Subscribers questions (OKU, CHZ, GPR, APT, KGN, TNK, BHP, BBOZ, TYR, Z1P, GDX)

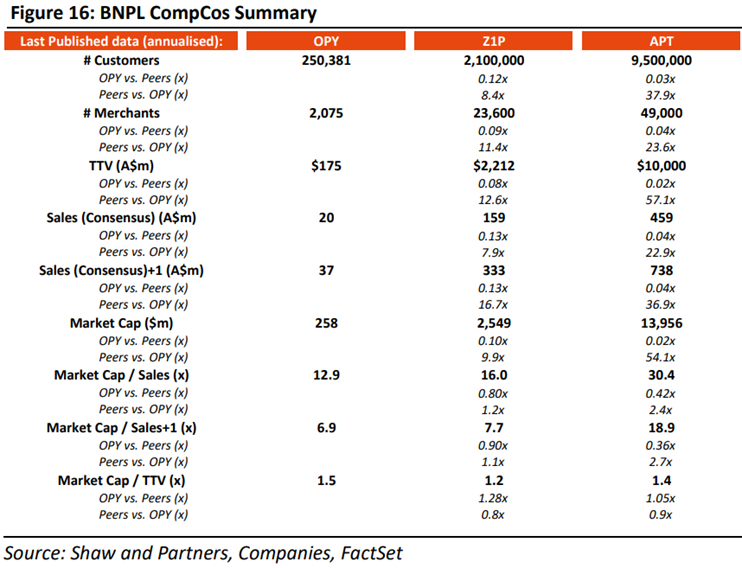

I’m sure most of us have enjoyed the previous few weeks when the coronavirus wasn’t dominating the news, alas it looks like we’re in for round 2 but let’s hope this doesn’t manifest itself into a full-scale second wave. At this stage I simply feel like it’s a warning against complacency, especially for stocks which in many cases were rallying as if the breakout hadn’t even occurred e.g. the MSCI World Index is only down 6% for the year, no more than a blip on the radar if we ignore the volatility around March. However the local news is a touch unsettling for our increasingly nervous equity market:

1 – Due to an increasing number of COVID-19 cases Victoria has decided to move back into partial lockdown which unfortunately doesn’t feel like a “V-shaped” recovery.

2 – Beijing has gone back into partial lockdown with all schools closing after an increase in fresh cases.

3 – Internationally South Korea has increased its border controls after new virus cases.

4 – The US headlines might have been dominated by racism issues over recent weeks but the coronavirus is raising its head again just as President Trump hits the campaign trail – a number of states have posted a record number of new cases last week suggesting a 2nd wave is a real possibility.

At MM our stance has not changed including the anticipated ongoing waves of volatility through 2020. We remain net bullish for the next 12-18 months given huge levels of stimulus but considering how far the recovery since March has already unfolded we are now sellers of strength and buyers only of decent weakness. The recent resurgence in the virus provides a reality check that it’s going to take longer than many anticipated to “get back to normal” which should keep valuations in check.

MSCI World Index Chart

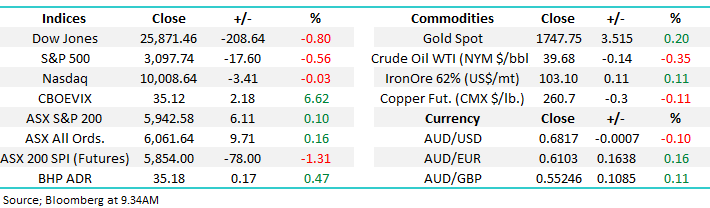

The ASX200 futures were slapped fairly hard after-market on Friday implying the ASX200 will open down more than 1% this morning, with the $A testing 68c on the downside, at the very least a “ risk off” session feels likely. With the Federal and State governments continuing to have different opinions towards COVID-19 the speed of our economic recovery appears destined to be slower than Scott Morrison & Co. we’re hoping, not a great scenario for equities.

MM remains bullish Australian stocks medium-term, however short term again the backdrop feels muted.

ASX200 Index Chart

A noticeably different tone to most of todays questions as they were largely directed under-the-hood of the market as opposed to discussing where the index itself may be headed – it will be refreshing if this continues and we can well and truly evolve from the coronavirus uncertainty, and focus more heavily on stocks themselves.

Question 1

“Hi MM Team, you are better and more relevant than ever in these volatile times! In answering one of the 15 June questions, you said that with a margin loan you were ‘5% to 6%’ behind before you started. I’m not sure to what these percentages are applied but when I went back to my figures for FY 2018-19 I find my return on my portfolio before the cost of margin loan interest is 12.3%, but after margin loan interest is deducted the return drops to 10.9% (a 1.4% differential). In the 11 months of FY 2019-20 so far, my returns are (same order as before) 9.6% and 9.1% (a differential of 0.5%). Can you pls explain what your ‘5% to 6%’ are based on.” - Regards, Gil.

Morning Gil,

I really appreciate both the positive feedback and researched question. I was simplifying the issue but also we must remember in your calculations both years have been ok for stocks and a portfolio with a decent weighting towards say the IT sector should look good with a degree of leverage.

The cost of a margin loan with CBA is current 5.5-6% depending on terms which compared to cash which earns ~0.5% on a term-deposit has investors needing a portfolio performance of around 6%, including dividends, to match risk free cash. Undoubtedly this can be achieved in positive market years with some reasonable stock selections but we were just highlighting the risks for an investor, especially with a market that’s been rising for over a decade.

MM is bullish equities over the next 1-2 years.

ASX200 Index Chart

Question 2

“Hi MM, a question i have is do you have an opinion on Gold explorers in West Africa, specifically Oklo Resources and Chesser Resources” – Jamie G.

Morning Jamie,

Firstly, great set of initials – while I sign things off for MM as James, many people call me Jamie!

The 2 junior gold miners mentioned have a combined market cap of $150m and as can be seen below they have been tracking each other fairly closely over recent years. We don’t research either company so I can’t really add a lot of value from that perspective, Canaccord have a spec buy on OLU with a 50c price target while I don’t see any coverage through Bloomberg on CHZ. Worth also noting that these 2 are significantly underperforming some of our majors like Northern Star (NST) and Evolution Mining (EVN). We believe investing must pay attention to risk / reward and in this case the more vanilla large caps of the sector are more attractive to MM.

That said. if you are looking to go more ‘speccy’ in the gold space, Geopacific Resources (GPR) is a stock we’ve recently looked at which has strong prospects as it develops the Woodlark Gold project on Woodlark Island in PNG, which once in production (expected in 2022), at today’s share price Geopacific will be trading on a PE multiple of just 1.3x and an EV/EBITDA multiple of 0.2x. Geopacific is one of the cheapest gold companies listed on the ASX.

MM are looking for areas to establish some gold exposure.

Oklo Resources (OKU) Chart

Chesser Resources (CHZ) Chart

Geopacific Resources (GPR) Chart

Question 3

“Hi, I have subscribed for your service I am newbie First I like to say that your posts are informative and helpful So I am just new to this stock investing like to know more about it need a good mentor or helpful resource who can share info or guide in right direction I hope you can help with this or can please share some good resources to point out as starting point.” - Thanks, Sam B.

Hi Sam,

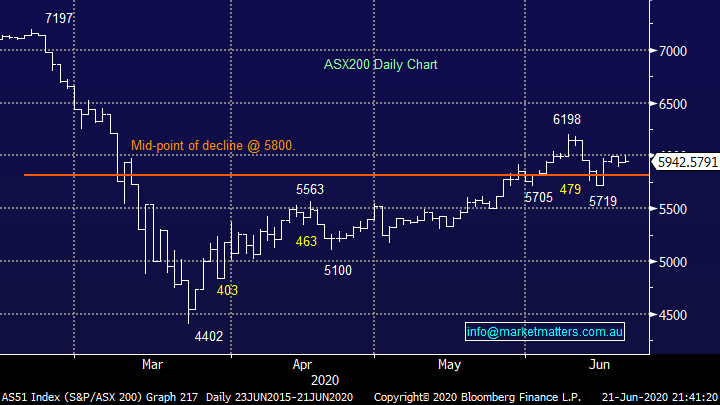

Welcome onboard! Successful investing is a multidimensional endeavour which includes getting both market weightings / risk and stock selection correct – just look at how Westpac (WBC) and Fortescue (FMG) have travelled in the last 2-years. Hence your hunger for knowledge is both wonderful and required in our opinion however I would stress there’s no silver bullet with good old fashioned hard work playing an important role.

The first and arguably most important issue is to identify your personality and look to invest accordingly e.g. are you mathematical and would prefer technical analysis, do you like the workings of a company and fundamentals are more your game or like ourselves a mixture of both. I stress that many courses / offerings have to be navigated very carefully as they are often motivated purely by $$ and if potential returns sound too good to be true, it’s probably because they are!

At this stage I would read, read and read again at least for 6-months to get a feel for the markets, a free daily offering from livewire.com.au is a good starting place along with some financial publications like the AFR, but obviously in some cases this might be looking in the rear view mirror but there’s no hurry the markets always going to be here!

Interestingly, at MM we have started discussing the launch of Market Matters Master Class in July / August which hopefully would look to provide additional help / insight to those members wanting more explanation / practical education around the market.

Westpac (WBC) v Fortescue Metals (FMG) Chart

Question 4

“Hi James 2 companies that I wish I had in my portfolio Kogan & Afterpay. Are they the Amazon and Apple of the ASX ? They both look very expensive on most valuations as did Apple and Amazon for many years (Amazon still looks expensive). My questions are do they have the vision and the management to become top 100 stocks on the ASX ? & Should we start to accumulate shares in these 2 companies (based on a 3-5 year view) or are there better options ?” – Michael S.

Hi Michael,

Undoubtedly these are 2 very successful and volatile stocks – they have both more than halved in 2020 and risen exponentially and like yourself I wish we had been onboard both. I feel it’s very early days to compare them to Amazon (AMZN US) while Apple (AAPL US) is a very different company but early assessment does indeed make sense.

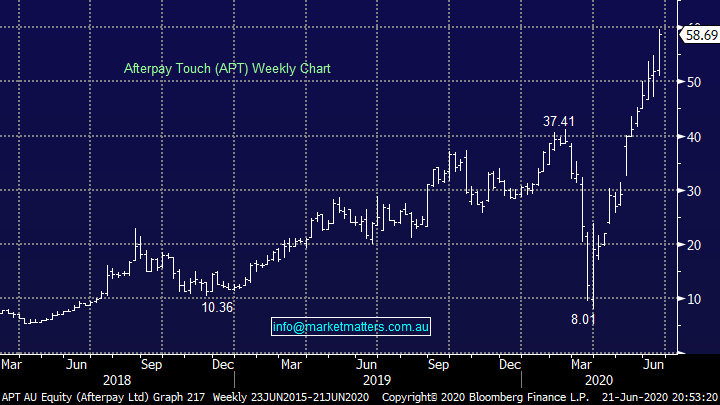

1 – Afterpay (APT) is a company where their business model has created a structural shift in how goods are paid for, and that’s been incredibly powerful. To give some context around the growth in the business, they listed in 2016 with a market capitalisation of just $165m and are now amongst the largest 30 companies on the ASX with a market capitalisation around $14bn, of similar size to Sydney Airports (SYD), QBE Insurance (QBE), and more than 3x the size of JB Hi-Fi (JBH)! We have largely got this sector wrong with APT being the most glaring omission to our growth portfolio, in short our concerns around regulatory issues and competition have been largely overstated to-date.

Markets are always a humbling mechanism plus a place to continually learn, and the major takeaway from the success of APT for us is the changing way goods are being paid for on a global scale, and how the concept of ‘exponential growth’ is very relevant to this sector – a theme Hamish Douglas from Magellan often speaks of.

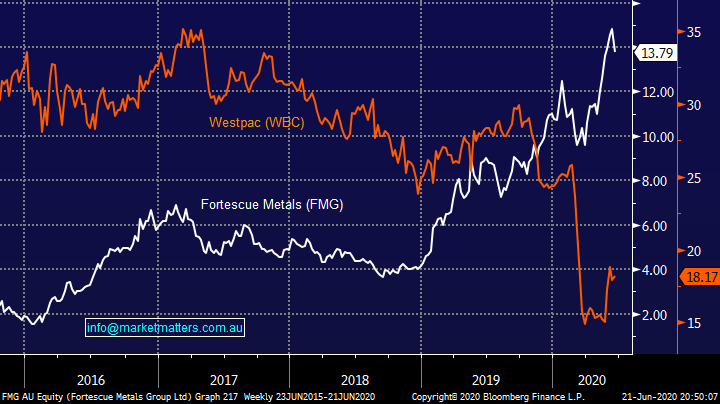

In terms of valuing APT and others, it’s very hard and normal metrics are fairly irrelevant. I’ve included a table from Shaw and Partners research below that looks at Openpay (OPY), Z1P Co (Z1P) and Afterpay (APT) on a relative basis.

The takeaway from the below table is that APT is expensive v others in the sector, although clearly they have first mover advantage and have scale, which is important.

From a relative valuation perspective, Z1P & OPY screen better

Buying pullbacks in the space including APT makes sense, I would use technical stops below $35 in an attempt to limit any major downside risks. Personally, I think better value is presenting itself through Z1P and more interestingly, OPY at current levels.

MM is bullish APT with stops below $35.

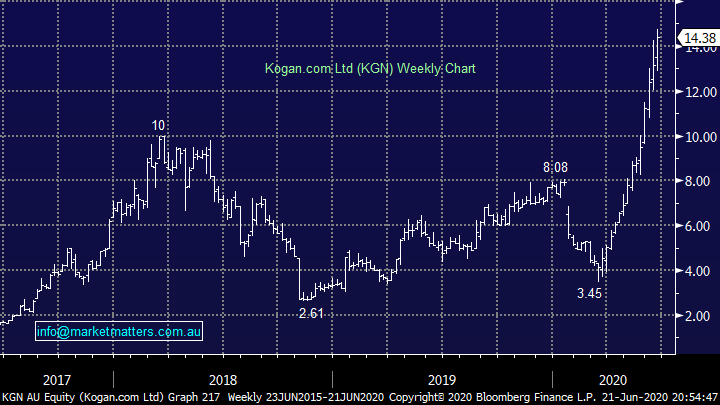

2 - Kogan (KGN) – we believe on-line retail is the future and the virus pandemic has undoubtedly accelerated the growth assisting both KGN and APT in the process. The Kogan platform has become a go to venue for many on-line shoppers looking for a bargain, interestingly often it’s not that cheap but the service is always slick and efficient which brings shoppers back time and again. Competition is likely to intensify moving forward but like Amazon they have first mover advantage, as a business it has surprised me on the upside and while it can hold over the $10 area it looks destined for better things.

MM likes KGN into pullbacks.

Afterpay Touch (APT) Chart

Kogan.com Ltd (KGN) Chart

Question 5

“In Wednesdays income report you covered a number of the larger child care companies. What are your thought on Think Childcare (TNK).” – Thanks Ian C.

Hi Ian,

TNK is a $50m business that like the sector has endured a tough few years with regulatory issues one of the major headwinds, however at some point the sector will turn and interest will re-emerge. When that happens, money typically flows into the larger players first before it flows up the risk curve to the smaller operators, hence our review of GEM in the first instance.

If / when money comes back into the sector we think GEM will move first providing the catalyst to further review TNK.

MM is neutral TNK.

Think Childcare (TNK) Chart

Question 6

“Happy Friday MM and keep the good stuff coming! China is getting testy with Australia. So for BHP and RIO is it easy to analyse what % of their revenue comes from CN and therefore to what extent they're exposed - if, for example CN suddenly preferred other sources of (say) Iron Ore or slapped tariffs? Does the above apply to WPL - in their case LNG I would guess.” - Cheers! Dave B.

Morning Dave,

BHP et al are undoubtedly in the cross hairs of an Australia – China Mexican stand-off but that’s almost old news now and we should not lose site of the fact that China need these raw materials to achieve their growth goals, short-term disruptions wont bother them but bigger picture they are major consumers who can’t get enough raw material elsewhere. We remain keen on all of BHP, RIO and WPL which is no surprise as we own them and they fit our medium-term outlook of a China led reflation trade hence any pullbacks courtesy of bickering between the 2 countries will provide buying opportunities in our opinion.

MM is bullish BHP, RIO and WPL medium-term.

BHP Group (BHP) Chart

Question 7

“Hi MM – I thought BBOZ was highly correlated with XJO? So today I noticed in (attached) todays intraday 1 minute updates chart of both. XJO is almost identical to where it began but BBOZ is quite a way up. How is this and how can it be used – or not. Cheers and thanks for your patience with us retail chumps!” - Dave

Hi Dave,

I teach my children “the only dumb question is the question not asked”. As you can see below the ASX200 and BBOZ are extremely well inversely correlated, i.e. they move against each other although note the BBOZ is leveraged around 2.3x. Personally I don’t even look at 1-minute charts they just convey confusing noise, in our opinion for stock investing a “daily chart” should be the lowest time-frame considered – see below.

NB The BBOZ is a bearish ASX200 ETF hence it will rally when the Australian index falls.

ASX200 v BBOZ ETF Chart

Question 8

“Are you fan of TYR? When would it be a buy?” – Dale C.

“Hey James and Team, a big thanks for another informative week. I am looking at two stocks in the Payment space - TYR and ZIP.

1 -TYR - they appear to be increasing their presence everywhere and most Brokers like the stock, but prefer it a lower price?

2 - ZIP- really impressed by their recent strategic acquisition in the US and they seem to offer a better risk/reward proposition than APT - I hold APT and am thinking about selling some to buy ZIP?

I am interested in your thoughts and a likely entry price for both stocks.” - Many thanks Dave P.

Morning Guys,

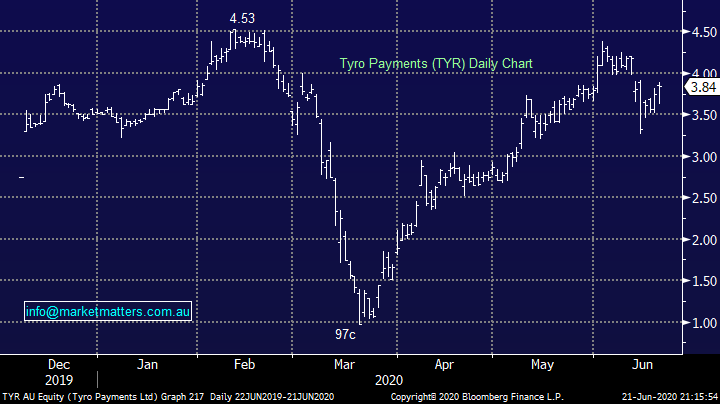

TYR and Z1P are in the payment space, although they are different business models. TYR is a fast growing payments platform underpinned by a large eftpos network, while Z1P is a buy now pay later platform, both however are obviously trying to walk in the footsteps of $15bn business APT.

While we like both from a risk / reward basis our preference is with Z1P who have recently purchased QuadPay in the US assisting its global expansion, we feel its going to be a classic case of the “quick and the dead” in this rapidly evolving new financial sector.

1 – Tyro Payments (TYR) – MM continues to like TYR and would consider accumulating into weakness but the risk / reward is not exciting close to $4.

2 - ZIP Co (Z1P) – Is our favourite of the 3 stocks discussed in the space today (although we also like OPY) and we are keen buyers into pullbacks towards $5.50, not too optimistic after the stock’s recent rapid appreciation.

**MM has been working on an Emerging Companies portfolio for the past 6-9months, which we intend to launch this year. Payment platforms have featured here with current holdings in OPY, TYR, EML & WZR.

MM particularly likes Z1P.

Tyro Payments (TYR) Chart

Zip Co Ltd (Z1P) Chart

Question 9

“Hi James, Given your view on the Aussie going to 80c how do investments in GDX (US) v GDX (ASX) stack up against each other? Also will the headwind of strong future AUD for Aussie gold producers be offset fully by the tailwind of US$ fall impact from various influences you have mentioned in your reports on the gold price in your opinion. Interested in your views on the relativities involved here including impact of hedging levels adopted by Aussie gold companies.” - Thanks Peter O (and keep up the great work by you and the team.)

Hi Peter,

A great and topical question, much appreciated! As you can see below the correlation between the 2 is very high but the locally listed GDX (AU) has outperformed of late as the $A has recovered hence over the medium-term we prefer the local ETF.

MM likes the GDX (AU) at today’s levels.

VanEck Gold Miners ETF (AU) v (US) Chart

Question 10

"Hi James & team, I would like your opinion on 5GN, BET, PIA, HACK and PEI” – Thanks Sidney H.

Hi Sidney,

Due to the number of stocks in the question please excuse brevity on each stock where we have provided a technical view:

1 – 5G Networks (5GN) $1.22 – neutral to bullish, we could buy around $1.20 with stops under $1.

2 – Betmakers Technology Group (BET) 41c - neutral to bullish, we could buy around 40c with stops under 35c.

3 – Pengana International (PIA) $1.07 – neutral, we would not consider buying until ~10% lower.

4 – BetaShares Global Cybersecurity ETF (HACK) $8.28 – we like this ETF at current levels with stops below $7.80

5 – PEI – sorry unsure what stock you are referring to?

Overnight Market Matters Wrap

- A volatile session in the US saw the Dow close near its low of the session, down ~600 points from its intraday high, while the broader S&P 500 also closed weaker.

- The fall on Wall St came in the wake of a resurgence in fresh US coronavirus cases, with 30,000 new infections reported on Friday, the highest level since May 1st. Total cases worldwide have now reached just under 9m with over 465,000 deaths, of which the US accounts for 2.2m cases and nearly 120,000 deaths.

- Crude oil gained, however remains volatile along with gold and copper.

- The September SPI Futures is indicating the ASX 200 to open lower, testing the 5920 level.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.