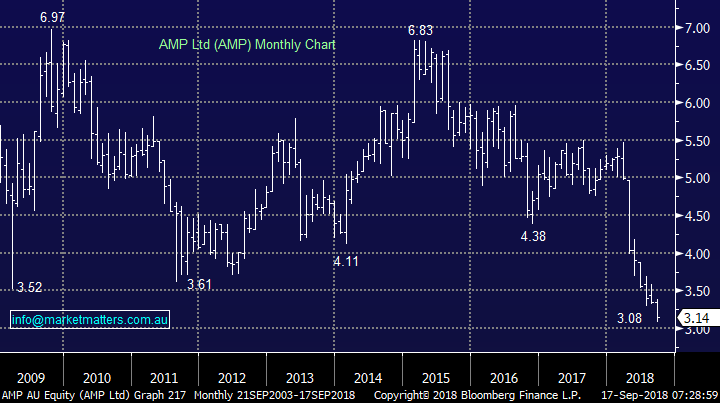

Subscribers questions (MWY, AMP, PTM, NXT, DCN)

The weekend brought no fresh news other than rehashing the Hayne Royal Commission and US-China trade war discussions. The currency market is trading unchanged with the $A around US71.50c, implying no great surprises are close to hand, although US equity futures are slipping lower down -0.25% while I type.

The SPI futures closed marginally firmer on Saturday morning, calling the ASX200 up ~10-points with BHP down a few cents, but the influential financials were the strongest sector in the US.

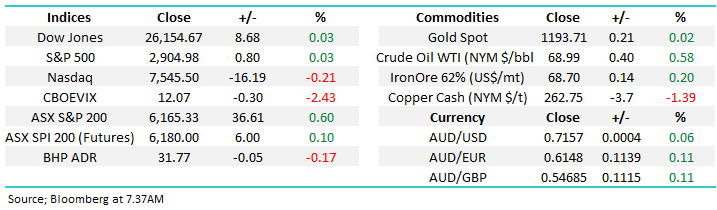

· We are mildly negative the ASX200 ideally looking for a further 5-6% downside.

Thanks again for some great questions including a number around the same subject as we get an almost discussion evolving, one of our goals at MM with Monday’s morning reports.

ASX200 Chart

Question 1

“I am always amazed how services like yours constantly feel the need to guess when the next great correction is coming. At some time in the future you will no doubt get it right and then tell everyone how wonderful you are at picking the market. When I signed up for your service I was told how wonderful your stock analysis was and how I could make money from following your stock picks. So far both have been extremely disappointing. Frankly I don’t really care if the index goes up or down I want you guys to tell me what stocks I should be buying or selling and when, however each day I read your reports on maturing bull markets and when the next big correction is coming. Earlier in the year you forecast with great certainty a 20% correction this year now you have some obscure other number sometime next year. What a futile exercise! I would ask that you concentrate on looking for good quality stocks that through your research and hopefully extensive knowledge will give investors like me a decent return on our money. If at some point in the future you feel these stocks are about to be severely hit then tell us to sell them. Would love you to put my e-mail in your Monday report and see if it generates any discussion.” Regards Craig B.

Hi Craig, thanks for the comment/question – as you say, it’s always interesting to see if Monday’s format generates discussion around the topics raised and importantly, gets readers thinking outside the box (us included!). Firstly, successful investing over time involves constantly analysing what we do, approaching the markets with a measured and analytical bias (rather than an emotional one) and importantly continuing to learn along the way. We take the same approach with the MM service and therefore we take all feedback on board.

I believe you’ve made some valid points and it is an area that we’ve discussed a number of times in the last few months – putting more airtime / focus on individual stock calls in our notes rather than the market collectively. We’re also in the process of developing a new online portal which will provide greater stock specific insight / research. That said, market trends generally are very important whether it be around sector rotation or picking levels in markets where we are bearish / neutral / bullish etc. This plays into our level of conviction when making stock calls and the overall composition of our portfolios. We’re different to many other services insofar as we run a real portfolio and make calls around weightings / composition of our portfolios.

In our defence, I would point out a couple of relevant points around our market calls:

1. We picked both the top in 2015 and low in 2016 to the week i.e. moving to 50% cash and then to fully invested – this adds value to our subscriber base

2. In 2018 we have been looking for a decent correction, but have largely remained fully invested, certainly not as bearish as in 2015.

3. We always suggest for investors to keep an open mind

Obviously we strive to satisfy all subscribers however it’s a balancing act in many respects and its why feedback is always important. In terms of the index, many do like our opinion as we’ve had good form picking larger turning points historically – and I’ve spent a lot of time trading the index over the past 10 years or so. You may recall that many thought we were “crazy” when we stepped up and bought the sharp weakness earlier this year.

A simplification of our process is:

1. What sectors we want to both be invested in and avoid.

2. What stocks and at what levels fit the above.

3. Hence an opinion on the next 5-20% swing(s) in the market is very useful.

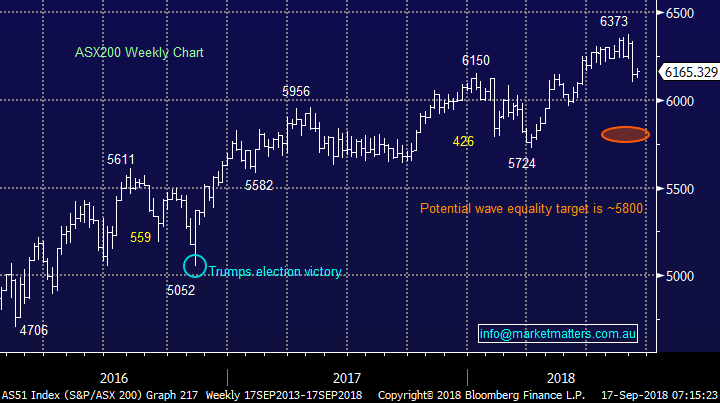

However as the below chart from the Weekend Report illustrates, we want to be invested in stocks over the long-term, hence we are simply attempting to add some value (alpha) through optimum market timing - please be patient Craig, this has proved a pretty successful formula since our inception with the occasional, but inevitable speed bump in the road.

Traditional Australian investments long-term performance Chart

Question 2

“Great report folks.” – Daryl W.

“Hi MM team, big thank you for giving us that golden nugget about buying resources on high PE’s and selling on low PE’s. Personally, I appreciate all useful insights and ideas, especially ones direct from the trading floor, keep ‘em coming!” -Regards Sean C.

Hi Guys,

Thanks for the positive feedback very much appreciated. We take all comments on board, both positive and less so. Please keep them coming.

Question 3

“What do you think of MWY? It is in the Materials sector, which according to your Weekend report, is a favourable sector. Fundamentally and technically it looks promising. It has just gone ex div and has still gone up, always encouraging. I do like the way you are anticipating the future in your market reports. It makes for interesting reading and helps one to disentangle from the noise of the here and now.” – Bruce B.

Hi Bruce,

For those not familiar with MWY it’s a forestry services company with a market cap of $237m which trades on a Est P/E for 2019 of 12x while yielding 5.68% fully franked. This morning the stock has entered a trading halt and is looking to raise capital. For that reason, we’ll cover it in more detail in a note this week after we know the outcome of the raise.

Technically MWY looks likely to range trade between $3 and $3.40 for a while thus making it attractive buying ~$3.

Midway Ltd (MWY) Chart

Question 4

1 “Hi James, I would strongly dispute the figures quoted by Margaret in Q5 last week. They seem inaccurate.

“A couple would need $300,000 each to get $33,000 living costs each year for 25 years (65 to 90)

A single person needs $440,000 to support $24,000 p.a. for the same timeframe

Used 5.5% returns p.a.”

I’m not quite sure where the $1.3m figure comes from, but it’s nearly a full order of magnitude away from being correct.” – Regards Pat P.

2 “Hi James, I'm in support of the author to question 5, she is definitely not alone. Bill Shorten, I believe, has no idea of the repercussions of his suggested changes to the franking credits system. It would be my submission that if he goes down this track he will place himself at grave risk of assassination.” – Steve.

3 On Monday you mentioned in reply to Margaret’s question that you were going to write an article by Livewire or in Livewire and you would let us know by the end of this week where we would be able to read this Have I missed your reply. I thought it a very appropriate question” - Thank you Eileen J.

Hi Guys,

Bill Shorten is certainly planning to poke the hornet’s nest from reading the above 3 missives. We are indeed looking to publish an article in the coming days on the subject with areas of focus from an investment perspective, it’s going through final stages. I’ll also look to compile a podcast in collaboration with an expert on the topic in the next week or so.

Question 5

“A question for the Monday email on AMP. AMP have clearly been belted, both the stock price and reputation in the public eye. After noting that you are looking at AMP as a potential buy during the week, I thought I would ask about their BOLR (Buyer of Last Resort) provisions they have with many of their financial planners. I am of the understanding that a significant number of financial advisers(up to 76% based on some surveys) are planning on leaving the industry by 2021 as the education requirements change. Many AMP planners are exercising their BOLR provisions within their franchise contracts. These basically force AMP to purchase the financial planning business for 3- or 4-times recurring revenue. AMP then don’t want these businesses on their books and so on sell them. The issue is they will be on-selling at less than 3- or 4-times recurring revenue in an environment where valuation multiples for financial planning businesses are declining. My understanding is that these BOLR arrangements are an unfunded liability and a wave of these BOLR provisions will all hit AMP over the next 1-3 years. I am interested in your comments / analysis and whether this is only a minor blip of AMPs overall earnings as I would be reluctant to buy AMP.” – Regards Grant L.

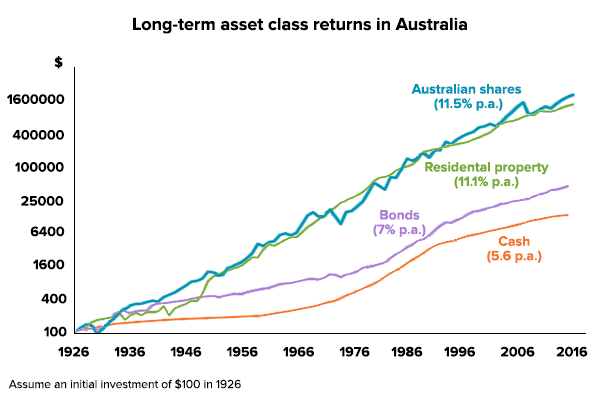

Hi Grant, an excellent point you’ve raised and one that I can address this week specifically in the Income Report on Wednesday. The BOLR facility could be a significant issue for AMP – for instance if the average payment per planner is $1M then the potential liability for AMP is $1.5B. AMP has no material excess capital so that liability could result in lower dividends or the issue of new shares. That said, whether or not AMP has a ‘legal out’ on these contracts is yet to be determined.

At a higher level, AMP is currently trading on a Est P/E of 10.1x Est 2108 earnings, while yielding 7.8% fully franked compared to say Janus Henderson on an Est P/E of 9.5x for 2018 and IOOF Holdings (IFL) on 12.1x Est 2019 earnings. We are expecting few strong bounces from the large underperformers in 2018/9, as we saw with Telstra (TLS) as fund managers re-evaluate the battered stocks as the high valuation / growth plays simply become too expensive.

However within this group there will be some “value traps” that undoubtedly keep falling, like AMP indeed has for most of 2018. We do like AMP’s appointment of David Murray but he even called his new position “the toughest in corporate Australia”, and overall we believe it’s a 2-3 year turnaround situation at best.

· We are watching AMP but it’s not yet cheap enough in our opinion to take on the risks associated with the stock and sector.

AMP Ltd (AMP) Chart

Question 6

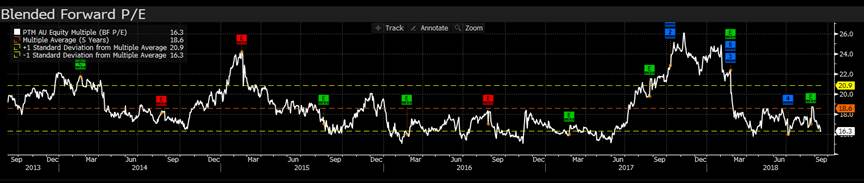

“Hi Guys, while we are on this sector any thoughts on PTM?” - Kind regards, Phil C.

Hi Phil, Active managers have struggled in recent times however there have been trades present themselves within the sector. In terms of PTM, they’re now looking reasonably cheap trading on 16.3 times versus a 5 year average of 18.6 times however they generally bounce well from levels nearer 15 times.

PTM Consensus PE Ranges

While the battered stocks are likely to become increasingly volatile in both directions moving forward we are remaining patient in adding to our current sector exposure through Janus Henderson (JHG).

· Technically we can see the current downside momentum taking PTM below $4 i.e. we intend to remain patient for now.

Platinum Asset Mgt. (PTM) Chart

Question 7

“Hi MM, being a subscriber for a while now and you’re twice a day feeds have been a great insight to the stock market. Keep up the good work. Have two questions: i) You mentioned in order for the anticipated correction, something in the US has to materialise negatively, can you elaborate. And are there data/graphs/events/ to look out for? ii) Can retail investors invest into one of your funds?” -Thanks, Jacky.

Hi Jacky,

Thanks for the positive feedback.

1 - Our simple “Gut Feel” is it will be hard for the ASX200 to add to its -4.2% correction while US stocks continue to rally, note it’s not impossible. Ideally we will see US indices have a ~6% correction which will in all likelihood provide some solid buying opportunities in the local market NB this would hardly be a “blip on the radar” for US stocks. Any number of catalysts could cause the move but of course everyone’s first guess would be Trump & China.

2 – Yes retail investors can invest in our funds (SMA) now however our official launch should happen later this month. We will send you some more information today.

US Russell 2000 Chart

Question 8

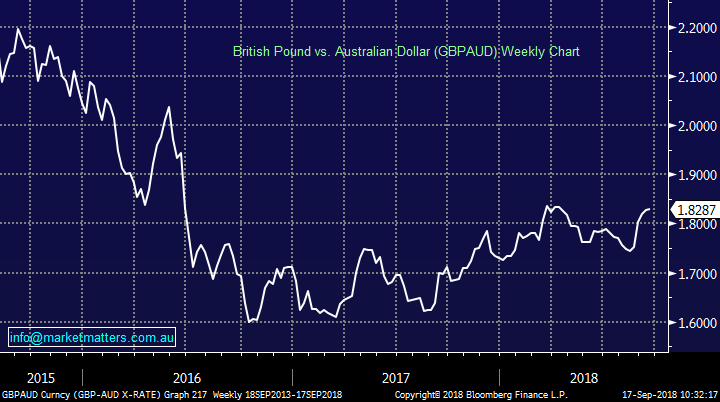

“If one took the view that the Pound was set for a rebound following a Brexit agreement, how would one best take advantage of that?” - Thanks Toby C.

Hi Toby, As you can see below the Pound has already corrected about 50% of its BREXIT decline so I assume you anticipate the currency will push on higher. From a local stock perspective the 3 options that come to mind are the UK exposed stocks that were hammered when BREXIT shocked us all i.e. CYBG (CYB), Janus Henderson (JHG) and Pendal Group (PDL). The other way is through an ETF and Betashares do a British Pound ETF with ticker POU. Buying that will give you direct exposure to a rise in the Pound vs the Australian Dollar.

British Pound v AUD Chart

Question 9

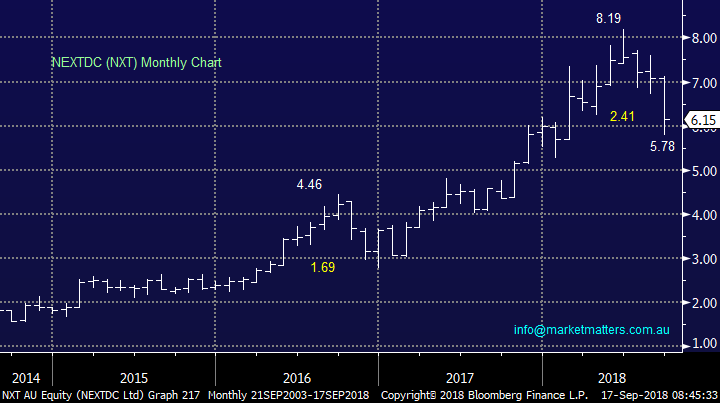

“Hi James, could you make a comment on NXT & why it’s been sold off on volume. Admittedly, their Capex is high, but Sydney will be finished this year and other sites (Melbourne, Perth) to come on line next year. So, do you think there is real traction with the legal dispute with AJD?” – Thanks Peter M.

Hi Peter,

The data centre developer NXT is very much a high growth / valuation stock that have become extremely volatile over recent weeks – a particular group of stocks that we are not keen on at this stage of the cycle. NXT is still trading on a “nosebleed” valuation so if the company coughs the shares could be hammered, however once its current investments in infrastructure comes on-line its valuation will fall accordingly.

Just like technology has sent NXT soaring future evolution of data storage could become its undoing in the future – always prudent to be aware of risks. In terms of the Legal dispute, I’m not sure about whether that will get traction or not.

· This is arguably the high / growth stock we like the most and see reasonable risk / reward in NXT ~$6.

NEXTDC Ltd (NXT) Chart

Question 10

“Hi MM team, I am a new subscriber so I am not sure the format of these Q&A sessions, but I was wondering if you could comment on the gold sector and specifically Dacian Gold (DCN) as an investment. As a commodity, gold has been kicked pretty hard recently due to the USD strength, but I was wondering, given your talk of going longer on some of your Bearish positions, what you think the future holds here?

And specifically, on Dacian Gold, all the developments appear positive as they gear up for production, but they appear to have been targeted by short sellers (hundreds of small parcel transactions) and the price has been hit way harder than the AUD gold price movements - so am I missing something here with this company?” - Many thanks and Regards Craig D.

Hi Craig,

We hold Newcrest (NCM) in the sector although this was a play more on the underlying business improvements as opposed to pure gold. Dacian Gold (DCN) is relatively small miner from WA with a market cap of $520m.

The current short position in DCN is 3.3% and its slowly rising compared to say NCM at 0.77% i.e. the professional market is not a fan. In June DCN did announce a solid market update sending the stock up close to 7% on the day but it’s since fallen ~30% - it feels wrong.

· MM would not be “fighting the tape” on this one, DCN feels simply too hard at present.

Dacian Gold (DCN) Chart

Overnight Market Matters Wrap

· The US closed with little change last Friday, as investors continue to decipher the US-China trade tensions, where US President Trump proceeded with the Tariffs despite talks between the two power countries are still continuing.

· A quiet session is expected in the Asian region as a typhoon passes through the Philippines and Hong Kong region over the weekend.

· BHP is expected to underperform the broader market, after ending its US session down 0.17% from Australia’s previous close.

· Today all eyes will be on the aged-care stocks as they front the Royal Commission.

· The September SPI Futures is indicating the ASX 200 to open 15 points higher towards the 6180 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.