Subscribers questions (SHL, AMC, BXB, SCP, CGF, SLM, WNB, FLT, BPT, STO, WEB, TGF, TNG, WPL, OOO, A2M, ELO, KGN, BHP, BGA)

The news over the weekend was very orientated towards “unlocking Australia” with different states appearing likely to be outlining their respective plans in the next few days, with the total Australian death rate sitting at 83 this morning it feels to me like a prudent course of action. I saw a beautiful site on the weekend news of the happiness on the faces of Spanish children who were allowed back onto the streets after a tough and painful lock down which has seen over 23,000 of their population pass away, things should get better soon!

The statistics show that Australia has clearly faired extremely well in its fight against COVID-19 and assuming the borders remain closed for the foreseeable future the major uncertainty we see is how will both our own and the global economy kick back into gear, it feels more like a case of a 50-year old Valiant as opposed to a 2019 Toyota Corolla, nobody really knows if it will start and then how well it will drive on any particular day. We have a number of very structural changes to our way of life / investment landscape that will not turn on like a light switch, for example:

1 – Overseas travel and tourism looks unlikely to return to normal until well into 2021 due to ongoing risks from COVID-19.

2 – The number of rental bond refunds is up by nearly 20% year on year as people move home or in with friends in times of uncertainty around money and employment – if property prices fall aggressively then equities become less attractive on a relative basis.

3 – People are enjoying some of the benefits of working from home and we believe commercial real estate is on a far more uncertain journey than in 2019.

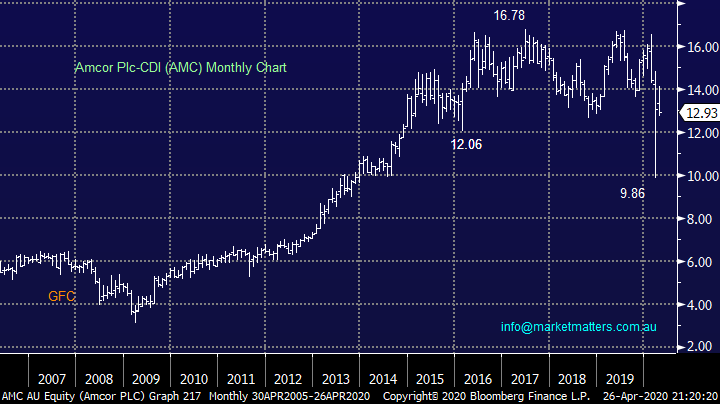

Today’s number of questions illustrates perfectly that investors are rapidly regaining confidence and looking for a bargain, especially in beaten up sectors like Oil. Our feeling is the market in general is a buy courtesy of interest rates plus general central bank / government stimulus but there are a number of sectors where its simply too hard for the foreseeable future, stock / sector selection is probably more important than ever post-COVID-19.

MM is in “buy mode” but short-term we are 50-50.

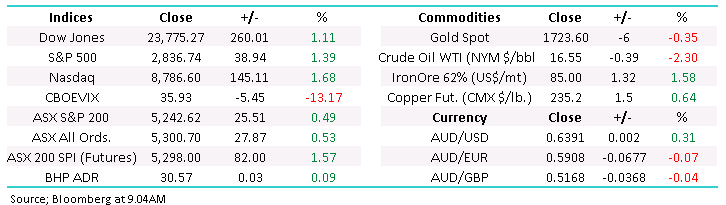

ASX200 Index Chart

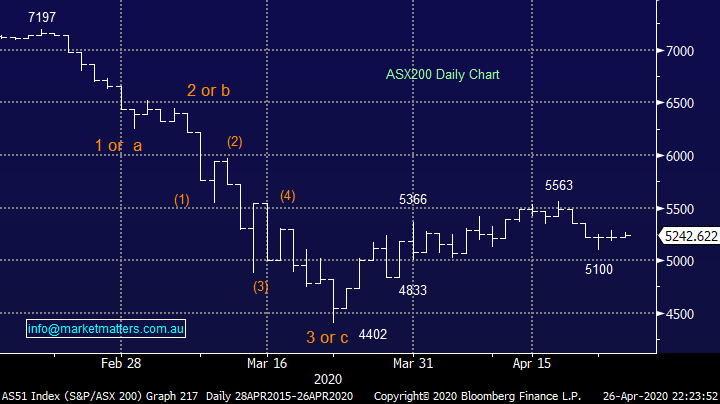

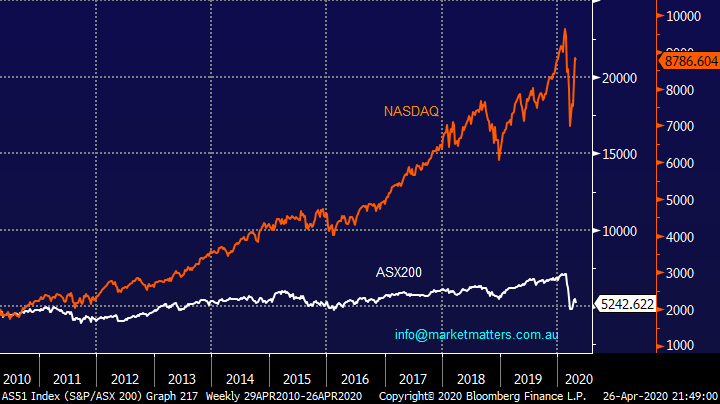

In the Weekend Report we outlined our 2 favoured paths for US equities with the more short-term positive picture shown below through the tech-based NASDAQ. For people who think that stocks are “a lay down misere buy” MM believes they should simply consider the below 2 facts which leads us to stick with our “choppy bullish bias” outlook:

1 – The NASDAQ is only 9% below its all-time high yet we have huge uncertainty around how the global economy will recover moving forward and that’s before we even consider how bad things are today – thank goodness for “free” money!

2 – Equites look very vulnerable from an earnings perspective as US stocks move into reporting season, again only bond yields offer any solace to the valuation side of the ledger.

US NASDAQ Index Chart

Thanks everybody for the number of questions this morning, please excuse the brevity at times but obviously we always aim to deliver our morning reports in a timely manner.

Question 1

“Hi, I am a new subscriber and enjoying your reports. I am looking to invest into 3 large caps, which I view as reasonably defensive. These are: SHL, AMC and BXB. I like all 3 for different reasons, can you give me a view on your price target /fair value on each and whether you like the stocks at this price level.” - Many thanks & Cheers David P

Hi David,

Welcome on board and thanks for the thumbs up towards our reports. I have given a quick snapshot on the 3 stocks below:

Sonic Healthcare (SHL) – this medical diagnostics company has withdrawn its FY2020 guidance like so many businesses however the company was sitting on over a billion dollars before its last dividend (~$160m) making it a relatively low risk investment. However the stocks not cheap and we put it in the neutral / bullish bucket, it’s hard to imagine more than 15-20% upside over the next 12-months but a pullback back towards $23 would be more appealing from a risk / reward perspective.

MM is neutral / bullish SHL.

Sonic Healthcare (SHL) Chart

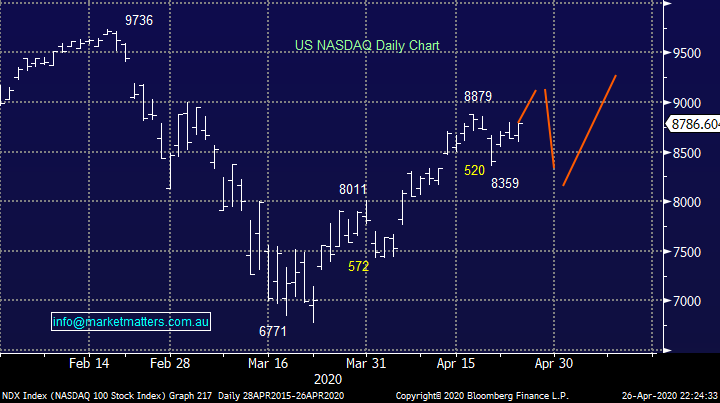

Packaging company Amcor (AMC) benefits from a significant portion of its revenue coming from defensive areas like food & beverages plus the company benefits from a plunging oil price. Overall AMC looks and feels similar to SHL as it enjoys a safety allure, our ideal entry level closer to $12.

MM is bullish / neutral AMC.

Amcor Plc-CDI (AMC) Chart

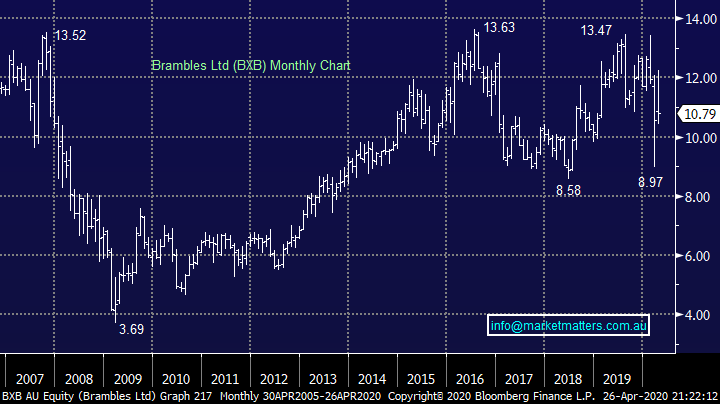

Pallet business Brambles (BXB) obviously is suffering like many through the global economic slowdown but if we stand back the shares have been trading between $13.70 and $8.50 for over 5-years making the risk / reward at $10.80 unexciting.

MM is neutral BXB

Brambles Ltd (BXB) Chart

Question 2

“Hi James, I’m thinking SCP and CGF are looking attractive as potential income stocks. SCP seems to be more defensive than other REITS with the majority of their tenants being non-discretionary retail e.g. supermarkets/ chemists/ fresh food etc. and has an estimated forward yield of just over 6%. CGF has recently confirmed FY20 guidance but is down 60% from its high and is on an estimated forward yield of >7%. I’d be interested in your thoughts as potential income stocks.” - Thanks Bruce G.

Morning Bruce,

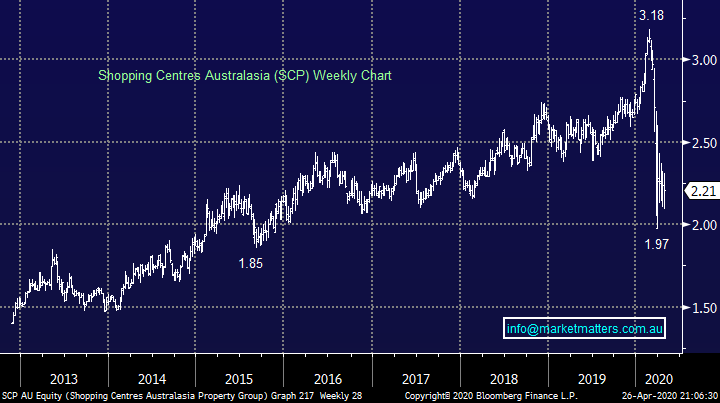

I agree on your synopsis with regard to SCP as 98% of their centres containing a Woolworths (WOW) or Coles (COL) but they also do have their fair share of cinemas and gyms. At the start of April, they raised $300m, not just too sure up the balance sheet but to invest further into this downturn, an aggressive move by the company. SCP are expected to yield 6.76% and trade on a P/E of 13x, which is attractive.

My concern is that property revaluations have not yet filtered through and the market is not yet pricing this into SCP – it trades on a price to book value of 0.96, while gearing pre-raise was 35% and post raise its 25%, which is low until they start deploying funds. We are neutral property stocks generally.

MM is neutral SCP.

Shopping Centres Australasia (SCP) Chart

Annuity Investment Manager Challenger (CGF) has fallen from grace with a thud over recent years, not just since COVID-19 graced our news. Last week’s 3rd quarter update led to more selling with concerns around defaults on some of its investment portfolio. We can see a downgrade looming hence we have no particular attraction to CGF – the tape is warning investors that all’s not right with CGF even at $4.

MM is neutral CGF.

Challenger Ltd (CGF) Chart

Question 3

“Hi James & Team, it is often quoted how the return can be adversely affected if the 5 or 10 best days are excluded:

1 - Any idea of how the return can be affected if the 5 or 10 worst days are avoided?

2 - Is Salamat SLM a cash box now? what is the NTA? Is it worth investing in to wait for the eventual return of capital to shareholders?

3 - Do you have an opinion on Wellness & Beauty solutions WNB?”

Many thanks, Sidney H.

Hi Sidney,

An interesting question around the best and worst days and as you say there’s plenty of data around missing out on the good times, my initial thought was if you miss the worst days the impact would be far greater because markets fall faster than they rise. However, as the best days often follow the worst days it becomes very micro and arguably irrelevant. For the record as I suspected missing the worst days has a larger impact however the below fact might surprise some i.e. avoid volatility which of course is easier said than done:

If you avoid both the best and worst days for an index a portfolio significantly outperforms.

Salmat (SLM) owned the largest letterbox distribution business in Australia and recently sold it to IVE Group (IGL) for $25m while they’ve also sold their MicroSourcing business for $100m with the company now looking to return funds to shareholders. They have a market capitalisation of $152m at 76.5c, they receive cash of approx. ~$125m subject to some settlement balancing and it looks like they had cash and equivalents of around $45m beforehand, so you’re right, SLM is a cash box and is looking to return funds to shareholders.

From a quick ‘back of the envelope’ calculation, the business could be trading around 11% cheap compared to its cash backing.

Salmat (SLM) Chart

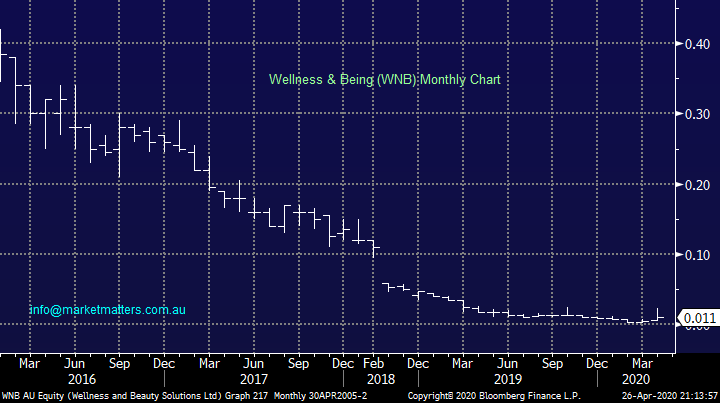

WNB being a “penny dreadful” is not our usual area of expertise, the stocks fallen over 95% over recent years and best left alone in our opinion.

Wellness & Being (WNB) Chart

Question 4

“Hi James and team, Once again thanks for your stellar service it’s become a haven of common sense, not to mention good ideas in these surreal times. Don’t stop:

1. Perhaps I’m looking for things that aren’t there yet , but I noticed the ASX Oil price ETF ( OOO) has followed the oil price down in stages over the years from 2012 to non from around $60.00 to around $4.70 today I think .....but today there was a massive volume spike....could this suggest an upward move in the offing?

2. FLT chart —since it resumed trading has gone from its opening low to a high and now almost back to its low in about an equal number of trade days up and down. I’m thinking that there must be an awful lot of pent up interstate travel demand pressure building rapidly now..I’ve heard a lot of friends/ acquaintances say that they MUST fly somewhere “ the second we’re allowed to travel” ..this is for family reasons of all kinds and of course some business reasons. The Australian family and society over the last 30 odd years IMHO has become scattered all over this large mostly empty country and it is considered the norm nowadays..eg I have siblings and immediate family in Cairns , Perth, Adelaide, Broken Hill , Florida..and the list goes on and I’m certainly not an “outlier”.

Australia's cancelling of domestic air travel has been brutally comprehensive and almost as savage in Europe UK etc ( USA..not so much) . However, with a heavy testing regimen at airports and the mounting political and business pressures, it’s not hard to visualise all these countries allowing at least some air movements sooner rather than later and it doesn’t take many jets in the air to push the oil price back up rapidly both on actual and anticipated future consumption . As soon as I can , I will be travelling again by air ..and yes I will probably use FLT again for quite some of that...my thinking is that these stocks may be worth a punt especially since FLT has completed is capital raising , and seems tightly managed .Could this also be a worthwhile punt in your opinion?

Could you comment on these situation(s)? hopefully I’m not suffering too much from lockdown fever and missing something bleeding obvious.” -Cheers Paul A.

Hi Paul,

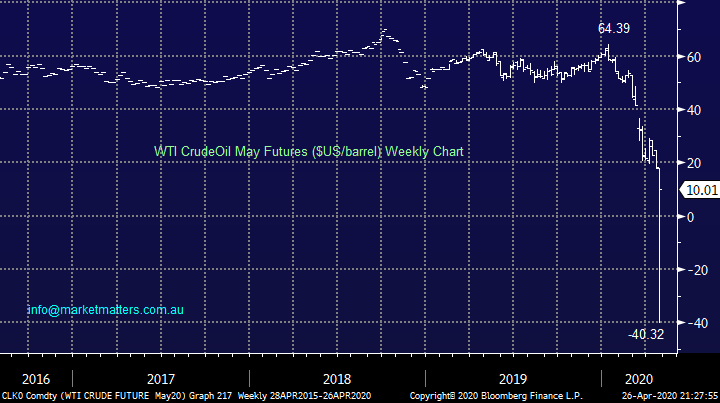

Crude oil went crazy last week as the front month May futures contract expired, as most people know it traded under negative $US40/barrel, as we’ve explained previously if you held the contract at the days end it was time to empty the pool because a lot of oil was coming your way and the worlds almost run out of alternative storage. The volume spike you mentioned in OOO was courtesy of this unprecedented move into negative territory. We are bullish oil from both a technical perspective, including the volume panic you referred to, and the fundamental supply / demand imbalance which is unsustainable.

MM is bullish oil from current levels.

WTI Crude Oil May Futures ($US/barrel) Chart

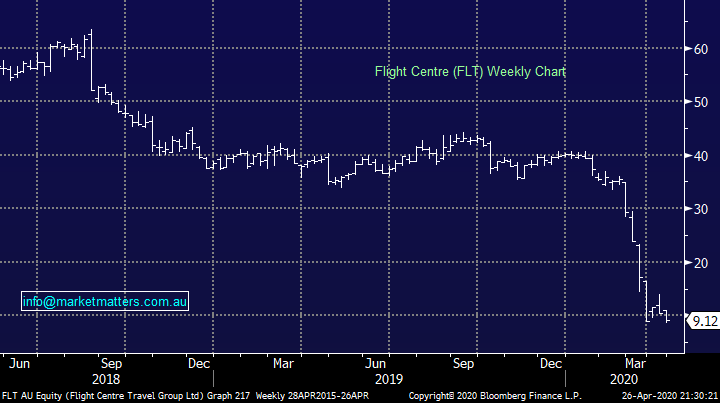

I really appreciate your “punt” reference to FLT because in today’s environment that’s clearly what it is, a sniff of a secondary wave of virus infections and FLT will be friendless although it almost is today. I agree that domestic travel will pick up when allowed but corporate and international are likely to be very different and these are important areas for FLT. In fact, the only part of FLT’s business doing well pre-crisis was their corporate division.

That said, my “Gut Feel” is if you buy FLT around $9 there’s a good possibility of a ~40% recovery and a stop of only 10% can be used, very attractive risk / reward.

MM likes FLT as a punt.

Flight Centre (FLT) Chart

Question 5

“Hi MM team - keep up the good work! Oil. Be it ETFs or Equities do you see a play in this historic downturn? Even if this is a historic circuit breaker and maybe Oil never recovers to what is was - there must be some upside to skim. Today we read about Oil futures trading at negative prices because if you were to hold the thing when it falls due, you'd have to find somewhere to store it! What's your think on Oil?” - Dave B.

“Hi Guys, Silly Question from this morning report STO with an initial target -30% higher I am assuming that the recommendation is buy at the current price and hope that the price increases by 30%” - Kind Regards Lionel P.

“Hi James. Just after your thoughts on which is the better buy out of Woodside (WPL) and Santos (STO) at moment as looking to add energy stock to portfolio. With oil prices weighing on pricing seems like good time to get on board with one of them.” -Thanks Ian H.

Morning Guys,

Thanks for the positive feedback, these are exciting times with crude oil very much at the forefront and its always important to remember the only “silly question” is the one not asked! We have understandably received large number of oil questions today and I have bracketed these 3 together here to avoid repetition:

1 – MM is bullish crude oil stocks although volatility remains likely.

2 – Yes, we are looking for Santos (STO) to initially rally around 30% from today’s levels.

3 – We like all 3 of Santos (STO), Beach Petroleum (BPT) and Woodside (WPL) but our slight preference is the first 2.

Beach Petroleum (BPT) Chart

Santos (STO) Chart

Question 6

“Sorry for late notice but wanted to get your opinion on the Webjet entitlement offer. Should I take it up. I also have the opportunity to take double my entitlement.” -Thanks Richard A.

Hi Richard,

The retail offer actually closed on the 21st April with the company raising $118m in that entitlement taking the total amount raised to $346m at $1.70 per share versus Fridays close at $2.50, therefore taking up the rights made sense.

The take up rate from retail investors was 72.2% while they also received oversubscriptions which covered the rest (and some) which is important, given it means the underwriter of the deal is not lobbed with stock, and is therefore not a natural seller in market. The fact WEB had to scale some of the retail deal is positive, while the institutional component was also over bid. New shares start trading tomorrow so expect some profit taking as a result.

MM remain cautious travel companies, Including WEB

Webjet (WEB) Chart

Question 7

“Hi James, Love your work. Given you're bullish on commodities what do you think of the TGF (Tribeca) as an investment. Seems undervalued ATM Cheers” -Tim R.

Hi Tim,

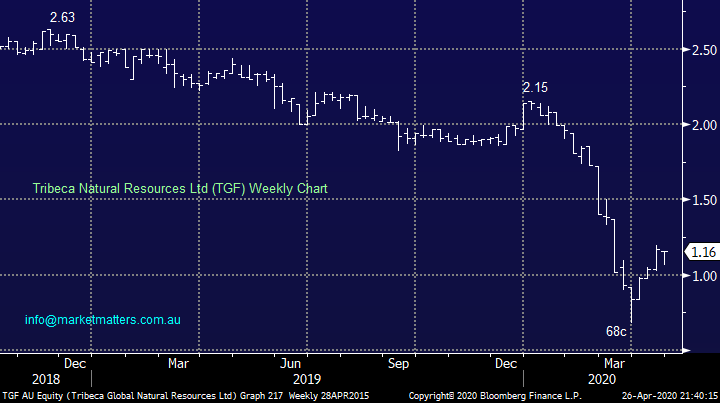

Tribeca Global Resource Fund (TGF) is a listed investment company (LIC) that invests both long and short in natural resource companies. They hold equity, debt and can also invest in the underlying commodity. I had Chinese with the guys when they were promoting this fund and initially came away with a reasonable positive view on face value, however, didn’t invest in it.

We are indeed bullish commodities and the reflation trade however ultimately we like investing directly into companies rather than through funds and the ASX is lucky to have a very strong mining sector which affords us enough diversity and opportunity in the space to do so.

This LIC now trades at a 32% discount to the value of its assets, which seems cheap however performance has been very poor since listing.

MM prefers investing in resource companies directly

Tribeca Natural Resources (TGF) Chart

Question 8

“Hi MM Team, Thanks for your ongoing efforts in covering the news cycles for us and distilling that down as you do. Great work. I’m wondering if you have any thoughts about mining companies mainly focussed on Vanadium? There could be more, but I know of AVL and TNG. They seem to be hoping for a increase in demand for Vanadium for the Redox Flow battery systems. Both are in the pre-operational stages undertaking feasibility studies, and organising finances. Have you looked into this much before or have any opinions about either of these two companies?”- Cheers Alan P.

Hi Alan,

Thanks for both the thumbs up and journey towards pastures new with Vanadium – chemical symbol V and it’s a hard-silver-grey coloured malleable metal for those unfamiliar.

This isn’t an area we have paid much attention to especially since the huge correction in lithium stocks, a market as is so often the case which got ahead of itself in this case with Electric Vehicles (EV). TNG being a more than $60m business is by far the bigger of the two you mentioned but it’s still remains unloved over recent years – we believe this sector is too hard until further notice.

TNG Limited (TNG) Chart

Question 9

“Hi James, What is the most practical way for a private investor to get set up to trade US equities or are we best to buy ETFs? Issues are converting dollars to US dollars at best rates, getting the funds to US broker, then actually executing the trades. When I last tried through Commsec it was a very slow process both the getting the funds ready and the trading. Is there another way that’s safe and efficient? With all the capital raising that has happened and more to come is there any dominant merchant banks that will get the lion’s share of the fees, or is it more widely disbursed? Is MQG dominant in this field? Just thinking of share price implications.” - Thank you, Marvin C.,

Hi Marvin,

It is more complex to set up an overseas account than a local one for obvious reasons. Interactive Brokers is best from a price perspective, through Shaw and Partners we offer both managed accounts which focus internationally or a traditional broking service, however minimum transaction charge is $US125 which can be limiting for smaller trades. There are newish products listed on the ASX called X TRACRS, which provide an easier, more cost-effective way of investing in large cap overseas shares, including Apple, Alphabet, Disney, IBM etc. Full list available at www.tracrs.com.au

ASX200 v US NASDAQ Indices Chart

Regarding investment banks, Macquarie is the main local listed beneficiary as shown by their underwriting of NAB’s $3.5bn raise this morning. JP Morgan, Morgan Stanley and UBS are beneficiaries internationally.

Question 10

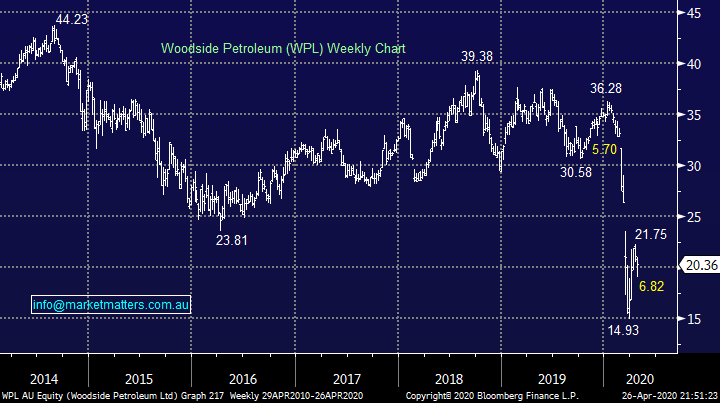

“I have just overplayed the chart of WPL & fuel - almost 100% coloration. Which is the better buy?” – Michael S.

Hi Michael,

I would probably KISS (Keep it simple stupid) and buy Woodside (WPL) plus some dividends never hurt.

Woodside Petroleum (WPL) Chart

Question 11

“Hi, I had a question about ticker OOO ETF oil tracker by BetaShares what is your view on these type of ETF’s. given the current move are they in danger of insolvency if contracts go negative again?” – Stuart T.

“ETF OOO what is your opinion on this stock, is it risky compared to say FUEL? - Daniel C.

“Beta Shares OOO ETF, Beta Shares sent out an ASX market announcement today regarding changes to the month which the fund will reference, changing from the Front Month to Front Month plus three months. They have made these changes due to the WTI crude oil futures May 2020 contract trading at negative prices on the 20th May. For your information and perhaps for your advice to other subscribers.” - Cheerio, Neil E.

Hi Guys,

Great questions and a risk we were cognisant of when we changed our mind to buy the FUEL ETF as opposed to the OOO alternative, we still prefer FUEL.

Also while it feels unlikely that the OOO will struggle in future as it changes from front month to plus 3 months I would counter with never say never i.e. who would have thought at the start of the new millennium that bond yields would be negative in many developed countries and oil futures could trade negative.

BetaShares Crude Oil ETF (OOO) Chart

Question 12

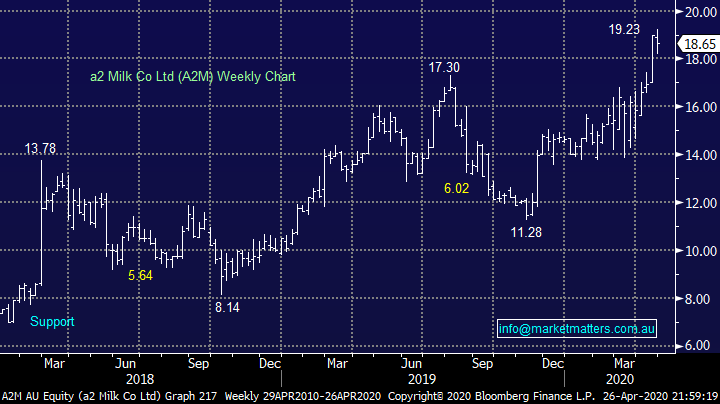

“Hi James and Team, A2m was out with an am update this morning. Would you mind giving a bit coverage on that. Would love to get your views on this.” - Regards Frank M.

Hi Frank,

A strong quarterly update from A2M and this is one of few businesses that are benefitting from increased demand for their products. At their quarterly update they provided FY20 sales guidance and upgraded margin guidance, saying that they’d benefitted from ‘pantry stocking’. Margin improvement obviously flows into earnings so we’ve seen earnings upgrades after the quarterly, with the market expecting Earnings Per Share (EPS) of 52c for the full year, which puts in on a P/E of ~38x, although that is supported by strong growth, the market expecting +16% EPS growth in FY21 & 22.

A2M remains bullish while it holds above $16

A2M share price (white) v Earnings per share expectations (red) Chart

A2 Milk (A2M) Chart

Question 13

“Subscriber question for MM Team, Love your reports. Would like to get your views on EML, MP1, Z1P, ELO and EOS, if possible. Does any of these companies have good growth potential?” – Pat.

Hi Pat,

Due to the volume of questions today I have quickly picked out the one we like most from a technical perspective with software and services provider ELMO Software (EMO) coming out on top. I will do a report shortly on payment providers.

MM likes ELO looking for at least 25% upside.

Elmo Software Ltd (ELO) Chart

Question 14

“Hello, many thanks for the great guidance. It has been proving very valuable to me. I would like to get your advice on Kogan (KGN). It dropped substantially in March and has rallied well since then. On March 23rd, it was at $4 and now at $7. There are some positive news around founder suggesting no redundancies in 2020 and offering $500 bonus to all employees. Do you see Kogan continuing to climb up or suggest booking profits at around $7-$7.5?” - Thanks, Vibs W.

Hi Vibs,

Thanks for the positive feedback always appreciated. Kogan is a volatile beast and we haven’t always been fans due to the “opportune” timing of the sell downs by insiders but the COVID-19 inspired kick up in e-commerce has certainly benefited Kogan. We are neutral KGN around current levels and wouldn’t be surprised to see a $1 move in both directions over the weeks ahead.

KGN is neutral around $7.

Kogan.com (KGN) Chart

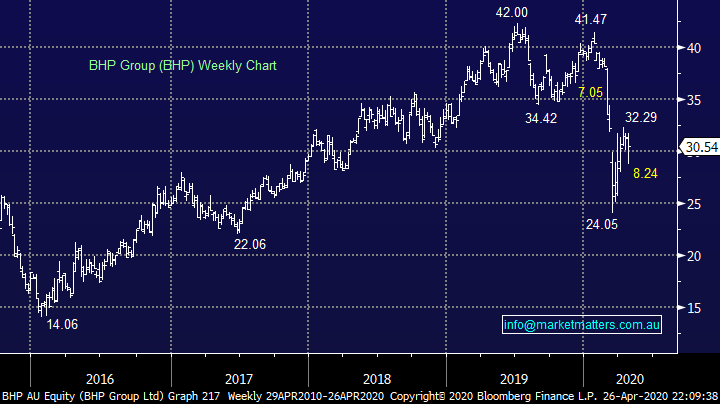

Question 15

“I have no doubt this government will very shortly lower company tax across the board - it has never been more important for Australian companies to be competitive on a global basis. If this happens should it change our view on the companies we buy? some of the obvious benefactor’s Australian banks, BHP & RIO” – Michael S.

Hi Michael,

I agree with your thoughts on the government looking to kick start the economy, they might wait to see how well it does under its own steam before cutting company tax but it’s clearly an option plus on the global stage a $A close to 60c should act as a huge tailwind for most businesses.

Potential company tax cuts is one of a number of reasons to be cautious being short stocks in our opinion.

BHP Group (BHP) Chart

Question 16

“Hi MM Team, What is your view on Bega (BGA) AND Sonic Healthcare (SHL). Both fundamental and technical analysis” - thanks, Tim C.

Hi Tim,

We looked at SHL earlier, Bega Cheese has clearly struggled for the last few years but we feel that any food produce from Australia should be well positioned moving forward as our “clean & healthy image” goes from strength to strength – technically BGA is neutral at current levels.

MM is neutral to bullish BGA.

Bega Cheese Ltd (BGA) Chart

Question 17

“Hi James, Wondering if you are familiar with this notes offer - Alpha Point Securities - Unsecured Notes I Offer ($3m). It brings to my mind if it sounds too good to be true........Paying 18% you thoughts would be appreciated” - Thanks Pauline B.

Hi Pauline,

I haven’t seen details of the offer, it’s not being listed on any of the systems we use however I would be very cautious on anything like this, touting such an interest rate, and in the form of an illiquid note offer. My first initial reaction would be the run a mile, however if you’d like to send me the details of the note, its structure, any security that underpins it, I will take a look.

US 30-year Bond Yield Chart

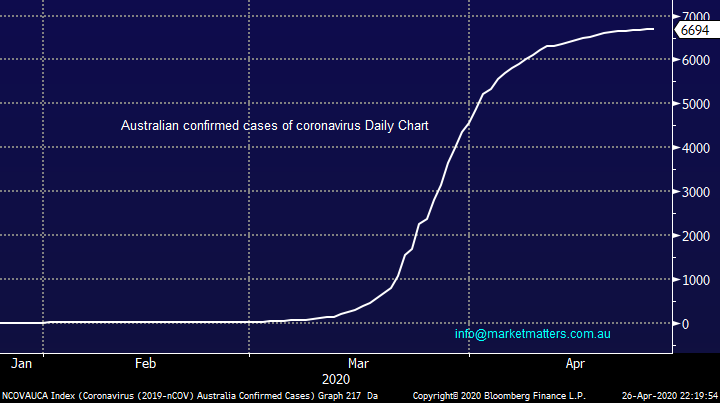

Question 18

“James, Re covid-19 please have a look at the performance of Taiwan. As of 23/04/20 Australia 6660 cases and 75 deaths and Taiwan 427 cases and 6 deaths. Only those suspected of having the virus are in isolation. No businesses closed, no jobs lost and no debt after it passes. Our Government has seriously over-reacted. Taiwan has the same population as Australia approx. In Taiwan they scan every person entering the country whilst we do not.” - John Randall.

Hi John,

You’re right, Taiwan have done a great job in handling COVID-19 with just 6 deaths without implementing lockdowns or social distancing. The key to their success was being decisive and acting early, their experience of SARS in 2003 would have helped this reaction time.

They initially extended Lunar New Year holidays for 3 weeks, schools stayed closed, they centralised the distribution of face masks and the like, they implemented 14 day quarantine for any entrants to the country, their tracking of cases was very strong and ultimately, they’ve continued to go to work without social distancing. This is an example of what to do, whereas the likes of the US and Italy are on the other end of the spectrum.

Australia has been more akin to Taiwan, although our response has had more dramatic economic influences. Ultimately, I think Australia now needs to focus on opening things back up, starting with schools and progressing from there. Our case numbers are low enough to get moving in my view.

MM believes Australia should move quicker to ease restrictions

Australian Confirmed Cases of COVID-19 Chart

Overnight Market Matters Wrap

- The US equity markets rallied last Friday, as most believe the coronavirus is dissipating with lockdown easing seen at some countries affected.

- Oil prices continued their recovery from unprecedented lows, which last week saw negative future oil prices, while base metals were seen slightly higher, with copper back to a near one month high of US$2.34/lb, from US$2.15/lb earlier in the week.

- This morning NAB went into trading halt pending an announcement on a capital raising and share purchase plan.

- The June SPI Futures is indicating the ASX 200 to open 80 points higher, testing the 5325 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.