Subscribers questions (PPT, OML, PGH, KTD, BABA US, SDA, MCT, MQG, DOW, SPT, AUDS, SFR, AVH)

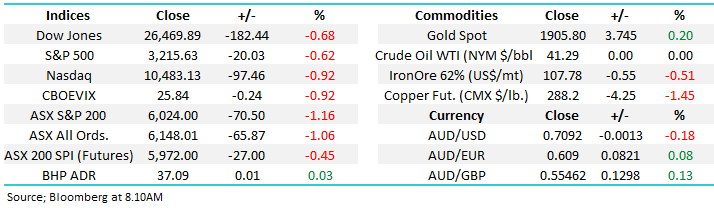

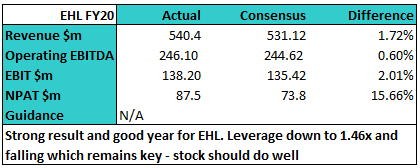

The ASX200 is likely to start off the week on the back foot this morning following the Dow’s -0.7% fall on Friday and Victoria’s reported 459 fresh cases of COVID-19 yesterday. July’s new wave which has been predominantly based in the southern state has already increased the whole countries infection rate by almost 80%! As the rest of the country looks on with trepidation we all hope and pray that Daniel Andrews and co can get it right, Victoria has already been in Stage 3 lockdown for 18-days and there’s no evident “flattening of the curve” at this stage – it appears after comments from the NSW Liberal Party that NSW will go back into lockdown if the current sub 20 cases per day spiral above 250.

I’m sure all readers know the numbers around the virus with Victoria and the US clearly struggling, we called the later in May / June but with the NASDAQ making fresh all-time highs last week its clear financial markets haven’t been reading the bears script so far. We made a comment in the Weekend Report which sums up our current feeling towards this scenario even though we are core bullish – “it’s hard to see further meaningful upside until the news improves”. Its one thing for US stocks to cope with a 7-day average number of daily new infections in excess of 65,000, it’s another to continue its upwards trajectory. Remember , markets are fickle and often look through something until they don’t, normally the status quo needs some sort of tweak, in the case of the original outbreak it was when meaningful new cases appeared outside of China, perhaps this time it could be if lockdowns become more widespread.

Confirmed COVID-19 cases in Australia Chart

The SPI Futures are calling the local market to open down ~0.5% this morning which may even prove a touch optimistic after virus numbers over the weekend although I wouldn’t ignore Bill Gates latest comments that a South Korean firm which he backs could make 200 million vaccines in under 12-months – remember this is not another tweet by President Trump, indices may take note this week.

Refreshingly, this week is the start of the “big boys” reporting season with RIO on Wednesday, while the market is likely to dance the virus jig and potentially remain riveted to the psychological 6000 area the volatility under the hood is likely to increase fairly dramatically, importantly I would remind investors that the market will be focused more on the next 12-months as opposed to the last 6-months, when it assesses the results, within reason of course!

For a full list of company results, CLICK HERE for the Market Matters Reporting Calendar

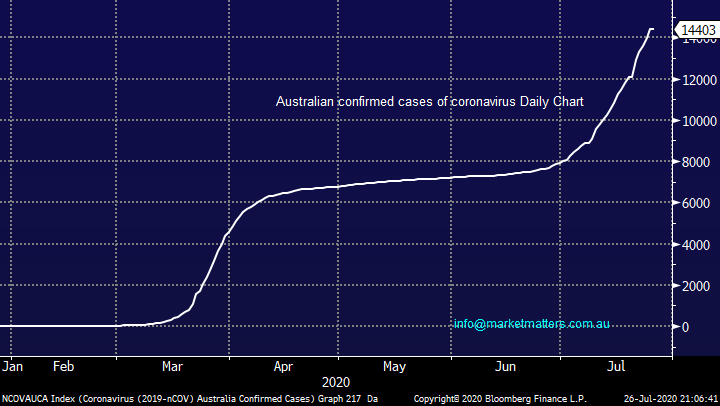

This morning Emeco (EHL) was out with FY20 results and delivered a rally good set of numbers. This is the weakest stock in the MM Growth Portfolio after having been removed from the ASX 200. Expect a pop in the stock today.

MM remains bullish Australian stocks medium-term.

ASX200 Index Chart

Last night the papers were full of talk around Perpetual (PPT), the speculation was around a $250m capital raise to fund an acquisition of a US investment manager. If this all proves correct the touted $30 raise price looks attractive to MM. It should come as no great surprise to investors after PPT’s CEO hinted that further purchases were on the cards in the company’s latest update – “we remain focused on adding further world class investment capabilities”.

MM likes PPT into short-term weakness.

Perpetual (PPT) Chart

Thanks as always for a great bunch of diverse questions, as always, they’re all very much appreciated as the Australian lifestyle we all love and cherish continues to be threatened by COVID-19, keep safe & be happy.

**A reminder that answers are of a general nature only**

Question 1

“Hi - I am holding 2 laggard stocks that I'm unsure what do with at the moment - buy more and hope for upside to offset my losses to date or just sit tight (or possibly sell out). I'm interested in your view of these stocks - OML and PGH. Thank you for any insights you can provide!” – Catherine P.

Morning Catherine,

Dealing with losers / laggards is a tough job that we all have to cope with, unfortunately a touch too often when stocks get hit by COVID-19. Firstly we never advocate averaging unless it was in the original plan when entering a stock i.e. we often scale into a position, otherwise it can become a case of throwing good money after bad, below are our general thoughts on the 2 stocks mentioned.

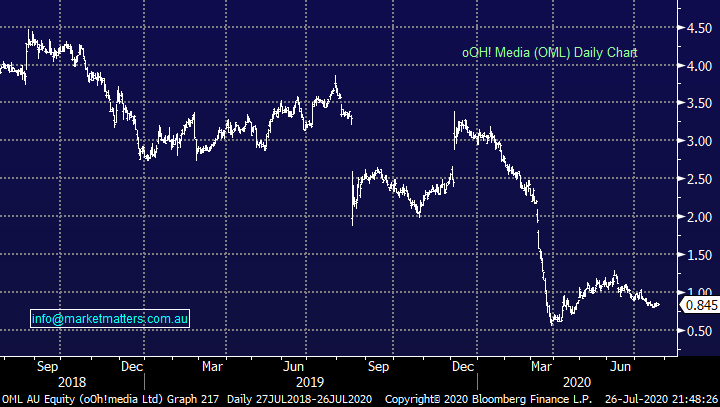

1 oOh!media Ltd (OML) 84c

Back in December before COVID-19 OML upgraded their guidance with EBITDA expectations for the calendar year end rising to $138-$143m, the update sent the stock surging above $4. The trouble is in today’s new world corporates are much leaner and advertising is on the chopping block for now, EBITDA is now likely to be half that number.

Holding or folding really depends on time frame and the shape of the economic recovery in Australia. They’ve recently raised capital which means their balance sheet is okay. If the economy bounces back, OML is well positioned to bounce back with it. We’ve had a similar experience with IVE Group (IGL) which is exposed to the same sort of trends across marketing spend. For now, we are being patient for a recovery in the space however that could take time.

All up, its simply too hard with the stock now feeling like a coin toss.

MM is neutral OML.

oOh!media Ltd (OML) Chart

2 Pact Group (PGH) $2.20

Packaging business PGH has been struggling for the last few years working hard to pay down debt and get the business back on track. We’ve owned this in the past and do see value as a turnaround story - we actually feel the start of the year may have been a classic washout at the end of a bear trend, we’re net bullish around the current $2 area initially looking for ~25% upside but we’d be using technical stops under $1.75.

MM is neutral to bullish PGH.

Pact Group (PGH) Chart.

Question 2

“Hi James, I would like your opinion on Keytone Dairy KTD. They reached a high of 45c in April and in May undertook a capital raise of nearly $13m at 31c to support continued expansion issuing 40m shares. The business has made great strides forward, has significant production capacity and improving orders which looks very promising for 2021. However, there has been relentless selling probably due to the net cash outflow which is substantial at $4.3m for the quarter but now expected to be temporary. I find it hard to understand where all the selling is coming from. Would the institutions that funded the capital raise be quitting and taking a loss, or is it more likely to be retail traders? What do you think the prospects are going forward? Thanks for the great work.” -Cheers John H.

Hi John,

Thanks for the thumbs up, much appreciated. KTD is a new one for the MM reports with the $59m dairy business clearly struggling over the last few years. There are no big name institutions as such on the share register, it carries a significant Chinese bias, the 3 largest shareholders who hold 28% of the stock all appear to be investing with China facing funds. From my own experience, I’ve never had much success investing in companies that are dominated by Chinese ownership, the story can often sound fantastic however when push comes to shove, my interests as an Australian minority shareholder doesn’t tend to be front and centre!

Another point of note is only 0.11% is held by insiders / directors which doesn’t excite me, in terms of selling, it could be for any reason perhaps the recent souring of Australia – China relations has led to some trimming back of positions however again, I’m a natural sceptic of these sorts of companies.

MM is neutral KTD.

Keytone Dairy (KTD) Chart

Question 3

“Hi James, thank you for your informative daily newsletter. I would appreciate your view on the following: 1) Are shareholders of BABA entitled to apply for shares in Ant Financial when it is spun off from Alibaba? If so, how would you rate Ant Financial? 2) SLC 3) AGG” – Sidney H.

Hi Sydney,

A fairly long question hence please excuse the brevity with our answer:

1 – MM is long Alibaba and we’re still targeting fresh all-time highs in 2020. Ant Financial is looking to IPO in Hong Kong & China with a potential valuation above $150bn. At this stage I’m unsure on price of / valuation of the offering nor who will have access to what stock. I would assume that all BABA shareholders will receive an equivalent holding in Any Financial, however I’ll look into this more and revert back.

2 – Telco infrastructure company Superloop Ltd (SLC) has fallen by ~60% of the last few years taking its valuation down to $418m. Around the current $1.10 the stock looks an interesting risk / reward buy with stops under 95c.

3 – AngloGold AS-CDI (AGG) has rallied 50% to $9.17 in 2020, this holding company for a group of gold stocks who mine internationally has enjoyed the strength of the whole sector – at current levels we are bullish targeting an initial 10% appreciation.

Alibaba (BABA US) Chart

Question 4

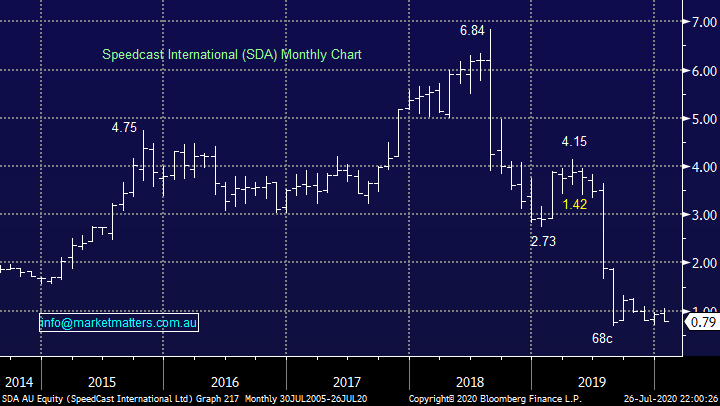

“Hi James I was interested to read that SDA SpeedCast is one of the most shorted stocks. Luckily I don't own any, but was curious, now that they have gone into chapter 11, essentially they are bankrupt, how do the shorters now "cash in"? I can understand if the share price drops from $10 to $5 then shorters can pick up the profits. But when the business is bankrupt, shares are cancelled or worth nothing, so how do they then realise their profits? Perhaps this could be answered in your subscriber questions weekly email. Thanks Peace out m/ “ - Paul.

Hi Paul,

Great question, indeed, 11.7% of SDA’s stock is held short. By definition the traders have borrowed the stock from existing holders to be able to short sell – they effectively pay interest or a fee to the holders for this privilege. Holders of shorts can do 1 of 3 things. Buy back stock at an agreed price with holders to realise the gains on the shorts (even though the stock is suspended this can still trade in size) 2. wait for a capital raise which means new stock would be issued likely at a deeply discounted price giving attractive volume and price to cover the shorts or 3. Hold until the company is wound up and the shares are worthless. The value of longs = zero and the value of shorts = zero.

SpeedCast (SDA) Chart

Question 5

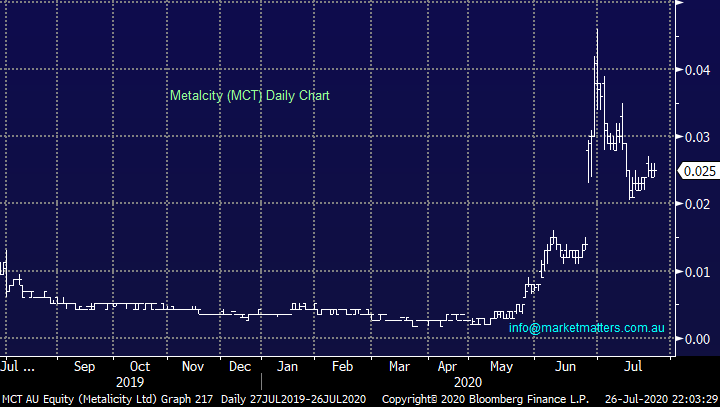

“Hi James and MM Team. Just wondering what your views are on ASX MCT and where they are going in the future.” - Thanks Paul D.

Hi Paul,

Metalcity (MCT) is WA based $35m capped metals business which is clearly struggling to get off the floor, but it appears to have refocused its efforts on the “hot” gold exploration market. This reminds me of a classic gold “speccy”, they used to be far more prevalent and often discussed in taxi’s - it’s a pure punt in our opinion. One Gold stocks we do like which is a measured ‘punt’ on the space nearer 60c is Geopacific Resources (GPR) which have a large tenement in PNG.

MM is neutral MCT.

Metalcity (MCT) Chart

Question 6

“Hi MM, Just wanting to check how much upside you think Macquarie Group (MQG) may have? I luckily bought MQG at $101 and my sell alert was triggered at 25% recently. I assume it's got more upside as you have them as a Buy?” – Tim A.

Morning Tim,

Macquarie (MQG) is as stock we’ve touched on in a number of recent reports. While we are still bullish it’s a holding, we are considering trimming into strength if / when we decide to de-risk slightly, primarily due to its $US earnings and our large banking exposure. We currently have a large 7.5% weighting towards the stock which we would likely take back to 4%.

MM is considering taking profit in MQG around $130.

Macquarie Group (MQG) Chart

Question 7

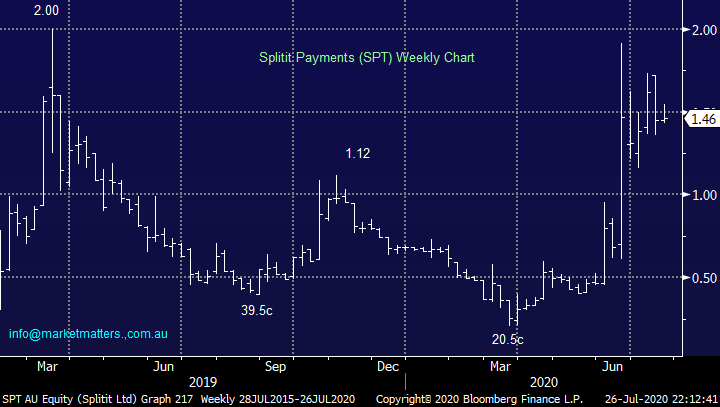

“Hi MM team, This morning Downer Edi announced equity raising. What is the MM's opinion on Downer's growth prospective / valuation? MM has recently bought Z1P which I had a great day today. Is MM bullish on SPT? It has run hard recently, is it too late to get on board?” – Pat.

Hi Pat,

Engineering contractor business Downer (DOW) should be in a fairly good position if our reflation trade starts to gain momentum. We like the companies outlook over the next few years once the debilitating COVID-19 pandemic comes under control.

They raised $339m through the institutional component of the equity raise at $3.75 versus their $4.33 Fridays close, it was a deep discount to their pre-announced price given they also downgraded guidance and announced a big write-down plus its looking to complete the full purchase of its ill-fated move into Spotless – it feels like a case of clearing the decks.

As a company they are juggling lots of balls, but this feels like an ideal time to clean up a few operations potentially to sell on in a stronger economic environment.

MM likes DOW as an aggressive play below $4

Downer EDI (DOW) Chart

SPT is another BNPL stocks which we like but has obviously run hard and is likely to remain very volatile moving forward. We had Openpay (OPY) across some of our client portfolio’s and sold out last week on the expectation that the sector may cool in the short term – the same looks likely in SPT however clearly this is an incredibly volatile area and one that could ‘do anything’.

Splitit (SPT) signed a partnership with US company Stripe earlier this year which has capitulated the Aussie business to a $520m valuation, we like SPT as an aggressive play around $1.30 which could happen in a heartbeat. We do stress that caution is needed in this sector – there is lots of hot / transient money in the space right now.

MM likes SPT, ideally sub $1.30.

Splitit Payments (SPT) Chart

Question 8

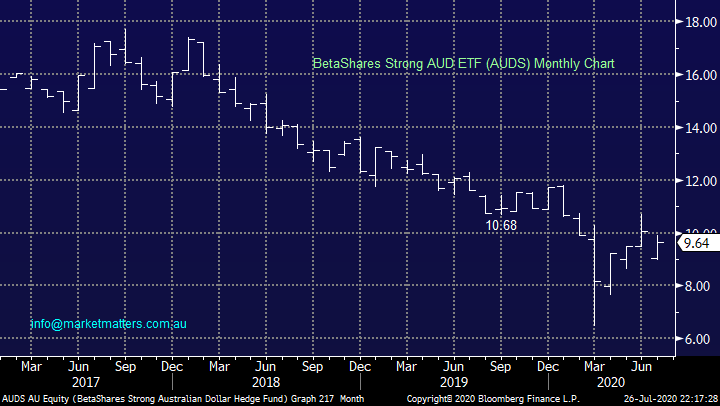

“Hi James I know you are bullish AUD, and we can it starting to move today. With that thesis in mind, is there any way to hedge the US portfolio from AUD appreciation? I thought about buying FXA, but I think that would be self-defeating as it is also essentially a US based stock. Any guidance would be appreciated.” - Many thanks Alex P.

Hi Alex,

MM is indeed very bullish the $A moving forward and perhaps the best vehicle for your needs is the BetaShares Strong ETF (AUDS) which we hold in our Global Macro Portfolio – current details are available here. https://www.betashares.com.au/fund/strong-australian-dollar-fund/

Obviously, it’s very important to spend the time considering appropriate position size. Assuming I’m long $1m worth of US stocks, then I’m long $1m worth of $US. To neutralise that, I would need to buy exposure to $1m worth of AUD.

MM remains bullish the $A.

BetaShares Strong AUD ETF (AUDS) Chart

Question 9

“HI James, your comments on SFR please.” – Thanks Indran R.

Hi Indran,

Sandfire Resources (SFR) is the ugly duckling in the copper and gold space – its fairly cheap and is forecast to yield over 3% fully franked but it remains unloved because of perception around short mine life and operational issues in the past. I can see it playing some catch-up to OZ Minerals (OZL) which has run hard of late but we prefer the latter medium-term however SFR often moves more aggressively and may be of interest to subscribers who like higher risk vehicles.

MM is bullish SFR.

Sandfire Resources (SFR) Chart

Question 10

“Hi there, Just wondering what your views are on Avita Medical changing to Avita Therapeutics? and the future of the business? Would you be able to share your top 5 most tipped growth stocks for 20/21?” - Cheers Nick S.

Hi Nick,

Repetitive medical company AVH has struggled badly in 2020, earlier this month the company announced a solid $US3.88m revenue for its 4th quarter of the FY. The company has suffered badly with COVID-19 due to limited facility and patient access but when a vaccine becomes available the stock should recover strongly – we like it at current levels with stops under $6. We continue to like their RECELL burns offering and see ongoing acceptance into 2021 – the virus may have finally have provided some decent risk / reward for the buyers of AVH.

MM is bullish AVH below $7.

Our top 5 growth stocks is a report in itself, perhaps a missive in the coming weeks, on the spot I would say: Trade Desk (TTD), Zip Co (Z1P), Xero (XRO), NRW Holdings (NWH) & Tencent (700 HK), but monitoring our portfolios is the best method day to day.

Avita Therapeutics Inc (AVH) Chart

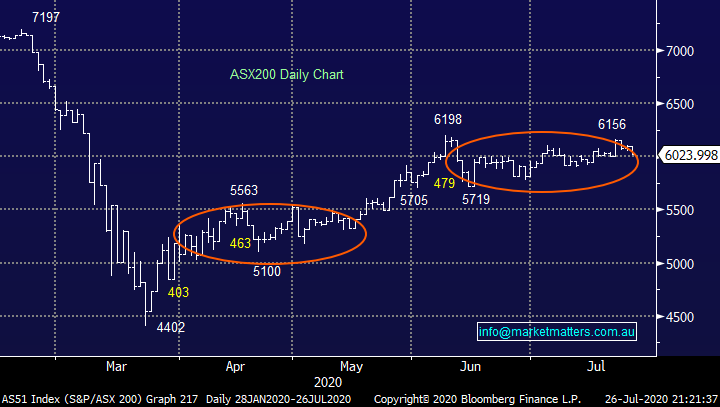

Overnight Market Matters Wrap

· Risk was clearly being taken off the table in the US equity markets last Friday, as tensions remain with US & China while the race for the precious covid19 vaccine continues.

· On the commodities front, gold continued to gain, while Dr. Copper was off towards US$288.20/lb. on increase supply

· The September SPI Futures is indicating the ASX 200 to open marginally lower this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.