Subscribers questions (NST, ABP, BBOZ, MYR, PBW US, WHC, MQG, BOQ, XARO, TWE, SKI, ILU, COI, HUO)

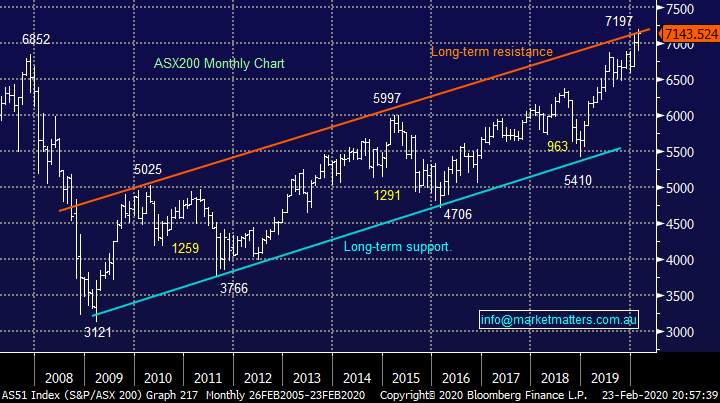

The ASX200 seems to have handed the controlling baton back over to the coronavirus as we enter the 2nd main week of reporting,, this continual rotation of the market rhythm coincides with our underlying volatile and choppy outlook for 2020 / 2021, our current preferred scenario is a pullback towards 6900 before another continuation of the post GFC bull market to fresh all-time highs. Nothing too scientific, as can be seen from the chart below the markets rallying in a simple staircase as opposed to escalator manner until further notice.

At the end of last week we had a new concerning twist in the coronavirus tail, as infections rose outside of China intensifying concerns across the globe about our ability to contain the virus leading to follow through worries for global growth forecasts, they have already fallen from 4% to closer to 3%, with questions now being asked as to whether they are still too optimistic:

1 - Italy which now has 100 cases has closed down schools in the north and even cancelled a carnival

2 – South Korea which now has 600 cases and appears likely to put some cities in lockdown as they consider drastic steps to contain the virus.

3 – Back to China, the talk is now that millions of companies face bankruptcy if banks / PBOC don’t act soon – we expect huge stimulus moving forward that will ultimately steady the equity ship.

The word pandemic is being banded around with increasing frequency making MM believe that equities might just panic in the next 1-2 weeks. Last week as equities made fresh all-time highs, we pointed out that zero risk of an escalation of the outbreak was being priced into stocks which MM felt was madness, now we may see the opposite unfold in the near future. The $A is testing 66c this morning implying to me that stocks are going to have a rough start to the week.

On balance MM still believes the ASX200 is bearish short-term, targeting 6900

A reasonable day on the reporting front with updates from Bluescope Steel (BSL), NIB Holdings (NHF), oOh!media (OML), WorleyParsons (WOR). By Thursday afternoon, most of the major companies will have reported.

Reporting schedule available here: CLICK HERE

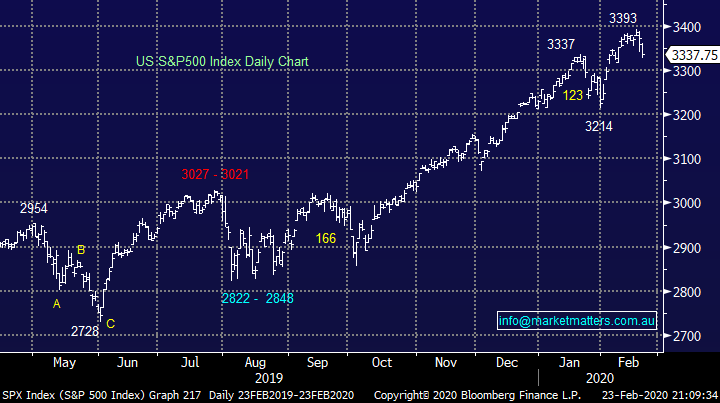

On Friday night US stocks had a tough day at the office with the tech-based NASDAQ falling -1.88%, the local market looks set to open down around 50-points, or potentially more.

Thanks, as always for the questions today, we’ve attempted to answer most! Please excuse the brevity / concise answers at times but I’m sure everybody understands.

ASX200 Index Chart

Local stocks look set to open lower this morning, our ideal target for this pullback is around 3% lower which is really nothing in the usual swings and roundabouts of equities, but it may offer us the perfect opportunity to add some value to our portfolios. MM is again looking to buy the pullback with “boring old banks” one of our targeted areas, technically the sector looks set to rally at least 15% which is very attractive when we consider the dividends delivered along the way, our fundamental reasoning is simple and logical:

1 – The Banking Royal Commission which helped create a period of significant underperformance for the sector is largely behind us.

2 – We feel bond yields are poised to reach a major inflection point; banks enjoy periods of rising bond yields / interest rates because it leads to increased margins.

3 – We feel the banks fully franked dividends are largely sustainable and very attractive compared to term deposits.

MM remains bullish the banking sector into 2020 / 2021.

ASX200 Banking Index Chart

Question 1

“Hi MM, I refer to your line charts and in particular the ASX200 monthly chart. I have no technical experience but am keen to understand why MM orange and blue lines are placed where they are, rather than where I have shown them with the yellow lines?” – Mic W.

Hi Mic,

Technical Analysis / Charting is far from a perfect science and we could easily have drawn our trendline support and resistance parallel tramlines slightly differently, they are pure guidelines that illustrate how the market has a been travelling, post the GFC in this case. Importantly interpretations from charts have to be especially open-minded / flexible when they’re applied to stocks / indices because there’s no allowance for dividends, a big influence on some stocks and indices.

NB Sorry everybody I was unable to show Mic’s attached chart but basically, he had his parallel lines starting at a similar position but ending slightly lower.

ASX200 Index Chart

Question 2

“Hi James & M&M, NST reported earnings on the 13th Feb, could you give your analysis, and is it worth buying into, if so at what level, and any idea of how high, short term and long term, do you expect it to go? Thank you and keep up the good work” - Tony.

Thanks Tony,

Northern Star Resources (NST) has been a standout performer in the local gold sector putting the likes of heavyweight Newcrest Mining (NCM) to shame. Operationally everything looks solid at NST while their acquisition of Super Pit in Kalgoorlie along with Saracens (SAR) looks to be a good one, although that’s now been priced into the market – hence the strong outperformance by NST in recent months.

We feel its share price action in the months to come will be largely determined by the underlying gold price – the precious metal made fresh multi-year highs on Friday as coronavirus fears intensified. We now think the gold sector has further upside as we discussed in the Weekend Report and NST at $16 would not surprise however if / when we see central banks stimulus roll through markets and bond yields tick up gold is likely to come off the boil hence we are looking for an opportunity to take profit on our Evolution (EVN) position. Newcrest actually looks a better short term buy than NST on a risk/reward basis at current levels.

MM is bullish NST short-term but cautious medium-term.

Northern Star Resources (NST) Chart

Question 3

“Hi James & Crew, as always, your insights and advice on the markets remains excellent reading and a good plan for action. I 'trialled' another service some time ago with positive, but not outstanding results. I have some 'legacy' stocks as a result, but no longer receive information regarding those stocks since quitting the service. I would like to liquidate them at an opportune time and use the funds to invest further in MM recommendations. Could you give me your thoughts on these companies please? They are: ABP, AWC, MTS, PTM, PPT and REA.” - Best regards, David H.

Morning David,

Again, thanks for the kind words, always puts a smile on my face to start the week. I have split you question into 6 quick on-liners for obvious reasons:

1 – Abacus Property (ABP): We own in the Income Portfolio and remain positive. Watch out for our alerts relating to this portfolio

2 – Alumina (AWC): We see better opportunities in other local resource plays, but it is finally becoming interesting towards $2.

3 – Metcash (MTS): Again, we bought recently for the income portfolio, so are positive on the stock, mainly for dividends.

4 – Platinum Asset Management (PTM): A stock we’ve been proven correct to be bearish for the last few years looks neutral now following its 50% decline.

5 – Perpetual (PPT): Has reached our recent $45 upside target leaving us neutral this fund manager. We still own in the Income Portfolio

6 – REA Group (REA): We like REA into weakness ideally sub $100 which is easy to envisage looking at the position of the market and IT stocks. i.e. a 15% lower.

Abacus Property (ABP) Chart

Question 4

“Hi guys, I’m starting to notice some negative sentiment in the business commentary, mostly around the disconnect between record index levels, stagnant earning and a future hit from Coronavirus. In a game of percentages, it must be almost a certainty that come next reporting season, earnings are going to be down. And assuming stock prices will adjust to reflect this, the current peak must be close. What is your take on this, and with this in mind, is it time to load up on BEAR, BBUS, BBOZ, etc, in preparation? Thanks for your work” - Charlie N.

“Thanks for your excellent no b/s publication, it's a breath of fresh air vs. lots of waffle out there. Recently you wrote "MM is bullish the BBOZ ~4% lower (than 8.48)" So today (20-2-20) BBOZ is as low as 8.03. What factors make BBOZ a buy?” – Dave B.

Morning Guys,

I’m sure you’ve noticed that MM is one of the “guilty parties” whose become increasingly negative albeit short-term but I stress at MM we are looking to increase our equities exposure into this correction assuming it continues – ideally ~3% lower. Our feeling is the world is again going to become panicked by the coronavirus outbreak as its spreads to the likes of Italy and Korea but a vaccine and central bank stimulus is around the corner so we’re backing mankind to ultimately win this fight making any decent weakness another buying opportunity.

Hence because we are looking for another “V shaped” recovery from the local market we’ve decided to focus on stocks as opposed to playing the BBOZ but for the active we can see 15-20% upside in this bearish ETF – it looks set to be an exciting week.

BetaShares Leveraged Bearish ASX200 ETF (BBOZ) Chart

US S&P500 Chart

Question 5

“Hi James, what easily accessed low cost active funds do you see out performing in the coming 12 months? P.S. Is Myer a value trap?” - Cheers Tim R.

Hi Tim,

Obviously the funds which perform over the next year will be those skewed in the correct direction e.g. leveraged long /high beta, US or overseas facing, defensive and hedged etc Todays market has a fund to cover all angles once you have decided on your preferred outlook into 2020 / 2021 – at MM we feel Value Stocks will outperform Growth after a period of underperformance, and as a consequence we ‘hope’ our actively managed funds will outperform.

More information here for those interested. https://www.marketmatters.com.au/news/sma/

US S&P500 Value & Growth Indices Chart

I think the share price of Myer says it all, a trap on all levels, they might not even survive.

MM regards MYR as simply too hard.

Myer (MYR) Chart

Question 6

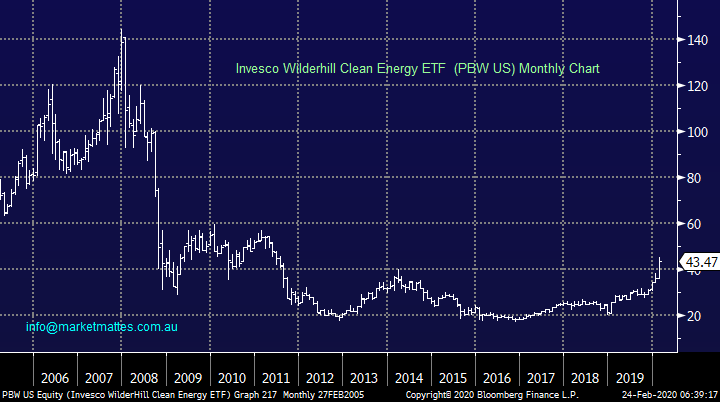

“Any Clean Energy Funds you could recommend?” – Mike C.

Hi Mike,

A very topical question but this is still a small market locally yet its worth over $US2.5 trillion globally, a perfect example in our opinion to cast one’s eyes towards the US.

MM likes Clean Energy Funds with the PBW an option we like.

Invesco Wilderhill Clean Energy ETF (PBW US) Chart

Question 7

“Dear MM, is there a balance ETF which allow exposure to the Chinese market which can be bought locally in Australia? What about a sectorial exposure to Chinese Market like technology, health care, financial etc.? Thank you. Regards Jimmy K.

Morning Jimmy,

Investing in China today is an interesting contrarian idea although their market has held up well through the coronavirus outbreak on the expectation of stimulus.

For a broad exposure to Chinese large cap stocks, the iShares China Large Cap ETF is worth a look, trades on the ASX under code IZZ.

Not specific to Chinese technology, however Betashares have an Asian Technology ETF listed on the ASX. It provides exposure to stocks like Alibaba, Samsung, Tencent & Baidu, 3 of which we hold in the MM International Equities Portfolio. It trades under ASX code ASIA and looks great technically : https://www.betashares.com.au/fund/asia-technology-tigers-etf/

Alternatively the ASX has a list of some other Asian ETF’s that may cover some of investment names / sectors you are looking for:

https://www.asx.com.au/products/managed-funds/access-asia-get-exposure-via-asx.htm

China’s Shenzhen CSI 300 Index Chart

Question 8

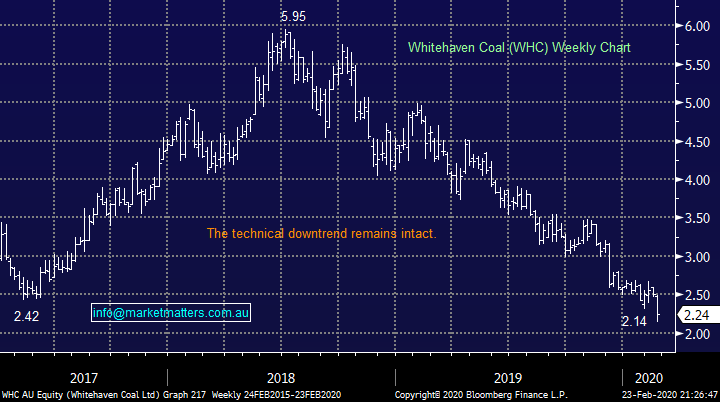

“Dear MM Team. Thanks for your call on ‘ethical-based’ changes to fund mgr. choices, which was as astutely perceptive as ever. However several economists have suggested that the decline of the thermal coal price (and the subsequent decline of stocks like NHC, WHC and SOL) was due to Chinese trade-war-related restrictions on Oz coal imports into China and that the coal price will probably rise in 2020 and stay higher until at least 2024 on increasing demand from Asian nations like India (especially), Malaysia, and Vietnam. Be grateful for your comments, all the more so since I own these stocks.” - Regards, Gil

Hi Gil,

Coal stocks are certainly a hot potato at present and an area we have covered at length recently following the announcements by the likes the world’s largest asset manager Blackrock to sell its coal assets – like all markets the price of these coal stocks will be determined by supply and demand and the supply of stock to the market is currently huge while the buyers are retreating, New Hope (NHC) for instance just lost an 11% shareholder in Mitsubishi who had held the position for more than 30 years. The trade was done at a ~12% discount to market highlighting that it’s a buyers’ market. Whitehaven Coal (WHC) also has the overhang from Farallon to contend with. Perhaps when all the bigger holders who are natural sellers come out of the market, we will see a bounce.

We believe the coal sector will become a phenomenal yield space over the next 5-years, but I don’t think there’s any hurry to fight the current entrenched downtrend in the sector.

MM is patiently watching the coal sector into further weakness.

Whitehaven Coal (WHC) Chart

Question 9

“Hi Questions for your next update I have offers for the following: Entitlements for additional units in MXT Securities Purchase Plan for shares in Orica Macquarie Capital Notes 2 What are your thoughts? (accepting that investment needs differ for each investor!)” - Thanks Chris F

“Hi, we have quite a high exposure to Macquarie via both their shares and the Capital Notes Issue of last year. I am wondering if you have a view on the latest Notes issue (Macquarie Bank Capital Notes 2)? Thanks in advance - we always find your commentary valuable.” - Regards Michael B.

Morning Guys,

MXT, we hold in the income portfolio however we are not adding to the position in the current offer. This is more a decision around weightings than a negative reflection on the security. That said, MXT invest in mortgages that are not liquid, and for that reason we don’t want to have more than 5% of the portfolio tied up here.

The new Macquarie Capital Notes 2 offer was mainly a reinvestment offer raising ~$400m, although there was a small amount of new money availability, but not much. I would imagine that the security holders offer will be scaled back significantly, however the notes are reasonable listing at 2.90% over the bank bill rate compared with the recent NAB issue which was priced at 2.95% over the bank bill rate. The Macquarie was a shorter dated issue (6.25 years to first call versus NAB at 7.5 years to first call) hence the tighter margin.

In short, a decent security that looks reasonable relative to other issues. We would expect it to list at a slight premium, around the $101 given current on-market pricing for this sort of duration.

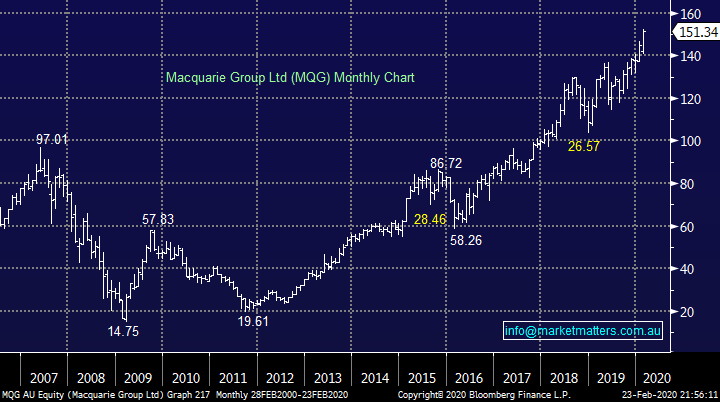

Macquarie Bank perse is on our list of stocks we would be keen to buy into weakness, we touched on the banks earlier – we are bullish MQG and the banks generally.

Macquarie Group (MQG) Chart

Question 10

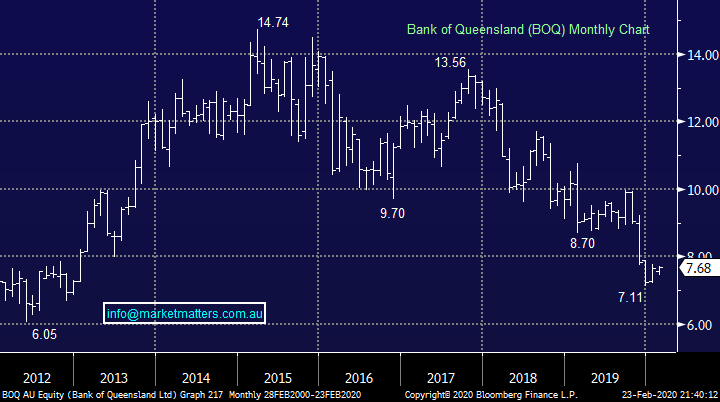

“What does MM think of the outlook for BOQ?” – Paul D.

Hi Paul,

BOQ has been the weakest domestic bank stock over the last 6-months falling by more than 15% while CBA has rallied by almost the same amount. We feel the regional bank offers value into weakness this week and we may just add it to the portfolio!

MM is bullish banks around current levels including BOQ.

Bank of Queensland (BOQ) Chart

Question 11

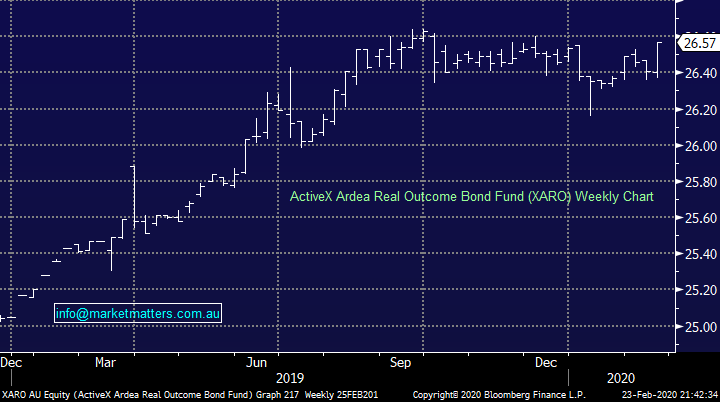

“Hi James, I am looking to buy a XARO. Given your prediction re bonds below, would now be a good time? Or is a product like this constructed to be able to deliver no matter which way yields are going? Cheers Tim 1 – US and domestic bond yields look perfectly positioned to break lower which implies a flight to the safety of bonds, potentially a case of short-term sell stocks and buy bonds.” – Tim R

Morning Tim,

That is a really good question Tim and gets to the bottom of why we hold XARO in the income portfolio. As you say, we are concerned about bond yields rising which if we held fixed rate bonds, this would be a negative. The XARO is different, it is not impacted by the level of yields or the direction of yields.

They run a relative value strategy that simply buys liquid government bonds that screen cheap and sells those that screen expensive, it’s essentially an arbitrage strategy. They have delivered strong returns over the past year; however, I wouldn’t bank on that continuing, something closer to 4% per annum post fees (0.5%) would be my bet.

MM remains positive on XARO for a low risk income exposure that is not impacted by credit or duration risk.

ActiveX Ardea Real Outcome Bond Fund (XARO) Chart

Question 12

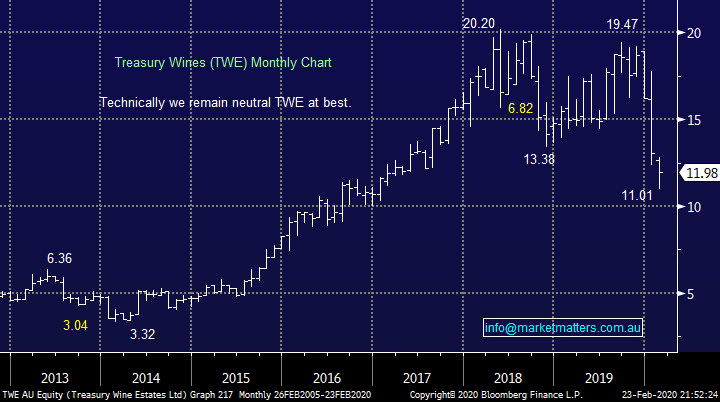

“Good Morning, James & teams, like your opinion at TWE and SKI in one to three months’ time” - thanks Regards Yi.

Morning Yi,

I have spilt your question in 2 but please note that 1 and 3-months’ timeframe in our opinion falls in the region of trading for an individual stock hence a lot of guess work comes into play:

TWE looks to have finally found a level of fair value around $11 and we can see the stock consolidating at current levels for the next few months until further company news flow. Overall though, the business has challenges from rising grape costs in Australia to increasing global supply of wine into its key growth markets.

MM is neutral TWE.

Treasury Wine (TWE) Chart

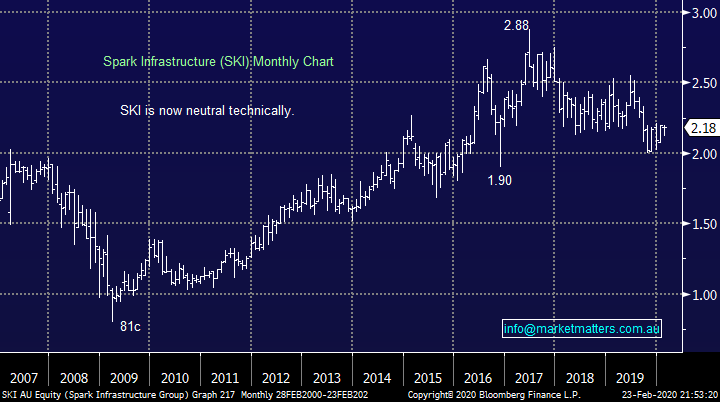

MM holds SKI in our Income Portfolio enjoying its almost 7% yield. The stock has traded sideways for the last 5-months and we see no reason to expect much difference through 2020 but if we had to “bet” on a surprise move it would be to the downside hence we are monitoring the stock carefully – like all of our holdings!

MM is neutral SKI.

Spark Infrastructure (SKI) Chart

Question 13

“Dear Market Matters Team. Thanks for the call a few weeks back on Nearmap. Sometimes it is best to let some go through to the keeper! I know MM has been keeping an eye on Iluka recently. Now that Iluka has announced to divest its iron ore royalty - what are your thoughts on next steps? Wait till the spin off before a possible entry?” – Cheers, Paul A.

Morning Paul,

I like the saying…best to let some go through to the keeper…I use it often!

ILU is a stock we’ve touched on occasionally in 2020 with a lot going on under the hood i.e. the demerger of its Mining Area C royalty business which generated EBITDA of A$85M in 2019.

The stock recently rallied on their half year despite numbers looking just a tickle below consensus. Sales were down around 8% on the year as prices slid, while EBITDA rose 15%. The main reason the stock rallied wasn’t due to their mineral sand’s operations, it came from the demerger plan mentioned earlier. Not surprisingly there has been speculation around what Iluka would do with these payments for a while.

Under these plans, Iluka would retain a minority stake in Royalty Co who would also look at purchasing royalties over other mining operations. In short, the royalty business could actually become a good yielding equity, simply collecting royalties from mining assets and passing them on to shareholders via a 100% payout ratio. If we put the royalty stream on the same multiple as Fortescue (FMG), it’s worth more than $5 per share.

The next time we’ll hear about the plans will be at the AGM in October, no further details before this so the company says.

MM likes ILU ideally ~5% lower.

Iluka (ILU) Chart

Question 14

“Hi James, I read your emails every day and find them very informative and educational. Definitely helping me develop my investing skills. You probably know nothing about this company, but I’m hoping you can help me learn something from the experience. At the recommendation of my broker I bought a relatively small amount of a speculative stock Comet Ridge (ASAX COI) several years ago. It has been a roller coaster ride, at times I have been up over 100%, but also had it halve. I have occasional sold some at a profit, but in December 2019 at the recommendation of my broker I bought more in a Share Purchase Plan at 19 cents. Almost immediately it started to head south. It is maybe as simple as the share price has been trending down since July 2018 and I should have heeded that warning. But I trusted my brokers recommendation and his research. So at present I’m feeling like a bunny that was sold a lemon.” - Best Regards Kevin W.

Hi Kevin,

Don’t feel too bad, we’ve all bought a lemon in the past, even Warren Buffett!

The key is now money / position management and as you rightly say, I have no idea on this particular coal seam gas stock with a market cap just over $100m. All investment decisions should have a ‘what if’ I’m wrong plan before implementation, this looks to be testament to this mantra.

Technically this looks bearish and given the appetite for CSG at the moment, and the red tape being applied by government, this company will need some type of ‘regulatory win’ in the sector to break its trend.

MM is neutral /negative COI.

Comet Ridge Ltd (COI) Chart

Question 15

“Hi James, In response to your request for feedback in regards to your “Direct from the Desk” broadcasts, I just wanted to let you know that I find these broadcasts and your video updates (in-house and via Livewire) to be an extremely valuable add-on to your regular email updates. There are not too many outfits in the market that provide this type of “in the moment” commentary and/or ad-hoc updates. I am a long-term subscriber and I am very happy with the progressive approach to communication being adopted by Market Matters. Keep up the good work. A question on a few stocks for Monday’s Q and A email. What is Market Matters’ view on Huon Aquaculture (HUO), Tassal Group (TGR) and Angel Seafood (AS1). If you had to make a choice, which one would you choose to invest in?” - Regards, Ian P.

Morning Ian,

Thanks for the feedback regards broadcasts / video updates; we plan for this to be a major growth area at MM as our new site / platform is launched later in the year.

Of the 3 I would plump for Huon Agriculture (HUO), the Tasmanian based salmon business. While Tassel is the bigger player in the sector, I feel I know Huon better given we have research coverage on it through Shaw, and these are fairly complicated businesses. The pros of Huon are longer term, being the increased consumption of fish at a time when they’ve bedded down a good foundation to improve operational performance - it’s been a long road to get this far for HUO!

On the flipside though, the con right now revolves around the elevated leverage in the business (never good in a volatile agricultural operation – Costa an example of this), while margins are also low.

While we like this business, it is higher risk at the moment and should be traded with that in mind.

MM is bullish HUO with stops below $4.20.

Huon Aquaculture (HUO) Chart

Overnight Market Matters Wrap

- The Coronavirus/COVID-19 outbreak has sparked investors to take risk off the table across the globe last Friday, as the unknown risk of the sizable impact of global growth is set in most minds.

- The Nasdaq lost the most, while the VIX (volatility) index surged 9.77% albeit currently remains at complacency levels… for now!

- On the LME, ‘safe haven’ asset, gold gained, while in the commodities front, crude oil lost 0.93%

- Locally – reporting season continues, with the following expected today – Bluescope Steel (BSL), NIB Holdings (NHF), oOh!media (OML), WorleyParsons (WOR), WPP AUNZ (WPP).

- The March SPI Futures is indicating the ASX 200 follow the global selloff and open 50 points lower, testing the 7085 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.