Subscribers questions (SGM, BKL, SPL, CIM, RCR, LLC, MIN, MQG)

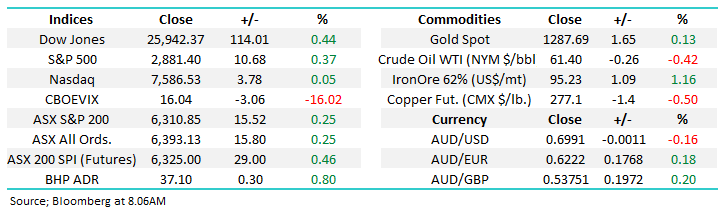

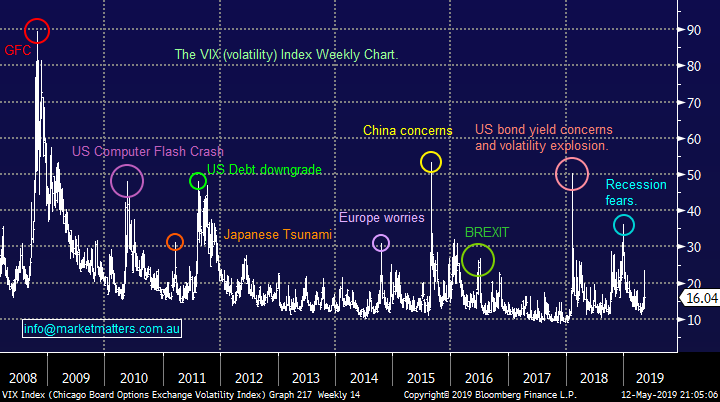

The SPI futures are calling the ASX200 to open up ~0.5% this morning following a strong recovery on Wall Street – the S&P500 rallied +2.3% from its intra-day lows. Under the hood in the US the eye-catching performance was by the Utilities, a similar story to the local index last week with investors positioning themselves for “lower interest rates for longer”. However the US futures have opened down almost 1% this morning following further Trump / US – China trade issues hence local stocks are likely to struggle early.

This time next week the bookmakers / markets are giving us 2 clear messages:

1 – Bill Shorten will be the new Australian PM with a potentially significant majority – the Coalition are now 6-1 with Sportsbet implying it’s a one horse race.

2 – The ructions in stocks that heralded the start of last week looks likely again today because of the fears of a US-China trade war will eventually be forgotten and the 2 main global superpowers will slowly progress towards a deal of sorts. Hence the current volatility should throw up solid buying / selling opportunities.

We have now shifted our short-term neutral stance to a more positive one but while we cannot ignore Trump et al, just like the looming Federal election, its no reason to flock away from stocks – Labor announced its original changes to franking credits back in March 2018, over a year ago, and the market is now sitting over 10% higher today illustrating that while Mr Shortens plans may not be a positive for our index they will eventually be taken in its stride.

MM remains in “ buy mode” primarily due to our decent size cash position but this is a time to be very fussy in our opinion.

Thanks as always for the great questions, it’s refreshing to contemplate that we are only a few days away from the end of the Federal election and hopefully can start reading some positive news.

ASX200 Index Chart

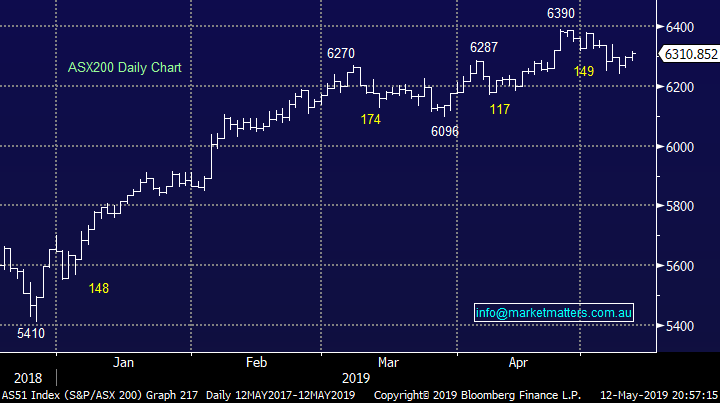

Last week we saw bond yields edge lower even as the RBA left the official target cash rate unchanged (for now), however our view remains that the RBA will cut rates at least once in 2019 which is the consensus opinion – as we mentioned early the idea of lower rates is clearly igniting sectors of the ASX200. The more concerned the RBA becomes on US – China trade the faster they are likely to cut.

MM feels “lower for longer” will be the phrase which covers both interest rates and property prices.

Australian 3-year bond yield v RBA targeted Cash Rate Chart

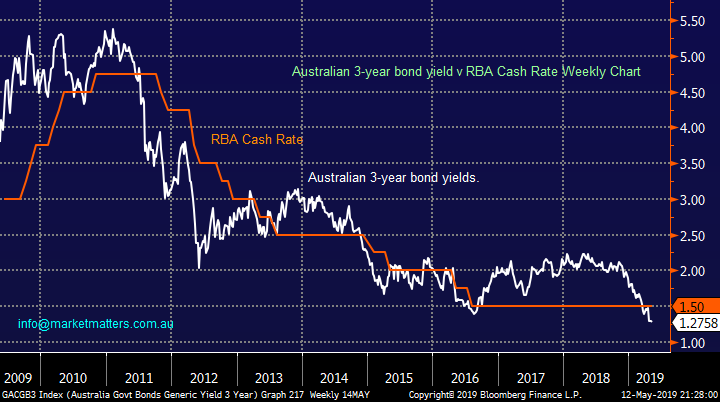

Last week’s shenanigan’s by President Trump and his Tweeting finger did manage to send the VIX temporarily above 20% but it closed the week back well and truly below this major psychological level – investors clearly remain net comfortable that the US - China trade talks will reach an amicable conclusion, if a little later than many first hoped.

We believe US-China will find a resolution BUT things do now feel like they may get worse before they get better.

CBOE Volatility Index (VIX / Fear Index) Chart

Question 1

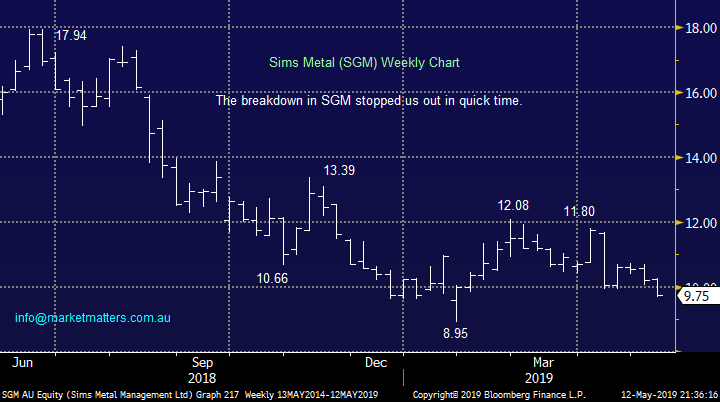

“Has your view on SGM changed? Do you think the price @ 9.87 is the right level to go in as a medium term investment?” Gregory C.

Morning Gregory,

MM was stopped out about a month ago as markets lost confidence in SGM shares following a company presentation that focused on longer term growth / and higher capex rather than capital management. Unfortunately the current market is constantly looking for short-term sugar fixes in the form of dividends / capital returns which puts SGM’s current strategy in the “naughty corner” for now.

SGM are looking to evolve the business in the coming years, and their strategy around using waste for energy makes total sense, however in the short term, the momentum is to the downside and we are happy to have cut the position at higher levels.

MM is neutral SGM for now.

Sims Metal (SGM) Chart

Question 2

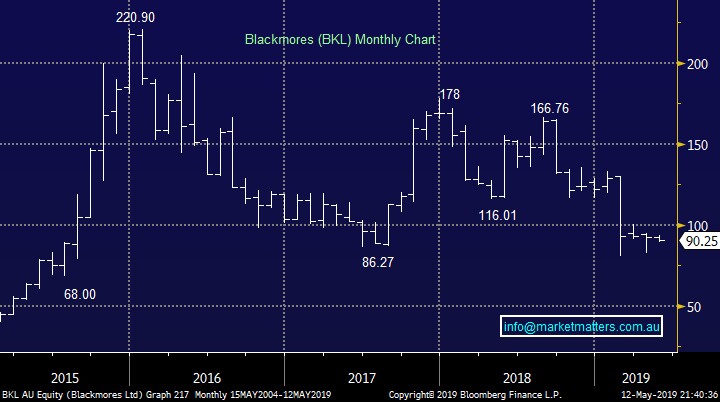

“Last year I sold Blackmores at a considerable profit. I am wondering if at around $90 it is worth getting back in despite the bleaker picture in China. As always, I appreciate the advice.” Chris G.

Health supplements company Blackmores (BKL) has again seen its shares decline following a poor 3rd quarter primarily due to weakening demand from China which feels unlikely to improve any time soon. Overtime, share prices track earnings and right now earnings momentum is weak. That may turn however incremental downgrades are becoming the norm at the moment as shown by the red line below (which tracks expected earnings per share (EPS)

Its shares are not cheap trading on a P/E of 26x Est earnings for 2019 while yielding 3.4% fully franked, we simply don’t see any compelling reason to catch this particular falling knife.

MM is neutral BKL.

Blackmores (BKL) Chart

Question 3

“Just wondering what MM/Shaw Partners will be replacing sky business with? Bloomberg Asia?” – Mark DL.

Hi Mark,

We joked about this last week liking the concept of “MarketMatters TV” but at this stage I’m not sure. CNBC & Bloomberg Asia is a possibility however from my own perspective, leaving the office is not ideal. With Sky we had the luxury of a camera in the office. So, not sure what SHAW & the TV companies are contemplating but at MM, we should be doing more content on video / “Direct from the Desk” / webinars etc. – this might free me up to do more of that!

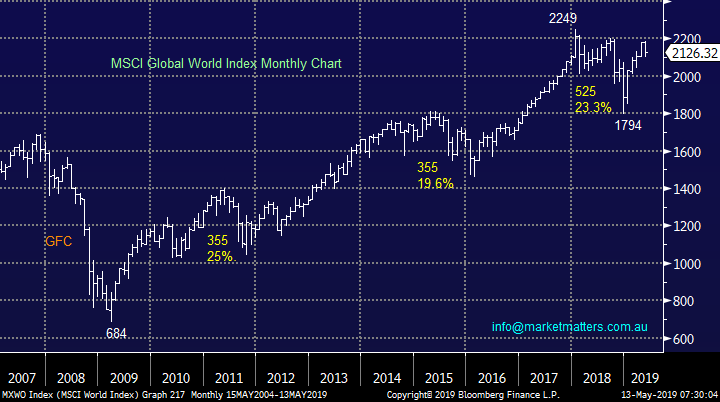

It’s actually interesting to see this type of action unfold as global equities are close to their all-time highs, its usually occurs near the bottom of a bear market.

MSCI Global World Index Chart

Question 4

“Hi James, what’s your view of Starpharma (SPL)?” – Thanks Charlie F.

Hi Charlie,

Biotech company Starpharma (SPL) enjoyed a great run in April after announcing its VivaGel product had officially been launched in Australia with further expansion planned on a global level – we like the story and product but its obviously very early days even though the stock has a market cap of $478m.

As the chart below shows, the stock is clearly extremely volatile having doubled and halved a few times in recent years. The recent news should be the catalyst to send the stock higher hence technically we could be buyers with stops below $1.10

MM likes SPL as a very aggressive play with stops below $1.10.

Starpharma Holdings (SPL) Chart

Question 5

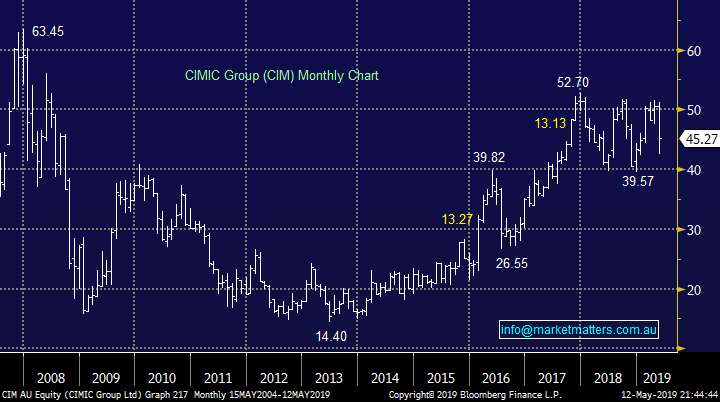

“A question for Mondays report. I am a holder of CIMIC (CIM) shares owing me around $46 per share. I note MM was previously optimistic on the company with a suggested price target of $55. Has that now changed given the recent commentary on their accounting practices? Thank you Ian C.

Hi Ian,

CIMIC (CIM) shares as you said were hit last week by claims from a Hong Kong based research house that its “growth was an illusion” – not what a company wants to wake up to in the morning!

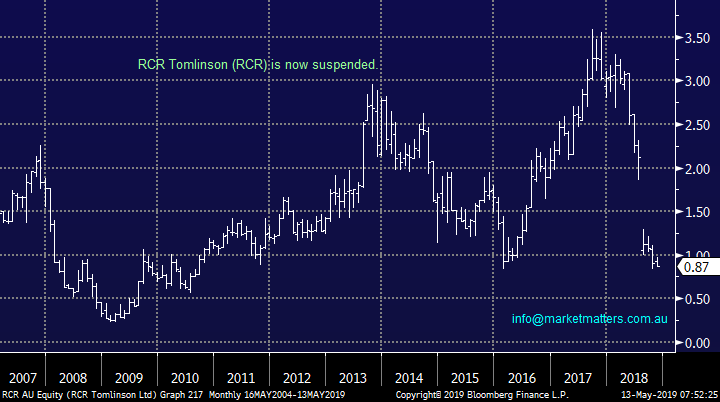

The engineering / construction company has refuted the claims that they have inflated profits by over $1bn however the reaction by the market was understandable when we reflect on what happened to another in the sector RCR Tomlinson (RCR) earlier this year i.e. administration.

We actually traded CIM late last year and cut it for a loss before the December route happened, however for now MM is neutral CIM awaiting further confirmation of the company’s finances.

We prefer Lend Lease (LLC) at current levels

CIMIC (CIM) Chart

RCR Tomlinson (RCR) Chart

Lend Lease (LLC) Chart

Question 6

“Hi James, I rolled out my KDR last week. Used some of the funds today to buy into ORE and EHL at good entry points compared to the last couple of weeks. Do you see MIN as a possible buy for the same reasons as ORE, it’s back to an entry point we haven’t seen since January but I think it may go lower. I’m a big fan of MQG and the seemingly regular drop on earnings announcement which invariably followed by the stock rising over the next couple of weeks. I’ve used this to top up my holdings after selling off about half when they hit $120 last September. Where do you see MQG by year end?” – Regards David H.

Hi David,

Firstly great trading / investing, its always nice to switch at optimum levels. I will answer your question in 2 parts as intended:

1 – Mineral Resources (MIN) $15.02 – I agree with your thoughts, MIN does “feel” like it could fall further after the board recently confirmed guidance of $360m-$390m for 2019. The issue at the time was that the market was already above that number, factoring in the more bullish Iron Ore price. The fact the lithium / iron ore producer has failed to keep pace with other iron ore stocks like FMG while embracing the volatile downdraft of the lithium sector implies that this stock is more influenced by Lithium than Iron Ore. We are neutral MIN preferring a more direct play in each sector - Iron Ore Fortescue (FMG) and lithium Orocobre (ORE).

Mineral Resources (MIN) Chart

2 – Macquarie Bank (MQG) – In our opinion an excellent company / business that continues to evolve and grow successfully. Your question is very crystal ball like, especially for a stock that follows US indices so closely as can be seen by its 9% correction following President Trumps Tweet. In terms of earnings, while the latest guidance for FY20 was for a slight decline on FY19, FY19 had been a very strong year. Plus, scanning through the financials post result showed a couple of larger impairments put through the books in FY19 plus some large one of cost items that may not be there in FY20 - essentially providing some ‘buffer’ to meet / beat expectations in FY20.

The trading range we envisage MQG trading in through 2019 is $110 to $140 putting the stocks smack in the middle today hence we are bullish MQG but from lower levels.

Macquarie Bank (MQG) Chart

Question 7

“Hi James, I have a SMSF which will be greatly impacted if Bill Shorten gets his way. Can we request the company’s pay our dividends unfranked, i.e. we get 30% more dividend and we pay the tax at 15% in accumulation or zip in pension phase.” – Trevor J.

Hi Trevor,

Unfortunately not. Companies are required to pay tax on their earnings by law and a franking credit is essentially just an acknowledgement of that tax having been paid. That said, your point is relevant to a new breed of structures known as Listed Investment Trusts (LIT’s) which simply pass through the earnings to unit holders who then pay the tax. Within the income portfolio, we hold Metrics Credit (MXT) that does this.

I think one thought thats not getting enough air time recntly is now considering quality stocks paying unfranked divideds, these will garner more attention under a Labor government – MMe will loook at this area in more detail in the weeks ahead.

Overnight Market Matters Wrap

· The Australian market was poised to start the week about 0.5% ahead, however US Futures have opened down around 1% this morning negating the positive read through we saw on Friday. It was a volatile Friday’s trading in the US with the Dow closing about 115 pts higher, having recovered 450 pts from an early sell off in the wake of President Trump sticking to his plans to raise tariffs on US$200bn worth of Chinese goods from 10% to 25%.

· The markets rallied after President Trump subsequently tweeted that the negotiations with the Chinese delegates had been “candid and constructive”. He also added that the increased tariffs may or may not be removed in the future, depending on the progress of further negotiations, with the next round expected to take place in Beijing. Among other market features the much vaunted market debut of Uber disappointed, closing its first day’s trading about 8% below the bottom of the range US$45/ share IPO price.

· Markets are likely to remain on edge this week given there is no sign of any near term resolution on US-China trade and Chinese threats to retaliate with further tariffs of their own on US goods. Commodities were little changed, with gold around us$1285/oz and oil just above US$70/bbl. The A$ is just below US70c, as the market focuses on increasing expectations of potentially 2 rate cuts in Australia this year.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.