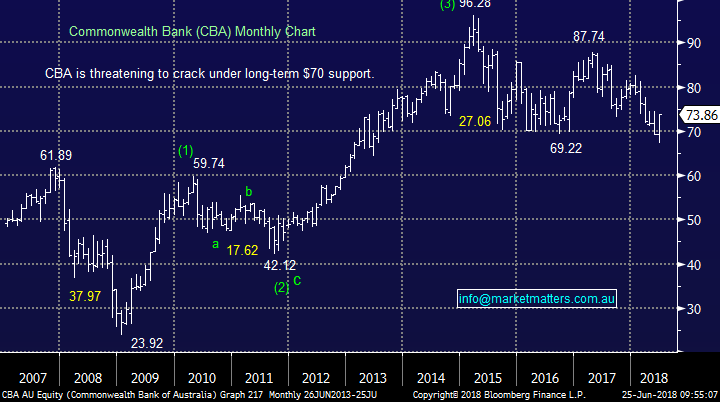

“MM believes bank dividends are sustainable, although ANZ and CBA more so than WBC and NAB. We are bullish CBA at current levels although concede this is an ‘uncomfortable trade’ – most good ones are!” - MM.

“Hi There. In your conclusion statement in a recent email.: Have Banks Bottomed? the above was said. I feel I need to respond to that statement as I find it quite onerous and rhetorical.

How can you be bullish on a stock and be uncomfortable. If you are uncomfortable on the stock then obviously you don't take the trade! You are either bullish or you are not! If you are not bullish then you are bearish! Then you don't take the trade. Right? If you are uncomfortable then you must be bearish and not bullish. You can only be one or the other! If a stock is a good one then it stands to reason that one would be bullish on that stock. And anyway, what is a good one...there no such thing as a good one? So, your statement to me is sorry to say....is nonsense.” – Regards Stefan K.

Morning Stefan, sorry you feel this way but we are investors first and writers second so if our wording is not perfect I do apologise.

I will try and qualify a couple of points quickly.

1. I would not agree that if you’re not bullish then you are bearish because markets travel sideways 80% of the time hence being neutral is a valid opinion.

2. We have been holding 10% of our Growth Portfolio in CBA and would have loved to have been averaging below $70 but we must use prudence and not put all our eggs in one basket. Ours is a real $$ portfolio and not theoretical so must be invested accordingly.

3. However, holding 10% in CBA and not selling is in itself bullish to us, we certainly do not hold stocks we are bearish on

4. Our meaning of being uncomfortable is just a phrase around buying stocks that are weak / in freefall – holding ones nerve at a time when the market in generally negative, can be ‘uncomfortable’, yet it’s not a reflection on how we view a stock.

Commonwealth Bank (CBA) Chart

Question 7

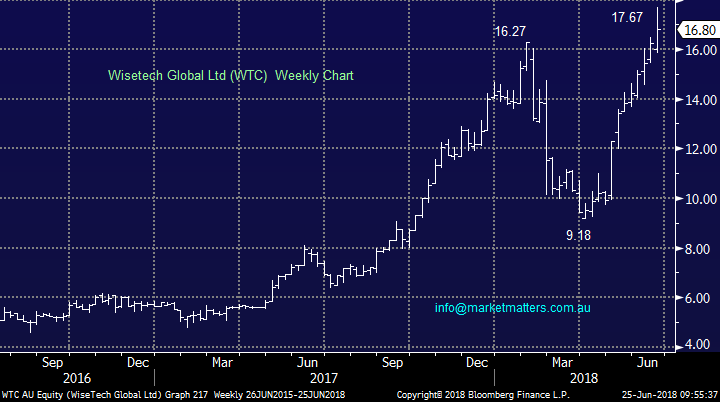

“I am interested in WTC. It has potential but what is MM’s assessment of this share?

Can you give an opinion or review?” – Thanks Phillip W.

Hi Phillip, WTC was a huge success in 2017 but its volatility cannot be ignored. We are neutral around current levels and with the stock now trading on a huge valuation another fall from grace as was experienced in February cannot be ruled out.

Considering our view that the US NASDAQ is in a dangerous position we will not be considering buying stocks like WTC in the coming months.

Wisetech Global Ltd (WTC) Chart

Question 8

“ASX200 at 6250, a 10-year high... any good reasonable profit to take....” – Joe B.

Hi Joe,

We are in “sell mode” but we are not being aggressive at this point in time, simply selling / reducing our holdings as the opportunity occurs. However, we are watching markets closely for more major “sell triggers” and this is when we are likely to start utilising bearish facing ETF’s.

Certainly expect more alerts over coming weeks with a sell bias.

ASX200 Chart

Overnight Market Matters Wrap

· A mixed session was experienced last Friday in the US, with the Dow and broader S&P 500 ending the session in positive territory, while the tech. heavy Nasdaq 100 closed marginally lower.

· The international trade war has moved focus to Europe with Trump threatening a 20% tariff on European cars unless the EU removes duties on US products.

· Locally, investors will likely welcome CBA’s announcement to demerge its wealth management and mortgage broking units, while the strength in oil will help the energy sector, with BHP expected to outperform the broader market after ending its US session up and equivalent of 1.1% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to open 15 points higher towards the 6240 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/06/2018.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here