Subscribers questions (QAN, XRO, WZR, DOW, ALX, WTC, ALL, ALU, LLC, CPU, LNK, IFL, APA, BABA US, EHL, CSL)

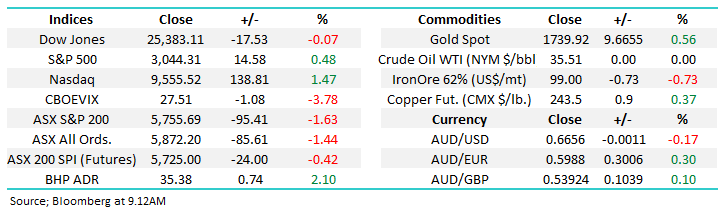

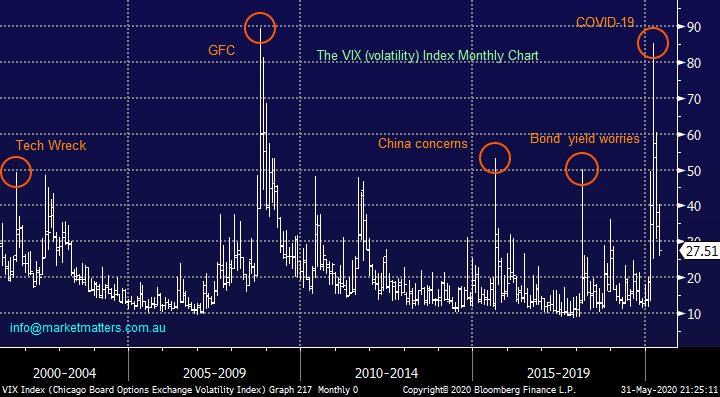

The SPI Futures were calling the ASX200 to open down around 30-points this morning while US Futures have also opened lower (-0.80%). On Friday night US stocks closed higher and BHP Group (BHP) rallied almost 2% as the major Australian iron ore miners like BHP, RIO and Fortescue (FMG) benefit from the huge COVID-19 outbreak unfolding in Brazil, when combined with renewed optimism towards Chinas recovery it sent the spot price of the bulk commodity back above $US100/tonne – not surprising that 2 of Australia’s richest 5 people are iron ore mining magnates.

However any optimistic thoughts towards today’s session is tarnished by the disturbing scenes that have greeted all of us from the US this morning, anarchy might be too big a word but it’s not pretty with 25 cities implementing curfews overnight as the protests have evolved into riots and looting in many places. The death of George Floyd is a very sad on all levels, but the escalation of violence has interestingly been predicted by many including billionaire investor Ray Dalio who said social unrest was inevitable as the polarisation of wealth accelerated.

From a markets perspective Donald Trump falling behind in the polls as he appears to fail as a another major crisis is sent his way is likely to be taken negativity by stocks – Trumps pro-business policies has helped propel stocks higher over recent years especially before we’d heard of the coronavirus, a Joe Biden victory in November might wobble US equities. The polls have Joe Biden ahead although Sportsbet has them neck & neck, stocks also don’t like uncertainty and that might be on the menu until a likely clear winner in November’s US lection can emerge.

MM remains bullish equities medium-term.

ASX200 Index Chart

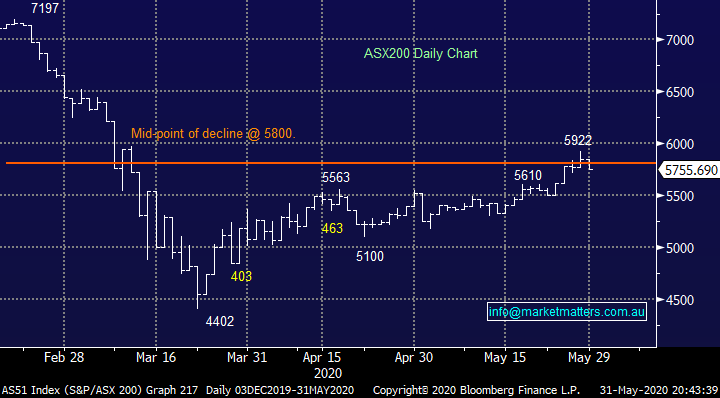

The broad-based US Russell 3000 has now surged almost 42% from its panic March sell-off, we’ve been bullish equities basically all the way but now the risk / reward feels far more balanced. The upside momentum is ok and a test of the 1800 area would not surprise but the next 5-10% is a different matter, a pullback seems inevitable at some stage in June, a move that MM would look to buy as opposed to sell.

MM’s remains wary of US stocks short-term.

US Russell 3000 Index Chart

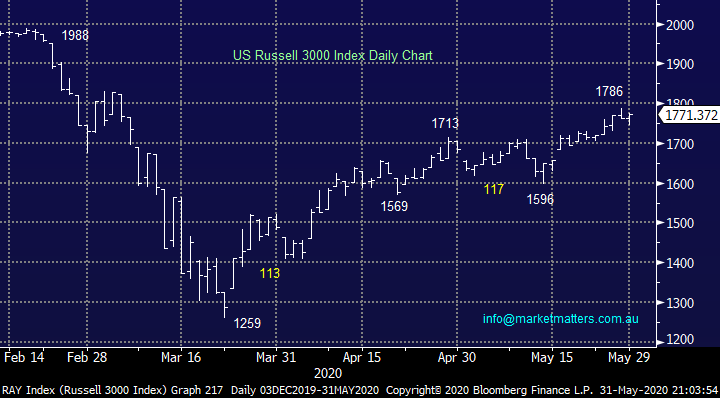

Thanks as always for the questions as we enter the last month of an unprecedented financial year, I believe higher volatility will become the new normal, but March was reminiscent of 1987 when stocks plummeted 20% in one day. Higher volatility is opportunity for active investors like MM but periods like the coronavirus plunge were just exhausting!

VIX / Volatility Index (Fear Gauge) Chart

Question 1

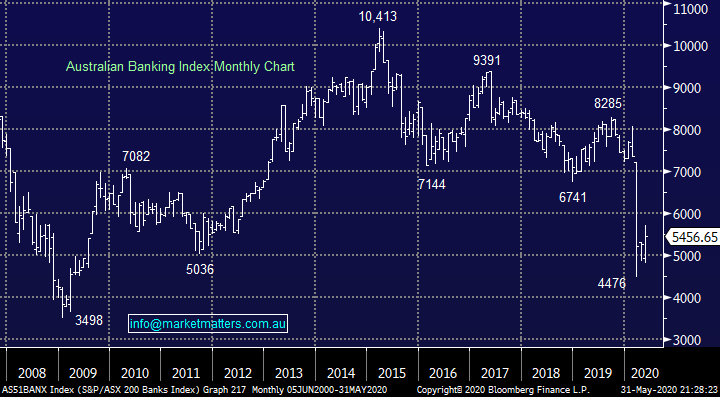

“In today's WE Report, you outlined the market situation very well. I have a query though on one point that you mentioned. "At this stage we have no catalyst to increase exposure to Australian Banks" With the news that the government had over-budgeted to cover the unemployment - the unemployment does not seem to be as bad as originally forecasted. In addition, NSW and Vic are relaxing patron nos.in clubs & restaurants sooner. This could further improve the employment. So, there is a chance the banks may have over-provided for the bad debts. This is not a strong indicator, but green shoots may have started to appear for the banks. Your thoughts?” – Gregory C.

Morning Gregory,

Firstly, sorry for the delayed response here Gregory, the question was sent late Sunday last week and missed last week’s report, although clearly your view was on the money. I agree with your points towards banks and last week they certainly came back into favour with a bang but across our MM Portfolios we already have decent exposure to the sector e.g. the Growth Portfolio is holding 19% in the “Big Four” plus 7.5% in Macquarie Group (MQG). Hence with an overweight skew towards the Sector already in place we simply don’t see the foundations yet in place to consider going “all in”. Watch for my video this week with Brett Le Mesurier on the banks.

MM likes the banking sector into pullbacks.

Australian Banking Sector Chart

Question 2

“Subscribers question: Hi James, we are subscribers, Dutch and trade in shares in Netherlands, Singapore and Australia. Companies like Boardroom, Computershare, Link Market Shares drive us nuts, zero added value. They are sending a s**t load of paperwork/e-mails and we do not understand the added value. Let the companies we buy shares off; pay us the dividend and we are done. Why all these complexities in Australia, why not keep it simple?” - Thanks, Xander O.

Morning Xander,

You must have been on the phone to the RBA last week!

The Reserve Bank Governor Philip Lowe expressed concern that excess regulation within Australia will stifle our recovery as we attempt to reopen from the virus shutdown. He’s encouraged Scott Morrison to push business & workers to co-operate on reviving productivity growth. "Over the past 20 years whenever a problem has emerged in society we have generally responded with additional regulation. But that process is also limiting the upside and the dynamism in the economy”.

We’ve already seen a range of regulations actually be temporarily paused during the crisis e.g. stopping the nigh time curfew on trucks enabling better restocking of supermarkets and the relief for company directors on continuous disclosure rules. Just consider the stock broking / advisory industry, ASIC and compliance costs have risen substantially, if these don’t stop rising retail investors will be forced to become totally independent. i.e. the costs do get absorbed by the customer making advice more inaccessible for smaller investors.

In terms of paperwork, I couldn’t agree more. The Chess Holding Statements actually come from the ASX however the registries also ply investors with a huge amount of paperwork.

MM as a finance business encourages sensible well considered deregulation – may help the banks.

Excessive regulation has undoubtedly restrained our stock market compared to many of our international peers.

ASX200 Index Chart

Question 3

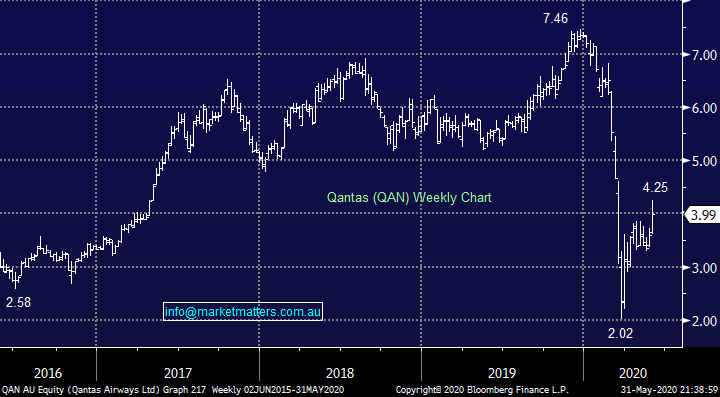

“Hi there, I have been following MM for a while now a really enjoy reading your articles. I have been setting up my portfolio trying to take advantage of some once in a lifetime lows. I had a few questions 1) Do you think VAH in voluntary administration put QAN in a good position for success and how will this affect FLT? Are QAN and FLT a good buy now? 2) I was wondering your top 5 small cap picks for 2020? I have been keen on AVH, EOS, PAR, NEA, FDV, AD8, NAN and WSP 3) With so much pressure from the current climate do you think companies such as COL, WOW, and WES and others that have benefited for C-19 are worth buying now with a long term view in mind 4) Do you think there is a future in uranium mining within Australia for companies such as PDN?” - Thanks, Nick S.

Hi Nick,

That’s a lot of questions in a few lines, please excuse the brevity in our answers:

1 – I believe VAH in administration may well help QAN but we have to see how Australia’s second carrier will rise out of the ashes, might even be stronger on some routes. FLT sells travel and therefore travel needs to be at the right price. If QAN is too dominate then prices could rise which is a negative for FLT. FLT benefit from a competitive aviation industry which keeps travel accessible for the masses.

2 – Both QAN and FLT are leveraged plays to a strong post COVID-19 recovery, I would side with QAN simply because it was in far better shape before the pandemic.

3 – In the small cap space I have mentioned Paladin (PDN) a few times recently and we still like it. In your list our favourites are Paradigm Pharma (PAR), Audinate (AD8) & Near Map (NEA).

4 – As mentioned above I still see share price appreciation for PDN, but it is an aggressive play.

5 – We recently added Wesfarmers (WES) to our income portfolio

QANTAS (QAN) Chart

Question 4

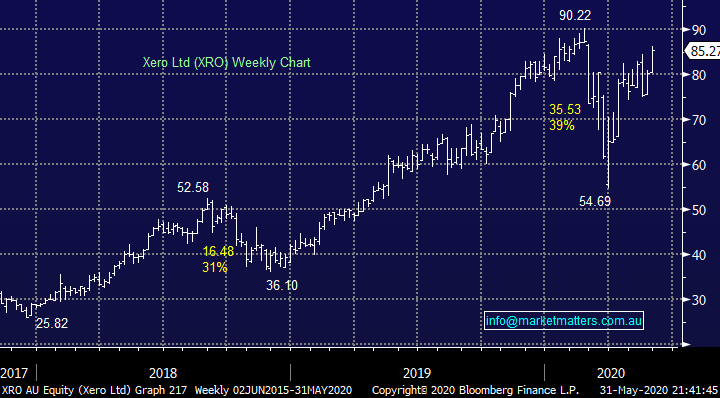

“Thanks for your responses to all the questions. Of the technology stocks ALU, APX, NXT, XRO, which presents the best opportunity over the next 12-months?” - Regards Ram H.

Hi Ram,

We actually like all of the 4 stocks you have mentioned but it’s all a matter of entry levels to provide attractive risk / reward. Last month we increased our exposure to Xero (XRO) when it spiked down under $77, a similar approach to the other 3 feels prudent at the moment following recent impressive strength in the high growth IT sector i.e. we look to buy periods of weakness / consolidation.

MM remains bullish XRO.

Xero Ltd (XRO) Chart

Question 5

“Hello MM, I had meant to put in a question regarding WZR for the Monday report but missed it. After a nice spike on 13th May it has deteriorated since and today it is being sold off significantly. Is there a reason that is not apparent to the retail trader like me, or is it a temporary weakness?” - Thank you. & Kind regards, John H.

Hi John,

Wisr Limited (WZR) is a smaller speculative company we’ve written about in the past and while its recovered well from the lows, it has stalled in recent times. I would put this down to a lack of updates from the company in the past month along with the sale of some shares from Adcock, which is their major shareholder.

At their last update in April, they shone some light on funding. This is a fintech / marketplace lending business hence access to capital is key. They said they have total funding available of $78m, which equals 18 quarters of funding available given 3Q20 net cash outflows of -$4.3m (-$10.5M YTD). They have net cash of +37m + unused facilities of $41m. This remains a good little speculative stock in my view.

MM likes WZR

Wisr Limited (WZR) Chart

Question 6

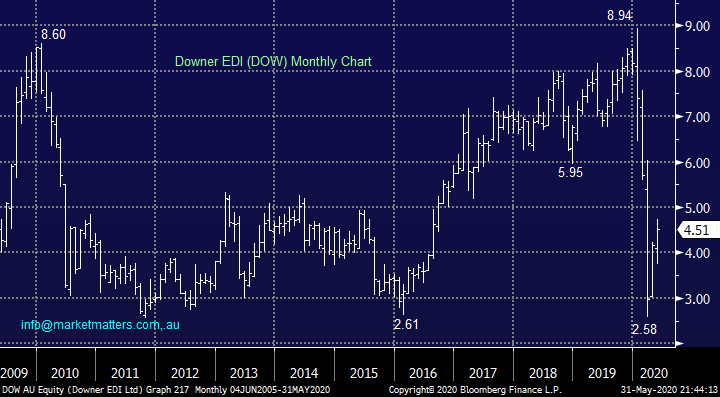

“Hi guys I've invested in Downer DOW previously and made a nice return. Are they a good option again at the moment. Surely the infrastructure division will benefit post covid19?” - Regards Tim A.

Hi Tim,

I totally agree that infrastructure sector should be well positioned over the next 18-months, but I can see your frustration with DOW, the share price is noticeably underperforming. At the end of April, DOW provided an update on their funding position, extending some facilities and confirming they have no debt maturing until the end of FY21. Gearing sits at around 40% versus loan covenants at 50%.

With most contracts currently with the government this looks a good risk / reward play, but the momentum isn’t pretty so we would leave room to average in to pullbacks.

We have elected to buy LLC recently in the Growth Portfolio for infrastructure exposure.

MM is neutral / bullish DOW.

Downer EDI (DOW) Chart

Question 7

“Evening, As you’ve probably noticed, Atlas Arteria graph did not appear - Morningstar had a Sell yesterday and you have Hold. Why is this company being marked down?” - Margaret Rees-Jones.

Hi Margaret,

Sorry about this missing chart in our Income note, when these human errors do occur, we rectify them asap on the website.

As we said on Wednesday for those who missed it similar to Transurban, ALX owns, operates and develops toll roads. They have 4 in their portfolio with 2 in France and 1 each in Germany and the US. Like TCL, they are set to benefit from increasing use of cars and their share price is clearly starting to factor this in. Low interest rates for an extended period of time is supportive of infrastructure assets, we believe that a significant amount of the recovery is now priced into stocks like ALX.

Overall, I don’t really feel ALX is being marked down, its moving pretty much in line with the ASX which is still 20% below its all-time high posted in February.

MM are still neutral ALX

Atlas Arteria (ALX) Chart

Question 8

“Hi Team, could you please give me your thoughts and possible entry prices for WTC and ALL. Both would be medium/ long term investments.” - Regards Burge

Morning Burge,

1 – Wisetech Global (WTC) designs, develops (& buys!) cloud-based logistics software solutions, is not one of favoured stocks in the “hot” IT space but for the believer the $19 area is where the risk / reward looks good with stops under $15.

2 – Aristocrat (ALL) – we took a nice profit on our ALL position last month, slightly higher than where it finished on Friday. Our ideal entry into the stock would currently be ~5% lower.

MM prefers ALL to WTC.

Wistech Global (WTC) Chart

Aristocrat (ALL) Chart

Question 9

“HI Guys love your updates and find your insight into the market invaluable. Can you do an update on EML and ALU, I know you have mentioned them previously but would like to know if you have changed your opinion on both of these stocks. Also just wondering what you horizon is for the LLC investment. Keep up the good work!” - thanks Andrew B.

Hi Andrew,

Thanks for the kind words, much appreciated. In the not too distant future, our views will be highlighted / updated on the MM website on individual stock pages, and I’m sure this will provide a great resource for subscribers, I’m certainly excited about it.

1 – EML Payments (EML) $3.64 – MM likes EML with ideal entry around $3.25.

2 – Altium Ltd (ALU) $37.19 – ALU designs automation software for printed circuit boards and they include Microsoft windows amongst other customers. We like this stock / business and would look to buy under $35.

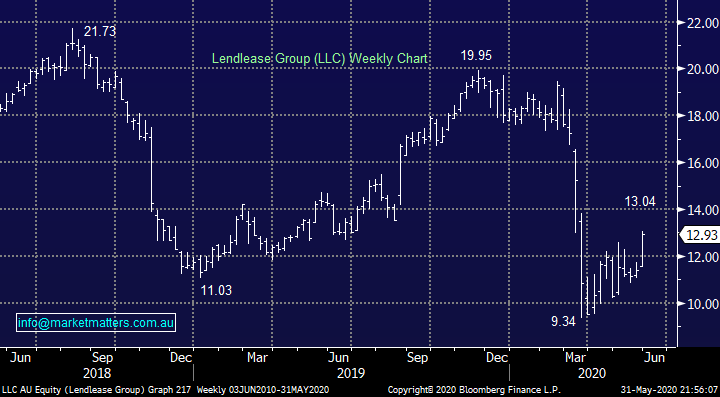

3 – Lend Lease (LLC) $12.93 - is a stock / position we can see ourselves holding for the foreseeable future, it should be perfectly positioned for increased infrastructure spending.

Altium (ALU) Chart

Lend Lease (LLC) Chart

Question 10

“Greetings James & co! Great to have your daily missives and wisdom gracing my Inbox. Possibly the wisest things in there! Be keen to see what you think of CPU and LNK from a total return perspective over a mid-term 12 months ish. Morningstar has LNK as about 50% undervalued and 100% franked with CPU at 25% and 30% franked. Both seem in similar businesses except CPU derives some 20% EBIT from interest on cash held in client accounts - which is declining. Both seem reasonably insulated from the current turmoil. So which if either is a pick?” - Dave B.

Hi Dave,

Thanks for the thumbs up, always a great way to start a Monday!

1 – Computershare (CPU) – share registry business CPU doesn’t excite me on the fundamental level with blockchain and the ASX potential concerns on the horizon, the market appears to agree looking at the stock over the last few years - MM is not keen on CPU.

2 – Link Admin. (LNK) – Link maybe the largest provider of fund administration for the domestic superannuation industry but the shares have had a tough few years. However strong insider buying in late March suggests the directors are seeing definite value emerging at current levels, its helped in these tough times that 80% of revenue is reoccurring in nature although relatively high debt levels will concern some investors.

MM is neutral / positive LNK at current levels with stops under $3.50.

Computershare (CPU) Chart

Link Admin (LNK) Chart

Question 11

“Hi James, you mentioned you are considering IFL in your email today, given IFL has big debt level is this affecting your consideration?” – Tony N.

Hi Tony,

IFL have clearly had a tough time and they do hold debt, $329m in net debt at the end of FY19 however that is expected to rise towards $450m by end of FY20, however they have a decent amount of room before any banking covenants become an issue. Things actually seem to be improving operationally with outflows reducing and they’re cheap, trading on just 12x i.e. its priced for a few curly issues.

MM likes IFL at current levels.

IOOF Holdings (IFL) Chart

Question 12

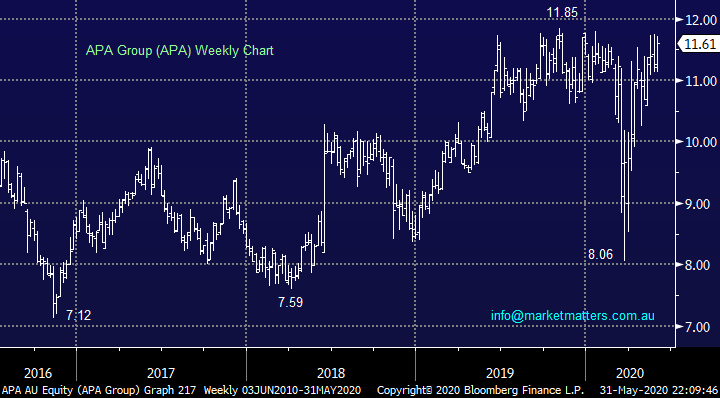

“My question is with APA. For 4 years from 2015, the share price bounced between $8-$10. Since early 2019, it has been fluctuating between $10 to nearly $12. I am flummoxed as to what drives APA pricing often with big steps up or down and in the absence of business news. Being an infrastructure business, I wonder if other factors such as interest rates drives the share price. Can you suggest some reasons? I have been buying APA since it first listed so it makes up 15% of my portfolio.” - Sandy.

Morning Sandy,

Utilities business APA is very much driven by interest rates and as such its enjoying the current environment of almost zero rates. APA is trading close to all-time highs in a weak market because its paying a reliable and sustainable 4.2% part franked yield that is underpinned by a regulated earnings base – way better than term deposits. The stock should remain very well supported until we see interest rates track higher – when this happens, we would be sellers of APA

MM believes APA’s outperformance will diminish over the next 18-months

APA Group (APA) Chart

Question 13

“Hi James, keep up your good work. Just a quick question in relation to investing in Chinese stocks, like Alibaba and Baidu, in view of the Covid-19 and the Geopolitical problems between the US and China, would you invest in these stocks in the New York Stock Exchange or in Hong Kong Stock Exchange?” - Best regards Patrick Y.

Morning Patrick,

We keep it simple and invest in the US, we hold BABA as such in our International Portfolio. I do feel the geo-political issues might escalate in the months ahead as Trump struggles at the polls which might provide great opportunities in these quality businesses

MM remains bullish BABA.

Alibaba (BABA US) Chart

Question 14

“Hi Team, you mentioned Emeco Holdings (EHL) on Thursday and you have me interested. What is your current entry price and Price target medium term for this stock?” - Regards Adrian B.

Hi Adrian,

Not our proudest moment with regards to entry into EHL, we are long from above $2 before the coronavirus but if we had no position we would be buying today. Medium-term we still can see EHL doubling in price.

MM remains bullish EHL.

Emeco Holdings (EHL) Chart

Question 15

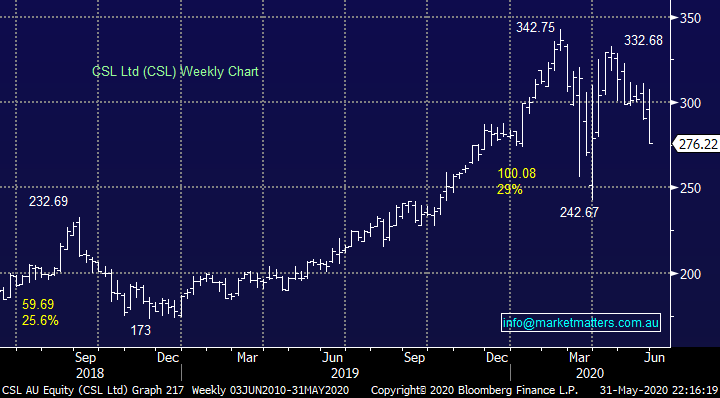

“Hi James, a quick question for Monday, if possible. Many investors are trying to "get set" to buy CSL after the recent share price decline. It's a trade that most subscribers can't afford to get "wrong", given that CSL can see significant price volatility (e.g. last Friday). Could you give an opinion as to how the CSL share price could be affected over the next few months in relation to the AUD? I'm assuming that a rising AUD could see further large CSL price falls? A lot of investors see the price as already being "cheap" at $276. Or am I just being too cautious?” - Best wishes John K.

Hi John,

CSL is experiencing a degree of “Fear & Greed” depending on what side of the fence your sitting. They generate ~46% of their revenue in the US and just 8% in Australia. In the March quarter the AUD was lower providing a tailwind while it will be a clear headwind to date in the June quarter. To us it still feels liked too many investors are complacently long CSL and any slip in terms of earnings will see the stock lower – we believe further weakness is a strong possibility.

MM would currently consider scaled in buying below $255.

CSL Ltd (CSL) Chart

Overnight Market Matters Wrap

- The US equity markets finished mixed as tensions and protests flared across the country, heightening investors’ concerns of a slower economic recovery.

- On the commodities front, iron ore hit the US$100/t mark which should see upside in our local miner names such as BHP, RIO &FMG this week.

- Locally this week, we focus on the RBA with an expected unchanged interest rate of 0.25% tomorrow.

- The June SPI Futures is indicating the ASX 200 to open 30 points lower, towards the 5725 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.