Subscribers questions (SGM, BSL, ISX, BBOZ)

The SPI futures are calling the ASX200 to open unchanged this morning even after the Dow rallied over 250-points on Friday night, it feels like another example of deja vu with Australia leading global markets in the short-term – not as crazy as it sounds as we are the first major international market to open every day. On Friday night within the US we saw very different sector performance across their market, just like as we have locally in 2019, with their Financials gaining almost 2% while Healthcare fell close to 1%.

From a news perspective the looming Federal election is coming to the fore with election day a month away, Labor still look set to form the next government unless we see a dramatic swing in the opinion polls - from our perspective, it seems to be Bill Shorten's race to lose from here. However its hard to imagine that a Labor victory and subsequent end to the cash refunds for excess franking credits is not already built into the price of impacted shares in the local market.

MM’s preferred scenario is the ASX200 will rotate between 6000 and 6300 in Q2 of 2019 as we approach the historically weakest month of the year for stocks. These moves can become self-fulfilling at times but over recent weeks stocks have certainly enjoyed strong support into any weakness.

MM remains in “ buy mode” looking for the abovementioned pullback to increase our market exposure.

Thanks as always for the questions – a couple are real corkers to help subscribers understand markets further and of course our underlying views.

ASX200 Index Chart

On Friday night we saw the little “Aussie Battler” rally +0.7% against the $US, testing 6-week highs – an excellent performance considering most pundits believe our economy is “stuffed” and the RBA is about to slash interest rates.

I know we keep highlighting the $A but our view is “long the $US earners” is one of the most crowded trades on the ASX200 over the last decade and we have all seen so named “crowded trades” come undone in dramatic fashion over the years - MM believes the $A is headed to 80c against the $US.

MM remains bullish the $A hence we are concerned with the markets underlying belief that a $US earnings tailwind will remain intact for many large players on the ASX200.

Australian Dollar Chart

Question 1

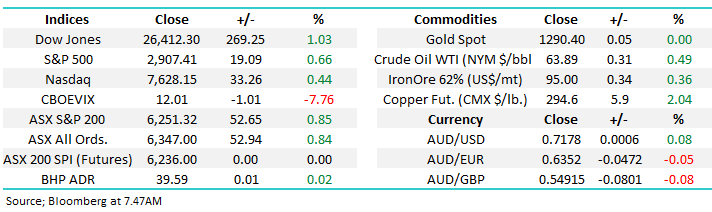

“Hi James Thank you for an excellent publication, I have been a member for a long time and I enjoy your insights. I am particularly interested in the international investment environment. You mention in your Sunday report: While the markets enjoyed a strong start to 2019 the diverse levels of performance across the ASX200 is simply staggering – at the extremes over the last 3-months we’ve witnessed well over 10% of the index rally by over 25% while 2% has fallen by the same degree. We ask the extremely poignant question “Why are investors flocking to market hugging ETF’s when much of our ASX200 will become a distant memory over the next decade?”- if you find this hard to comprehend remember that Facebook was founded just 15-years ago and the first iPhone is only 12-years old , I cannot imagine a teenager living without either today! At MM we believe that investors are investing in ETF’s in an almost herd like mentality just when they should be considering stocks / sectors for the future as our lives evolve at an amazing pace. It is extremely difficult to beat an index like the S&P500 as was proven time and again. The iPhone (Apple) and Facebook became part of the S&P 500 and the FAANG stocks are now around 11% of the S&P 500. So the better shares become part of the index. The herd made a lot of money in the S&P 500 so all the stock pickers and sector rotation have lost out on return for many years now. It would be interesting to see how you propose to beat an index like that. Yes there was excessive returns in certain sectors but this was only known after the fact. But the S&P500 and ASX200 will also change with the times and "index hugging" ETF investing is much cheaper? Where in the world can you get an investment consistently outperforming the S&P500?” - Kind regards Manie M.

Morning Manie,

A great question to kick off the day and as you rightly point out the index itself does act as a distillery for quality stocks with the weak falling out of the index while the strong arrive e.g. The ASX200 no longer contains serial underperformer Myer (MYR) as its very existence is threatened by e-commerce.

Myer (MYR) actually illustrates our point perfectly, it was a stock in decline which has struggled for years, you only had to walk around the stores or talk to any youngsters to comprehend that the department store model was under serious threat – we felt the stock was easily too hard from an investment perspective. At MM we have not considered Myer as an investment for years, only once or twice as an aggressive trade. This avoidance of businesses in decline enables investors to outperform an index which does suffer as stocks / sectors struggle. In other words it’s an issue of avoiding the losers rather than picking the winners which we believe can be a touch easier at times.

A couple of sectors / stocks that we currently have in the too hard basket from a long-term investment perspective due to very clear and easily comprehendible disruption to their industries over the years ahead are coal stocks, some media businesses, shopping centres and some retail businesses. While we may occasionally consider a few stocks from this group as short-term plays we have no interest being long-term holders. If we are correct with just a couple of these opinions and the respective stocks go into serial decline without us being on board we will be well positioned to outperform the ASX200 – remember just a few % per year compounds beautifully over time.

At MM we believe ETF’s have their place for investors looking to gain easy exposure to a specific theme, i.e.a basket of global equities or a short exposure on the ASX for example, but as stock pickers, we need to back our selves to outperform.

An interesting consequence of the growth in passive ETF investing may mean fewer genuine activemanagers, and that could mean the market becomes less efficient. This would then create more opportunity for genuine active managers that are small enough to be nimble to find mis-pricing opportunities.

US S&P500 v NYSE FAANG Index Chart

Question 2

“Hi guys, My daily share actions does not start until I have read your morning email, and over dinner with your evening analysis of the days actions. I have held ANZ, BOQ, CBA, NAB and WBC banks since 2012. They have paid great dividends and Credits. However, over the last few years their capital share prices have been in decline, further accelerated by the Banking Royal Commission, though seemingly starting to recover lost ground, albeit slowly. Because I have been reducing stocks, and building a cash stash, my banks, at 43% of portfolio, need thinning to minimise my future capital losses and maximise my share diversification. Before I acted too rashly, I checked my banks results. My bank portfolio indicates a Capital return of -12.5%. If I incorporate Dividends and Credits over the 6+ years, my bank's net return is +14.2%. So, not too bad. But, when I did an exercise in what the returns would have been if I had treated the banks as growth shares, e.g. if they hit a hard stop, sell them, I see a different story. My capital return would have been 21.4 % and with my dividends and Credits, the return would have been 28.8%. Being retired, capital preservation is important. I will ensure all my portfolio stocks have active stops so as to minimise capital losses, which in most cases, exceed dividend income and credits. three questions: Do you think the banks going forward will generate sufficient income to maintain similar dividends and still add capital growth? I am considering keeping some banks, I thought NAB and ANZ. Do you have any preferences, and why? Can you try and provide both lower stops and upper target values for recommendations. This seems especially for the ‘dogs’ “ - Regards Geoff

Hi Geoff,

Another excellent and encompassing question and of course the much appreciated thumbs up!

We believe that banks have for now almost become technology businesses as they look to reduce costs with last weeks rumour of CBA cutting 10,000 jobs and closing 300 branches a classic example. At MM we have recently used the rally in Australian banks to reduce our sector exposure and increase cash levels, like yourself. Three relevant thoughts on the banks:

1 – We believe their dividends are largely sustainable but meaningful earnings growth may be some way off.

2 – Lower interest rates are tough on banking margins, the sector should outperform when we see bond yields increase, this now feels a few years away.

3 – Our preferred bank is Commonwealth Bank (CBA) as they are the most progressed down the technology upgrade path but generally the sector performs as one.

For some of the portfolios I manage within Shaw, we do sell covered call options over bank holdings to improve returns while maintaining the dividend stream – happy to discuss this with you – although it is a more sophisticated strategy; [email protected]

On your question around targets and stops we are definitely looking to continually improve this part of the MM service especially after ourselves back testing MM’s results over recent years which although good could have been significantly improved by just cutting a couple of underperformers i.e. better use of stops.

MM likes the banks moving forward but will only move to an overweight stance into fresh multi-year lows.

Westpac Bank (WBC) Chart

Question 3

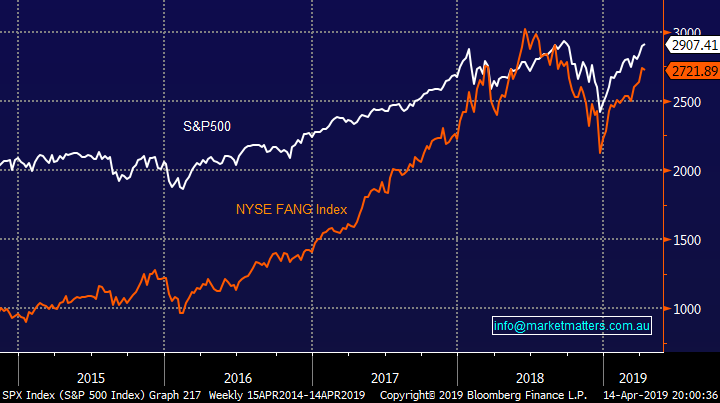

“Hi there, I had a subscriber question: Last year you bought BEAR and BBUS short ETF positions in the Growth Portfolio. With NASDAQ hitting 2019 highs and Aussie market also having rallied strongly - would you be moving into these short ETF positions again?” - Regards, James D.

Hi James,

The answer is yes and we will be extremely surprised if there isn’t at least one more foray into a negative facing ETF in 2019 but entry levels are obviously critical to success – the BBOZ, leveraged bearish ETF shown below is one we are watching closely for next time.

At this stage we are not considering such a move but we will are likely to be flagging our intentions when the time comes.

BetaShares Leveraged Bearish ASX200 ETF (BBOZ) Chart

Question 4

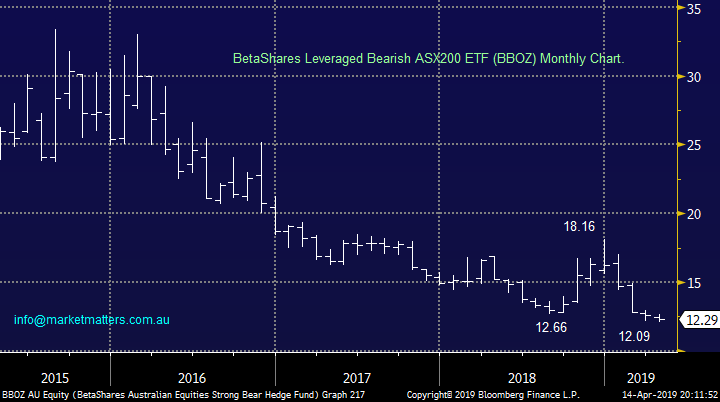

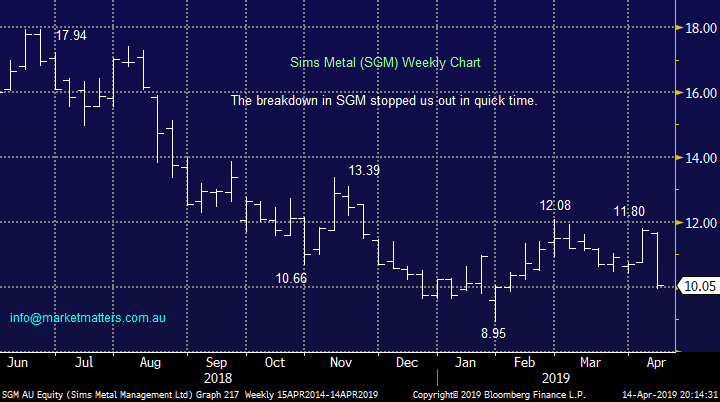

“Hi MM, unfortunately I was unable to sell my holding in SGM around the 10.20 Mark and it has since dropped to 9.98. Is this stock still a sell at these levels or should I be holding?” – Regards Mitchell N.

“Hi Guys I bought SGM today at $10.06. Would this be a hold or sell as per your alert today.” - Cheers Mike F.

Hi Guys,

Sims Metal (SGM) was a tough one for MM last week but our reason for the position vanished as the market gave the company the thumbs down due to the company’s growth plans for the years ahead. When entering a position we believe being fussy to maintain acceptable risk / reward is always prudent but once we decide to exit a position we are generally far more decisive i.e. if we want out we get out. So to answer both of your questions we are now neutral, not bearish, SGM which is not the perfect answer but we are not considering re-entering anytime soon.

MM is now neutral SGM until further notice.

Interestingly BlueScope Steels share price has been correlated with SGM of late and its rapidly approaching our risk / reward buy zone ~$13.50 which implies that SGM may bounce but it’s a tough one.

Sims Metal (SGM) Chart

BlueScope Steel (BSL) Chart

Question 5

“Hi I am a subscriber and just wanted your thoughts on ISX.” - thanks Arthur H.

Hi Arthur,

ISX is a deposit taking financial institution or “neo bank” providing transactional banking services. The company is undoubtedly gaining some solid traction as the stock price illustrates but the volatility of the shares makes it a trading play for MM. The market cap of $400m does leave room for disappointment but the business does sound very interesting our end.

Technically we like ISX with stops under 30c, not bad risk reward for such a volatile beast.

ISignthis (ISX) Chart

Question 6

“Could you please outline The size of these funds Performance yearly and from inception” – P Turley.

Hi There,

At MM we have 2 Separately Managed Account portfolios (SMA’s) which I assume is what your are referring to, they are both tracking along pretty well in their first year. If you want further information on the below please don’t hesitate to ask plus there is a section on our website under Funds which provides further information:

For subscribers that would like to be included on monthly fund updates, please reply to this email. The monthly updates provide fund commentary, and performance stats monthly for both portfolios, one that broadly tracks the MM Growth Portfolio (growth) & one that broadly tracks the MM Income Portfolio.

Overnight Market Matters Wrap

· The US had followed Asia Pacific’s performance last Friday, with the 3 major indices ending their session in positive territory as concerns about a global economic slowdown was eased from positive China data, along with a good start to the US earnings season.

· On the commodities front, crude oil continues to climb, currently at US$63.89/bbl.

· The June SPI Futures is indicating the ASX 200 to open marginally higher, testing the 6260 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/04/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.