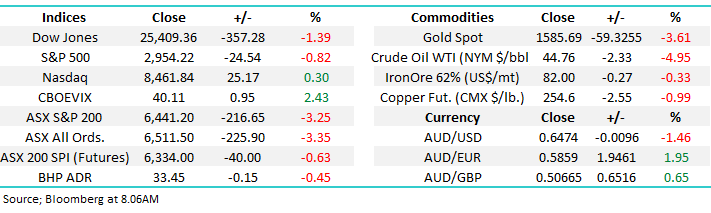

Subscribers questions (MXWO, MXT, CSL, ORI, TWE)

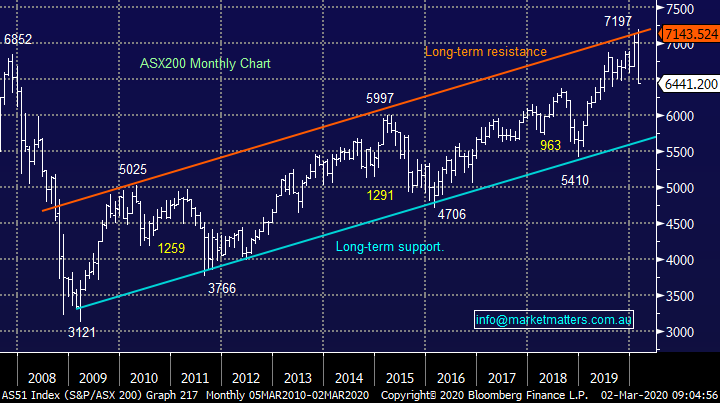

As I’m sure all of you know the ASX200 was battered last week finishing 5 tumultuous trading sessions down almost 10%, it was basically aggressive one-way traffic from Monday morning with the market gapping down on 4 of the 5 days and while it bounced twice around 100-points the gains were extremely short-lived. We must remain focused looking through the windscreen, not in the rear-view mirror as another Covid-19 influenced volatile week kicks off this morning, it appears bets are currently being laid in favour of more bad news ahead.

However, since our market closed on Friday afternoon the news is mixed but considering the entrenched negativity it might take a more positive news / rhetoric to reawaken the bull:

1 – Jerome Powell, the Fed Chair, opened the door on Friday for an interest rate cut in the US stating they are “closely monitoring the coronavirus, MM believes it’s a question of when not if.

2 – Many investors / economists are expecting, or perhaps hoping, the RBA will cut rates tomorrow afternoon, the market now pricing in an ~90% chance, we feel the likelihood is less than that – they may keep their limited ammunition on lock until the economic impact from the virus becomes clearer.

3 – We saw over the weekend that China’s manufacturing & services sectors have contracted far faster than expected. The PMI printed at 35.7, down from 50 in January with anything below the half century regarded as contraction – importantly expectations were closer to 45.

4 – The coronavirus continues to spread across the globe with Britain already talking about quarantining some cities, politicians will undoubtedly talk a lot of rubbish in the weeks to come but with a fatality rate of around 2.3% this story undoubtedly has much further to play out.

5 – Conversely the news out of China is slowly improving with steel demand, internal flights and power usage turning north albeit it from very low levels.

We believe central banks will / should hold fire for now because if they act and the underlying Covid-19 outbreak gets substantially worse financial markets might lose faith in the likes of the Fed & RBA which could lead to further panic across markets.

We feel this unprecedented event is in the 2nd stage of a 3-step process which is when the “bargains” arrive, but the current sale may easily accelerate further, MM believes the market is in slow accumulation phase:

(i) - Global growth slows, companies make less money and supply chains get disrupted – this has clearly occurred in China and is now threatening to roll across the globe – markets have been pricing this into stocks.

(ii)– Financial stability is threatened as stage (i) unfolds i.e. panic selling and a threaten to liquidity. Importantly these 1st two stages feed on each with panic leading to further panic, this was certainly prevalent in stocks last week.

(iii)– Financial markets usually pre-empt the bottom to the “event” i.e. Covid-19. In our opinion central banks cannot engineer this, sure they can help but we must see an improvement with the outbreak front which appears to be unfolding in China today.

On balance MM believes the ASX200 will test lower levels before finding a meaningful low but short-term a decent bounce feels close.

On Friday night US stocks reversed heavy early losses as optimism of an interest rate cut swept through stocks following Jerome Powell’s comments, unfortunately the Chinese data will probably put a dampener on things this morning, my best guess is the ASX200 will open down around 1%.

Thanks, as always for the questions today, the reduced volume is a clear sign that many people are concerned of the pandemic outbreak of Covid-19 – it’s all about big picture macro stuff at present.

ASX200 Index Chart

Technically equities look awful, if it wasn’t for the underlying issue being the total panic around the unprecedented Covid-19 issue MM would be extremely concerned for the health of equities but recent events make us more open minded to news flow as it flashes across our screens.

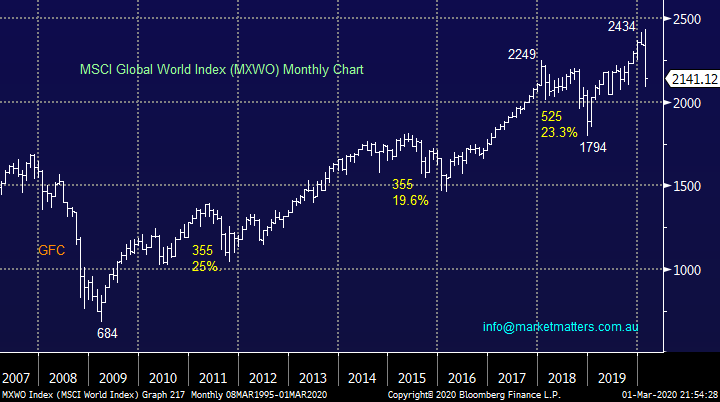

Technically global equities look potentially capable of declining another 15% - scary stuff.

MSCI Global World Index (MXWO) Chart

However, bond yields are painting a more optimistic picture for risk assets, subscribers should remember it’s been MM’s outlook through 2020 the global bond yields would form a panic style low in Q3, here we are right on time. If we are correct the flight to safety is already very mature implying the worst is already behind equities:

1- German Bunds look set to make one final low before forming a base i.e. yields higher and bonds lower.

2- US 10-year bond yields already appear to be very close to their low i.e. bond prices forming a high.

MM believes global bonds are very close to an inflexion point implying the panic in financial markets is set to ease.

German Govt Bund Generic Yield Chart

US 10-year Bond Yield Chart

Question 1

“Just wondering what impact, you think the horrific Chinese data from yesterday will have. I see another bad day here and in the US.” - Cheers David M.

Hi David,

The data was simply awful showing China is undoubtedly contracting faster on the economic front than many feared, not overly surprising with 500 million people living in a state of lockdown. However to give a balanced answer I think the China situation may have already bottomed, I’m more concerned with the likely slowdown through the likes of the US & Europe, if this gathers momentum stocks are likely to see more downside.

MM’s best guess is the ASX200 will open down 50-points this morning.

ASX200 Index Chart

Question 2

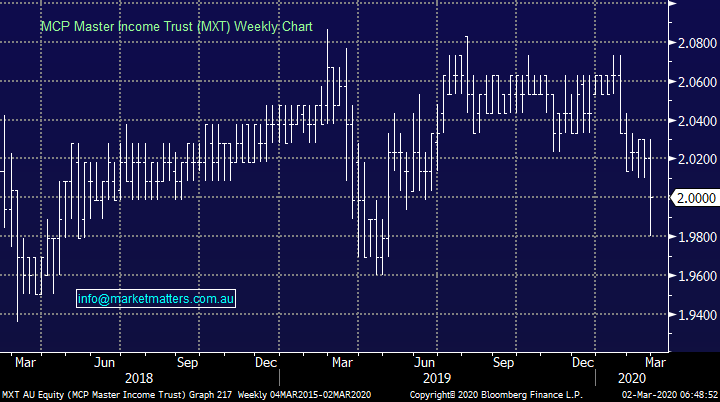

“Hi James, A quick question for Monday. With the current sell-off, do you think there is much to gain in holding bank hybrids and income stocks, such as MXT and NBI? Would the returns not be greater in the future by selling these stocks, and investing the proceeds into good stocks which have fallen significantly?” - best wishes John K.

Hi John,

Asset allocation depends on each individuals circumstances, something we do not take into consideration at MM, however our view is bond yields are close to a major bottom which implies it is time start tweaking allocations, reducing the uncomfortable switch from the stability of hybrids / income securities to battered equities given relative value from stocks has improved, with a focus on those that pay a decent sustainable yield. However, we feel stocks are in accumulation phase at present, not an aggressive “all in” situation hence a scaled approach is what we do in our Income Portfolio.

As it stands, we are skewed 42.5% towards income securities, 55% towards equities and 2.5% in cash. We view this as a fairly neutral stance for this income focussed portfolio. The most aggressive stance we would take here is 70% towards equities, meaning we have room to scale.

MM believes equities will outperform income securities / hybrids medium-term BUT short-term its obviously news dependant.

MCP Master Income Trust (MXT) Chart

Question 3

“Hi MM team. A query for Monday. There seems to be a strange silence from MM re portfolio positioning during this tough time. No buy sell or insuring calls. Do we just sit and watch this unfold or have we missed the boat on something (buy BBOZ or similar)” - Regards Neil W.

Morning Neil,

Thanks for the feedback, as you may know we previously increased our cash levels up towards the 7200 area in our Growth Portfolio before putting out a number of buy/switch alerts on Tuesday of last week into market weakness but unfortunately our pullback prognosis was way too conservative – I’m sure all subscribers understand it’s impossible to forecast a full blown pandemic, doomsday merchants have lost a fortune over the last decade!

I actually thought we were active last week, too active on the buy-side as it turned out.

We do anticipate being proactive in the weeks ahead across our 4 Portfolios, we outlined much of our thoughts and plans in this Weekends Report (click here) – in hindsight aggressive selling last week of the acceleration lower would have paid dividends short-term but history tells us this is not usually the prudent path. At MM we intend to focus on structuring our portfolios for the future not the next 24-hours panic and fortunately the current blind panic should assist us with the adding of value in this area.

MM prefers Value stocks overgrowth and actually believe its again time to cautiously buy weakness.

NB Last week on a number of occasions we saw a usual month’s activity in one day hence MM may become more active accordingly.

ASX200 Index Chart

Question 4

“James and Team, A readers question. Thanks for the support through this last month, a bit bumpy for SMSF in pension mode…. What do you think about switching some profit from Australian equities into AYF and HBRD.” – Cheers Tim H.

Morning Tim,

As we alluded to above, asset allocation depends on each individuals circumstances and tolerance for risk, something we do not take into consideration at MM. Selling equities and buying more defensive securities such as the Hybrid ETF reduces downside risk, and this market could certainly continue to trade lower in the short term, however for our income focussed portfolio we are likely to take the opposite stance, using market weakness to reduce our weightings to hybrids / income securities and increase our weighting into equities as per above i.e. taking on more risk with stocks paying sustainable yield.

Ultimately, the Coronavirus outbreak is unlikely to have long term ramifications on the outlook for equities. In the short-term equities are uncomfortable however history shows us that these are times to accumulate shares.

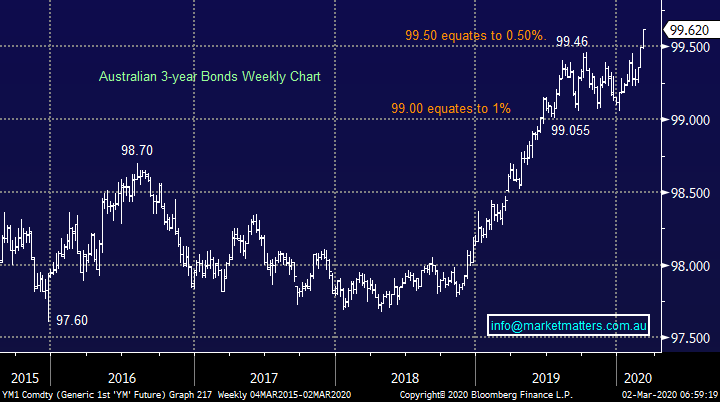

MM believes Australian bond yields are forming a “blow-off top” implying the basic chase for yield is reaching maturity.

Australian 3-year Bond Yield Chart

Question 5

“Hi James, just to confirm what you said in your last email, we have switched our holiday to Japan in April School Holidays to Tasmania. Travel Insurance won't cover us for Coronavirus they said so better to be safe than sorry. At least we have Medicare covering us here if things get worse.

You gave some tips on 4 sectors that will outperform over the next 12 months. I wondered if Healthcare would too and especially CSL that are working with Qld Uni to find a vaccine?” - Thanks, Kim B.

Hi Kim,

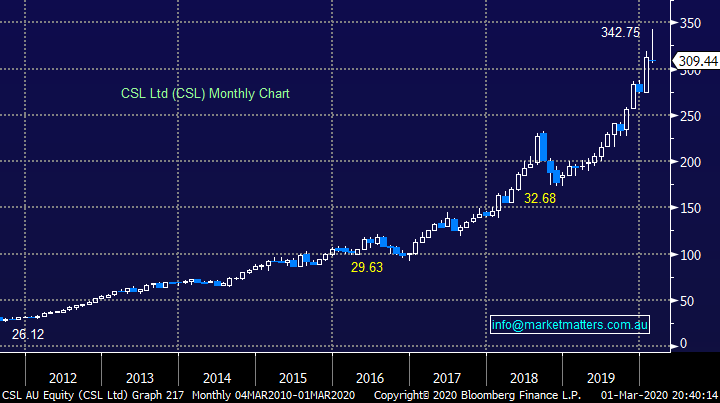

CSL is a world class business and if it is ultimately involved in the Covid-19 cure / vaccine another leg higher is almost a given. However, it also carries on its back a high valuation due to the combination of its pure quality as a business and record low interest rates making us cautious. This is a phenomenal company but it has run hard and we feel it’s very “owned”, it corrected 10% last week almost exactly in-line with the broad market – however this is definitely a stock to consider into further weakness, a move below $300 will become interesting.

MM is neutral CSL around current levels.

CSL Ltd (CSL) Chart

Question 6

“Hi I asked this question last week but you didn’t answer it. What are your thoughts on the current Orica share purchase offer? Current feedback would indicate that the shares are overvalued. Also, what would be your choice - Macquarie or NAB notes currently under offer? Or are we better just to purchase shares during this market downturn?” - Thanks Chris F.

Hi Chris,

Sorry we missed your question last week, it’s always our intention to answer all whether tough / confronting or nice and easy.

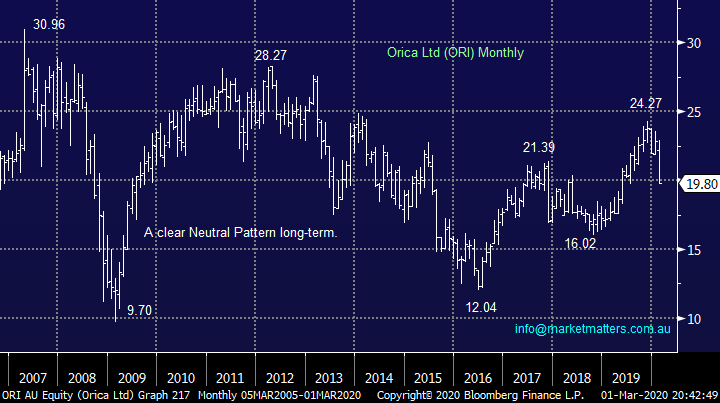

Orica are raising money to increase their exposure / capabilities in Latin America, a growth market for the company.

1. Orica raised $500m via a share placement to institutions at $21.19 per share, a handy price given it closed Friday at $19.80

2. A share purchase plan is now open for retail investors to buy up to $30,000 worth a share

3. The pricing will be set at a 2% discount to the volume weighed average price (VWAP) during the pricing period, which starts on the 13th March to 17th March.

4. Taking the offer up will depend on what the shares do during this time, for instance if they slide lower during that period, it’s probably worth leaving alone, if they rally then the price offered will likely be lower than the market price at the time.

That said, to MM ORI’s underlying shares are not exciting at present and another 10-15% downside would not surprise.

Orica (ORI) Chart

In terms of Macquarie v NAB hybrids, given where hybrid spreads have moved over the last week, it is now likely that both issues will open below their $100 face value. Macquarie is a shorter dated issue, while NAB is a longer dated issue and pays slightly more as a consequence.

Our preference marginally favours NAB, slightly safer, slightly higher yield offset by longer duration.

Question 7

“Hi James, Firstly, thank you for your ongoing and pro-active market views. I was hoping to get your view on TWE at these levels (<$11)? Given the demand for brands such as Penfolds should remain highly sort after once the flu concerns dissipate, are we seeing a fantastic long-term entry point? Thank you for help.” - Kind Regards, David W.

Morning David,

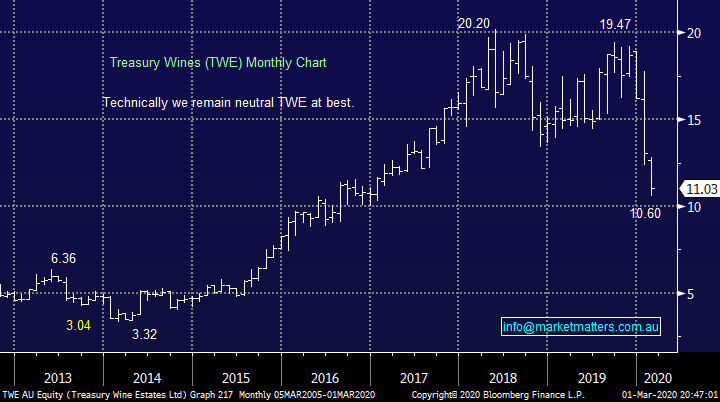

TWE has other issues apart from Covid-19 as can be seen from its weakness from Christmas, way earlier than the virus led plunge in equities. Last week we saw mass indiscriminate selling across our market as “virus fever” took hold, we believe investors should be looking to accumulate the quality end of town with sustainable yield as opposed to companies like TWE that were struggling prior – KISS (keep it simple stupid) buy quality into weakness.

MM is neutral TWE at current levels.

Treasury Wines (TWE) Chart

Question 8

“Hi Guys, I know this is next level but surely you need a service to alert when the market is tanking overseas at night. Looks like 5% down over 2 sessions, is it buying night? Too late in the morning if it is?” - Regards, Scott Donald.

Hi Scott,

That is next level! We are in the process of a major facelift for the MM service and this does include a platform for more timely updates around our views, including a potential ap that allows for push notifications. Whether that is overnight, I’m not sure at this stage.

The NASDAQ shown below plunged 16% last week, before recovering on Friday from the daily lows.

US NASDAQ Index Chart

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.