Subscribers questions (PDN, A2M, BAL, BUB, NGI, SPK, IRI, TLS, NBI)

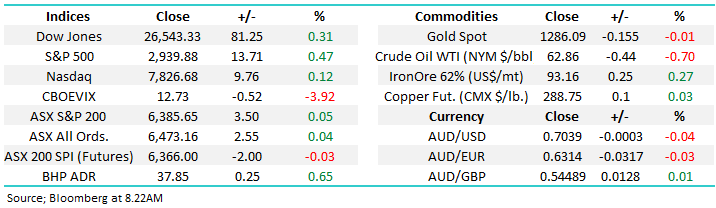

The SPI futures are calling the ASX200 to open unchanged this morning and with currency markets quiet as New Zealand starts the worlds market activity they look about right. A bounce in BHP on Friday night in the US suggests we may see some mean reversion to the short-term sector weakness, potentially at the cost of a little selling in the banks.

From a news perspective there was little to discuss from the weekend although the AFR is trying to convince us that the election is becoming a tighter race which of course would sell more newspapers but Sportsbet still have May’s contest as a fundamentally foregone conclusion. However Bill Shortens cash splash on Sunday targeting weekend penalty rates looks sombre news for the retail space which feels likely to experience some selling today – a vote grab at the cost of business is how the move has been described by many.

We have now shifted our short-term neutral stance to a more positive one which feels a touch nervy with May just a few days away, but a break back below 6270 would negate this opinion from a technical perspective.

MM remains in “ buy mode” primarily due to our decent size cash position.

Thanks as always for the excellent questions, a number of which have taken us to areas not often discussed by MM.

ASX200 Index Chart

Can rate cut (s) support the floundering Australian property market is the question on many investors lips.

Our view is that the RBA will cut rates at least once in 2019 which is NOW the consensus opinion. However the impact on housing is a tougher call – our best guess is prices are approaching a plateau but we cannot see any catalyst for the style of recovery such as we’ve witnessed by stocks. Perhaps “lower for longer” will be the phrase which covers both interest rates and property prices.

Australian 3-year bond yield v RBA targeted cash rate Chart

Question 1

“Great note as always on the weekend. Question for Monday please: Team, excellent insights as always in the daily notes. Question relates please to uranium and miner Paladin (PDN). It is now trading at a valuation below Property, Plant & Equipment (PPE) of 0.4x mkt cap. Morgan’s put out a note last week valuing the business x5 todays enterprise value. With the impending S232 Announcement from Donald Trump, do you have a view whether uranium prices trade higher? (current spot price of $26, long run incentive price is $55), and hence Paladin follows. The insto register for Paladin now includes Tembo, Paradice, China's sovereign wealth fund and Soul Pattinson.” – Thanks Rodney F.

Morning Rodney,

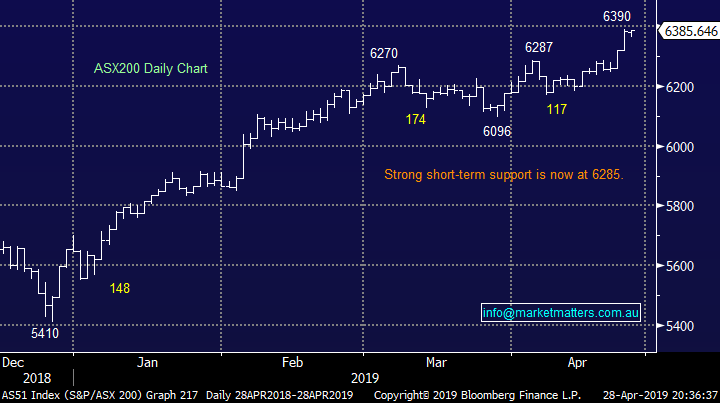

Thanks for the thumbs up! Uranium and Paladin (PDN) has been a regular question in 2019 with both China and David Paradice getting plenty of air time but the share price remains heavy at best and our previous comments still feel on the money.

With China set to potentially install up to 400 nuclear reactors the demand for uranium could clearly be huge but when will this translate into profits for uranium stocks remans the key question. PDN was at $5 when the Fukushima disaster occurred in 2011 and a lot of money has been lost trying to pick the bottom of the uranium sector, including PDN.

We can undoubtedly see some upside with PDN but we believe it’s one to invest / trade primarily using technicals at this stage, buying below 15c with stops under 11c looks about right today but that’s a very large % stop - it’s all about risk / reward in this more “speccy” end of town in our opinion.

Remember, even the best fund managers get some wrong within their portfolio.

Uranium ($US/lb) Chart

Paladin (PDN) Chart

Question 2

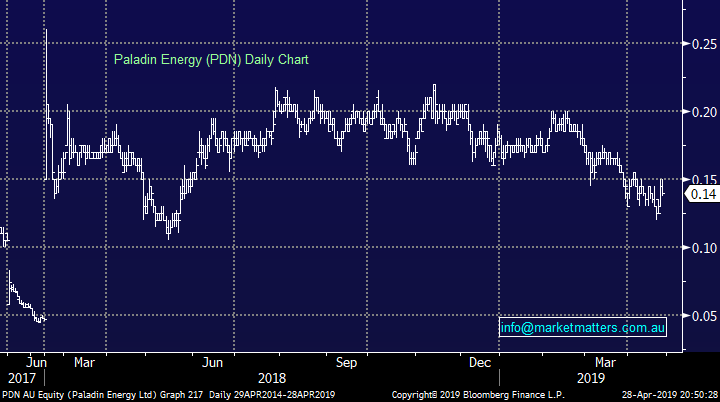

“Hi I am the 88 year old who sent you the time clock late Jan. 2019 when I thought we were around 8 o'clock and your thoughts were 2.30. We seemed to skip the recession period 4/5 o'clock or perhaps we've learned to manage the down turn through low interest rates. Banks have tighten lending, property prices are falling and there is speculation of interest rates falling. So with rising share prices, perhaps my judgement was not that far wrong. I also believed that the stock markets/economies since GFC put in a sound base (bear phrase) over many years and were entitled to a similar bull run. Forget the bears for a while and wait for commodity price rises now that electric and self-driven cars advancement is unstoppable. Your ardent reader still enjoying speculation in the pennydreadfuls.” - Cheers Clive B.

Hi Clive,

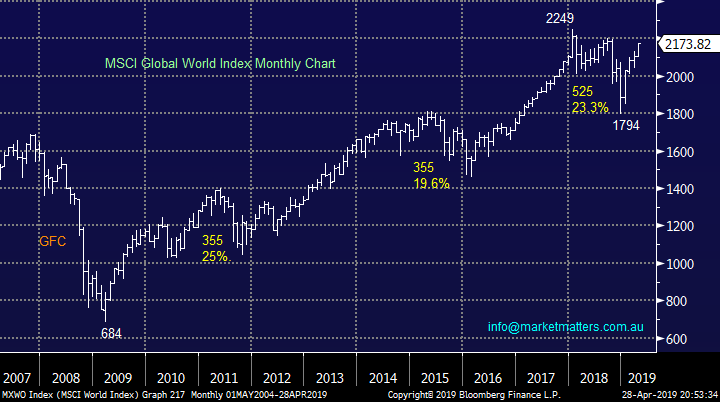

I do indeed recall your question back in late January regarding the investment clock, a great one as we love visual market representations at MM.

With stocks soaring all over the world the market does now feel as if we are approaching 8.30 implying that the recent weakness in local resource stocks will ultimately prove a buying opportunity – a view / intention we have flagged over recent weeks..

MSCI World Index Chart

Question 3

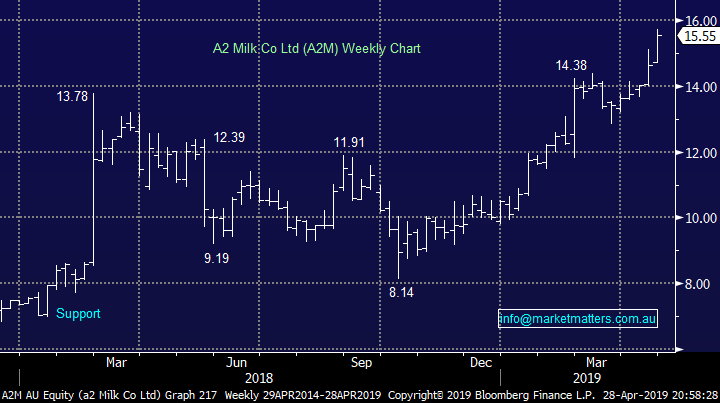

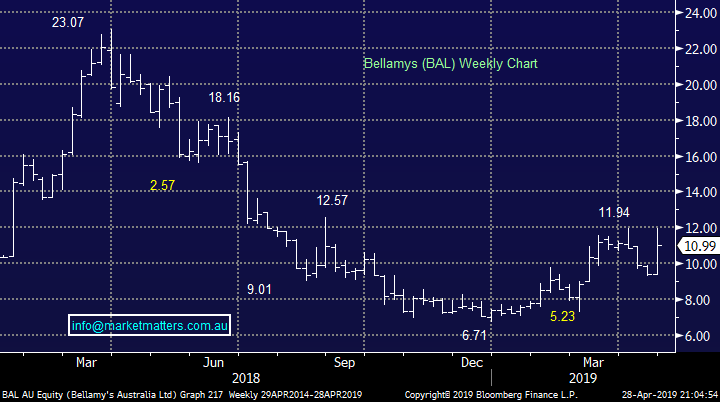

“Hi MM I hold A2M, BAL, and BUB - All three have rallied at various times over the past months. BUBs announcements to partner with Beingmate China, launch of new organic toddler snacks, acquisition of CNCA approved Australia Deloraine Dairy and their strategic equity-linked alliance with chemist Warehouse have seen the stock rally. While on wed you addressed the reasons for Bellamy's 15.59% rally and the risk - "this is where the risk lies, Bellamy’s is also awaiting separate SAMR approval for the organic products it wishes to manufacture from Camperdown in Sydney. As someone who holds these 3 stocks at lower levels should I hold for further upside or sell into these recent rallies. Do you have an opinion on price targets for these stocks?” - regards Debbie G.

Hi Debbie,

A fairly large question on these 3 China facing stocks which I have answered from a technical perspective but overall they look good:

1 – A2 Milk (A2M) remains technically bullish while it can hold above $14.

2 – Bellamys (BAL) looks neutral at present with a large trading range between $9 and $12 still in play, if pressed I would say a pop higher is probably the next move.

3 – Bubs Australia (BUB) looks destined to make fresh highs above $1.10, technically the picture would cloud below 90c.

A2 Milk Co Ltd (A2M) Chart

Bellamys (BAL) Chart

Bubs Australia (BUB) Chart

Question 4

“Questions re: NGI: Rocketed up today - still worth getting into? SPK: You liked it in December - still as a yield play? REITs you see as worthwhile and not too overvalued?” – Sharon H.

Hi Sharon,

I have answered your question in 3 separate parts:

1 – Global Investment Manager Navigator, did soar on Friday after breaking above $3.50, a level not seen since 9th January. However the stock is still down significantly from its 2018 high putting it well and truly in the high risk basket. Technically it looks ok with stops below $3.50.

2 – SPK still looks ok as a stable yield play but its not cheap and has now got a new CEO creating a degree of uncertainty. We believe the stock can grow their earnings but an opportunity to enter ~5% lower feels a strong possibility.

3 – Refer to our comments on GMG in the Weekend Report, we think the rate sensitive REIT’s have further upside in the very short term, but the risk / reward is not attractive at current levels.

Navigator Global Instruments (NGI) Chart

Spark New Zealand (SPK) Chart

Question 5

“Hi James & M&M, could you evaluate IRI Integrated Research, their PE ration is 22 and EPS DPS are all heading north. What is your opinion of this company are they worthwhile investing in and if so what enter level and exit levels do you see?” - Thank you Tony.

Hi Tony,

Software business IRI has been a laggard in a “Hot Sector” although it has bounced strongly in 2019. We have the business on an Est P/E for 2019 of 20.8x while it has yielded a steady ~2.65% fully franked based on Fridays close. Unlike SPK the companies shares has embraced the appointment of a new CEO who has an excellent international software resume. While I haven’t looked in any real depth into this stock, only 2 brokers are covering it and they have significantly divergent views, Bells are bullish with a buy and $3.40 target while Wilsons have it on a sell with a $2.18 target.

MM likes IRI around $2.60 but would leave ammunition to average closer to $2.30 if the recent euphoria fades.

Integrated Research (IRI) Chart

Question 6

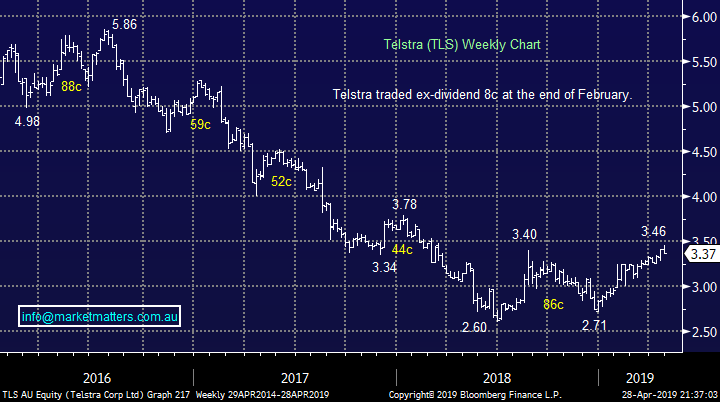

“Not sure about reducing TLS. the chart is in a very strong uptrend.” - Geoff V.

Hi Geoff,

As you know we have simply followed our plan and still hold 4% of TLS in our Growth Portfolio. However I would question your interpretation of the stocks uptrend, to me its still looks more like a bounce in the downward spiral from closer to the $6 area in 2016 – we find longer term charts like weekly/monthly better for determining overall trend.

Markets generally work as a mosaic and we are a touch concerned that the REIT’s are looking like a top is close, if the current chasing of yield is mature TLS could easily be poised to underperform.

Telstra (TLS) Chart

Question 7

“I think Phil King must be having a chocolate hang over too if he think Australian stocks are very, very cheap! A conservative valuation would put our market at one standard deviation above the long-term mean PE (see Fig 9bii). Moreover, over the long run, share price growth reflects earnings growth i.e. there is a very strong correlation between the two. Thus, does the attached chart imply that stocks are cheap? It illustrates that EPS growth only accounts for 34% of share price growth since 2009. Hence 64% is essentially PE re-rating! Bond yields alone can't justify such a massive PE re-rating. Therefore to suggest that stocks are 'cheap' is somewhat baffling to me. Happy to hear any counter arguments you may have. Obviously stocks can continue to become "less cheap", but unless earnings grow strongly, valuations might start to look very, very expensive! Indeed there are numerous examples where earnings / results disappointed the market, and the stocks got smashed!” – Regards Scott T.

Hi Scott,

At MM we do sit more in your camp feeling the market is rich but experience / history also tells us that markets can remain this way for longer than many expect e.g. a few years back, the $A spent close to a year around 1.10 where almost every expert said it was overpriced.

We are seeing the weight of money push up stocks but a classic “Fear of Missing Out” (FOMO) blow off top does not yet feel apparent in our own market.

We are buyers of select stocks / sectors at present but not the market at large.

US S&P500 Chart

Question 8

“Has MM looked at Pengara Private equity trust? Can you give me the date if you did? If not has MM any thoughts?” – Thanks CG.

Hi There,

I believe you mean Pengana Private Equity Trust (PE1) which is Australia’s first ASX listed investment trust that invests in global private equity and its set to list on the ASX tomorrow. It’s a bit of a different sort of deal providing a way for smaller retail investors to gain access to Private Equity. As it stands, Pengana has a number of unlisted wholesale PE funds and they’ll leverage these existing channels / relationships to invest into Private Equity Funds around the globe with this retail offer. It’s essentially a fund of fund type structure that gives smaller investors global diversification, and importantly, diversification to a wide range of underlying private equity funds. Harry met with management a few weeks ago, and here’s his notes.

They are looking to raise up to $600m for its listed trust that will give retail clients access to PE unlike ever before.

Pengana invests with and alongside PE managers through:

· Primary deals – newly established PE funds available only to wholesale/institutional investors

· Secondary deals – acquiring interest in existing funds from third parties

· Co-investments – investments alongside a PE fund into a private company

Investment returns of PE is attractive, however illiquidity, minimum investment sizes and difficult capital management structures. It does however provide better return profile at lower volatility than listed equity. Pengana has a number of unlisted wholesale PE funds which help wholesale investors get access to PE through Grosvenor Capital Management (GCM). From day 1, the trust will invest in these funds, secondaries & primaries.

GCM, through their previous investments with PE, has built strong relationships with many managers which allows them better access that other wholesale investors. Since 2000 they have sourced on average over 500 funds a year, while only committing to 8% following an extensive due diligence process. In direct and co-investments, GCM review around 200 a year, while only committing to ~7%.

To entice investors into the trust, the trust will also be granted entitlement shares in the head company Pengana (ASX: PGC) to the value of 5% of the trust. The trust intends to distribute the shares to unit holders after 2 years when they will convert to common equity. Effectively this will mean that from day one units in the trust raised at $1.25 will have a pro-forma NAV of $1.3125. The Trust expects to distribute cash income of 4% per annum. The fee structure is okay for this sort of investment at 1.2% management and performance of +20% over an 8% hurdle.

We like it as an alternative asset approach, however it doesn’t really fit into either of our portfolio’s.

Question 9

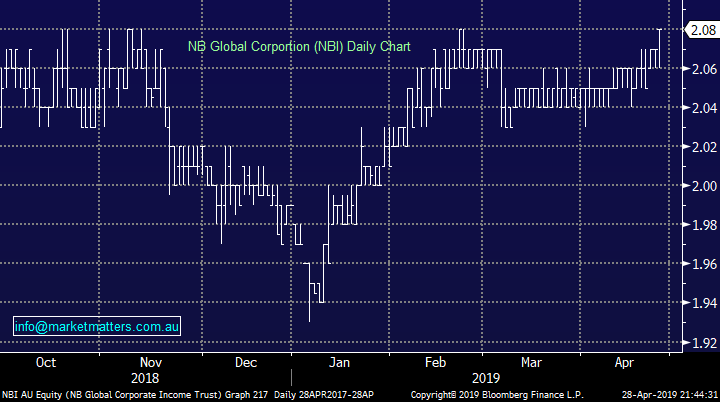

“Hello James and Crew, You have written a lot about Bonds lately and as such I would be interested in your thoughts on NB Global Corporate Income Trust (NBI). I believe they derive their income from Bonds of large and global companies, pay a monthly distribution with a target of 5.25%, which apparently is on track. Sounds like a nice little number for a diversified portfolio perhaps. Cheers. Michael H.

Hi Michael,

Your thoughts are correct with a targeted yield of 5.25% and given the recent rise in price, the current yield is 5.05% unfranked. When bond markets are strong, bond prices rise pushing down yields. This theme has played out calendar year to date and that’s why the current Net Tangible Assets (NTA) per share is now $2.05, meaning that the current price of $2.08 is a premium to its assets

In today’s environment MM likes NBI for yield.

NB Global Corporation (NBI) Chart

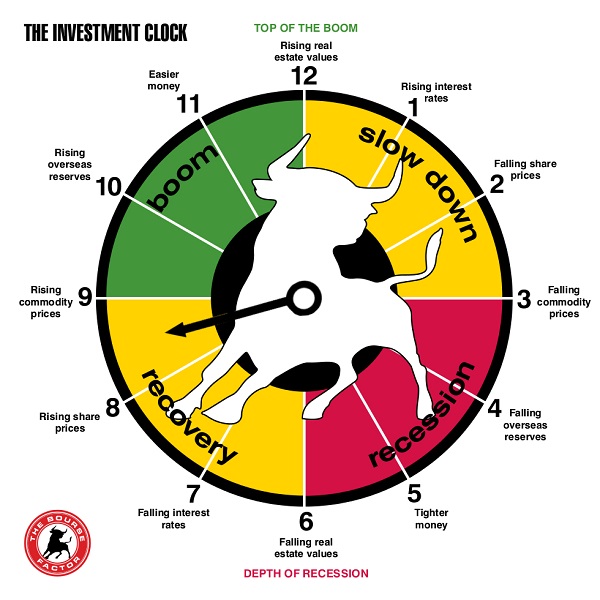

Overnight Market Matters Wrap

· The US equity markets closed at record levels last Friday, following stronger than expected first quarter GDP numbers more than offset a mixed set of corporate earnings reports.

· US growth for the quarter of 3.2% easily beat expectations of 2.5%, largely on the back of much higher export levels. US Bonds were lower despite the strong numbers, with 10 year bonds at 2.5%. After a strong week of corporate earnings, results were more mixed on Friday with Exxon Mobil (-2.1%) and Intel (-9%) weaker after missing expectations while Amazon (+2.5%) and Ford (+10.7%) rallied on stronger numbers.

· Crude oil slumped nearly after President Trump tweeted that he had pushed OPEC to increase supply to ease petrol prices. Other commodities were mixed with gold stronger and base metals steady.

· BHP is expected to reclaim some of its recent losses, after ending its US session up an equivalent of 0.65% from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open 5 points higher, edging closer towards the 6400 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/04/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.